Marko Geber/DigitalVision via Getty Images

As a teenager, I spent a few years working in the local Shoppers Drug Mart, helping the pharmacist prepare prescriptions and stocking shelves. I knew the pharmacy sector has fantastic tailwinds, as ageing demographics will increasingly require more medicines and healthcare services. I was actually quite mad when Canadian retail giant, Loblaws (L:CA), acquired Shoppers Drug Mart a few years ago and removed a favorite investment vehicle. So when I saw there was a new public entrant, Neighbourly Pharmacy Inc. (TSX:NBLY:CA), I was intrigued.

Unfortunately, Neighbourly is a name I would stay on the sidelines on for now. NBLY has not demonstrated operating synergies typical of roll-up strategies. All I see is an indiscriminate acquirer of low margin community pharmacies. I think it’ll serve the company well if management pauses on major acquisitions and focus their attention on wringing out some operational inefficiencies.

Company Background

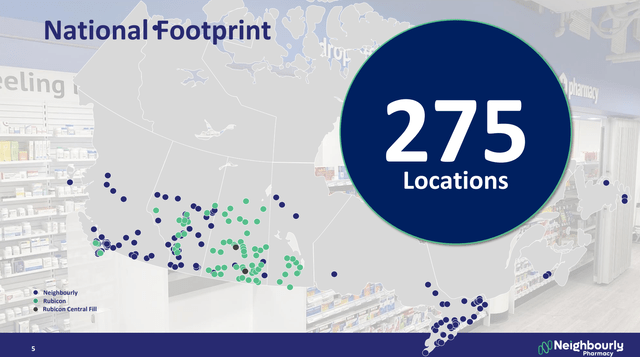

Neighbourly Pharmacy Inc. is a fast growing national chain of independent community pharmacies in Canada. With the recent acquisition of Rubicon Pharmacies, Neighbourly boasts a coast-to-coast footprint with 275 locations (Figure 1).

Figure 1 – NBLY national footprint (NBLY Q1/F23 investor presentation)

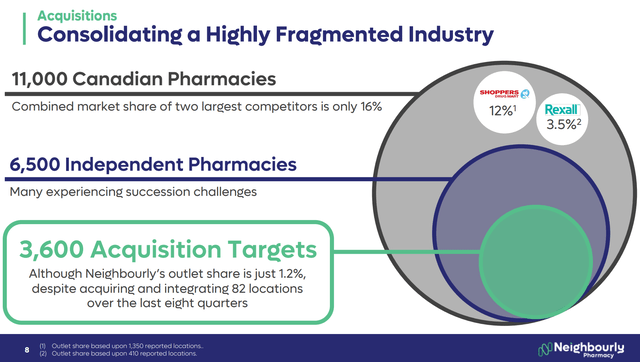

By store count, Neighbourly claims to be the 3rd largest operator of pharmacies in Canada, behind leaders Shoppers Drug Mart (owned by Loblaws), and Rexall (owned by McKesson) with a 2.5% market share. (Author’s note, Jean Coutu, owned by Metro, has more than 400 stores and should rightfully be considered #3)

Figure 2 – NBLY Market share (NBLY investor presentation)

Neighbourly’s main corporate strategy is a “roll-up strategy.” Neighbourly wants to be the acquirer of choice, particularly for independently-owned pharmacies in smaller, underserved communities where competition is less intense (Figure 3). As baby boomers reach retirement age, Neighbourly is capitalizing on the need for succession planning among many independent pharmacy owners.

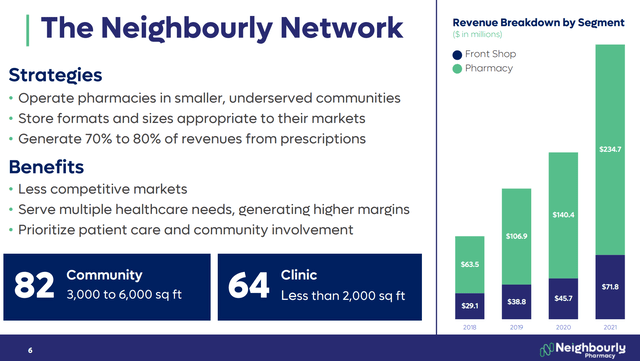

Figure 3 – NBLY business strategy (NBLY investor presentation)

In contrast to national chain Shoppers Drug Mart where front-store sales account for ~50% of revenues, Neighbourly generates 70-80% of revenues from prescriptions. This is by design as more than two thirds of Neighbourly’s pharmacies operate in communities with less than 100,000 inhabitants. Neighbourly pharmacies often serve as a “community health center” by providing a broad range of healthcare services to patients and hence enjoy higher patient loyalty and margins.

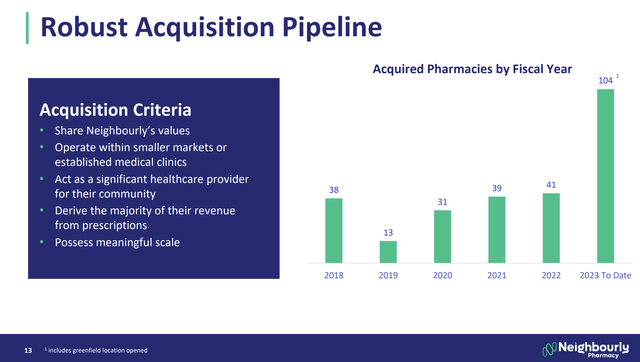

Since the company’s founding in 2015, Neighbourly has acquired and integrated over 270 pharmacies, developing expertise in sourcing, closing, and integrating pharmacies into its network. According to company literature, Neighbourly can complete an acquisition within 8 weeks of signing a letter of intent, with minimal disruptions to banner, staffing, layout, and patients. Figure 4 shows the number of pharmacy acquisitions in the last few years.

Figure 4 – NBLY acquisitions (NBLY investor presentation)

Financials Do Not Show A Good Model

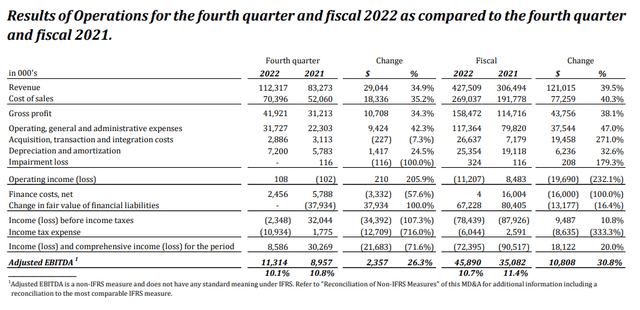

Neighbourly’s breakneck pace of acquisitions have made the financial reports messy and difficult to analyze. Figure 5 shows the company’s condensed financials for the F2022 (March year-end). On a full-year basis, F2022 saw revenues of $428 million, an increase of 39.5% YoY. Same store sales growth was 3.1%. Pro-forma acquisitions (those completed in F2022 and Rubicon, which closed after the end of F2022), revenues would have been $798 million.

Figure 5 – NBLY condensed financials (NBLY Q4/F2022 MD&A)

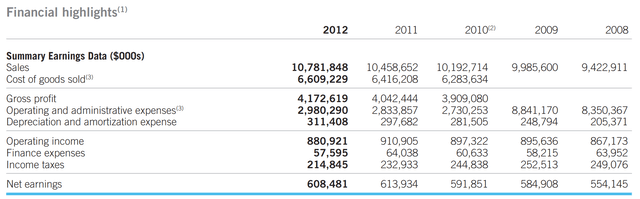

What stands out at first glance is the overall lack of profitability. F2022 gross margins was 37%, roughly inline with F2021’s 37.4%. This gross margin is inline, as Shoppers Drug Mart showed gross margins ~39% prior to its sale to Loblaws (Figure 6).

Figure 6 – Shoppers Drug Mart Financial Highlights (Shoppers Drug Mart 2012 Annual Report)

However, Neighbourly’s operating margin was -2.6% in F2022, compared to 2.8% in F2021. The swing to an operating loss was due to an increase in operating costs (from 26.0% of revenues to 27.4%) and higher acquisition costs (2.3% of revenues to 6.2%).

What is concerning, from an analyst’s point of view, is the lack of operating leverage. The whole point of a roll-up strategy is to leverage economies of scale. However, seeing operating and administrative costs rise as a % of revenues is disappointing. Furthermore, NBLY’s financials do not demonstrate the higher margins and less competitive operating environment that the company trumpets in its investor presentations.

For context, Shoppers Drug Mart, had consistently reported operating margins in the 8-9% range, from Figure 6 above. Loblaws, which does not break out its pharmacy business, reported F2021 retail operating margins of 5.2%. Metro Inc. (MRU:CA), another grocer/pharmacy operator, reports operating margins in the 7-8% range.

Neighbourly also had large change in fair value of financial liability losses in F2022 and F021 due to its May 2021 IPO and conversion of preferred shares and warrants into common shares. These losses are expected to be one-time and non-recurring.

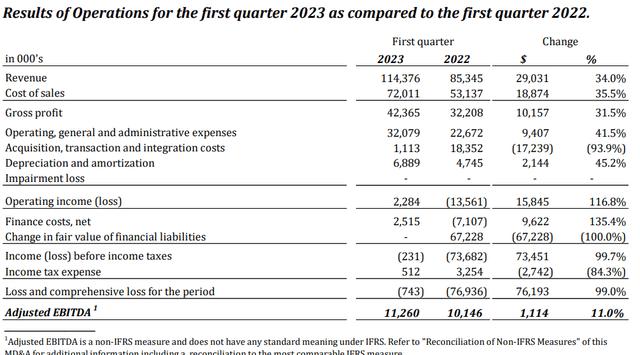

Latest Quarter Was More Of The Same

For the quarter ended June 18, 2022 (author’s note, what a weird date for quarter end!), Neighbourly reported revenues of $114 million, growing 34% YoY. Gross margins remained stable at 37%, however, operating and administrative expenses grew to 28.0% of revenues. A notable decreases in acquisition costs led to an operating profit of $2.3 million or 2.0% operating margin.

Figure 7 – NBLY Q1/F23 operations (NBLY Q1/F23 report)

Valuation Is Expensive

As Neighbourly does not have earnings, it is not meaningful to value Neighbourly on P/E metrics.

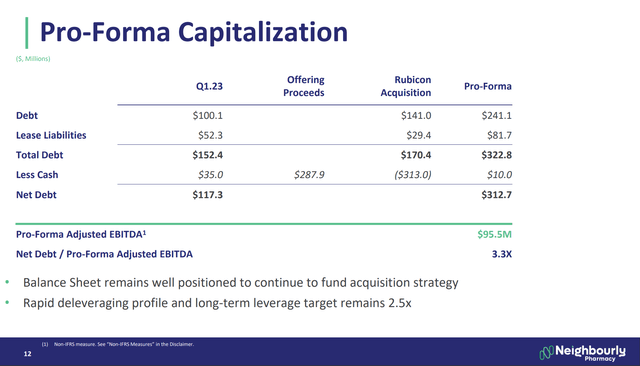

Neighbourly currently has a market cap of $900 million and $313 million in net debt, for $1.2 billion in enterprise value. Even if we scale the company’s revenues to ~$800 million pro-forma the Rubicon acquisition and applying the Q1/F23 adjusted EBITDA margin of 11%, this translates into a current valuation of 13.6x EV/EBITDA. Note, management believes pro-forma EBITDA is $95.5 million, so on management’s EBITDA estimate, NBLY s trading at 12.6x EV/EBITDA (Figure 8).

Figure 8 – Pro-forma capital structure (NBLY investor presentation)

Loblaw’s, Canada’s premier retailer with much higher operating margins, trades at a 9.3x Fwd EV/EBITDA. Metro, another leading Canadian grocer with pharmacy operations, trades at 11.9x. On EV/EBITDA, Neighbourly looks overvalued.

Technicals Weak

Neighbourly stormed out of the gates in May 2021, rising from its $17 IPO price to almost $40 at year-end. However, since the beginning of 2022, NBLY has fallen precipitously to a recent low of $19, below the closing price on its first trading day (Figure 9).

Figure 9 – Technicals weak (Author created with price chart from stockcharts.com)

Risks

The biggest risk to the Neighbourly story is the lack of operating leverage. So far in its short operating history, NBLY has not shown any ability to capitalize on economies of scale and generate superior operating margins. Instead, operating margins have been razor thin. A continued roll-up strategy without clear operational benefits will eventually fail as the acquiror typically takes on debt to make acquisitions and is dependent on synergies to pay off debt.

Speaking of debt, Neighbourly currently has $313 million in net debt outstanding or 3.3x Net Debt / Pro-forma EBITDA. Even if the pro-forma EBITDA figure is accurate, that is still a hefty debt load. High debt may restrict management’s ability to react to challenging market conditions.

Conclusion

In conclusion, Neighbourly is a name I would stay on the sidelines on. While the tailwinds for the pharmacy sector are clear from aging demographics, NBLY has not demonstrated it has a superior operating model. All I see right now is a deal-hungry acquiror of low margin community pharmacies.

Be the first to comment