cyano66

Netflix (NASDAQ:NFLX) has been bludgeoned during the bear market. The company’s stock price is down by 75% from the November top, and it’s essentially trading like it’s going out of business. However, Netflix is not going out of business. On the contrary, Netflix’s business remains robust as the company operates the most successful online streaming platform and provides (arguably) the best content in the world. Nevertheless, the company is going through a transitory slowdown phase and may even show a decrease in subscribers in the coming quarters. Still, the stagnant slowdown phase is very likely a transitory phenomenon. Moreover, at only 14 times forward earnings estimates, Netflix is dirt cheap now. Netflix’s stock price should appreciate considerably as the company continues to expand revenues and grow EPS in the coming years.

Netflix’s Demand Issues Are Temporary

Netflix’s global demand share for digital TV originals fell by about 20% from Q2 2020. However, Netflix’s share constituted 45.4% last quarter. Also, with Apple TV+ (AAPL), Disney+ (DIS), HBO Max (WBD), and others expanding aggressively, was it realistic not to expect Netflix’s share to decline? Yet, I monitor new content closely, and Netflix remains the best content producer, in my view. The company invested about $17 billion into content last year, and with great hits like the new Stranger Things season, 2022 will likely be another tremendous year. Also, Netflix took home 44 Emmy awards last year, far more than second-place HBO with 19. Moreover, Netflix earned more Emmys than the following three streaming services combined (HBO, Disney, Apple). Netflix’s content house is in order, and lost market share is probably a temporary event.

Lost Subscribers Are Also Temporary

Netflix reported a loss of 200,000 subscribers last quarter (Q1 2022), the company’s first quarterly decline in over a decade. However, we need to consider that Netflix suspended its operations in Russia, leading to a loss of about 700,000 accounts. However, the company also guided to a loss of another 2 million subscribers in the second quarter. This poor guidance shocked the market, which is primarily why the stock has got hammered so hard.

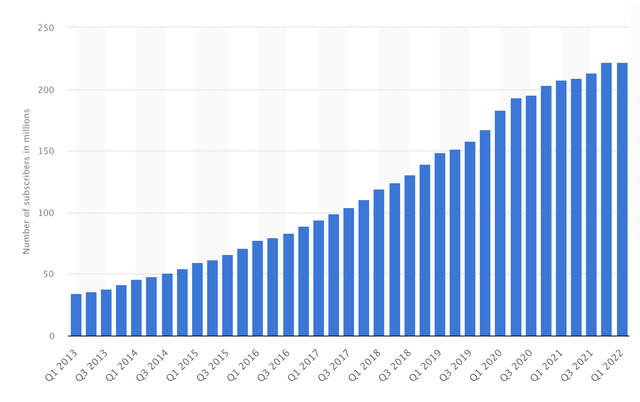

Netflix Subscribers

We see that Netflix’s subscriber growth is starting to stagnate a bit. However, the company has grown subscribers very aggressively over the last decade. Now that competition from several streaming platforms has materialized, it may be normal to see a temporary growth slowdown and even a modest decline. Additionally, the war in Ukraine is affecting subscriber numbers as Netflix is exiting the Russian market, and fewer people are probably subscribing to Netflix in war-torn Ukraine. Also, there is a global slowdown to consider, where inflation and other variables may be affecting the company’s subscriber growth now. Nevertheless, Netflix’s subscriber slowdown is likely a transitory phenomenon as the company remains the top streaming platform in the world.

While Netflix warned it could lose up to two million subscribers in Q2, the company may surprise market participants with a better number. Netflix stunned the market with a shockingly lousy number in Q1, and the company may have lowballed Q2 estimates so that it doesn’t miss again.

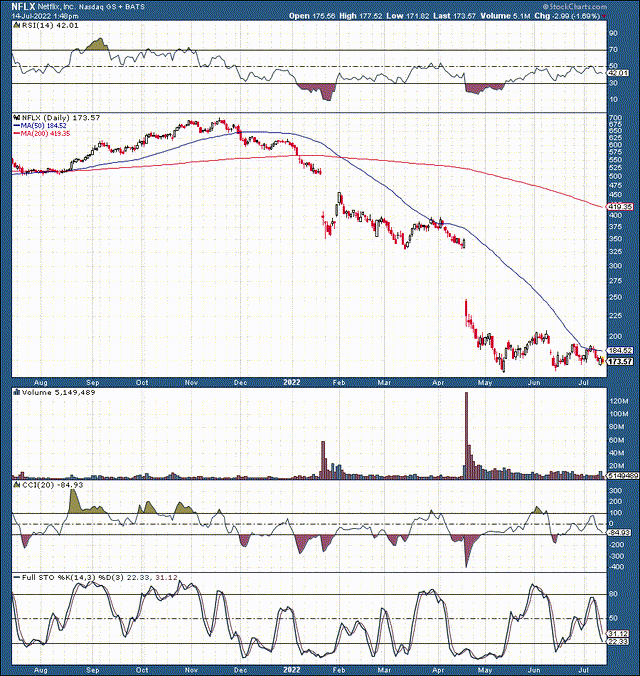

The Technical Take

Since we’re talking about last quarter’s decline in subscribers and poor guidance for Q2, let’s talk about the massive drop the stock took after Q1’s earnings announcement. Netflix was at about $350 before its last earnings announcement, and now it’s 50% below that price. Netflix may have “kitchen-sinked” the previous quarter, and the stock’s downside is probably limited now. Additionally, we’ve seen several attempts to break down below $170, but the stock looks like it is building a base. Furthermore, Netflix is highly profitable now, and there is only so low that its valuation can go.

The Valuation Is Compelling Now

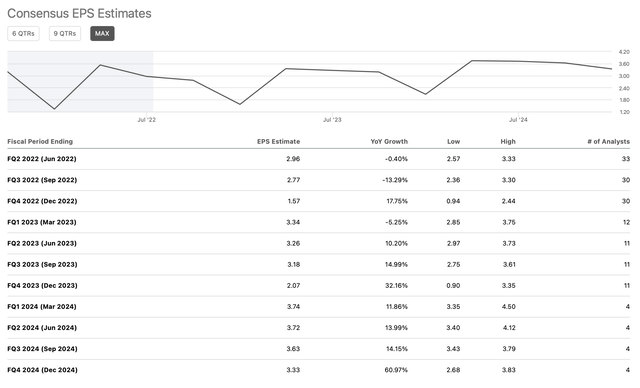

When Netflix was trading around the highs at $700, its forward P/E ratio was around 70. Well, we’re looking at a much different valuation for Netflix now. The consensus analysts’ EPS estimate for 2023 is $11.85, putting the company’s forward P/E ratio at just 14.

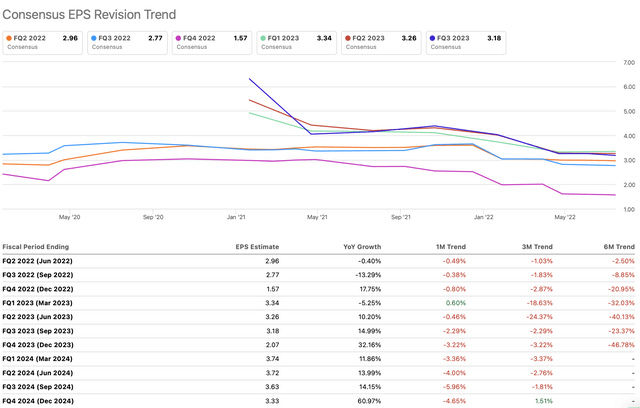

EPS Estimates

Despite Netflix’s transitory slowdown, we should see relatively healthy EPS growth numbers next year and in 2024. The consensus EPS estimate for 2024 is $14.42, implying a 2024 P/E ratio below 12. Moreover, we’ve seen sharp revisions due to the growth slowdown.

EPS Revisions

We’ve seen earnings estimates come down substantially, especially for this year and 2023. Some estimates are down by almost 50% from six months ago, illustrating just how much earnings estimates have been brought down due to the growth scare. However, estimates may have come down too much, and there is an increasing probability that they may have to be brought back up.

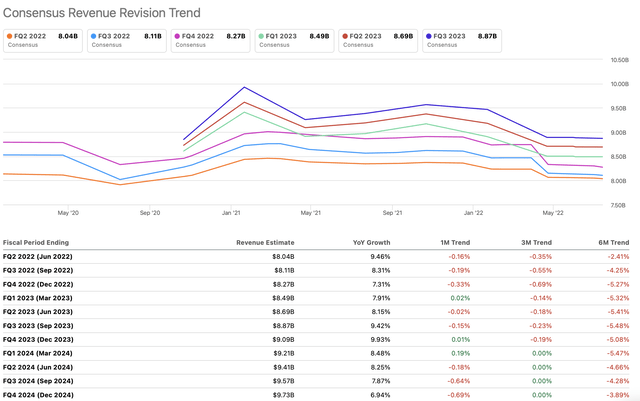

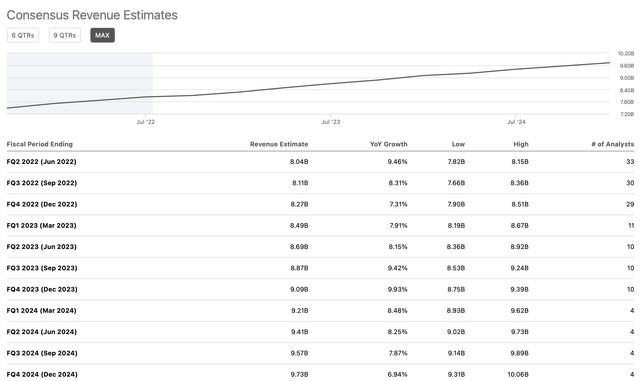

Revenue Revisions

Revenue estimates (SeekingAlpha.com)

Revenues have been revised lower, but only by about 5% relative to six months ago. Therefore, a drop of 40-50% in EPS is not likely, even if Netflix goes through a slightly lower revenue growth phase.

Revenue Estimates

Despite the mild revisions, Netflix should still deliver a healthy 7-10% revenue growth in the coming quarters (consensus estimates). The company could return to low double-digit revenue growth if we look at higher-end estimates. Netflix should report about $32.3 billion in revenues this year and about $35.2 billion in revenues in 2023. So, we’re looking at revenue growth of approximately 8.6% YoY. Now, Netflix’s market cap is around $75 billion, illustrating that the stock is trading at slightly more than two times sales.

Additionally, Netflix earned $7 in EPS in 2020. The company earned $9.53 in 2021, putting its earnings growth at 36%. This year, the company should deliver approximately $11, decreasing its EPS growth to about 16%. However, even if we use the reduced 16% EPS growth rate with the 14 P/E ratio, we arrive at a rock bottom PEG ratio of 0.875, making Netflix’s valuation remarkably cheap.

Here is what Netflix’s financials could look like in the coming years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue Bs | $32.3 | $35.2 | $38.5 | $42 | $46 | $50 | $54.3 |

| Revenue growth | 9% | 8.6% | 9.4% | 9.2% | 9.1% | 9% | 8.5% |

| EPS | $11 | $12 | $14.5 | $17.4 | $20.8 | $25 | $30 |

| Forward P/E | 15 | 17 | 18 | 19 | 20 | 20 | 19 |

| Price | $180 | $247 | $313 | $395 | $500 | $600 | $665 |

Source: The Financial Prophet

While my earnings projections may look modest (after all, Netflix was around $700 in late 2021), the proposed price appreciation through 2028 is nearly 300%, or roughly 4X considering today’s stock price. Also, my estimates are pretty conservative, as I am using a revenue growth rate below 10%, an EPS growth rate of about 20%, and a forward P/E of 20 or lower. Netflix’s revenue growth could accelerate beyond 10%, the company could become increasingly profitable, and its P/E ratio could go well above 20 in the coming years. Therefore, Netflix’s stock price could appreciate faster than projected and may even go higher than anticipated as the company advances.

Risks to Netflix

Despite my relatively bullish outlook, Netflix remains an elevated risk investment now. Increased competition, growth issues, inflation, global conflicts, an economic slowdown, and other factors could negatively impact the company’s growth and share price as we advance. Therefore, one should consider these risks and others carefully before committing capital to an investment in Netflix.

Be the first to comment