Authors Note: Please note that the prices, ratios and financials explored in this article were current at time of writing. With the significant price fluctuations in recent weeks, it is possible that the figures mentioned may change materially before publishing.

Never Waste a Good Crisis

In times like this, there are countless opinions about what is going to happen with the stock market. I have no special insight into what the market will do next, but one thing I am confident about is that over the long term markets move upward. With the recent market meltdown, the S&P/TSX Capped Financial Index has dropped approximately 35% from its Feb 20, 2020 highs. This dramatic pullback is reminiscent of 2008; a period that despite its challenges presented long-term investors with tremendous buying opportunities.

Source: Real Business

“Never Waste a Good Crisis” – Winston Churchill

A similar situation is unfolding today that will allow patient investors with long time horizons to purchase good companies at discounted prices. The silver lining of any major pullback in the market is that good companies with safe dividends become higher yielding as a result of lower prices. This is a great opportunity for investors to begin accumulating shares of blue chip dividend growth companies.

In volatile markets, I would advocate owning high quality stocks with strong balance sheets that will be able to endure any temporary market conditions. I am not suggesting that now is the moment to back up the truck and go all in. Bottoming is a process and it not something that I would attempt to predict a timeline for. I don’t know where the bottom is and I don’t think that there is any urgency to purchase today or tomorrow, but investors can start picking up shares a little bit at a time. One strategy to achieve this is to average into new positions buying a third of a position now and continue to add subsequent portions in April and May respectively.

Canadian Banking Sector

Regular readers will know that I view the Canadian banking sector as best in class due it its protected oligopoly status and highly regulated nature. Although there are 88 banks with charters to operate in Canada, approximately 90% of the sector’s market share is controlled by the six largest banks: Royal Bank of Canada (RY), The Toronto-Dominion Bank (TD), The Bank of Nova Scotia (BNS), The Bank of Montreal (BMO), Canadian Imperial Bank of Commerce (CM) and National Bank (OTCPK:NTIOF). These six are all considered Domestic Systemically Important Banks (D-SIBs) and one of them, Royal Bank was named a Globally Systemically Important Bank by the Financial Stability Board in 2017.

The oligopoly banking structure that prevails in Canada has allowed the large established incumbents to consistently earn high margins due to a low-cost asset base and high switching costs for consumers. These enduring competitive advantages along with explicit government subsidies on deposit and mortgage insurance have supported the development and success of a strong domestic financial sector. The strength of the Canadian banking sector and the consistent high returns earned by the large domestic banks have enabled them to expand retail and capital market operations into the U.S., Asia and Latin America.

Strong Regulation Has Made a Strong Banking Sector

The Canadian banking sector is a beneficiary of strong regulatory oversight and protection from foreign competition. The “Bank Act” in Canada limits foreign ownership of Canadian banks and adds barriers to entry for would-be market entrants. This market structure along with a robust regulatory architecture has ensured the stability and growth of the Canadian banking sector through all economic stages, including wars and recessions.

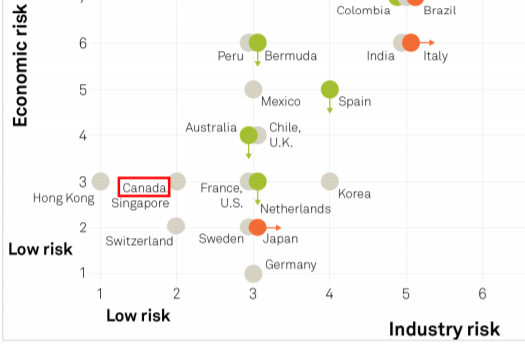

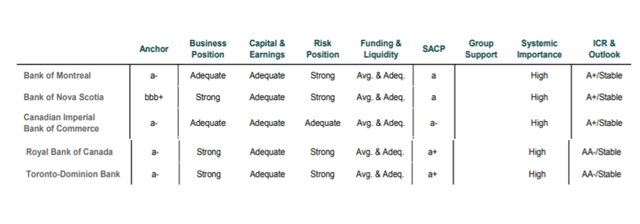

The large banks in Canada have a tremendous track record of long-term performance and stability. Strong regulation helped to ensure that the Canadian banks fared well during the global financial crisis. In that last major financial crisis none of the Big-5 Canadian financial institutions defaulted and all of them maintained their dividends. Furthermore, all of the major banks ended the financial crisis with balance sheet strength, liquidity and adequate capitalization. According to Standard & Poor’s “Canadian Bank Outlook 2019” Canada along with Switzerland, Japan and Singapore are among the lowest-risk banking sectors globally.

Source: Standard & Poor’s Global Ratings

Dividend Premiums

The large Canadian banks have long histories of rewarding shareholders with consistent dividend growth. CIBC’s dividend track record dates back to 1868, while Royal Bank has paid a dividend on its common shares every year since 1870. The Bank of Nova Scotia has distributed dividends annually dating back to the company’s formation in 1832. Not only do the banks have long track records of paying dividends, they also have a strong track record of increasing them.

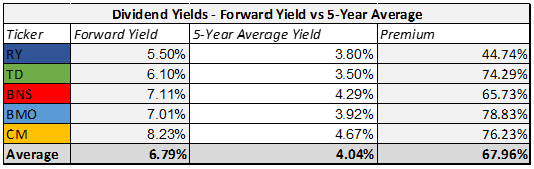

With interest rates at historic lows, dividends offered by solid blue chip companies with long histories of dividend growth and consistency are especially attractive. With the recent sharp declines in share price, the dividend yields on the biggest 5 Canadian banks are far above their historical averages. The average forward yield of the Big 5 banks is now a mouthwatering 6.79%; which represents a 68% premium to the group’s 5-year average yield of 4.04%.

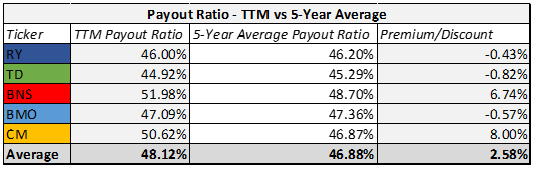

In addition to the attractive yield, the banks have conservative payout ratios that give them significant latitude in the event of steep earnings corrections. The trailing 12-month payout ratio for the largest 5 Canadian banks is 48.12%, only 2.58% higher than the 5-year average payout ratio. While this premium may increase as earnings are impacted by a slower economy, the group average is very attractive. For Royal Bank, TD Bank and Bank of Montreal, the trailing 12-month pay-out ratios are below the company’s 5-year averages.

Table Source: Author; Data Source: Morningstar

Compelling Valuations

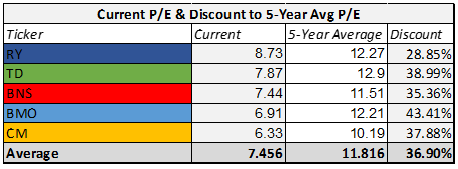

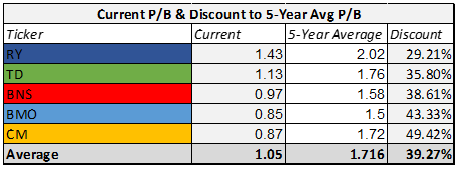

Not unlike the high dividend yield, the valuation metrics for the Big 5 Canadian banks have also been dramatically impacted by the recent sell off. From both a price/earnings and price/book perspective the banks are attractively valued at current levels. The current average P/E of 7.46X represents a 36.9% discount to the 5-year average P/E of 11.82X.

Table Source: Author; Data Source: Morningstar

The current average P/B of 1.05X represents a 39.3% discount to the 5-year average P/B of 1.72X.

Table Source: Author; Data Source: Morningstar

While no doubt earnings will be negatively impacted in the coming quarters, investors with a long-term focused will note the current opportunity. A share price is essentially the representation of a company’s expected future earnings. The current valuations suggest that this event is the new normal when market history has taught us that black swan events like this are in fact transient. As an investor who has held bank shares for years and plans to hold them for many decades more, the current valuation is not rationale and will eventually revert to normalization.

Toronto Dominion Bank

TD Bank is the 2nd largest bank by market capitalization in Canada and the 5th largest bank by assets in North America. TD is noteworthy for its U.S. exposure, where it has more branches than in Canada. Currently, TD earns approximately 30% of its revenue from U.S. making it nicely diversified across North America. TD has the best dividend growth profile of the Canadian banks making TD Bank one of the best dividend growth stocks in the North American financial sector. Morningstar currently maintains a fair value estimate of CAD $82, suggesting the stock deeply discounted in the mid CAD $50 range. For my bull case on TD and why I continue to buy it, please see my analysis here.

Royal Bank of Canada

RBC is the largest of the Canadian banks and the most diversified by business segment mix. Royal Bank of Canada is one of 29 financial institutions considered to be globally systemically important and is the only Canadian institution on the list. RBC has 81,000 employees and 1,221 branch locations worldwide. The company operates in 36 countries around the world with extensive focus in Canada, the United States and the Caribbean. Royal Bank has over CAD $5.5T in assets under administration and over CAD $700B of assets under management making it one of the largest 15 banks in the world. RBC has significant operations in wealth management and capital markets in addition to its core personal and commercial banking sectors.

Royal Bank along with TD are in my opinion the highest quality names in the Canadian financial sector. Morningstar currently has a fair value estimate of CAD $111. Royal Bank is one of my largest positions and one of the best banks anywhere. For a closer look at RBC, please see my analysis here.

The Bank of Nova Scotia

The Bank of Nova Scotia has used the profits from its lucrative high-margin Canadian consumer banking operations to build up a substantial network of financial services in Latin America. This strategy has focused on the rapidly developing group of Pacific Alliance countries: Mexico, Chile, Peru & Columbia. BNS serves more than 25 million customers worldwide and holds approximately ~$1Trillion in assets. Its retail banking, wealth management and international banking segments employ ~97,000 people at over 3,000 retail locations. Scotia Bank has recently made acquisitions in the wealth management sector to further diversify its revenue from its core consumer banking segment. Morningstar has a fair value estimate of CAD $74, suggesting the bank is attractively valued at current levels. The Bank of Nova Scotia is a core long-term holding of mine, for more information on the company’s operations, please see my analysis here.

The Bank of Montreal

With over 200 years of experience, the Bank of Montreal has built a client base of 12 million customers in Canada and the United State. With total assets of approximately CAD $800B, BMO is the eighth largest bank in North America by assets. Under the brand “Harris Bank” BMO has a strong presence in the United States with a history of branches in New York and Chicago dating back 150 years. BMO operates four major business segments: Canadian Personal & Commercial Banking, U.S. Personal & Commercial Banking, BMO Capital Markets, and BMO Wealth Management. Morningstar fair value estimate of CAD $103. For a closer look at the Bank of Montreal, please see a full analysis here.

Canadian Imperial Bank of Commerce

CIBC is the smallest of the Big 5 Canadian Banks and is also the most domestically focused. CIBC has a growing U.S. foot print, however its Canadian operations in personal banking, commercial banking and wealth management in Canada accounting for approximately 70% of net income. Canadian Imperial Bank of Commerce has historically traded at a lower multiple than its larger peers due to its largely Canadian focus. In turbulent times, I would always advocate owning only the highest quality companies. While you can sleep well at night collecting CIBC’s nice dividend, it is not as high quality as TD, or RBC. At current levels it has among the highest yields and is deeply discounted. Morningstar has a fair value estimate of CAD $123.For an in depth analysis on CIBC, please see my article here.

Risk Analysis

There are many standard risks associated with investments in financial services companies. Economic, interest rate and credit risks are common concerns for investors in banking stocks. The latest development that has upended current stocks prices is COVID-19 and the impact that the global response is having on the economy. In the medium term, reduced economic activity due to self-isolation and higher unemployment are likely to be outcomes from the precautions being enacted around the world to slow the spread of the virus. These outcomes will inevitably reduce bank profitability and weigh on earnings.

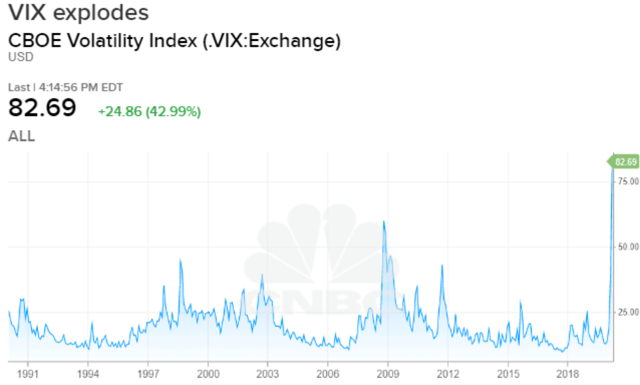

In the nearer term, significant volatility in the wider equity markets may continue to cause dramatic moves in share prices of otherwise stable companies. On March 16, 2020, CNBC reported that the VIX, a volatility index surged almost 43%, to close at a record high of 82.69. This close surpassed the peak level of 80.74 that occurred in the depths of the Global Financial Crisis on Nov. 21 2008. Any equity investment at this time may carry significant risk due to enhanced market volatility.

Source: CNBC

While share prices may continue to fluctuate in the coming weeks or months, I am confident that over the long-term the Canadian banks will prove to be good investments. These are institutions that have survived the great depression, Spanish Flu and two world wars. With banks having made major investments in financial technology and significant pivots to digital and online banking, the Canadian banks are better prepared to continue offering services to clients that should result in mitigated exposure to the interruption impacts of COVID-19.

The Canadian banks are well capitalized, have strong credit ratings and are extremely well regulated. While there will be pain in the short term, there is no indication that any of the large banks are in any kind of structural trouble. Even if the banking sector in Canada did become imperiled, all 5 of the big banks are domestically systemically important and would be supported by the Federal government if need be.

Source: Standard & Poor’s Global Ratings

Investor Takeaways

Although the recent downturn has caused significant pain, it has also created opportunities for long-term investors to pick up some good dividend paying companies at deep discounts. Transient market events such as this black swan, COVID-19 related downturn should be viewed as an opportunity. The Canadian banks are trading at deep discounts to their historical valuations and are offering dividend yields that are at significant premiums to their long-term averages. Now is a great time to start adding to positions of these high quality dividend growth companies.

Disclosure: I am/we are long RY, TD, BNS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment