cyano66/iStock via Getty Images

Intro

Before writing this article, I calculated that 10 articles about Netflix (NASDAQ:NFLX) were written on Seeking Alpha just yesterday. The statistics of recommendations are as follows:

The vast majority of writers who recommended sell or hold mostly wrote that Netflix is no longer a growth company. This conclusion follows from the disappointing dynamics of growth of subscribers. This is clear. But is that really all there is to say about Netflix?

What is really the current problem of Netflix?

I remember very well the wave of optimism about the future of Netflix when the pandemic hit. The most vivid memory for me was an article on Nasdaq called “The Pandemic Will Put Netflix Into Our DNA, Analyst Says”. This prospect was truly impressive.

Then it was difficult to imagine that users would get tired of video services during the period of quarantine measures, and high inflation would force them to cancel subscriptions. But it happened. And this serves as another lesson that every growth is followed by a pullback.

So, the key reason why Netflix is going down right now is not because of the company’s business model or its free cash flow growth dynamics, but because the company’s subscriber loyalty has been overvalued. But in my opinion, this does not mean the death of the company.

Is it all that bad?

The drop in Netflix subscribers was the first since 2011. This figure takes into account the loss of 700 thousand subscribers from Russia. Without taking this into account, the increase in subscribers on the Netflix platform in the world would be 500 thousand subscribers. In addition, Netflix reported more than 100 million subscribers who use the services of the platform and do not pay for them:

…we’re working on how to monetize sharing. We’ve been thinking about that for a couple of years. But when we were growing fast, it wasn’t the high priority to work on. And now, we’re working super hard on it. And remember, these are over 100 million households that already are choosing to view Netflix. They love the service. We just got to get paid at some degree for them…

Q1 2022 Results – Earnings Call Transcript

In my opinion, if the company develops something like two-factor authentication, it will complicate the exchange of passwords and increase the number of subscribers.

Further, judging by the earnings call, the company is considering the introduction of additional tariff plans that include advertising:

And one way to increase the price spread is advertising on low-end plans and to have lower prices with advertising. And those who have followed Netflix know that I’ve been against the complexity of advertising and a big fan of the simplicity of subscription.

But as much I’m a fan of that, I’m a bigger fan of consumer choice. And allowing consumers who would like to have a lower price and are advertising-tolerant get what they want makes a lot of sense.

Q1 2022 Results – Earnings Call Transcript

I think, this is a very correct measure which could increase Netflix revenue from global base. After all, the world economy is now going through hard times and most consumers are focused on saving their budgets.

Next. Judging by the comments in the conference call, Netflix tends to consider itself an entertainment company, and not just a streaming one:

…But also, very importantly, allows us to bring in revenue for everyone who’s viewing and who gets value from the entertainment that we’re offering..

Q1 2022 Results – Earnings Call Transcript

This means that the company may well diversify its line of services, for example, by gaming services. Be that as it may, the company’s international audience exceeds 191 million users. This base can be monetized through the games industry.

What about valuation?

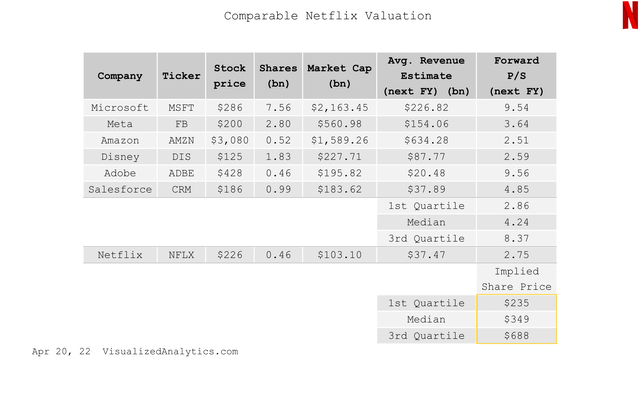

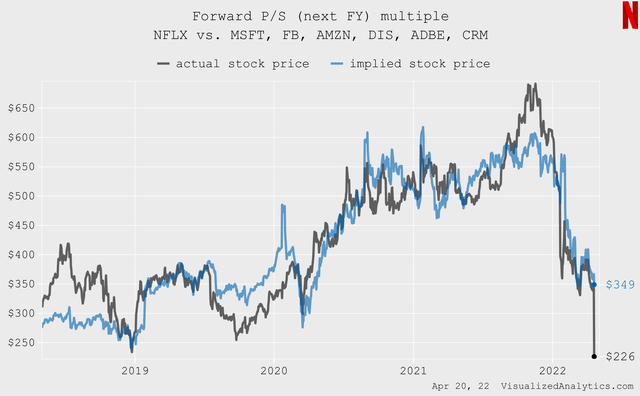

I need time to update my Netflix DCF model with new perspectives. Later, I will definitely introduce it. But now I want to pay attention to the model based on the forward P/S multiple. Despite its simplicity, in the past this model has been a good indicator of the company’s balanced price:

VisualizedAnalytics VisualizedAnalytics

As you can see, the price of Netflix is already well below its adequate level.

Bottom Line

Yes, Netflix is no longer a growth company. But since its peak in November, the company’s price has fallen by almost 70%. I think this is a good discount for an international entertainment company with ~191 million users and a huge amount of video content. In general, I do not think that Netflix is a corpse company. Moreover, I even think that one can start buying carefully.

Be the first to comment