Mario Tama

Investment Thesis

Strong reaction to the Netflix, Inc. (NASDAQ:NFLX) Q1 report created a good opportunity for long-term investors, and even after the subsequent positive report, there is still a high upside of the stock. The company’s management has presented a strategic plan for the coming year, providing clarity on how the company shall cope with challenges. We maintain a positive view on prospects of Netflix.

Trends and prospects of the streaming services market

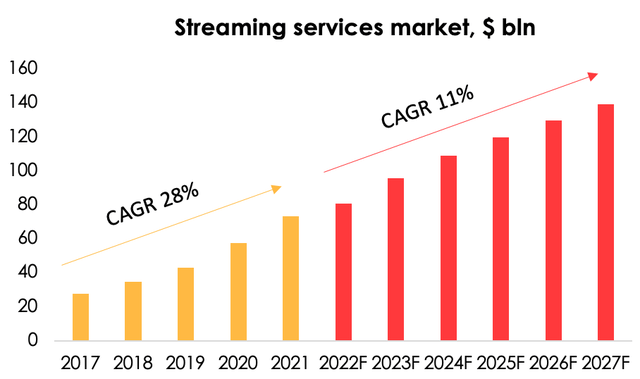

The video-on-demand market is a relatively young industry. Over the recent years, demand for streaming services has been rapidly growing. Streaming has almost completely supplanted the DVD market and manages to compete with cinemas. To some extent, the VoD market benefited from the COVID-19 pandemic: due to lockdowns, people were looking for virtual leisure activities, and streaming services were among the leaders due to abundance of content and affordability.

Despite rapid growth over the previous 5 years, research agencies still predict further development of the sector, albeit at a slower pace. According to Statista, the streaming market will grow at an average rate of 11% over the next six years.

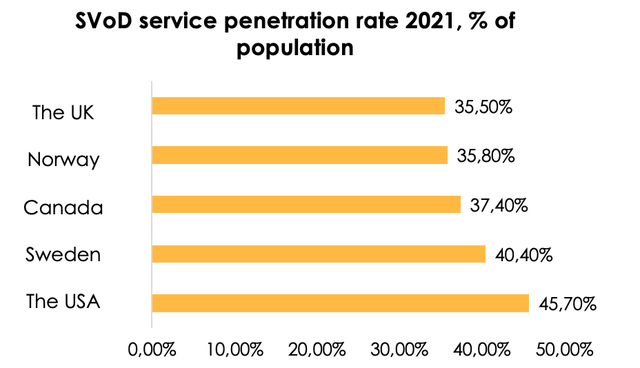

The slowdown is largely driven by widespread adoption of these services, according to Statista. In 2021, between a third and a half of population in developed countries had subscription to at least one of the services like Netflix or Amazon Prime (AMZN), with many households being subscribed to several services at the same time. The growth potential of such markets for streaming companies is significantly limited, the spread of services across large emerging markets, such as Asia and Latin America, is the main driver.

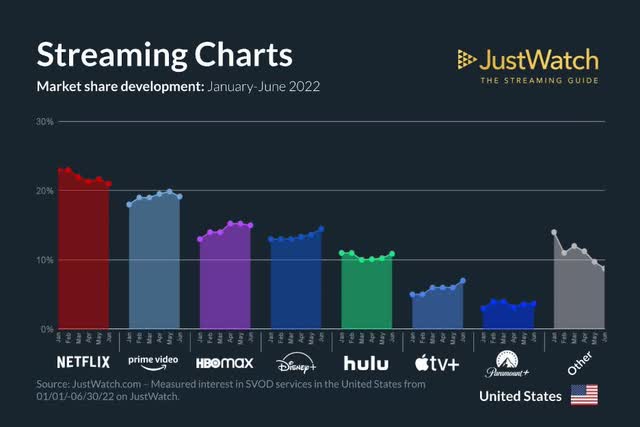

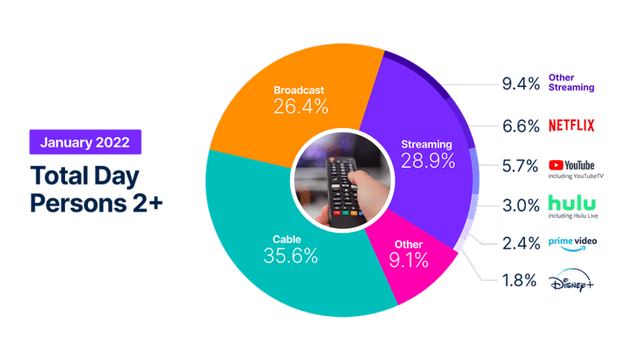

There are several key players in the streaming market now, forced to compete for the audience. The main source of influence on the consumer is still the quality and quantity of content, because absorption and retention of users is mostly achieved by high-profile releases (Stranger Things by Netflix, Obi Wan Kenobi by Disney+, etc.).

Companies that are relatively new in the streaming services market continue to increase their degree of influence, according to JustWatch. We believe that one of the main reasons is relatively low base. The SVoD market changed significantly last year, now it is mature, so attrition of the audience in favor of newcomers with completely different and original content is a consequential phenomenon but limited in scope.

The prospect of long-term struggle for the consumer is tied to the success of the original franchises. In this regard, we expect Netflix to remain the global market leader, although it shall lose some of the audience.

This year the hot topic is the expected recession in the USA and the EU, which are the largest markets of streaming services. We expect the industry to get through the period of economic slowdown and falling real income of the population quite easily. Streaming is a cheap entertainment, as for a very reasonable price subscribers are usually offered a large library of content, so the sector can get through the recession as a substitute for more expensive types of leisure (e.g., going to the cinema).

Cross-subscription to several services at once is an important criterion in market analysis concerning recession expectations. According to the September 2021 survey, conducted by Leichtman Research, approximately 58% of households are subscribed to two or more streaming services at once. Given the falling real income, this fact means potential revenue decline in the broad market, as households are likely to refuse using several services and shall choose one.

Monetization is a driver of growth

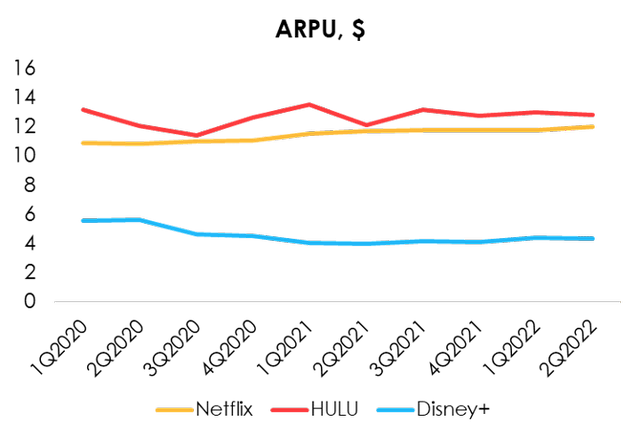

Growth of the sector was supported not only by new customers uptake, but also by steady ARPU growth, according to Netflix data and Statista. ARPU decrease of Disney (DIS) is explained by the company’s entry into new markets – the company began to gain cheaper subscribers, revealing the reasons for rapid growth rate of the service’s subscribers.

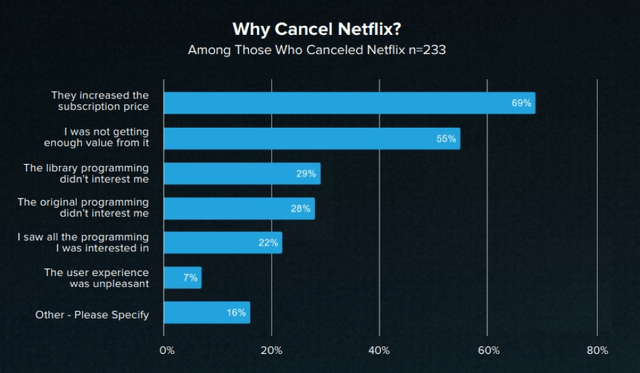

On the other hand, higher prices tend to be accompanied by higher consumer churn rates. Given the growing competition, audience reaction to increasing price shall be even stronger. According to the survey, held by WhipMedia in June, about 69% of unsubscribers mentioned the price increase

In the face of competition, companies have a choice – either to continue to increase ARPU, at the risk of seeing higher consumer churn, or to test the quality of business margin, as investment in content continues to increase, and subscriber growth shall not maintain previous rates.

Representatives of the sector with other sources of income (Apple (AAPL), Amazon, Disney) can afford expansive market capture at the expense of pricing, as revenue from the core business can support low-margin segments, if future opportunities justify the costs. However, since even the most expensive subscriptions remain relatively cheap for the average household compared to similar leisure activities, the long-term factor of content quality shall prevail in consumer choice. Therefore, we do not expect significant dumping in the foreseeable future.

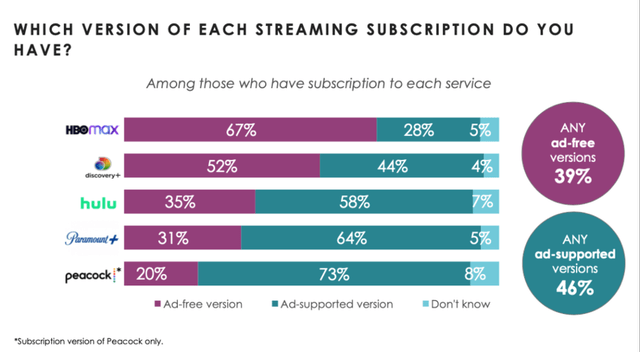

Cheaper ad-supported versions of subscription as the new model of service monetization shall be the key to balance between ARPU growth and subscriber uptake. The companies that have already offered cheap subscriptions with ad, are demonstrating high consumer loyalty, according to The Streamable.

With the current decline of online ad market and decreasing budgets of large companies, the new versions of subscription shall not immediately show positive results in terms of ARPU. However, in the long term, we expect this initiative to have a positive impact on financial results, according to Nielsen.

Now the VoD sector represents approximately one-third of total video content consumption in the USA, and ad placement there is more effective than on TV due to advanced targeting. Transition of major streaming platforms, such as Netflix or Disney+ to the new subscription model shall have significant impact on the ad market, as it shall cause overflow of ad budgets to new players.

Thus, we expect further increase of ARPU across the sector. With the introduction of new monetization model, companies shall increase the subscription cost without setting new records of customer churn, as there are cheaper alternatives for the price-sensitive segment of the audience. Providers shall compensate for the difference in the subscription cost with ads revenue, which is expected to be significant given the popularity of streaming.

Netflix and its temporary challenges

Netflix has remained the key player in the development of the SVoD market for a long time. The company was the pioneer of the industry and now is the leader, although it had to deal with new market realities and certain difficulties last year.

The churn of subscribers due to competition is an inevitable scenario for Netflix. It is well observed in developed markets, where distribution of the service was almost ubiquitous. For example, in the USA, 2021 market share of Netflix (based on annual revenue) was around 40%, so the observed users churn in the H1 2022 on the background of deteriorating economy and developing competition is inevitable.

Asia is an important target for Netflix, and the company has been investing heavily in this market for the recent years. Subscriber growth in the region remains strong, and the company has great potential to raise subscription fee there.

Moreover, the customer churn, as mentioned earlier, is also partly due to the company’s price increase policy, but Netflix intends to adapt subscriptions with integrated ad in 2023, so the effect of the price increase shall be mitigated by the new pricing option. Now we believe that ARPU growth, rather than uptake of new subscribers, shall become the main driver of Netflix financial results.

Last year the so-called sharing of subscriptions was another important problem for the company. It’s when accounts are used by several users at the same time, without creating additional value for Netflix. The company’s management is still looking for a way out. It is testing a new strategy in several Latin American countries, where the problem of sharing is the most acute.

Now the consumer is offered to pay extra for sharing, and the cost of the extra fee depends on the number of users. According to the test results of the first half of the year, the management is quite satisfied with the results. Based on the company’s financial statements, ARPU increased by 15% YOU across the region, while the number of subscribers at the end of the period remained virtually the same. In the future, Netflix shall expand the geography of the new feature and we expect it to solve the problem of sharing by creating additional factor of ARPU growth.

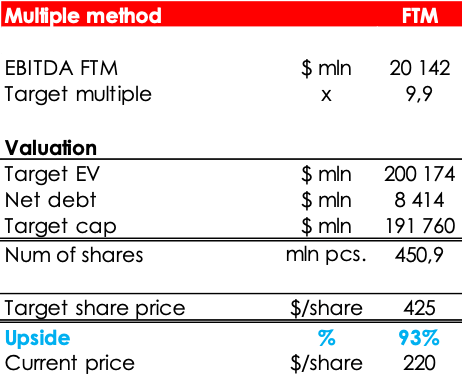

Valuation

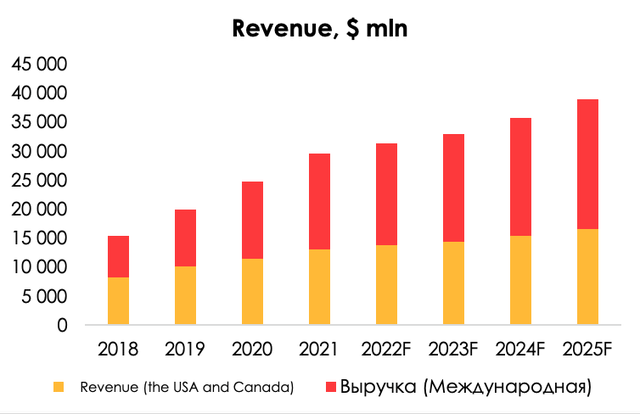

We expect Netflix revenue to grow at an average rate of 7.2%. The main drivers shall be ARPU growth and the international sector development.

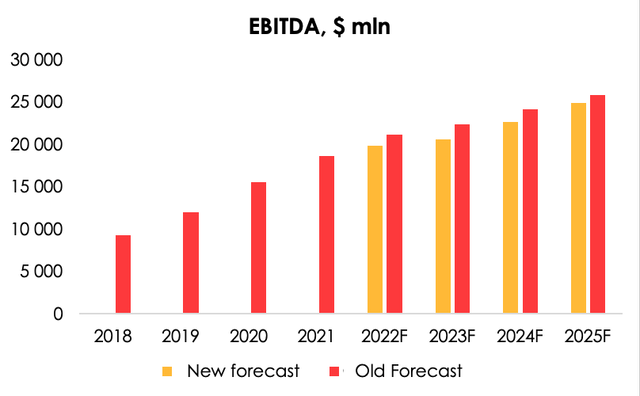

We have included the factor of recession anticipated in Q4 2022 – Q1 2023 and faster attrition of the company’s market share (vs. previous expectations) in our EBITDA forecast.

Based on our forecast, the company’s stock price is $ 425/share. We consider NFLX stock to be undervalued and maintain BUY rating for the company. Upside – 93%.

Invest Heroes

The conclusion

We maintain positive view on long-term prospects of Netflix. The market reaction to the Q1 report was extremely negative, and even with higher stock prices after the Q2 report, shares still have high upside.

We believe that Netflix is an undervalued growth company, but the updated account monetization program shall be the main driver of financial results. Netflix stock had high volatility last year, so despite the fact our valuation assumes BUY status at current levels, we recommend scaling the position, as decline of the major indices is likely to cause the company’s quotes to fall further. To manage the position, we recommend keeping an eye on Netflix financials, industry analytical researches (e.g., Leichtman Research, JustWatch, Nielsen), and schedule and release statistics of upcoming movies and TV shows, as they largely determine the success of Netflix quarterly reports.

Be the first to comment