Wachiwit

Background

As part of my previous article, I noted the undervaluation of Netflix’s (NASDAQ:NFLX) shares, that were sold off to the range of $150-250 from the peak price of $700. Two weak reports in a row were the reasons for the stock price fall (Q4 2021 results in January 2022 and Q1 2022 results in April). Historically, the company’s shares have traded at a premium to other major technology companies. That could be explained by stable double-digit revenue growth rates and annual margin improvement. Nevertheless, both of the above-mentioned reports led to the fact that inflated expectations for further growth were not met and investors began to believe that further subscriber growth would be problematic due to the streaming market saturation. Such a strong stock fall, which began even before the correction of all technology companies, created an interesting opportunity for investment in Netflix, which I wrote about in the last article (Netflix: Not The Time To Write Off The Company). Since the last article, the company’s share price has grown by 29%. Looking ahead, I note that I do not plan to buy more shares of the company in the coming months, as the shares look fairly valued after the post-earnings growth. Let’s dive into the quarterly result to understand why I came to the conclusion about the fairness of the current market valuation of the company. However, before that, let’s look at the state of the streaming market in Q3.

A brief look at the streaming market

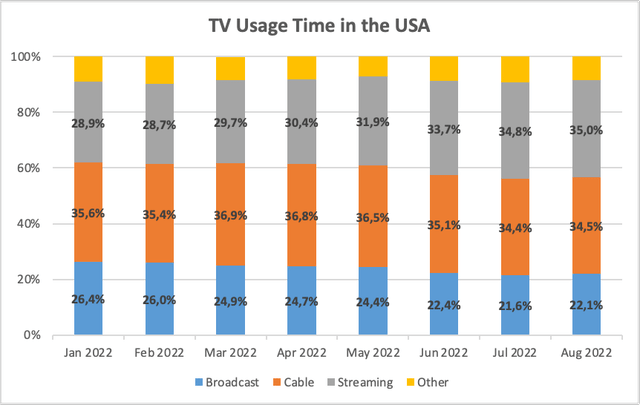

According to Nielsen’s July and August data, the growth of the streaming share in TV usage in the USA continued in August. At the end of June, streaming share was at 33.7% of the TV usage time. By the end of August, the share increased to 35%. That was partly due to the summer lack of traditional TV and cable TV new releases. The share of cable TV decreased from 35.1% to 34.5%, and traditional TV share decreased from 22.4% to 22.1%. At the same time, Netflix’s position in streaming has not changed much. In June, the Netflix share in TV usage was 7.7%. At the end of August, the share was at 7.6%. There is no September data in free access yet, but there is a possibility that some viewers will switch from Netflix to HBO Max and Amazon Prime to watch House of the Dragon and The Rings of Power, respectively. Nevertheless, the unexpected popularity of Monster: The Jeffrey Dahmer Story series was partly supposed to hold the attention of Netflix’s subscribers (824 million hours viewed, the second place among the English-language series of the service).

TV usage time in the USA (created by the author based on Nielsen data)

Thus, in general, the trend favored streaming services, but Netflix’s share in TV usage did not change much in the first two months of the quarter. Nevertheless, the actual results were quite positive.

The overview of actual results

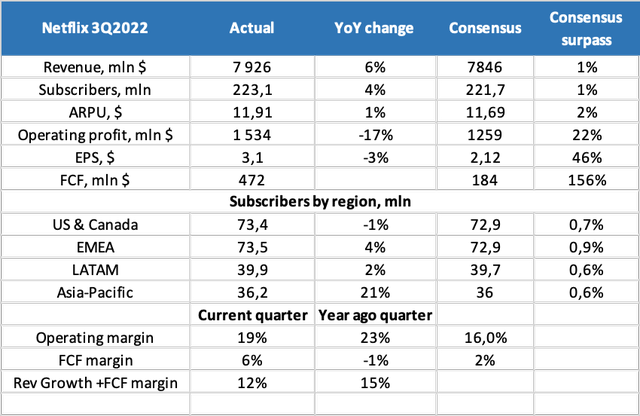

Netflix’s revenue was 1% better than consensus expected and amounted to $7.9 billion (+6% YoY). Excluding the impact of F/X, revenue increased by 8% YoY. 55% of the company’s revenue comes from regions outside the United States and Canada, so the strengthening of the US dollar has a negative impact on the company’s performance. The number of subscribers increased by 2.4 million (+5% YoY, consensus was at 1.4 million) to 223.1 million (expected 221.7 million). By region, APAC showed the best growth in subscribers. In the Asia-Pacific region, net inflows amounted to 1.4 million. I would like to note that Netflix’s focus on creating local content is bearing fruit and is already reflected in the subscriber engagement data. The TV series Extraordinary Attorney Woo scored 402 million hours viewed in 28 days, Narco-Saint scored 128 million hours viewed, and The Empress – 136 million hours.

Netflix 3Q results (created by the author based on the company filings and FactSet data)

The positive reporting is mostly associated with good margin indicators, especially taking into account the impact of the US dollar strengthening. The operating margin in Q3 was at the level of 19%, 16% was expected, and a year earlier, it was 23%. The result was better than expected due to the transfer of some expenses from 3Q 2022 to 4Q 2022, and the YoY decrease is due to the impact of F/X. FCF margin was at 6%, a year earlier (-1%), consensus expected 2%.

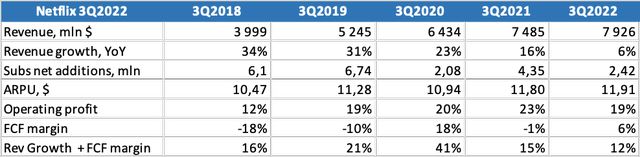

Netflix main indicators by years (created by the author based on the company filings)

The overview of the management forecast

The management provided a weak 4Q subscriber forecast, but the market did not pay much attention to this. The forecast assumes a net addition of 4.5 million, while the consensus expected the net addition of 9.9 million (233 million paid subscribers at the end of Q4). Before the report, I believed that the 4Q consensus forecast was too optimistic, because, in previous years (2018-2021), about 8 million subscribers were added on average in Q4. Only in Q4 2019, there were 11 million net additions. On the one hand, the management’s forecast looks conservative and there is a chance to surpass it. But on the other hand, the management historically has been relatively accurate in forecasting the subscriber number in the last five years. The average difference between the fact and the forecast was only 1% of the subscriber base. So it is not worth waiting for a significant surpass of the forecast. Highly anticipated releases (Knives Out 2, the prequel of The Witcher, the new season of Emily in Paris, and Pinocchio) will be released only towards the end of December. Until then, the major releases will be among the content, mostly focused on Asian markets. It is far from a fact that such a release schedule will help exceed management expectations. Probably, some subscribers may prefer to subscribe in January to watch all the new content at once. Revenue is expected at $7.7 billion (+1% YoY, consensus expected $7.9 billion). Adjusted for the F/X impact, growth is expected to be 9% YoY. The operating margin is projected at 4% (a year earlier it was 8%, adjusted for the F/X impact, the 10% margin is expected). By 2022, the company expects FCF at the level of $1 billion (margin of 3.2%, in 2021 the margin was 0%).

Thoughts on the further stock dynamic

Although the company’s long-term prospects remain very attractive, I believe that we shouldn’t expect a significant growth in the share price in Q4. The launch of the ad-supported plan will not have a significant impact on the company’s business yet, and other initiatives in the form of solving a problem with the sharing accounts by different households and the launch of the video games have not yet gotten significant results. Regarding the ad-supported plan, management noted that it expects the ad-supported plan to launch starting in November in 12 countries with a total addressable TV advertising market of $140 billion (75% of the global TV advertising market). In the USA, the price of the ad-supported subscription will be $6.99 (the standard plan starts at $9.99) with the need to watch ads (5 minutes per hour). As advantages of the advertising plan for the company’s business, the following can be distinguished:

- Reach a new audience – households with lower income, loyal to watching ads.

- Potentially higher revenue per user (ARPU) due to the high interest from advertisers. The ability to display ads to an audience of 223 million is very attractive to advertisers in conditions of difficulties with targeting and measuring the effectiveness of advertising in social networks due to the changes in Apple’s IDFA policy.

- Higher marginality in the long term. The advertising business has an average of 45-50% EBITDA margin versus 25-30% for paid streaming.

In the year since the start of the development of the video games, the company has already launched 35 games. All games are included in the subscription and do not require watching ads. 55 games are in development. The company plans to focus in the coming years on the release of potential blockbuster games. In my opinion, the company can make an M&A to expand these initiatives. As possible takeover targets, I single out Ubisoft and CD Projekt RED, with which the company has partnership agreements to create content based on their video game franchises.

The company has started monetization of sharing accounts in a number of LATAM regions and plans to develop it more actively in other regions next year. Let me remind you that according to the company’s estimate, about 100 million households share their account with other households. The practice of connecting new devices for an additional fee will partially solve this problem, but we probably won’t see the effect of this until the 2nd half of 2023.

Risks and final thoughts

In the context of declining purchasing power due to high inflation and increased competition for the attention of viewers from different streaming services, I expect an increase in the volatility of end-of-period subscriber results in the coming quarters for all streaming services, because households will be more likely to subscribe and unsubscribe to streaming services depending on the content release schedule. This is not the only risk that the company may face. The continued strengthening of the US dollar against other currencies will also negatively affect the company’s results. I recommend familiarizing yourself with the company’s other risks in Netflix’s latest financial statements (10-K).

As a result, I note that after the growth on the reporting, the company’s shares are trading close to the current fair value ($276 per share according to my DCF model). That does not create a lucrative opportunity to buy Netflix’s shares now, given the lack of strong drivers in the next month or two. My long-term view on stocks is positive, but a significant growth should be expected only after the wide deployment of the combined plan. To increase Netflix’s share position, it is better to wait for the 4Q results. There is a high probability that by this time there will be more attractive levels to buy.

Be the first to comment