shotbydave

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on October 5th, 2022.

Tortoise Energy Independence Fund (NYSE:NDP) is a position I labeled as “somewhat speculative” in my last update. The fund’s heavy exposure to energy leaves it more vulnerable to volatility. As we know, the energy sector has still been on a sharp rise that began in the depths of 2020 when prices of oil went negative briefly. In my last update, the fund was reinstating its distribution, too, after a suspension in the COVID crash.

The energy sector had been on quite a struggle even before the COVID pandemic. 2014, 2015, 2018, 2019 and 2020 all marked years where energy was the worst performing sector. 2012 and 2017 had the sector as the second worst performing. Though 2012 and 2019 still showed a positive return. The negative impact from 2020 for NDP saw the fund complete a 1 for 8 reverse stock split. Interestingly though, the fund had maintained its distribution to investors until 2019. Then in 2020, it was suspended completely.

I even admit that I was becoming bearish on the energy sector after such a hot run and with the potential of a recession. As the Fed has become more aggressive despite inflation that is actually coming down a bit, I was a bit more nervous that we could see something beyond a mild recession in 2023.

Longer term, I continue to remain rather neutral on energy overall as I think they have a lot of competition from renewables that are being pushed through whether people want them or not. Of course, that’s a whole different debate!

While a recession is certainly still hanging over the near-term horizon, the actions that OPEC has taken to cut production shows that they are willing to support the price of crude. That leaves me with a bit better outlook for energy in the near term, despite the strong runs we’ve seen already. If that plays out and oil can keep its prices elevated, then companies that NDP invests in should also perform well.

The fund is also sporting a fairly attractive discount and is currently in the midst of a tender offer. Albeit a rather small tender offer of 5% at 98% of NAV, that can still create an opportunity kicker. We covered the tender offer opportunities earlier when we touched on its sister fund, Tortoise Energy Infrastructure Corp (TYG).

It’s the same situation here for NDP. Except that it is officially launched now. Investors have until November 1st, 2022, to make their decision unless the offer is extended (brokers may have different internal cutoffs.)

The tender offer will allow an investor to offload some of their position at a higher than market price. If one chooses, they can take that cash and simply reinvest it back into the fund to gain “free shares” potentially. I say potentially because there is a risk that the fund’s discount could shrink or the share price rise rapidly. Either of those would potentially dampen or eliminate the positive benefit of the tender and buyback route.

The Basics

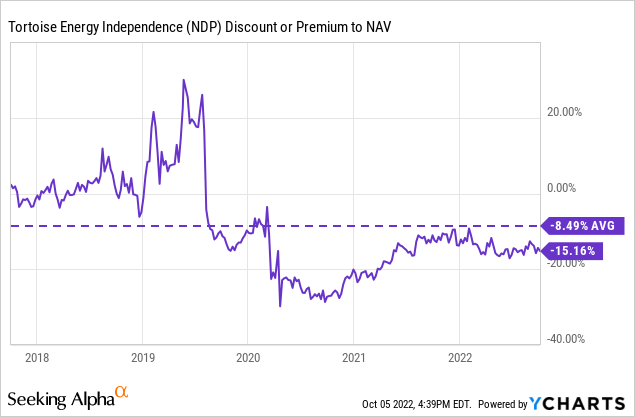

- 1-Year Z-score: -0.78

- Discount: -15.16%

- Distribution Yield: 7.24%

- Expense Ratio: 1.44%

- Leverage: 6.10%

- Managed Assets: $65.7 million

- Structure: Perpetual

NDP seeks “a high level of total return with an emphasis on current distributions paid to stockholders.” To achieve that objective, the fund “invests primarily in equity securities of upstream North American energy companies that engage in the exploration and production of crude oil, condensate, natural gas and natural gas liquids that generally have a significant presence in North American oil and gas fields, including shale reservoirs.”

With the fund’s fee waiver in place, the expense ratio for the fund comes to around 1.44%. When including leverage expenses, the total expenses come to around 1.56%. The little difference here is due to the very mild level of leverage the fund has. That isn’t necessarily a bad thing, either, given the volatility of energy in the first place. Unfortunately for investors, that’s a lesson some didn’t really factor in until 2020.

The amount of leverage could be increased, but they haven’t been too aggressive. They took the debt outstanding from $2.7 million at the end of November 2021 to $3.6 at the end of May 2022. Keeping a low amount of leverage also has the other added benefit of keeping interest rate expenses from getting out of hand. Since they borrow at 1-month LIBOR plus 1.10%, the higher interest rates go, the higher this would start to cost them.

The fund is also quite small, which can be a problem for larger investors or those that want to trade in and out efficiently. In this case, the average daily trading volume is around 6.8k.

NDP Performance – Strong Run, Tempting Discount

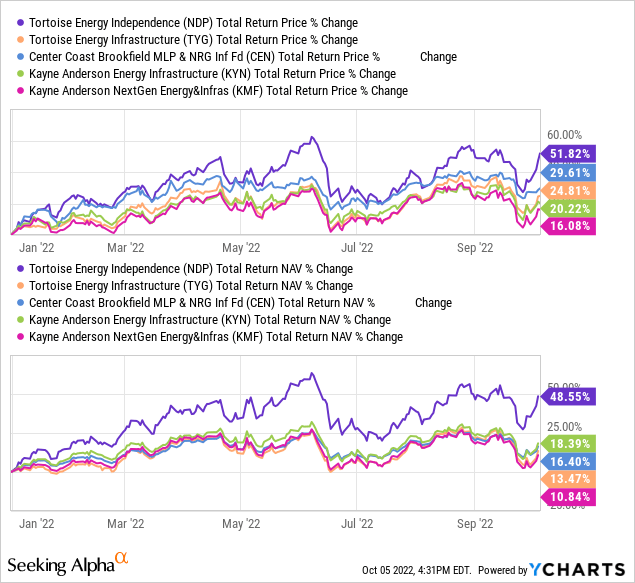

Helping NDP perform so well is the overall energy market having a fantastic year. Here are several comparisons to other energy-related funds. We can see that it has clearly led the field on a YTD basis. That’s both on a total NAV and total share price return.

Ycharts

However, this isn’t exactly a perfect comparison but simply provides some context of what we are seeing. TYG and Kayne Anderson NextGen Energy & Infrastructure (KMF) have a pretty meaningful difference in their approach now. They are more encompassing of the entire infrastructure space that includes a heavy focus on midstreams. They even include meaningful exposure to utilities.

NDP holds significantly heavier exposure to exploration companies; those are the types of companies that benefit the most from a change in oil and natural gas prices. They keep some holdings in renewables, and the occasional utility will show up, but it certainly isn’t a dominant weighting. Center Coast Brookfield MLP & Energy Infrastructure Fund (CEN) and Kayne Anderson Energy Infrastructure Fund Inc (KYN) are more focused on MLP and midstream investments.

Going with that stronger performance due to the price sensitivity of oil means that the lows can be sharper too. I think that’s clearly illustrated from the charts with the latest decline in September. It is also quite noticeable in June when the energy sector actually entered the bear market along with the broader markets.

So what is the positive catalyst for this position can also be its own detriment. It cuts both ways—just something to consider before wanting to get too overweight.

Looking at the fund’s discount shows us quite an unusual occurrence. Despite the underwhelming performance, there was a time when NDP traded at a premium. That premium even reached over 20%+on a couple of rather brief occasions. So our longer-term five-year average discount chart might be slightly distorted. That being said, we are still at what would be an attractive 15%+ discount.

Ycharts

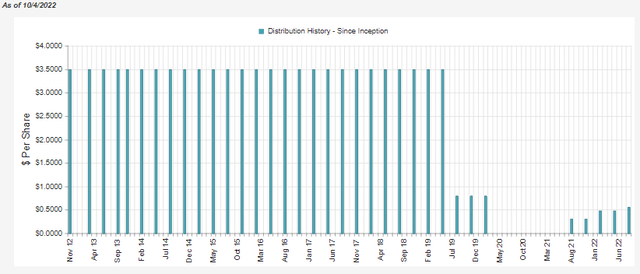

Distribution – Strong Performance Sees Payout Grow

A consequence of the strong performance in the fund has also bled over into a higher payout for shareholders. They target a 7 to 10% NAV payout. If the fund performs well, the distribution can continue to tick higher. The NAV rate is currently at 6.14%, which would indicate that a raise could be coming again with the next payout, too, as long as they can maintain the current NAV.

The fund had suspended its distribution after the COVID crash and really waited for some time before implementing it back. One of the reasons for this could have been that they were trying to merge the fund, which we discussed previously, where it ultimately didn’t happen.

NDP Distribution History (CEFConnect)

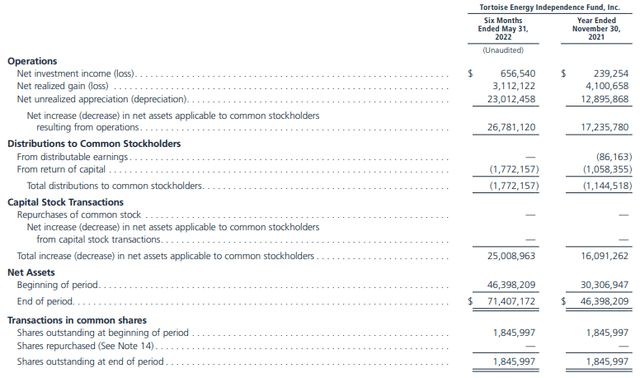

To cover this distribution, the fund will rely on some capital gains to fully cover the payout to shareholders. That isn’t uncommon for equity funds; those have also been quite easy to come by for energy-focused funds this year.

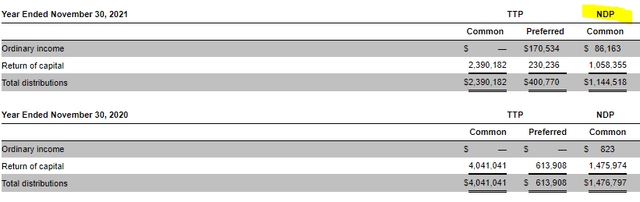

We see net investment income coverage come in at around 37%. That doesn’t tell us the whole story. Due to the return of capital that the fund receives from the underlying holding, that needs to get added back in. That will give us the net distributable income or NDI.

For NDP, the last report shows $377,510 in return of capital paid out. That brings the NDI to around 58.3%. Which would make the capital gains required significantly smaller.

NDP Semi-Annual Report (Tortoise)

For the most part, this could still be seen as low compared to other energy funds. However, that would be at least partially caused because NDP isn’t as highly leveraged. The largest holding of the fund only pays out a very small dividend yield too – which the position makes up over 10% of the fund at this time.

The tax character of the distribution has primarily been return of capital for the previous two years. Due to significant and heavy losses, that isn’t too surprising.

NDP Tax Character (Tortoise (highlight from author))

However, due to the regulated investment company structure, return of capital can still make an appearance due to the underlying holdings paying return of capital. In this case, return of capital isn’t always a bad thing.

NDP’s Portfolio

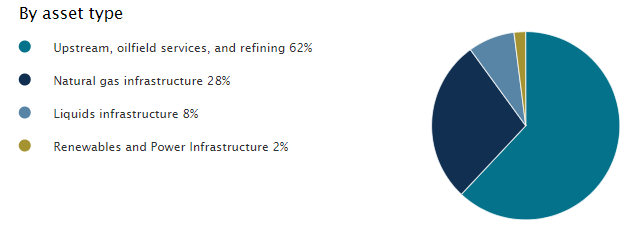

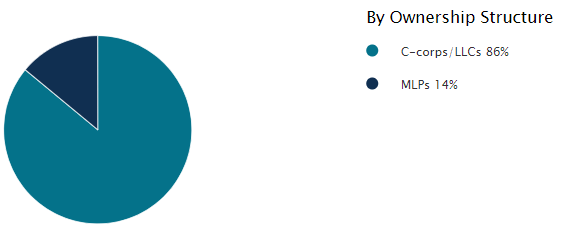

The fund is unique because it is a CEF that provides meaningful exposure to the upstream segment of the energy industry. The primary focus of most CEFs is going to be the “steadier” midstream and MLP funds.

Tortoise Asset Type Weighting (Tortoise)

The fund has a fair bit of MLP exposure, so it isn’t completely avoiding that area of the market.

NDP Structure Weighting (Tortoise)

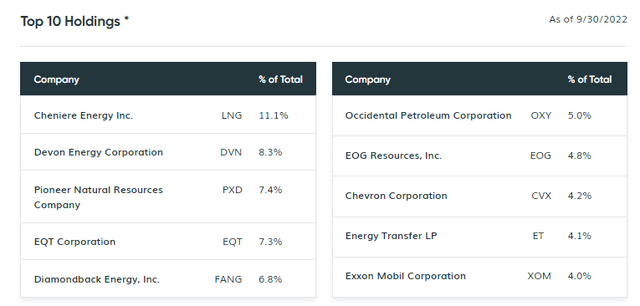

One thing that should also be noted is that the fund’s top holdings make up 63% of the portfolio. That means they are highly concentrated, which can be good or bad. You are still avoiding single-stock risk, but a portfolio of only around 38 names (according to CEFConnect) is still rather narrow.

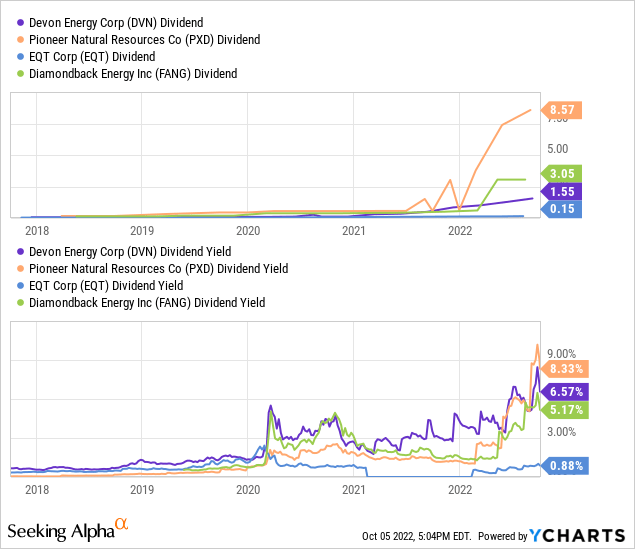

In particular, Cheniere Energy (LNG) had made up a significant 11.1% weighting at the end of September. This is the company that I was talking about with a relatively low dividend yield. They recently just raised it to $1.58 annually from $1.32. That brought the yield up to 0.92% based on the latest close, which should also positively impact NDP’s NDI. Here’s a comparison of the dividend yield with the other top four names in NDP’s portfolio.

Ycharts

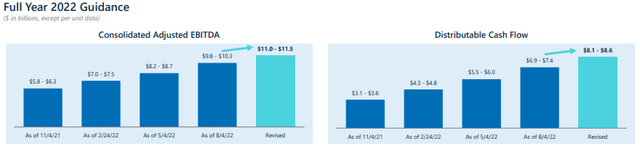

LNG’s biggest play is, well, LNG (liquified natural gas.) They own and operate LNG terminals that have been in strong demand. That has shown explosive growth in EBTIDA and DCF for the company in the last year. This demand is only looking to continue to stay strong if they reach their guidance numbers.

LNG Investor Presentation (Cheniere Energy)

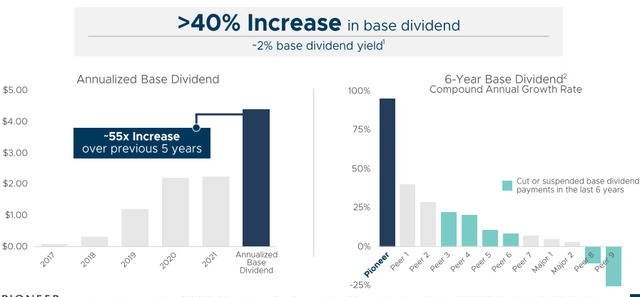

Pioneer Natural Resources (PXD) is an oil and gas exploration and production company that pays a regular plus variable dividend. This has increased substantially so far this year. That’s why the latest payout has pushed it so high. Devon Energy (DVN) also pays a variable dividend and a fixed that has also been raised. An increase of 13% for the regular but with the variable included, it would be a 22% increase.

As long as profits continue to pour in, they can keep these high as well. As shown below for PXD, the base dividend yield would work out closer to 2%. That was still an over 40% increase in the base dividend.

PXD Investor Presentation (Pioneer Natural Resources)

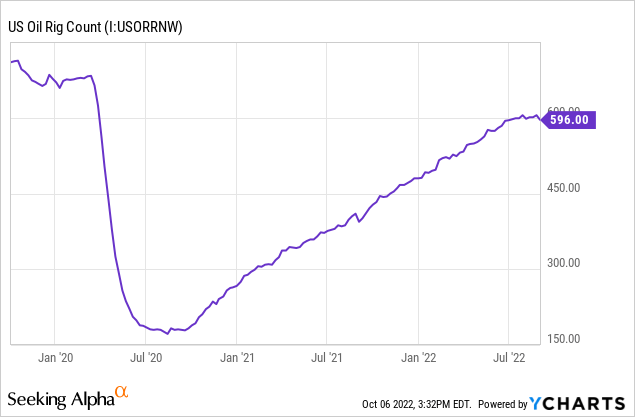

If we go into recession, that could cause a problem. No one can predict the future, but energy companies are more focused on returning capital to shareholders instead of worrying more about increasing production substantially. The natural gas rig count has only recently passed pre-COVID levels. The U.S. oil rig count for oil hasn’t surpassed the pre-COVID levels.

It’s hard to blame the CEOs of these energy companies, too, given the current political climate. They’ve also seen how volatile energy prices can be; playing more conservatively might not be the wrong approach.

Conclusion

NDP has been a strong performing fund and is only very mildly leveraged at this time. Now that OPEC has called for production cuts to help support the price of oil, the energy boom could live to see another day. The major risk for NDP and the energy sector would still seem to be an economic downturn. The more severe a downturn, the harder the drop for NDP could be as they focus on the upstream producers that tend to be less sheltered than their midstream counterparts.

At the same time, the latest discount is quite attractive. The small tender offer is still a bonus and worthwhile for an investor to participate in. That way, they could potentially turn around and reinvest back into more shares of the fund. Next year they have a similar conditional tender offer in place, so that could be a follow-up opportunity if you miss this first one.

Be the first to comment