mphillips007

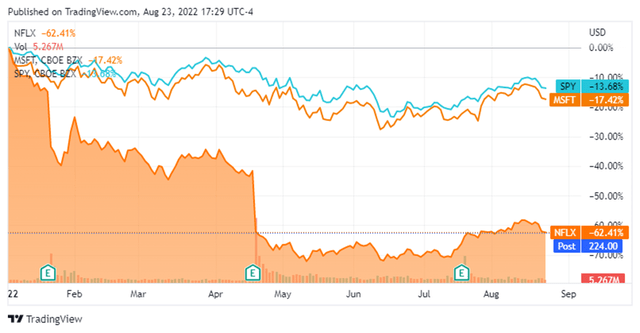

Netflix (NASDAQ:NFLX) shares are down over 60% year-to-date and nearly 70% from the all-time high reached in November 2021. The driving force behind this decline is the slowing growth rate of revenue and first in company history decline in subscribers. At its current valuation, Netflix is trading below its pre-pandemic level, despite its business being significantly larger. Total company assets at year-end 2019 were about $38.9 billion compared to $46.4 billion as of the end of the second quarter 2022. Similarly, book value of the company has grown from $7.6 billion to $19.1 billion, respectively. Revenue has also grown significantly over this period and has grown in the most recent quarters despite losing subscribers.

Good content has a very long tail. The dividends over time can be extraordinary: Ask the surviving Beatles or Rolling Stones about royalties from songs written 60 years ago. I recently binged Black Mirror, a series that spanned 2011 to 2019. I hadn’t heard of it in 2011, but my recent interest in sci-fi and dystopian themed shows and movies drove me there. It’s a beautiful thing when you can satisfy a new interest with what is already available to you. And I’m sure I’m not alone. Content, of all types and genres, will always be king. How it’s delivered will always be profitable, and Netflix is the leader in that space.

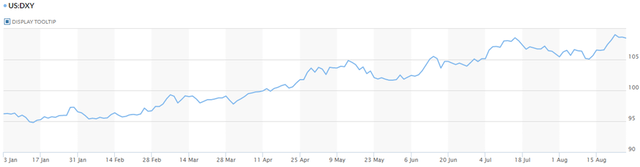

In addition to slowing growth and decline in subscriber numbers, foreign exchange has also created a headwind that is likely underappreciated. Unlike most of its direct competitors, Netflix is a true global platform. The increasing strength of the dollar, higher by about 14% against a basket of currencies, has a significant impact on revenue and earnings once foreign earned revenues are converted back to dollars. While it is difficult to predict the future path of exchange rates, it is reasonable to expect this trend to flatten at some point, if not reverse, lessening the foreign exchange impact on financial results. In fact, not only revenue, but margins would have improved from 2020 through the first half of 2022 if exchange rates were neutral.

YTD Change in US Dollar Index (MarketWatch)

Adding Advertising

In an effort to stop the loss of subscribers, the company has decided to offer a lower cost ad-supported service while retaining the current ad-free version at a higher price. To bring this venture to fruition, Netflix has partnered with Microsoft (MSFT) as its technology and sales partner. Netflix anticipates launching the ad-supported service in early 2023. For its part, Microsoft has recently made significant investments in its advertising business, buying Xandr from AT&T (T) for somewhere in the ballpark of $1 billion. Xandr was AT&T’s global advertising marketplace, and will bolster Microsoft’s advertising business, which represents approximately 6% of the company’s revenue.

In addition to launching the ad-supported service next year, Netflix has rolled out two different paid sharing offerings that are being tested in Latin America. This effort is intended to monetize a portion of what the company estimates to be over 100 million households that use the service, but do not directly pay for it. Success of this effort in Latin America will likely result in a similar offering rolled out globally in the near future.

The ad-supported model for Netflix, while new, is not in itself a surprise. The partnership with Microsoft may not have been obvious, but with other partners offering competing streaming services, combined with Microsoft’s competence and growing influence in the space, the decision makes sense.

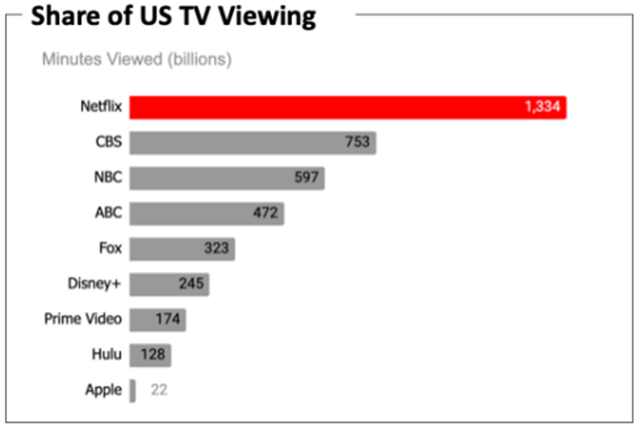

But what is important to understand about Netflix is its size and influence over the viewing public globally. As an advertising platform, it could potentially become the most desirable real estate in advertising “overnight.”

That is what needs to be focused on and understood. This new venture, if executed well, has the potential to be an enormous catalyst for Netflix’s business. The lower price point is likely to add subscribers, therefore making money from both these otherwise non-subscribers and advertisers. This will create an influx of cash which can then be reinvested in new and better content, and ultimately recapture the growth and profitability experienced in previous years. I think moving in this direction will be exceptionally positive for the top and bottom line for years to come. Oh, and the stock is trading for less than it did two years ago. So, dare I say, Netflix is almost a value stock (trading in the low 20s for forward P/E.) Add on the jet fuel of the ad-supported model, and that is a compelling story.

YTD Performance of NFLX versus MSFT and SPY (Seeking Alpha)

Microsoft as a Partner and Potential Acquirer

While the lack of a competing streaming service was a selling point to Netflix as an advertising and technology partner, this could potentially evolve into an even more lucrative partnership. The prospect of Microsoft acquiring Netflix is a long-shot, but not out of the realm of possibility. Microsoft currently has a market cap of over $2 trillion compared to Netflix’s $100 billion. Microsoft currently has that amount in cash and short-term investments, so it could effectively takeover Netflix without outside financing or really even blinking an eye. An acquisition of this type would immediately place Microsoft at the top of the streaming market and accelerate its advertising business as well. Hmmm. I’m sure they have thought of that. The question would be if a strong and constructive leader like Reed Hastings would be interested in that. For reference, Mr. Hastings is 61 years old and has a net worth is in the neighborhood of $3 billion.

So why should the Netflix ad model be so profitable? Well look at the metrics compared to other media outlets. It’s all about eyeballs and the time those eyeballs are watching the content. Netflix is the runaway leader with its viewers watching more minutes of content than CBS and NBC combined. The graph below is in billions, so that is over 1.3 trillion with a “T” minutes watched by Netflix subscribers (for reference, this viewing was done from September 20, 2021 through May 8, 2022.) Also, the content on Netflix, like other streaming services, is well staged for binge watching. This is important because those opting for the lower cost ad-supported model are more captive than audiences of network shows that are available once a week in 30-60 minute increments.

Minutes Viewed by Provider (Netflix (data from Nielsen))

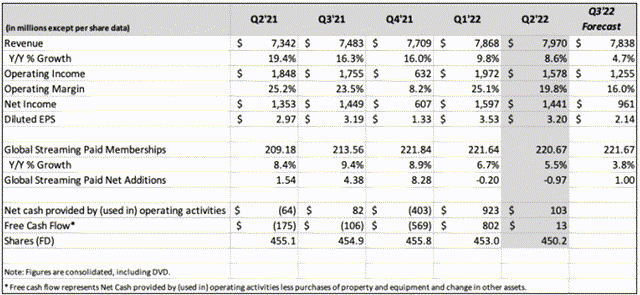

Company forecast

The company’s own near-term forecast is modest compared to what is likely to happen in subsequent quarters. While company executives can’t change the forecast in anticipation of future changes, I think this paints an underwhelming picture of the company’s future, one which might lull traders and investors into thinking high growth for Netflix is in the past, setting up a significant upside surprise next year. Below are the forecasts from the second quarter 2022 shareholder letter.

Inflation/Recession Trade

With lower cost options available to consumers, this will become more attractive to those on the margin of either cancelling their subscription or paying for a new one. Netflix is the ultimate at-home entertainment to save money. Yes, Disney+ (DIS) is great too, but Netflix is the gold standard when it comes to at-home entertainment and streaming, especially on a global scale. It’s not just an early mover, but a model of how to create proprietary content, a great user interface, and overall value. Whether the U.S. enters a recession, or some countries around the world do so, this flexible pricing scheme is likely to draw people back in, drive new subscriber growth, and be one of the most powerful advertising platforms in the world. A win for subscribers, shareholders, and advertisers? I think so.

Final Thoughts

The move into an ad-supported offering is inevitable and expected to be available in the first half of next year. While this is not a secret, what may be underappreciated are the multiple impacts and the true magnitude of these changes, particularly at a time when the stock is out of favor and its price reflects that.

Netflix has navigated through company-level (existential) transitions in the past with great success. Skeptics didn’t believe in the transition from mailing DVDs to streaming only. How has that worked out? Despite what any naysayer might think about the next move for the company, it is reasonable to think they will be successful in not only returning to subscriber growth, but to a multi-year period of high growth and profitability. I look forward to your feedback in the comment section below.

Be the first to comment