gorodenkoff/iStock via Getty Images

A Quick Take On NerdWallet

NerdWallet (NASDAQ:NRDS) went public in November 2021, raising approximately $131 million in gross proceeds from an IPO that priced at $18.00 per share.

The firm provides consumers and small businesses with financial information and a variety of financial services.

With most economists predicting a recession in 2023 in the U.S., I’m not optimistic about the firm’s growth prospects or ability to produce significantly higher operating results.

In the near term, I’m on Hold for NRDS.

NerdWallet Overview

San Francisco, California-based NerdWallet was founded to operate at the intersection of financial service providers and consumers by providing consumers and small businesses with information about financial offerings.

Management is headed by founder, Chairman and CEO Tim Chen, who has been with the firm since inception and was previously an Investor at JAT Capital Management and Perry Capital.

The company essentially provides financial service providers with leads to interested app users and generates revenue on a per action, per click, per funded loan or per lead basis.

The firm seeks new customers through word of mouth, online advertising, and mobile app downloads from major mobile platforms.

NRDS’s offerings include:

-

Banking

-

Credit Cards

-

Financial Planning

-

Investing

-

Insurance

-

Mortgages

-

Loans

-

Small Business

-

Taxes

-

Travel

NerdWallet’s Market and Competition

According to a 2021 market research report by Startup Bonsai, 61% of marketers said that lead generation was their most important challenge.

53% of marketers spent 50% or more of their marketing budget on lead generation and outsourcing lead generation generates 43% better results.

Also, 80% of APSIS survey respondents seek to automate lead generation, whether in-house or outsourced and that such automation results in a far higher ROI.

Major competitive or other industry participants include:

-

Bankrate

-

Credit Karma

-

LendingTree

-

Zillow

-

Others

NerdWallet’s Recent Financial Performance

-

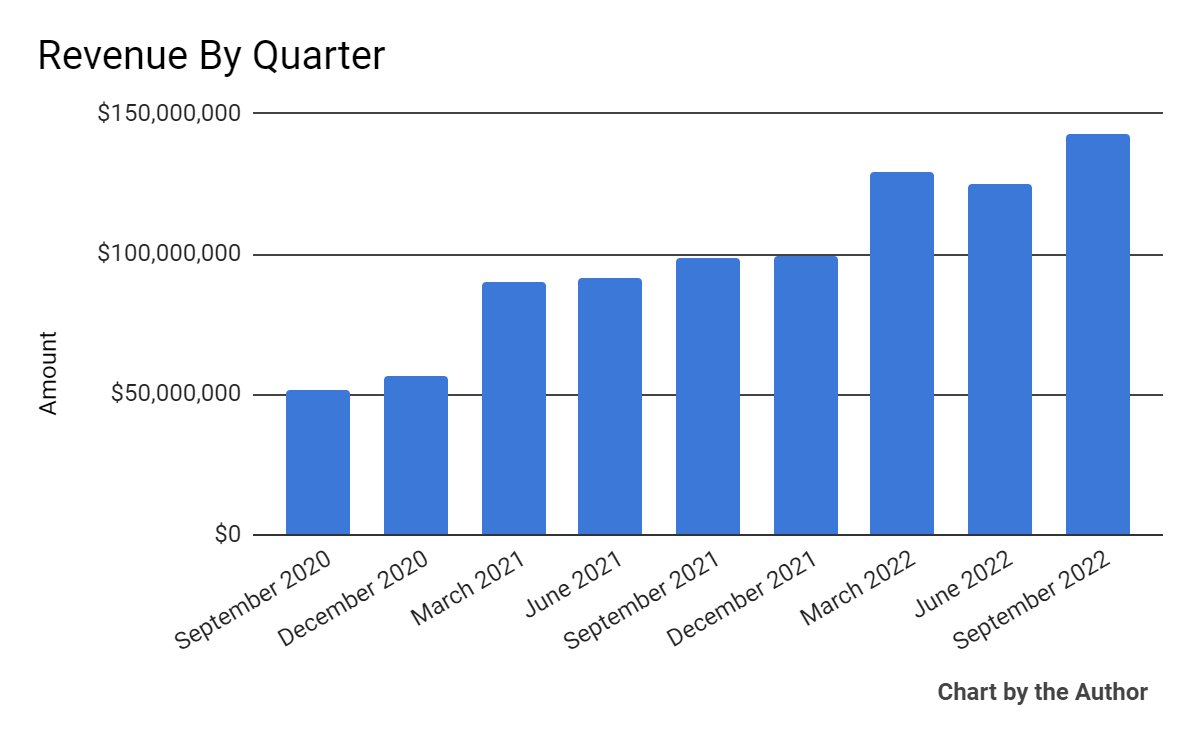

Total revenue by quarter has risen according to the follow chart:

9 Quarter Total Profit (Seeking Alpha)

-

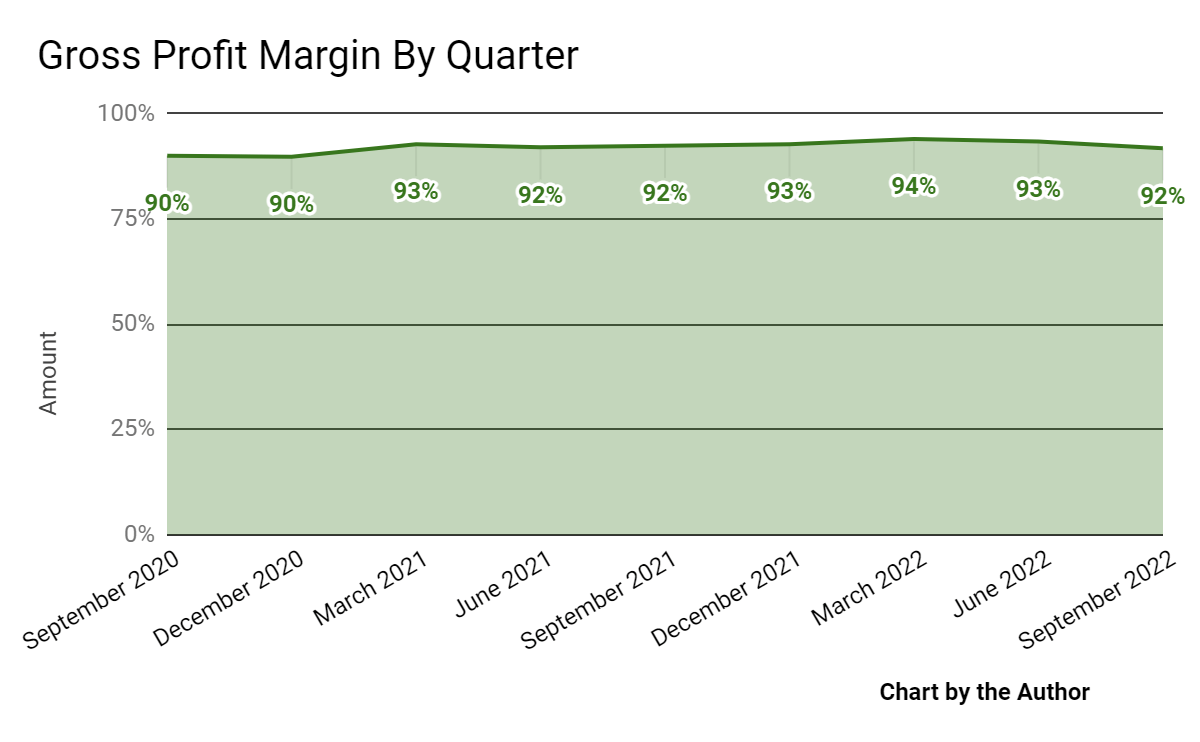

Gross profit margin by quarter, while still quite high, has dropped slightly in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

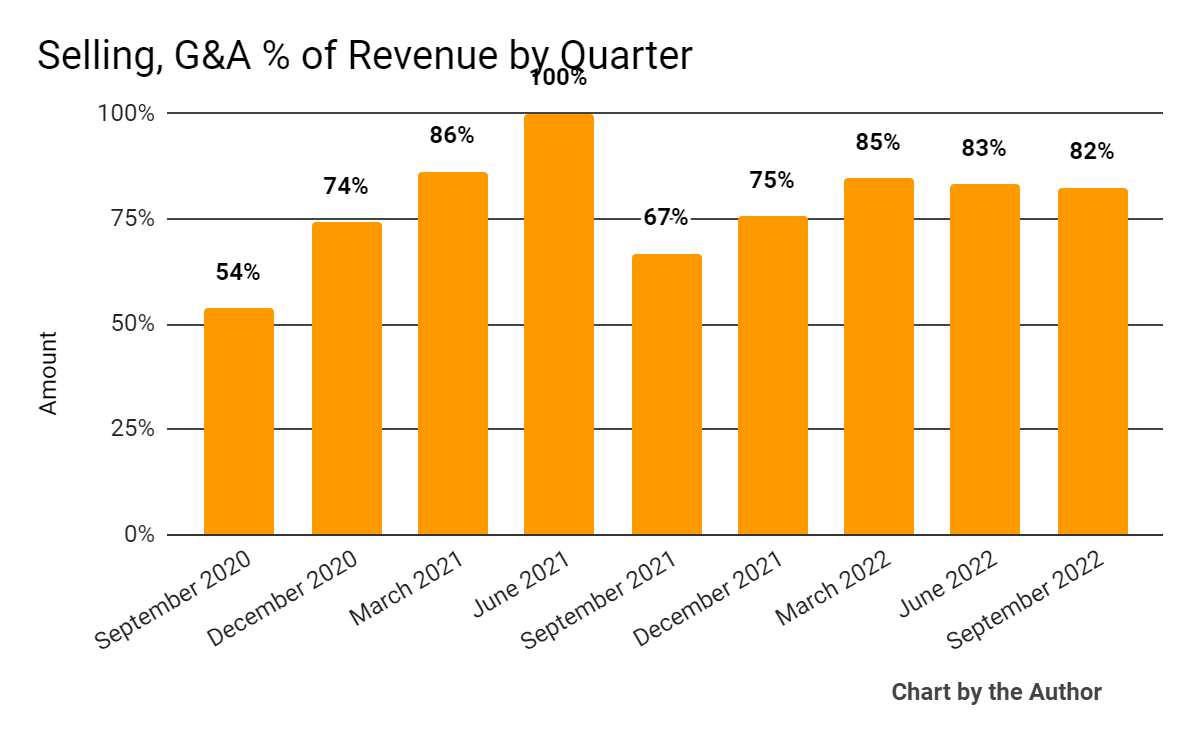

Selling, G&A expenses as a percentage of total revenue by quarter have remained quite elevated:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

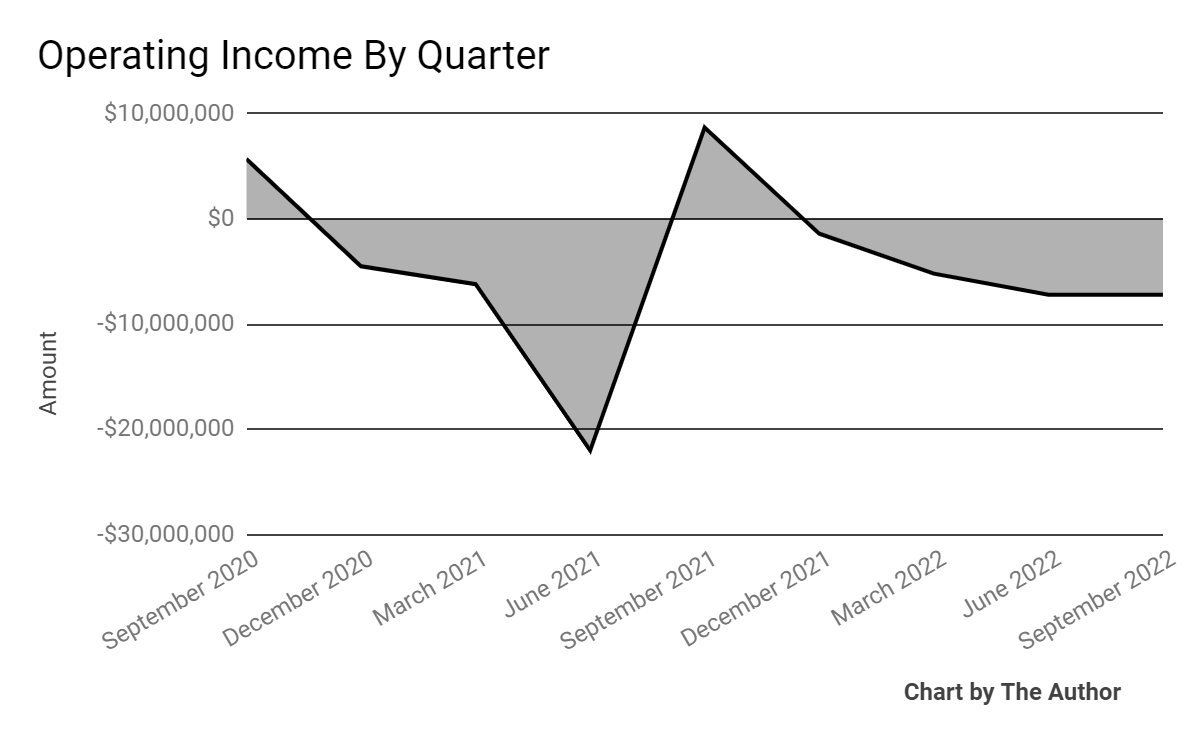

Operating income by quarter has remained negative in seven of the last nine quarters:

9 Quarter Operating Income (Seeking Alpha)

-

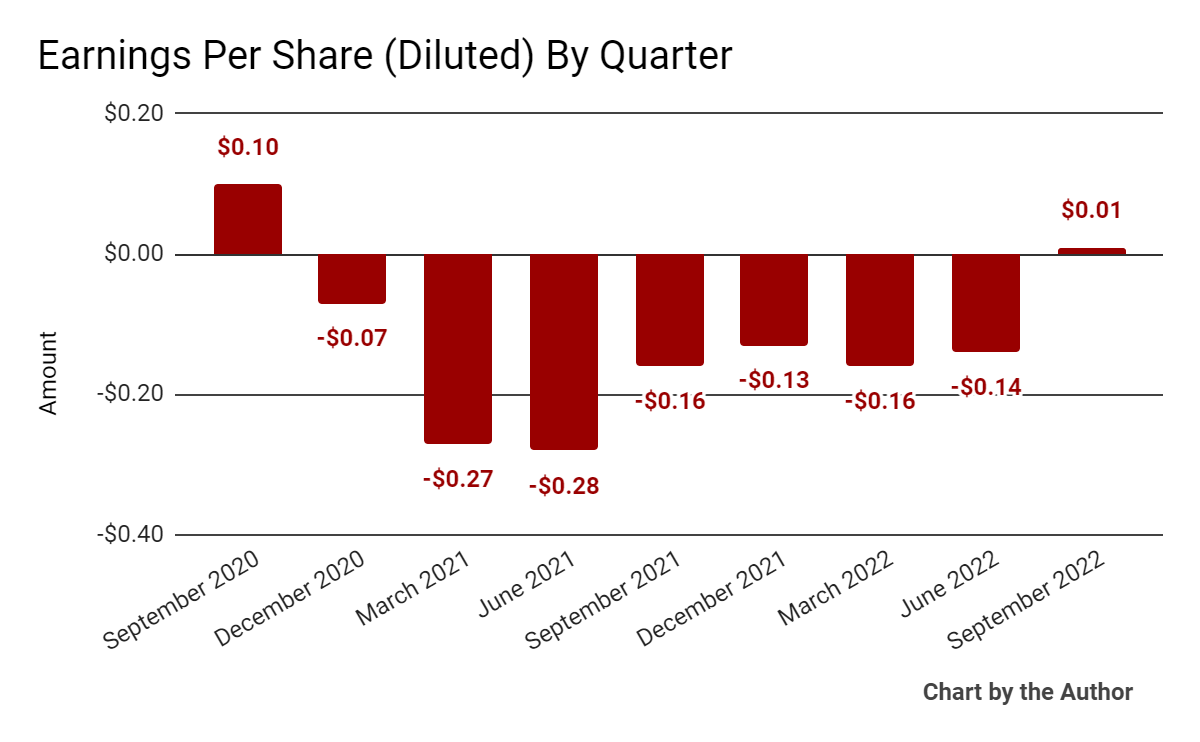

Earnings per share (Diluted) have recently turned positive:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

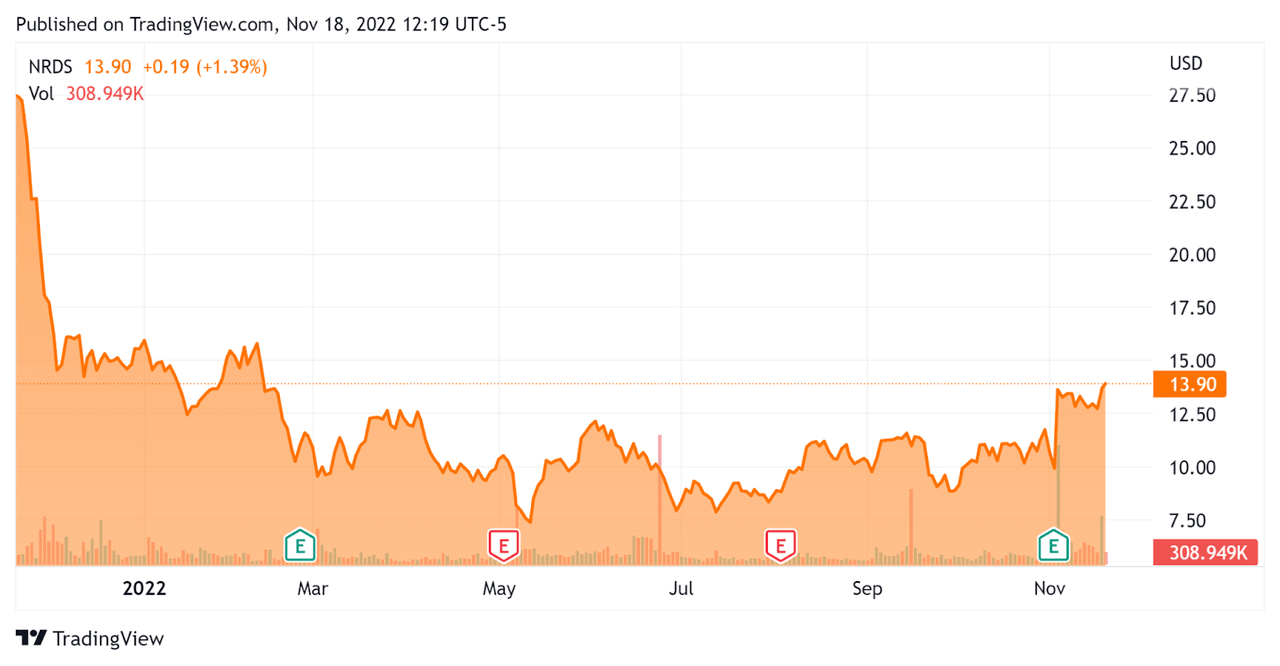

Since its IPO, NRDS’s stock price has fallen 49.6% vs. the U.S. S&P 500 index’ drop of around 16.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For NerdWallet

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.8 |

|

Revenue Growth Rate |

47.4% |

|

Net Income Margin |

-5.4% |

|

GAAP EBITDA % |

-1.3% |

|

Market Capitalization |

$947,010,000 |

|

Enterprise Value |

$892,010,000 |

|

Operating Cash Flow |

$13,600,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.42 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

Although the company is not strictly a software firm, NRDS’ most recent GAAP Rule of 40 calculation was 46.1% as of Q3 2022, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

47.4% |

|

GAAP EBITDA % |

-1.3% |

|

Total |

46.1% |

(Source – Seeking Alpha)

Commentary On NerdWallet

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted exceeding its revenue and adjusted EBITDA outlook, “driven by growth across credit cards, banking, personal loans and SMB verticals.”

Management has pursued a “land and expand” strategy of cross selling its services and has continued to focus on increasing its international presence with further expansion into Canada.

Also, the SMB vertical appears to be growing quickly, with personal loans being a bright spot.

As to its financial results, topline revenue grew 45% year-over-year, while gross margin percentage was flat, although still extremely high by any standard.

Management didn’t disclose any retention rate metrics, but the firm’s Rule of 40 results have been strong.

Notably, its mortgage vertical has been negatively impacted by the rise in interest rates, but its personal loans services have picked up some of the difference.

Operating income remained negative, with EPS turned slightly positive.

For the balance sheet, the firm ended the quarter with $138.4 million in cash and equivalents and $70.0 million in long-term debt.

Over the trailing twelve months, free cash flow was $7.7 million and the firm spent $5.9 million on capital expenditures.

Looking ahead, management expects full year 2022 revenue growth to be approximately 41% and adjusted EBITDA to be around 12% of revenue.

Regarding valuation, the market is valuing NRDS at an Enterprise Value / Revenue multiple of only 1.8x on 45% topline revenue growth.

The primary risk to the company’s outlook is a slowing U.S. economy with high interest rates, reducing demand for many of its services as consumers and small businesses pull back.

A potential upside catalyst to the stock could include a pause in interest rate hikes, which would likely increase its valuation multiple.

With most economists predicting a recession in 2023 in the U.S., I’m not optimistic about the firm’s growth prospects or ability to produce significantly higher operating results.

In the near term, I’m on Hold for NRDS.

Be the first to comment