Dr_Microbe/iStock via Getty Images

Among Declining Biotech Stocks, Nektar Therapeutics Has Little Chance of a Rebound

Biotechnology stocks are down about 30% since the beginning of the year as they faced severe headwinds from high inflation, tight monetary policy, and the war in Ukraine.

Once the bearish sentiment ends, biotech stocks will bounce back. However, for some of them, that may not be the case, as market headwinds are not the sole reason for their decline.

Nektar Therapeutics (NASDAQ:NKTR) could be one.

This stock doesn’t seem to have much chance of recovery, as medical treatments in development have lost their bite while the financial situation worsens instead of improving.

Who Is Nektar Therapeutics

Based in San Francisco, California, Nektar Therapeutics is a biopharmaceutical developer of medical treatments for unmet medical needs in the United States and abroad.

The company develops its medical treatments in the fields of oncology and immunology.

The Pipeline of Novel Treatments for Inflammatory Conditions

Nektar Therapeutics is collaborating with Eli Lilly and Company (LLY) on a treatment called NKTR-358 that targets severe inflammatory diseases.

Based on proof-of-concept data in atopic dermatitis, the company says the treatment has the potential to become a new treatment option [i.e., a first-in-class medicine] for patients suffering from a serious inflammatory disease.

A proof-of-concept is a demonstration that a concept [or theory] can be put into practice.

The company awaits topline data from a Phase 2 study evaluating NKTR-358 in lupus. Lilly should release these data sometime in the first half of 2023. They will include, among other things, data on the achievement of the primary efficacy objective and a summary of safety data.

In the first half of 2023, the company should also announce the initiation of phase 2 of a study evaluating NKTR-358 in atopic dermatitis.

Atopic dermatitis, better known as eczema, is a chronic and, therefore, long-lasting condition that affects the skin, causing multiple symptoms such as inflammation in addition to redness and irritation.

This inflammatory skin disease is quite common in the population and usually begins in childhood, although there is a risk of it occurring at any age after childhood.

The factors that cause the condition range from the most common such as irritants [soaps and detergents], or environmental [cold and dry weather or humidity], or some food, to more specific factors [dust mites, animal dander, spring allergies caused by pollen and fungi].

There is no cure for this condition, but symptoms improve spontaneously in most children as they get older.

The main treatments for atopic eczema consist of the [daily] use of emollients to prevent skin drying and topical corticosteroids in the form of creams or ointments used during flare-ups to reduce swelling and redness.

Most commonly, lupus is identified as a type of systemic lupus erythematosus [SLE], which is an autoimmune disease.

The disease affects the following organs: joints, skin, central nervous and respiratory systems, nephrological system and blood vessels.

The causes of lupus belong to a wide range, including environmental factors such as exposure to the sun or psychophysical factors such as stress or certain habits such as smoking, or certain medications.

In some people, the immune response to certain viral infections triggers the symptoms of lupus.

Patients can manage their condition with medical treatment, which means the problem can get better or worse, but it will never go away.

Anyone can get lupus, but the condition seems to favor women and especially African American women.

Lupus is not fatal in humans in approximately 90% of cases, and this population lives alongside their autoimmune disease and has a normal life expectancy.

The Pipeline of Cancer Treatments

Nektar Therapeutics’ pipeline also includes the NKTR-255 treatment, which the research group plans to develop as an enhancer of CD19-directed CAR-T therapies.

CD19-directed CAR-T therapy is a therapy that causes T lymphocytes [T cells] to target cells that express CD19. The therapy is a potential treatment for large B-cell lymphoma [a sub-type of non-Hodgkin’s lymphoma] since most B-cell malignancies express CD19.

CD19 is a biomarker for normal and neoplastic B cells. Blood tests are performed specifically on CD19 B cells, the results of which help to detect and diagnose leukemia and lymphoma.

T cells are part of the immune system. They circulate throughout the body until they encounter and attack their specific antigen [bacterial, viral, enzymatic, therapeutic protein], thereby participating in the immune response against foreign substances.

The company thinks that there is potential to initiate a comparative study of NKTR-255 together with CD19-directed CAR-T therapies in autologous patients with large B-cell lymphoma. Autologous are those B-cell lymphoma patients who receive transplants of their own bone marrow tissue.

The company intends to participate in the further development of NKTR-255 and to further investigate its potential impact on the treatment of multiple myeloma [MM] patients. The novel treatment will be evaluated alone or together with monoclonal antibody therapies.

B-cell lymphoma, a type of lymphoma that affects B lymphocytes, accounts for the majority [about 85%] of non-Hodgkin lymphoma [NHL] cases in the United States.

B lymphocytes are a class of white blood cells that produce antibodies against foreign substances [bacteria, viruses, enzymes, therapies], i.e., participate in the immune system response and develop from stem cells in the bone marrow.

B-cell lymphoma can affect people of all ages, but older people are much more susceptible to the disease. It usually begins as a rapidly growing mass located in a lymph node, usually in the chest or abdomen, or more prominently in the neck or armpit. However, it can also grow in the gut or bones, and the central nervous system and spinal cord are not excluded either.

This form of lymphoma is aggressive but, in most cases, its response to the treatment is good, with 75% of patients resolving their symptoms after initial treatment and many being cured.

Multiple myeloma [MM] is a type of cancer that originates in plasma cells which is a class of white blood cells. When healthy, these cells protect the body from infection, but when sick, they multiply in the bone marrow until they replace healthy blood cells.

Treatment is not always necessary, at least in the early stages of the disease. When MM is slowly growing and has no signs or symptoms, careful monitoring may be sufficient rather than immediate treatment. When MM requires treatment to keep the disease under control, there are numerous options available.

The Treatment Pipeline and Its Chances

The company develops products aimed at treating inflammatory skin diseases and certain types of cancer through innovative solutions, with the aim of either expanding the range of options available to patients or improving existing therapies.

When it comes to therapies to treat dermatitis, eczema, or lupus, they’re going to face stiff competition, assuming they hit the market. In addition, most cases do not involve serious illnesses that require treatment, as they heal spontaneously or disappear after the cause has been eliminated. No major enrichment opportunities are therefore foreseen for this part of the portfolio.

As for the cancerous B-cell lymphoma or multiple myeloma, the project is interesting if, as the company proposes, the treatments can provide valuable help in treating patients once they become available to healthcare facilities and specialists.

There is no lack of prospects for therapies such as Nektar Therapeutics would like to develop.

These cancers are increasing mainly due to the aging of the population as they have a certain predilection for the older age groups. Scientific advances, particularly in medical therapies, are enabling people to live longer than they could a few decades ago. However, increasing life expectancy puts older people at greater risk of developing certain diseases that are rare or near rare in younger populations.

Other conditions can also promote the occurrence of these pathologies, such as exposure to carcinogens or proximity to radioactive sources, or even air pollution.

These are environmental factors that today’s society, full of polluting technologies and human activities, wants to eliminate or transform into greener activities in the fight against climate change and the adoption of behaviors that respect human health and the environment.

Unhealthy lifestyles such as alcohol, obesity and smoking, as well as psychophysical factors such as stress and worry can contribute to these pathologies.

Humanity is being bombarded with predisposing factors. But how long will it be before Nektar Therapeutics can contribute to the well-being of mankind, the company’s shareholder wonders.

It will certainly be some time before NKTR-358 and NKTR-255 or at least one of them can become a treatment that can be sold in the market.

The road to market objectively seems long as these new treatments are only a few steps away from preclinical testing and there are many steps between the current state of work and submission for commercial approval.

On top of this, there is a risk that these novel therapies could also fail, doubling the recent failure of another Nektar Therapeutics treatment, as detailed below.

But if the treatments prove successful and allow the company to break sales records and generate profits that flow back to shareholders, then buying the stock today is a bargain given this price level.

So far, the possibility of the second scenario seems remote compared to the many possibilities that Nektar Therapeutics will not meet its goals.

The Financial Condition

There is still money left to continue funding the project. However, a net cash position of around $412 million won’t offer this life indefinitely.

Nektar Therapeutics reports a negative 12-month operating cash flow of $397.8 million as of September 30, 2022, which means it is consuming far more resources than it can earn from revenues.

Moreover, the revenues are declining as they were $70 million in the first 9 months of 2022 while totaling $77 million in the same period of 2021.

These are unable to sustain the $394 million in operating costs and expenses incurred in the first nine months of 2022, versus $410 million for the same period in 2021.

The decline was primarily due to the termination of the development program for bempegaldesleukin (BEMPEG), an investigational cancer drug candidate for melanoma and renal cell carcinoma. This certainly did not please shareholders, as did the net loss of $308.5 million in the first nine months of 2022 versus a net loss of $378.2 million in the first nine months of 2021.

Therefore, with these spending rates and no significant income, the cash reserves should be depleted within a few years. Unless something very positive happens that improves the quality of the treatment development pipeline, if only to have a higher chance of accessing credit should the latter be needed to continue research and development activities.

However, it will not be easy to get credit on favorable terms as the financial costs are becoming more and more expensive due to the aggressive policy decided by the U.S. Federal Reserve until the problem of runaway inflation is solved.

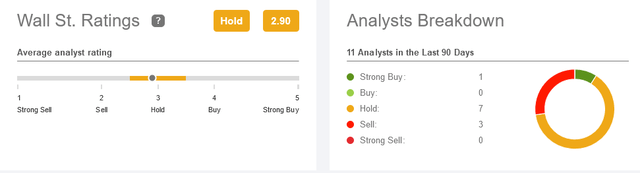

Analyst Recommendation Rating and Price Target

On Wall Street, the situation regarding analyst recommendations for Nektar Therapeutics stock is as follows: only 1 Buy recommendation, but 7 Hold and 3 Sell recommendations, resulting in a medium recommendation of the Hold rating.

seekingalpha/symbol/NKTR/ratings/sell-side-ratings

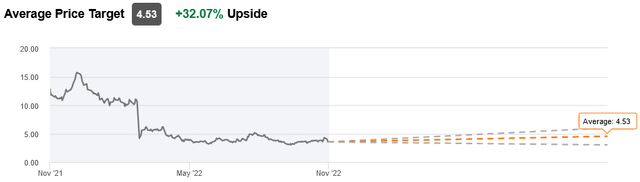

These analysts have issued price targets averaging $4.53 per share, which implies a 32.07% upside potential as of this writing.

seekingalpha/symbol/NKTR/ratings/sell-side-ratings

There Is a High Risk That the Share Price Will Fall Further

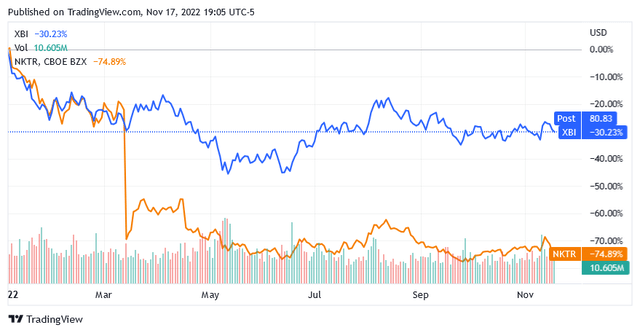

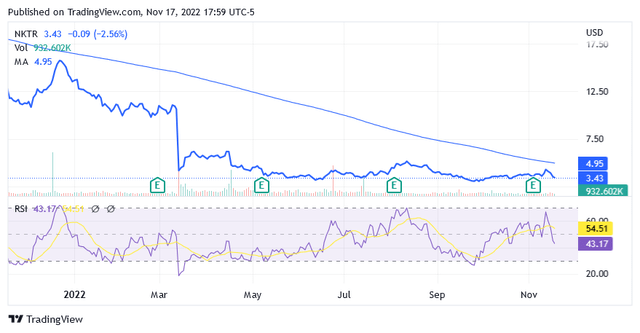

The stock price has fallen more than 70% over the past year and is trading at $3.43 at the time of this writing.

The stock is trading below its long-term trend of the 200-day moving average line of $4.95 and has a 14-day Relative Strength Index of 43.17.

The first indicator says that the stock price is currently very low compared to last year’s levels, while the second technical indicator suggests that despite the plunge, the stock is still far from oversold levels.

The stock has a 52-week range of $2.96 to $15.95 and a market cap of $736.78 million.

There is a high risk that the stock price will fall further as the company’s liquidity shrinks and the treatment development pipeline remains at risk of a debacle.

A different scenario of a price recovery currently seems unlikely.

Conclusion – The Share Price Is Bound to Face Additional Headwinds

Nektar Therapeutics funds continue to dwindle while projects for novel treatments for skin inflammation and cancer are still far from commercialization.

Due to the discontinuation of the Bempegaldesleukin program, the market will understandably view the other treatments with increasing skepticism, which could potentially weigh adversely on the share price.

Nektar Therapeutics stock is probably not a Buy and investors might consider selling the shares in their portfolio.

Be the first to comment