designer491

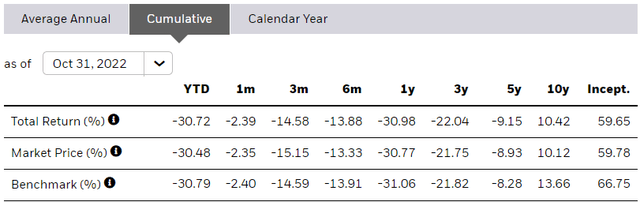

iShares Long-Term Corporate Bond ETF (NYSEARCA:IGLB), the name says it all, but we will reiterate with a few additional details thrown in. This exchange-traded fund (“ETF”) invests in USD denominated, fixed rate, investment grade corporate bonds that have remaining maturities greater than 10 years. It endeavors to track the performance of its benchmark, the ICE BofA 10+ Year US Corporate Index. Owing to IGLB being a passive ETF, its annual expenses, which comprise the management fees, are a nominal 0.06%. With such low expenses, IGLB does not have any significant handicap in replicating the performance of its benchmark index, and we can see that below.

Being a passive ETF, IGLB also does not try and outperform its benchmark by adapting its investment strategies to the prevailing market conditions. Over the longer term, we see that the fund underperforms the index more than what one would expect taking into account just the management fees. This could be partially because this ETF uses representative sampling instead of full replication of the index. In IGLB’s case, it means that at least 80% of its portfolio is made up of securities that are in the index. 10% can be invested in securities from outside of the index, but of the same type. Balance can be in derivatives or in fixed income securities of types other than those included in the index, provided that BlackRock, the investment advisor to the fund, believes those will help the fund track the index. The prospectus warns the investors of performance variances vis a vis the index as a result of this methodology, other timing differences and costs such as taxes and commissions. It notes that IGLB “will experience higher tracking error than is typical for similar index ETFs”.

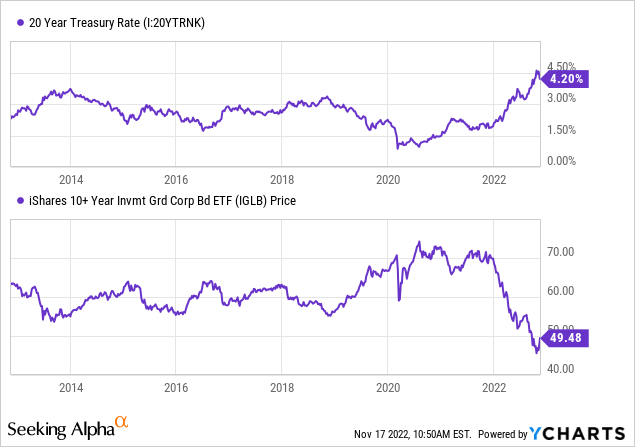

Being invested in fixed-rate securities has not done IGLB any favors with rates on the rise in the last year. The 30% drop is easily the worst on record for any period. We examine the current holdings, the macro backdrop, and give you our view of this fund.

Portfolio

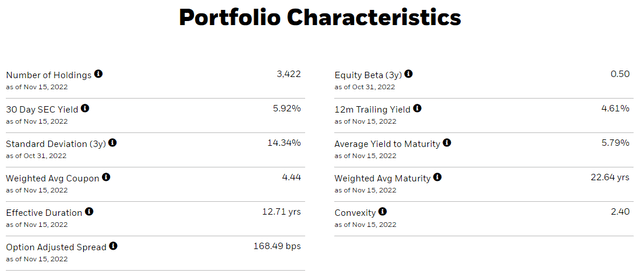

The over-$1.3 billion IGLB portfolio has 3,400 securities. The weighted average maturity of the holdings is 22.64 years, having an average yield to maturity, or YTM, of 5.79%.

The YTM math makes sense when we see the comparable risk-free rate and tack on the current option-adjusted spread data noted under the portfolio characteristics above.

Another point to note is that with the current rates highest they have been in the last decade, IGLB’s price is at its lowest. For that we have to consider the effective duration of the portfolio, which is 12.71 years. This should not be confused with the average length of time until the bond principal will be repaid, which, as we saw under the portfolio characteristics above, is over 22 years for the cumulative portfolio. Duration, on the other hand, measures the interest rate sensitivity of the portfolio. While not an exact science, it tells you broadly how much the value of the portfolio will rise or fall when the opposite happens with every basis point change in the applicable risk-free rates. In IGLB’s case, as we can see above, with around a 2.5% rise in the 20-year rates from late 2021, the price fell by 30% (approximately 2.5 times effective duration of 12.71 years).

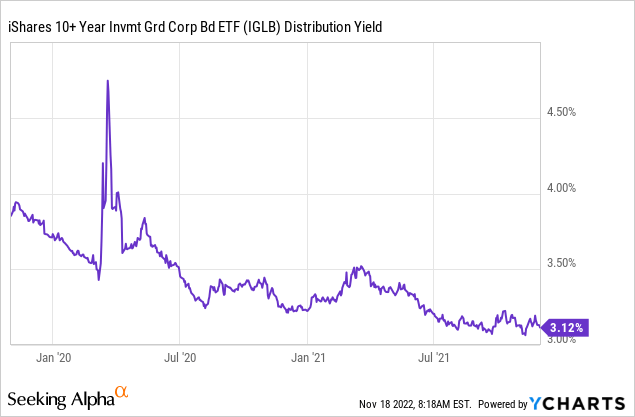

While this ETF currently yields 4.6% (current price $49.48, latest dividend $0.188209), the fund has inflows closer to 6% as indicated by its 30-Day SEC Yield. The 30-Day SEC Yield reflects the net income earned by the fund in the most recent 30-day period. The outflows to investors catch up to the fund inflows, so the incoming investor can expect a yield closer to 6% in the coming months.

Outlook & Verdict

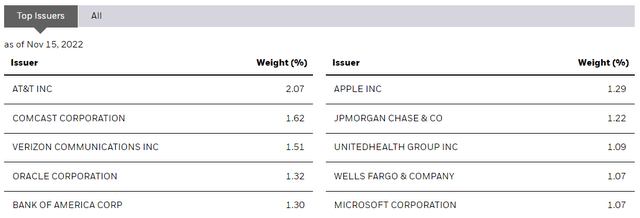

The portfolio is made up of investment grade securities, and the top 10 issuers, making up around 14% of the portfolio, are well known in their sectors. While their equities may not be experiencing loads of love from the market in recent times, their bonds are considered solid.

In the past, we have shunned fixed income securities as they represented return-free-risk. Regardless of the “timeless wisdom” of portfolio allocation or of the 60:40 portfolio, we felt that bonds would get you destroyed. IGLB was no different with a 15-year duration at the time coupled with 3% distribution yield. Let’s face it. You asked for this.

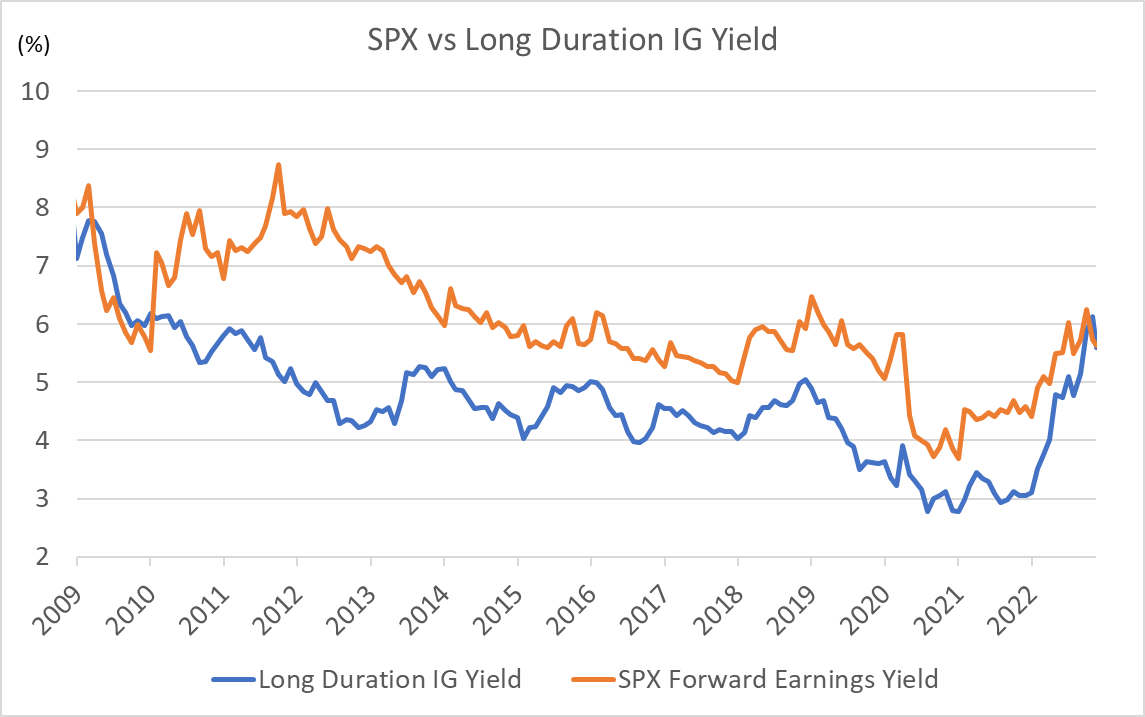

But at present, things have improved to the point where you are getting a better risk-reward structure. Is it enough, is what you need to ask yourself. Long duration investment grade yield is now on par with S&P 500 (SPY) earnings yield.

The Spread Thread

So, from that perspective, it is hard to argue that they are overvalued. If you own long durations securities like stocks, you should own some long durations securities like bonds. At least you are getting paid almost twice as much as you were in late 2021. Investors that think interest rates are peaking may find this a good place to get aggressive and allocate a good chunk of their funds and earn a decent yield. From our view, we are finding far better opportunities in short term investment grade credit and hence are not chasing this IGLB fund.

Be the first to comment