Thomas Barwick

Description

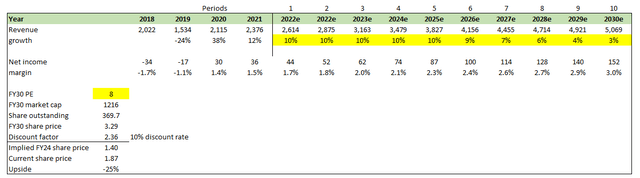

I believe Newegg Commerce (NASDAQ:NEGG) is worth $1.40/share, representing ~25% downside from the date of writing. I am not recommending to short the company but rather to stay neutral until a better valuation.

The success of any business model is determined by global market forces and trends. With the digitization of businesses and operations around the world, the e-commerce industry is on a growth path that is going up. NEGG is a leading player in the IT and tech e-commerce worlds. With 20 years in operation, NEGG has formed successful partnerships with leading tech companies. Going forward, NEGG should continue to broaden its client and customer base, thereby warranting its economic growth.

Company overview

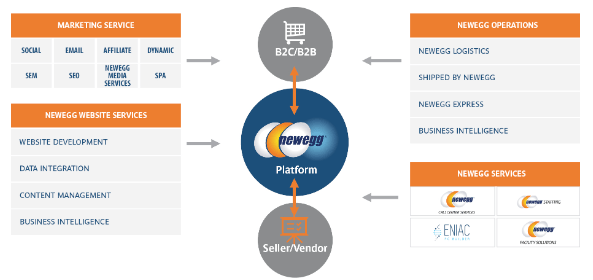

NEGG is a North American-based online retailer of computer hardware and consumer electronics. This tech-focused retailer is a go-to seller for thousands of brands in the IT and consumer electronics markets. Apart from availing their platform for sales, they also offer services to improve business efficiency for their clients.

NEGG’s offers brands the option to sell products directly to them. This way, NEGG is in charge of inventory and customer transactions. NEGG’s broad customer base and efficient E-commerce solutions provide a platform for brands to generate more sales.

S-1

Global info tech & consumer electronics is a big market

The IT and Consumer Electronics online markets are massively growing. The COVID-19 pandemic accelerated the adoption of online solutions by businesses to ensure business continuity post-COVID. Remote working was adopted (where possible) by businesses due to lockdown restrictions imposed by Governments and States globally to reduce the spread of COVID. The pandemic saw an increase in businesses that had to use e-commerce platforms like NEGG during and after the pandemic.

This growth rate is estimated to reach a TAM of $3.3 trillion by 2026, more than double the current TAM of $1.4 trillion (NEGG data, S-1). The current E-commerce market providers still fall short of meeting their customers’ needs and expectations. These customers represent a large and growing percentage of the global consumer population. Their purchasing decisions are primarily based on

- Selection and price,

- Compatibility of parts and products,

- Accessibility of dependable servicing and,

- Shipping logistics.

Finding a provider who can meet all these expectations has been a hard task for the consumers. In fact, only a few providers have been able to meet these customer expectations online and offline. Even though the e-commerce market provides a great opportunity for global businesses, they still struggle to find and serve global consumers. Collectively, their scale power and economic power are massive, but individually they struggle. The ability to reach and target a larger number of customers is key to a business’ growth and success. This might be due to a lack of technologies, poor infrastructure, inefficient shipping and logistics platforms, a lack of comprehensive data insights, low payment capabilities, or a lack of access to credit. These challenges increase as they venture into the global market.

Strong vendor relationships

A trustworthy business relationship takes time and trust to build. In its two decades of operations, NEGG has built formidable relationships with large IT and tech companies such as AMD, Intel, Microsoft, Asus, and Nvidia, among others. Working with such industry leaders eases access to favorable terms, large inventory allocations, and programs that can be translated to benefit the end user in terms of demand and pricing. This makes NEGG a trusted player and a go-to channel for other authority tech brands that seek to sell products and services, especially in the North American, Asian, and Middle East markets.

With a loyal customer base already in place, NEGG keeps building relationships with brands in similar product categories to better meet customer needs. Also, with established E-commerce expertise and experience, successful online platforms, functional logistic networks, cost-effective distribution channels, and excellent supply chain capabilities, NEGG continues to broaden its client and customer base. When brands work with NEGG, they have access to all of these features. For example, they can get first-hand customer insights and feedback, which are then analyzed by NEGG’s massive data and analytics capabilities to help the brands make smart decisions about how to improve their products, how to market them, and how to increase their sales.

Data-driven shopping experience improves users UX

To improve the consumer experience and help them make informed purchasing decisions on their easy-to-use and user-friendly platform, NEGG provides customers with new products and market trends, intelligent product recommendation, personalized content, detailed product descriptions, product tutorials, customer reviews, and a community for consumers. A team that makes videos in-house works around the clock to give the customer original, interesting content.

Strong reputation in the industry

With over 20 years in operations, NEGG has earned consistent recognition as one of the best online selling platforms for IT and Consumer electronics products. Building on this success are the excellent reputation with tech market authority players, competitive pricing, excellent customer-based support, and consistent delivery performance.

These 4 factors have made NEGG’s branding and marketing a success, as they make it a go-to seller for industry players and a go-to marketplace for consumers.

Valuation

I believe NEGG is worth USD1.4/share today, representing -25% downside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue growth will follow management’s long-term guidance (until FY25), and afterwards, growth to slow down to inflation rate in the 10th year.

- Net margin to slowly expand overtime to reflect any potential fixed cost leverage and reduction in marketing expenses

- I assumed NEGG would trade at a mature e-commerce company, similar multiple as to what eBay (EBAY) is trading today. I applied a slight discount to EBAY multiple given NEGG has lower margin

KEY RISKS

Competition from global and domestic players

The low initial investment required to start an e-commerce business makes it an easy idea for investors. This makes a lot of new competitors enter the market. These new competitors can make deals with manufacturers to offer similar products and services at lower prices. Manufacturers might also venture into the market directly without using third-party platforms like NEGG and may offer products and services at slightly lower prices.

Dependent on vendors for availability of inventories

Being a retailer has a challenge of its own. One, you cannot guarantee the continuous availability of merchandise. Manufacturers and producers might also change the terms of their contract with you, affecting the pricing structure in place. They might also get better terms with other retailers, thereby shifting their operations to your competitors.

Summary

NEGG is overvalued at its current share price as of the date of this writing. In spite of the risks and challenges faced by NEGG, the years in trade (20 years), forged alliances with large industry players, and access to a loyal consumer base are positive investment merits. As businesses also transition to digital ways of doing business, NEGG has an opportunity to increase its client base and, subsequently, its customer base. The only thing that lacks here is a cheap valuation.

Be the first to comment