Petmal/iStock via Getty Images

Finnish renewable products company Neste Oyj (OTCPK:NTOIF, OTCPK:NTOIY) can be fairly considered the poster company for realizing the pan-European endeavor to become greener and more energy independent. These twin challenges have never been more critical. (One other company that comes to mind is Orsted (OTCPK:DOGEF, OTCPK:DNNGY), though it is much closer to completing its transformation.)

Neste, led by a new CEO, has stayed on track. By now its renewable diesel, jet fuel, and solvents are produced almost 100% from waste and residues, which settles questions about the genuine sustainability of biofuels. Newer and more innovative solutions – such as sustainable aviation fuel and renewable chemicals – are receiving a lot of attention. Oil products, in contrast, are no longer the focus of growth efforts, although still a big part of the business (with refining capacity three times larger than that of renewables).

Financial update

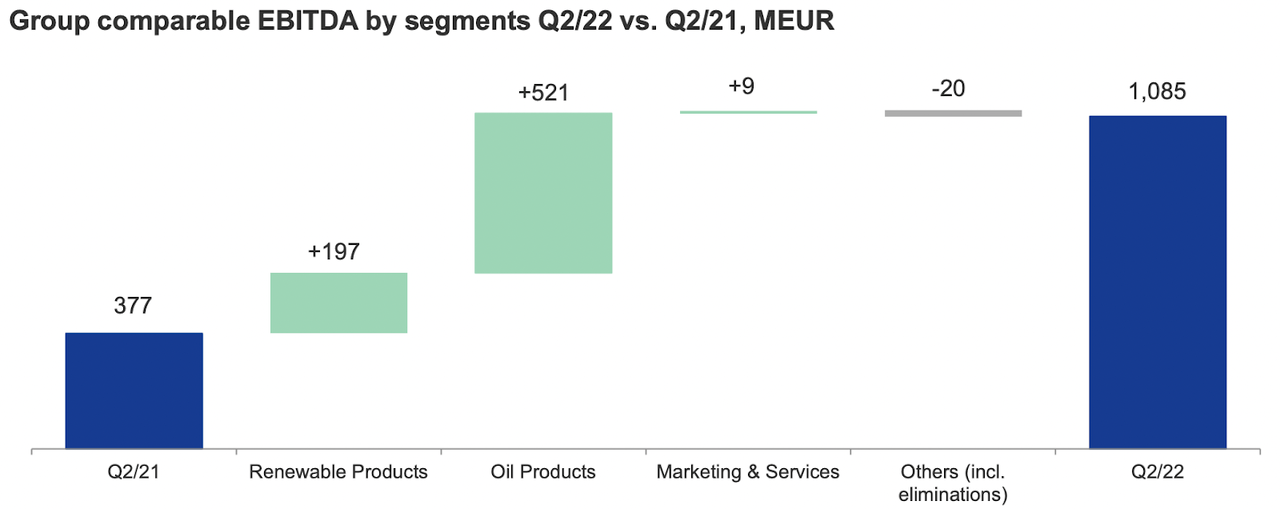

Neste says it delivered “excellent performance in exceptional market conditions” in the second quarter of 2022, and it is not an overstatement. Revenue went up 133% quarter over quarter, comparable EBITDA 55%, comparable earnings per share 3x to €0.96. These accretions were driven primarily by higher volumes and better sales margins in Oil Products, which comes as no surprise seeing how windfall profits are being reported across the industry.

Neste

The results from Renewable Products, which is the core business given the company’s vision of total green transformation, were also solid thanks to a strong diesel market and favorable feedstock prices. The segment’s revenue rose by 105% and comparable EBITDA by 58%.

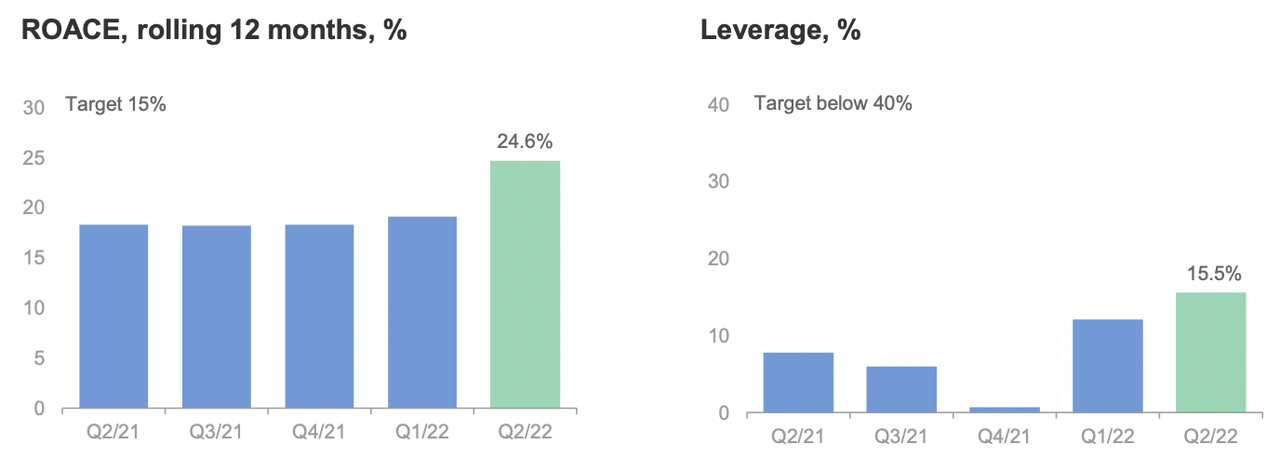

Overall, Neste continues to find itself in a very solid financial position. It hit a record return rate in Q2 of 24.6% above targeted 15%. At the same time, it has low leverage against a good cash cushion. Free cash flow for the period was negative due to an inventory build-up ahead of planned turnarounds in the coming quarters and possible price increases – a necessary measure in the current environment of high uncertainty.

Neste

Niche growth area

Although Oil Products contributed to comparable EBITDA just as much as Renewable Products in the past quarter, it is still a legacy division that ought to be reformed eventually. Neste has committed to reaching carbon-neutral production by 2035 and replacing at least 10% of crude oil with renewable or recycled raw materials at the Porvoo refinery where Oil Products are made.

Meanwhile, all growth efforts have been directed at renewable and circular solutions. In June, the company finalized the investment sum going into expanding its renewables refinery in Rotterdam: €1.9b will lift the annual production capacity at this facility by 1.3 Mt to a total of 2.7 Mt starting from 2026.

Coming online in 2023 is the upgraded Singapore facility and already this year a converted refinery in California belonging to soon-to-be joint venture partner Marathon Petroleum (MPC). These two expansion projects will bring the production capacity for renewable products from 3.3 Mt at present to 5.5 Mt by the end of next year, potentially adding €4b to annual revenue (based on the share of “Clean Revenue” in 2021 of approximately €6b).

Active enlargement of Neste’s capacity has put a new spotlight on sustainable aviation fuel (SAF). By end-2023, some 1.5 Mt will be dedicated to the production of SAF, far above the current capacity of 100,000 tons per year. The company’s banking on biofuel for aviation is strategically timed as the sector commits to reaching carbon neutrality by 2050, with SAF considered by far the most viable alternative jet fuel.

Neste continues to make inroads in the U.S., making its SAF available in more locations, not least spurred by enabling regulation (e.g., the SAF tax credit) and a supportive government stance. Airlines across Europe are being encouraged to switch by policymakers in individual countries as well as under EU-wide initiatives such as ReFuelEU Aviation. It is still early days, but as a leading maker of SAF, Neste stands to benefit.

Risks

The very circumstance that led to extraordinary performance in Q2 doubles as a key risk. Energy markets will stay volatile, but it is hard to predict for how long. Oil products and waste/residue feedstock are both concerned. (The Russia problem was addressed early and has been eliminated completely by now.) Of course, how much the company sells is also a factor of the evident weakness in global economic growth.

Valuation

Since I last wrote about the stock with a Neutral rating more than a year ago, it has come down about 30%. My only real issue was how expensive the shares were at $64. Now NTOIF is selling at a much more palatable $44, near the center of its 52-week range. (How the two symbols traded in the US, NTOIF and NTOIY, differ was recently mentioned by Michael Dolen.) At 12.64, trailing twelve-month EV/EBITDA is slightly lower than the five-year average of 13.90, though still significantly higher than the Energy sector median of 9.13. The original HLSE:NESTE is trading at a P/E of 17.5 at €50.08 and has a 12-month target price of €52.63.

Conclusion

It is safe to say that the last quarter’s outperformance was mostly due to factors that are transient in nature. What is more permanent and what I am more interested in is how Neste handles its long-term transformation. And that is coming along nicely, with generous funding allocated towards increasing capacity to produce renewables products – by 67% in about a year’s time. It is also expanding geographically, finally setting up shop in North America beyond sourcing. All in all, I remain positive about Neste and believe at this price it may be worth the premium as a long-term hold.

Be the first to comment