simpson33

Netflix, Inc. (NASDAQ:NFLX) is one of the world’s leading streaming service providers, with more than 223 million paid memberships in over 190 countries. It offers TV series, documentaries, and feature films across a wide variety of genres and languages. Members can watch as much as they want, anytime, anywhere, on any internet-connected screen.

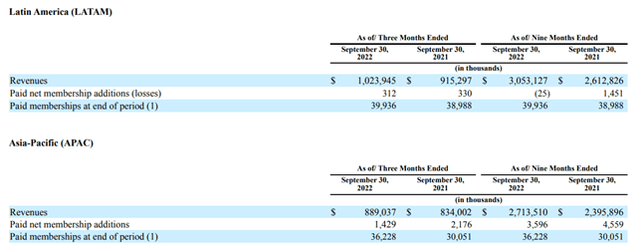

Also, as the entertainment industry is changing rapidly from traditional TV cable to streaming services, Netflix has a huge opportunity to grow its operations worldwide, many developing countries don’t have streaming services at a large scale and the company can benefit from the underserved markets. As we can see, Netflix is aggressively growing its subscriber counts from Asia pacific and LATAM regions where there is a lot of opportunity for the business to grow at a substantially high rate, although the prices of monthly subscriptions are increasing. Still, the growth in those regions is very much attractive.

Furthermore, the company has been expanding largely in Asian markets, collaborating with many productions house, The company has been able to bring trending and popular web series. The main thing is Amazon (AMZN) prime and Disney (DIS) are also putting extraordinary efforts to grow in those markets which has led to intense competition. But in my view, the overall market is very large and expected to grow at a very high rate due to the technological transition from cable operators to streaming services, where viewers could watch as per their interest.

I believe, due to the current adverse economic environment, customers are avoiding recreational and entertainment expenses, this is the reason why the company is struggling to gain subscribers, and as the economy recovers Netflix might see substantial growth in subscriber count.

Also, due to the current negative environment about technology stocks, the stock has dropped significantly and has been trading at a considerably low valuation, and so I think Netflix is a buy.

Historical performance

Since its inception, Reed Hastings holds the CEO position, in his leadership the company has grown significantly from its DVD rental operations to the leader of streaming services, over the period Reed has taken key decisions that were crucial to the company’s business model. In 2007, The company started streaming services and from its start, the business has grown significantly due to the CEO’s entrepreneurial approach toward the company, Reed has tried multiple models over multiple regions and whichever was working he applied to the streaming business, such an approach has brought huge value for the company, and due to its consistent efforts for innovation the company was able to grow even in the intense competition. In my view, having a CEO with such a fantastic track record provides the business with a substantial edge.

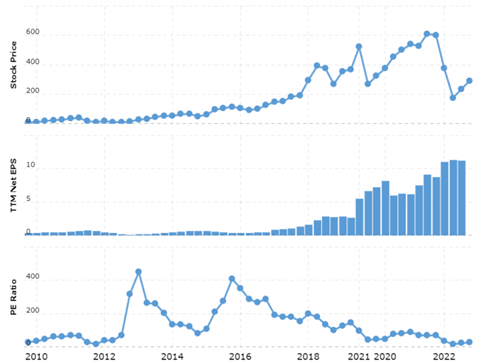

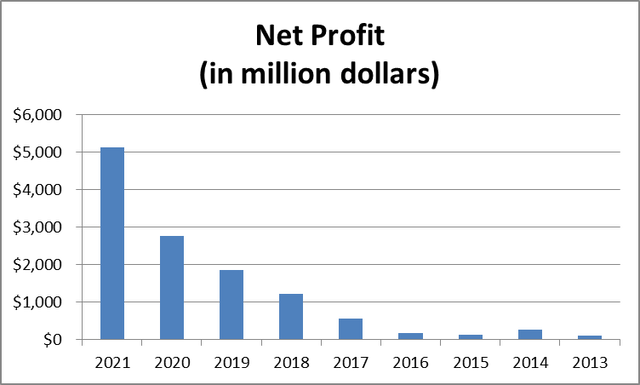

Over the period, as the subscriber count started increasing, Netflix has seen substantial and exponential growth in the net profits, which is likely why in the last few years the stock has produced considerably higher returns for the shareholders.

Furthermore, management has played a very vital role in such an exponential performance, over the period, attractive entertainment and excellent service have created strong brand value in the minds of the customers, which has borne sweet fruits for the company.

Also, Netflix has managed to produce the content at a fair price, and along with that, the company has managed its operating costs much more efficiently which has translated into extra high returns for shareholders. Also, note that its monthly membership price is very much competitive and provides the viewers with very large and diverse entertainment content.

Strength in the business model

Netflix has a substantially strong business model, which has been generating strong returns on capital, but the significant strength of the company lies in its strong brand value, internationally Netflix has a very high subscriber count as compared to its peers, and for a very long time the brand value has been expanding consistently which gives its business model a substantial strength.

Risk factors

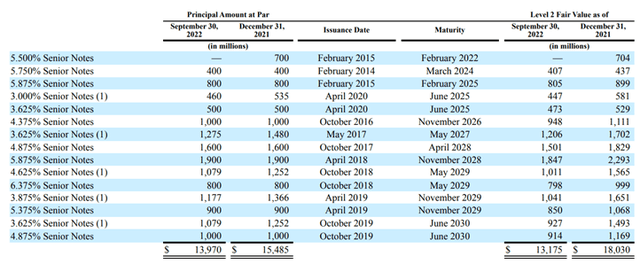

Debt maturity (quarterly report)

Netflix has significant debt, which is going to mature in the upcoming years, but due to its high market value and strong presence worldwide, the company should manage to comply with its obligations.

Also, optimism about future growth prospects has led the stock to considerably high valuations, and if the company’s growth stabilizes and the market sentiments become negative, the stock might suffer a correction. Hence, there lies a risk of uncertainty in the stock price, but looking at the track records and brand awareness amongst the youth, it seems that the company could manage to expand its operations.

Currently, by looking at the attractive returns and the strong future prospects, many content production companies are entering the field, and as a result, competitors are increasing. Cable operators such as AMC Networks (AMCX) are also entering into the streaming field, which might lead to increased competition and reduced profitability; in such conditions, the only way for the company to grow is to consistently bring trending web series and movies, which over the period, Netflix has managed well. However, the concern remains that, could Netflix’s content remain trending in the future?

Recent development

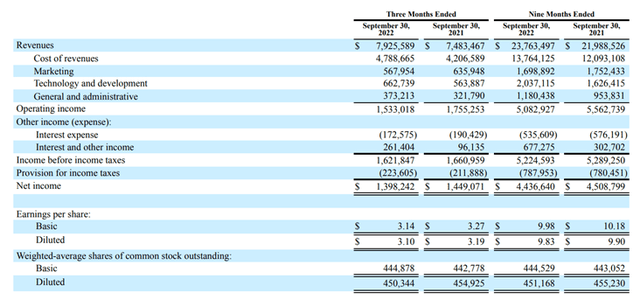

Quarterly income statement (quarterly report)

Over the last nine months, the company’s revenue has been increasing but as the company is spending huge sums of money on technology and development, net profit has remained subdued. It should be noted that the company has been spending hugely on innovation which will drive its competitive strength, resulting in a significantly strong moat generation.

Overall, this quarter’s result remains attractive, with considerable growth in the subscriber count and membership revenue. Also, streaming membership grew more than 5% in the last 3 months.

Subscriber count (quarterly report)

Growth in the subscriber count primarily came from Asia pacific and Latin American segments, which offer substantial potential for future growth, as the company has been expanding its footprints in those markets, it will likely bring fruits in the future

Furthermore, in the last two years, due to the lockdown when people were spending much time at home, streaming was the best option to them for entertainment. As a result, Netflix has seen unusually high subscriber growth which translated into share price appreciation, hence the stock reached all-time-high levels, as the lockdown restrictions lifted up in mid-2021, the subscriber growth dropped down and till early 2022, Netflix saw a sharp decline in subscriber growth. The condition affected the stock price severely, and as a result, the stock price dropped more than 72% from its all-time high despite such a leading and growing position of the company.

Stock price (macrotrends.net)

Currently, as the investors are turning bullish, the stock has been rising from its low levels, Also the market capitalization of the company is around $122 billion, trading at 24 times its earnings, whereas historically the stock had been trading for more than 76 times its earnings, and after considering the future growth prospects it seems that the company has been trading at significantly attractive valuations and provides upside potential. Netflix is a buy.

Be the first to comment