aluxum

[This article was first published for Inside the Income Factory members and free-trial subscribers on July 8.]

Leverage: Prudent Income Booster………. Or High-Wire Act?

Virtus Convertible & Income Fund II’s (NYSE:NCZ) suspension of its dividend payments (initial announcement here) only lasted for a week. But it was a shock to investors, most of whom don’t pay much attention to closed-end fund leverage ratios and restrictions. Even those of us who are aware of the regulatory restrictions tend to expect that funds with experienced managements are monitoring their leverage restrictions closely as an essential part of their ongoing fund management.

So even though it didn’t last long before NCZ corrected it (follow-up announcement here), the temporary break must have been an embarrassment to NCZ’s management, and certainly doesn’t help project the image of “steady hand on the tiller” that investment firms would ideally like their clients to have of them.

Virtus, the firm that sponsors NCZ, may feel it avoided an even worse embarrassment, inasmuch as Virtus Convertible & Income Fund (NCV), NCZ’s sibling, carried a leverage ratio very close to NCZ’s. Last week when it announced the postponement of its July 1st distribution, NCZ’s leverage was listed on CEF Connect as 50.12%, just a hair over the limit and enough to prohibit its paying dividends. On the same day, NCV’s leverage limit was listed as just over 49%. So we will never know how close NCV came to breaking its limit and being in a similar position to NCZ, but I suspect it was too close for comfort for Virtus management and – one hopes – both funds will fly a little less close to the sun in the future.

What makes this particularly interesting is that apparently this was a “leverage issue” and not a “coverage issue”, since the management of both NCZ and NCV felt totally confident just a month earlier to declare both funds’ distributions for three months out through September.

NCZ’s postponement announcement came as quite a surprise to shareholders, even though the shock passed quickly once the fund straightened itself out and reversed its suspension of the July 1st payment and re-declared its August distribution. Although we no longer hold Virtus Convertible and Income Fund II in any of our Inside the Income Factory model portfolios (switched it out in February), some of us still hold it in our personal portfolios. So we all took notice when they first announced its postponement of the July 1 distribution that had been previously declared, and its postponement of the declaration of the payment originally scheduled to be paid August 1.

Of course, there is a cautionary tale here about the fact that “declaration” of a distribution means nothing if the fund later on finds out that it doesn’t meet the regulatory leverage requirements that would allow the fund to pay it. So when we read “declarations” of future distributions, especially ones that are made several months in advance, we should always read “declared” to mean: “The fund declares that it will pay a dividend of X, assuming that it is legally allowed to do so when the payable date actually comes around.“

While this episode may suggest that NCZ’s management was either (1) unwise to run that level of leverage to begin with, (2) careless about monitoring it, or (3) genuinely surprised that its asset values dropped so suddenly as to trigger a leverage violation, it doesn’t necessarily mean the fund’s underlying portfolio can’t support the level of distributions that were previously declared, then undeclared, and now re-declared.

So I’m inclined to wait before passing judgment on NCZ’s management, but keep an eye on their leverage policy and see whether they bring their levels down going forward. I’m also anxious to hear what NCZ’s management itself says about this incident. If they are candid and relatively straight-forward, I think the market will be more understanding than if they are seen as just blowing smoke, or ignoring it.

How About Other Funds’ Leverage Levels?

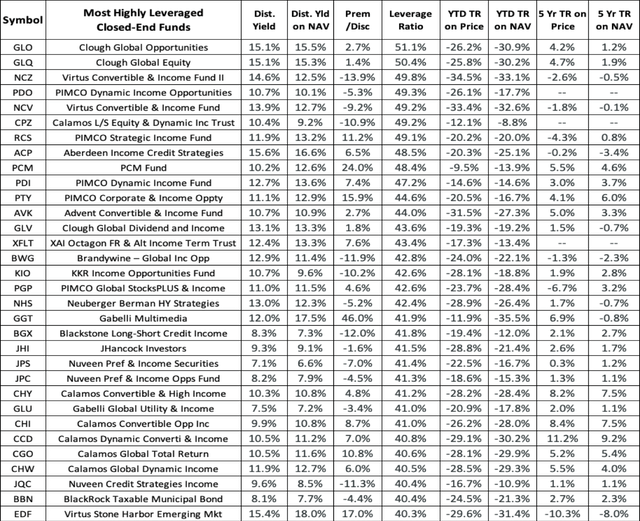

Meanwhile, it’s worth looking at how other funds handle leverage and whether NCZ was an outlier or not. Here are all the closed-end funds on the CEF Connect website with leverage of 40% and above.

CEF Connect

Note that NCZ and NCV are #3 and #5, respectively. The only funds more highly leveraged are the Clough Global Opportunities (GLO) and Global Equity (GLQ). Keeping them company, with 5 out of the 11 most highly leveraged funds, is Pimco, with PIMCO Dynamic Income Opportunities Fund (PDO) grabbing the #4 spot. I guess this tells us that Pimco is fairly aggressive in its use of leverage to boost earnings and, therefore, distributions. I suspect that if an outfit as smart and sophisticated as Pimco is using aggressive leverage, that they are probably putting substantial effort and resources into managing it closely. Let’s hope so.

Once you get down below the top 10 most leveraged funds, the percentage of leverage drops below 45%. So funds at that level and below are not operating as close to the edge as the ten above them. I suspect it’s a bit like driving on the highway. If you’re running leverage in the high 40% range – say, 47% and higher – with a 50% regulatory limit, it’s probably like 80 mile-per-hour highway driving, and you can’t let your eyes stray for a moment. If you’re only leveraged 45% or below, with a 50% regulatory limit, then it’s more like driving the speed limit. You still have to be careful, but it probably doesn’t involve the amount of risk or demand the level of minute-to-minute attention (running a fund, not driving a car) as that required of the funds that leverage to the 48-49% level.

There’s also more to it than that. While CEF Connect provides a “leverage” percentage for each of the funds it lists, it labels it as “effective leverage.” In some cases, effective leverage is the same as “regulatory” leverage. In the case of NCZ and its sibling NCZ, the percentage provided is labeled “regulatory” leverage, so it is the applicable percentage for determining distribution payment eligibility. In the case of GLO and GLQ, the statistic provided is labeled “effective” leverage and the “regulatory” leverage figure is lower. That explains why GLO and GLQ, while highly leveraged, are still able to pay distributions, which they recently declared out for another three months.

Bottom Line

Leverage is a valuable tool for closed-end funds and the investors who buy them. Being able to borrow money for 1, 2 or 3% and re-invest it at 6, 7 and 8%, is a valuable feature of closed end funds and is one of several attributes that make them attractive to retail investors, as well as an ideal vehicle for holding higher yielding but less liquid and/or more complex asset classes (as explained here.) But fund managers have to manage it just as carefully as other aspects of their job, like portfolio selection.

Thanks for reading. I look forward to your questions and comments.

Be the first to comment