Mario Tama

Netflix (NASDAQ:NFLX) stock has lost more than 60% of its value this year as it struggles with increasing churn coming off of hot demand during the pandemic-era that has been further complicated by a consumer slowdown due to rising inflation this year. Yet, the stock staged an intraday gain of as much as 10% on Thursday after announcing the debut of its long-awaited ad-supported tier beginning Nov. 3. The stock’s outperforming rally came on the heels of broader market-wide gains that defied Thursday’s release of another 40-year high core inflation print. The compounded gains underscore investors’ optimism on Netflix’s ability to contain market share loss by offering a more budget-friendly subscription tier that would not only improve its competitiveness within the increasingly crowded streaming landscape but also retain users that would have otherwise cancelled as inflation forces a cut back on spending.

As discussed in a previous coverage on the stock, Netflix could potentially offset lower prices from the ad-supported tier by drawing a greater volume of sign-ups and reducing churn, while also benefiting from another uplift from digital ad sales – a rapidly-growing industry. This is consistent with Netflix’s rivals, such as Disney+ (DIS) and HBO Max (WBD), which have credited their respective ad-supported tiers as a growth-supporting strategy during their respective build-outs.

Even under the best-case scenario, where Netflix executes its ad-supported tier roll-out plans, alongside other monetization strategies (e.g., paid sharing), smoothly over the longer term alongside an eventual improvement in the market climate, we expect the stock to maintain at our previous bull case PT of $235. This approximates the shares’ performance today, implying that markets may already have priced in Netflix’s potential longer-term upsides for now based on currently known growth objectives, offset by increasing competition in streaming that has now stripped the company of its first-mover advantage that had allowed it to expand its profit margins over the years. But with mounting macroeconomic uncertainties and rising recession risks still, which implies a direct impact to Netflix’s recession-prone business given its massive consumer end-market exposure, the company is still a long way from sustaining said upsides, especially with investors still looking for evidence that the company can deliver as promised.

The Long-Awaited Ad-Supported Tier

Netflix surprised markets with the announcement Thursday that it will begin rolling out its ad-supported tier beginning Nov. 3 across 12 countries, fast-tracking earlier plans for launch beginning early 2023 by two months. The long-awaited service, which starts at $6.99 per month, will first become available at its core regions: UCAN (effectively, the U.S. and Canada), France, UK, Germany, Italy, Spain, Mexico, Brazil, Australia, Japan and South Korea. The budget-friendly option, known as “Basic with Ads,” is a whopping $3 discount to its “Basic” tier which limits users to viewing on one screen at a time. Considering Netflix is currently the most expensive streaming service in the market, its $6.99/month ad-supported service also surprises both users and investors by beating rival platforms like Disney+ and HBO Max’s equivalent by $1 and $3, respectively. The Basic with Ads option will show about “four to five minutes of commercials per hour.” which is consistent with the average advertising video on competing ad-supported streaming platforms. It also will feature “lower video quality” and a smaller content library given some licensed titles do not support advertising rights. Kids’ programming will also not be featuring ads.

On the advertising sales front, Netflix will be charging advertisers a higher rate compared to the industry average. Netflix will be utilizing a targeted ad delivery strategy that limits the “number of times people can see the same ad,” while maintaining effective engagement and conversion by leveraging users’ viewership data to gauge their preferences. The proposition backs Netflix’s ask to advertisers for “more than $60 per thousand viewers,” which is almost twofold the average market rate. Netflix also boasts one of the largest viewership volumes in streaming, reaching more than 500 million users worldwide despite having only about 221 million paid subscribers. Paired with its ability to deliver targeted ads, Netflix’s platform makes an attractive outlet for advertisers willing to pay the premium rate.

As discussed in our previous coverage, streaming is about more than just capturing high subscription volumes, but also knowing how to maximize monetization. And what has led to Netflix’s rapid deceleration over the past year is likely its failure in acknowledging the latter – despite charging its industry-leading subscription volume one of the highest rates, it was not enough to cover for lost sales from adjacent services such as digital ads, especially given recent churn due to both intensifying competition and inflation. But now, with streaming slowly, but surely, eating into linear TV – streaming represents 35% of total TV viewership in the U.S. today – and Netflix entering into the digital ads arena at a premium rate charged to advertisers, it’s well positioned to ramp up its massive user base monetization, especially given the favorable long-term outlook in digital advertising demand despite near-term macro woes:

While global TV advertising opportunities are only expected to grow at a compounded annual growth rate (“CAGR”) of 5% over the next five years, Internet advertising is expected to advance at a CAGR of more than 8%, driven by accelerated online data consumption in coming years. Specifically, video streaming platforms are now home to about 23% of total ad spend in the U.S., and the figure is expected to expand further as digital advertising’s more than 60% share of the broader advertising market today is projected to grow at an 11% CAGR through 2030.

Source: “Netflix is Getting Desperate“

Fundamental Implications

However, some are raising concerns that Netflix’s profit margins could come down in the near term due to the inevitable decrease in streaming revenues given the lower rate charged on ad-supported subscriptions, as well as advertising technology roll-out costs. Meanwhile, some are optimistic that the lower-priced option can help Netflix partially salvage lost revenues from those unwilling to pay the premium standard pricing, as opposed to before when it was all or nothing.

Given the ad-supported tier is priced at a lower rate, it’s likely that Netflix will see an influx of conversions over the coming months once the option rolls out across 13 of its hottest locations. This is further corroborated by both market trends observed at peers that offer ad-supported options, as well as the looming economic downturn that has consumers paring spending.

Based on a recent survey performed on American Netflix subscribers – the bulk of Netflix’s user base – about 46% cited they would “consider switch to the streamer’s upcoming ad-supported tier.” Meanwhile, about 45% of surveyed users said they would consider a downgrade to their subscriptions if the ad-supported tier’s fee is halved from the current standard charge, and show fewer than “five minutes of ads per hour.” The trends are consistent with those previously reported by peers like HBO Max, which cited that more than half of its user base is subscribed to the lower-priced ad-supported tier.

At $6.99 per month, Basic with Ads would be 30% cheaper than the rate charged on its ad-free equivalent – both only allow one screen viewership at any given time, while the latter allows downloads for one device. Under the simple assumption that all users are subscribed either to the Basic with Ads or Basic tier at a 45-55 split, Netflix is looking at a 30% decrease to overall revenues, even if its subscriber count stays steady at 221 million. But of course, not all is so simple – Netflix does not separately disclose the number of subscribers across each of its current Basic, Standard and Premium tiers, making it difficult to gauge the portion of lost subscription sales as a result of rolling out Basic with Ads. But in our opinion, the new tier is not expected to impact the Standard and Premium tiers, which allow views on two or four screens together at any given time, as much as the Basic tier.

Look at it this way – if Standard (two screens @ $15.49/month in the U.S.) or Premium (four screens @ $19.99/month in the U.S.) subscribers want to downgrade to Basic with Ads (one screen @ $6.99/month in the U.S.), they would need to double or even quadruple their subscriptions, making it more expensive. Alternatively, Standard and Premium subscribers can downgrade to one subscription for Basic with Ads over the longer term and pay a smaller “paid sharing” fee instead when the new monetization strategy rolls out across all markets – Netflix currently charges between $2 to $3 per additional user per month during test-runs implemented across several of its Latin American markets, but the rate should be much higher once it starts rolling out in the U.S. and Europe that will not make it any more enticing than paying $6.99 per month for one whole Basic with Ads subscription. Market estimates that almost a third of Netflix’s subscription base is paying for a Standard/Premium subscription, which safeguards its total streaming revenues from a material downsize in the near term upon the roll-out of an ad-supported tier.

The ad-supported tier also is expected to draw a greater volume of sign-ups and reduce subscription churn at Netflix, which should partially offset some of the anticipated downsizing in streaming revenues. A recent survey of 1,200 non-Netflix subscribers shows that 90% already “watch ad-supported content today, indicating these audiences have no aversion to watching ads in exchange for free or reduced price content and are prime candidates to turn to Netflix’s new ad-supported tier.”

In addition to an anticipated influx of new compensating subscription volume, advertising revenues also will make up for the subscription pricing gap. Netflix could potentially generate $40.5 million in advertising revenues in the fourth quarter alone upon initial roll-out of its ad-supported tier based on our forecast, with gradual growth toward $235.0 million by the end of 2023 on a full-year basis with expanded availability. The estimate draws on Netflix’s advertising rate at $60 per 1,000 views per ad x four ads per hour x 24 hours per day, pro-rated by a 35% streaming share of total TV viewership for the fourth quarter, which is expected to gradually expand toward more than 60% over the next five years based on the anticipated pace of viewership transition away from linear TV. The assumption also considers the gradual roll-out of Netflix’s ad-supported tier, from 12 countries beginning in November toward all 190 countries that the streaming platform is currently available in by 2026.

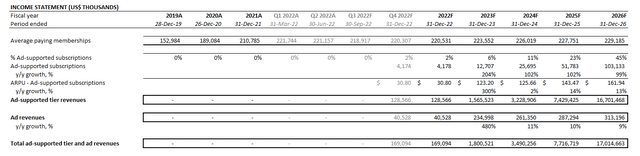

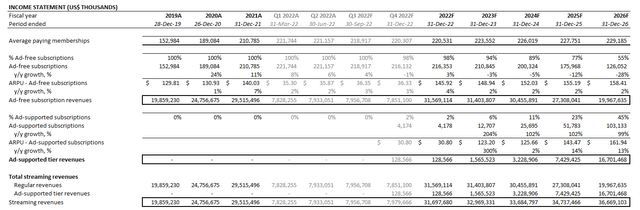

Netflix Ad-Supported Subscription and Ad Sales Forecast (Author)

Based on the foregoing assumptions and market trends discussed, Netflix’s ad-supported tier is expected to generate more than $1.8 billion in revenues from both Basic with Ads subscriptions and related ad sales by the end of 2023. This also is consistent with consensus estimates for Netflix to generate “at least $2 billion in sales from its ads and subscription tier in the first year.” Our forecast assumes that initial ad-supported subscriptions will represent 2% to 6% of Netflix’s total subscription base within the first year of roll-out, which is estimated based on initial availability across 12 of 190 serviced countries that will gradually double by 2023, prorated by a 45% take-rate.

Netflix Ad-Free and Ad-Supported Subscription Forecast (Author)

And over the longer term, when Netflix’s ad-supported tier becomes available across all 190 countries that it currently services, with a 45% take-rate, we expect the average revenue per user (“ARPU”) of Basic with Ads to top $160 per year, beating the ARPU of ad-free tiers at the $150-range. This is consistent with management’s expectations for rapid scale and ad revenues to eventually contribute to an ARPU for Basic with Ads that will exceed the ARPU for ad-free subscriptions.

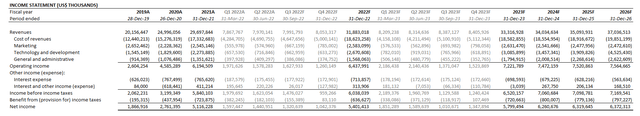

Netflix Financial Forecast (Author)

Netflix_-_Forecasted_Financial_Information.pdf

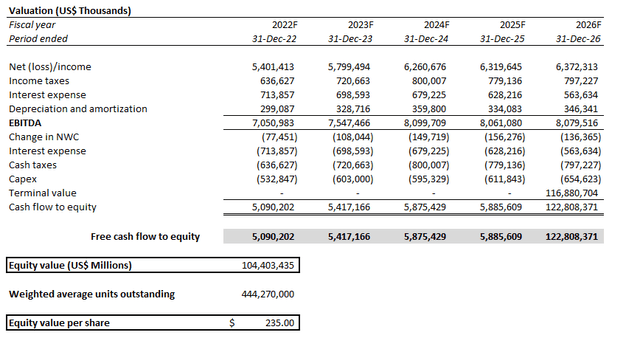

Valuation Implications

Drawing on the above fundamental adjustments based on recently disclosed details on Netflix’s pricing strategy for its upcoming ad-supported tier and advertising strategy, we have arrived at an estimated intrinsic value for the stock at $235 apiece, which is consistent with our previous forecast.

The $235 PT takes into consideration the best-case scenario where Netflix successfully executes its ad-supported service over the five-year forecast period, alongside alleviation to current macro headwinds that have caused both earnings forecasts and valuation multiples to compress across the board. Specifically, our valuation estimate is derived from performing a discounted cash flow analysis in conjunction to the fundamental forecast discussed in the earlier section. The analysis assumes a perpetual growth rate of 4.9%, which would be reflective of the continued transition from linear TV to streaming, as well as the growing adoption of digital advertising, plus an added premium for Netflix’s industry-leading audience reach. The forecast cash flows are discounted at a WACC of 9.6%, which is consistent with Netflix’s current risk profile and capital structure backed by steady positive free cash flow generation and profitability, alongside low leverage.

Netflix Valuation Analysis (Author)

Given the $235 price target approximates Netflix’s last traded share price of $232.51 on Oct. 13, we believe the market may have started to price in the stock’s best-case scenario. This is consistent with observations on Oct. 13 where the broader market rallied with benchmark index S&P 500 up 2.6% to account for positive forward market expectations, as well as added investor optimism over Netflix’s outlook with the roll-out of an ad-supported tier, which together made up the stock’s 10%-plus intraday gains.

Risks to Consider

Yet, we believe it’s too soon to tell whether the Netflix stock can sustain at the current $230-range.

First, it remains uncertain how take-rates on both Netflix’s ad-supported subscription and advertising sales will look like. Netflix’s advertising charge rate is currently at a significant premium that doubles the industry average, so advertisers are likely expecting nothing less than what the company promises to deliver – maximized engagement and conversion from its industry-leading subscription base of 221 million (or more than 500 million on a user basis) achieved through effective data-driven targeted ad delivery. This is especially true under the current macroeconomic environment, where advertisers already are cautious about ad spending in anticipation of a looming economic downturn.

Meanwhile, although the ad-supported tier will likely help Netflix arrest the rapid decline in subscription volumes observed in recent quarters by offering budget-conscious users an alternative choice, increasing competition remains a challenge on the company’s potential return to accelerating growth. There also are uncertainties still on the pace of rolling out the cheaper tier across Netflix’s some 180 other serviced countries.

Under today’s economy, where investors prefer results over speculation, Netflix’s upcoming 3Q22 earnings release will be a key focus – first on whether its subscription volumes have improved, and second on what management has to say on the anticipated near-term take-rate for Basic with Ads. 4Q22 and early 2023 financial results will be even more critical as that is when it becomes more evident on whether Basic with Ads is a boom or bust for Netflix’s long-term comeback plan. Between now and then, the stock will likely succumb to further volatility, especially as market conditions tighten and recession risks rise in the near term.

Final Thoughts

We believe the Netflix investment remains susceptible to significant downside risks, despite having lost more than 60% of its market value this year already. With increasing competition, where almost every rival is already offering some variation of an ad-supported option, whether Netflix can catch up and regain market share remains an uncertainty. However, we remain optimistic that its industry-leading reach remains a competitive advantage that can offset some of that risk, given the appeal to advertisers looking to maximize their ad spending – but that’s only if Netflix can put a stop to its declining subscription volume over coming months and arrest its rapid market share loss to competition.

Looking ahead, earnings results from the second half of 2022 and early 2023 will be a critical determinant for where Netflix’s stock is headed in the near term. Investors will be focused on whether Netflix’s churn has slowed in 3Q22, as it would imply resilience against an unraveling macroeconomic backdrop. 4Q22 forward guidance and actual results will be another key focus area, as it will imply how well take-rates on its ad-supported tier and ad sales are, which will be critical to absorbing downside risks stemming from the rising odds of a recession in 2023.

Despite an optimistic best-case scenario, macro factors and uncertainties over execution of its advertising strategy (i.e., execution risks) remain large overhangs on the Netflix stock. As such, we expect continued volatility in the near term until the company provides structural evidence supporting a sustained turnaround from its fundamental slump observed over the past year.

Be the first to comment