cofotoisme

A Quick Take On nCino

nCino (NASDAQ:NCNO) reported its FQ3 2023 financial results on November 30, 2022, beating revenue and EPS estimates.

The firm provides modernized cloud software solutions to financial institutions.

Until management can make meaningful and sustained progress toward operating breakeven, I’m on Hold for NCNO.

nCino Overview

Wilmington, North Carolina-based nCino was founded to develop cloud-based financial software to assist financial institutions in serving their customers in an efficient and modern manner.

Management is headed by President and Chief Executive Officer, Mr. Pierre Naude, who has been with the firm since its founding and was previously Divisional President of S1 Corporation, and Vice President and Managing Partner of Unisys.

nCino’s partners include:

-

Consulting Partners – Large and medium-sized consultants

-

Technology Partners – Financial technology providers

The company’s primary offerings include:

-

Deposit account opening

-

Commercial loan origination

-

Retail loan origination

-

Auto loan decisioning

-

Document management

-

SBA

-

Collateral management

-

Specialty lending and administration

nCino’s Market & Competition

According to a 2019 market research report by Gartner, the global market for financial institution IT spending was $63 billion in 2018, of which 29%, or about $18 billion, was for vertical-specific software.

Gartner also estimates that the demand for cloud-based delivery of software to financial institutions will grow at a CAGR of 17% from 2018 to 2023, reaching $29 billion in total value by the end of 2023.

Also, management commissioned a study by Grata that estimated the firm’s serviceable market at more than $10 billion.

The breadth and depth of nCino’s offerings may give it an advantage in a market where vendor bloat may be seen as a negative due to increasingly complex integration overhead.

nCino’s Recent Financial Performance

-

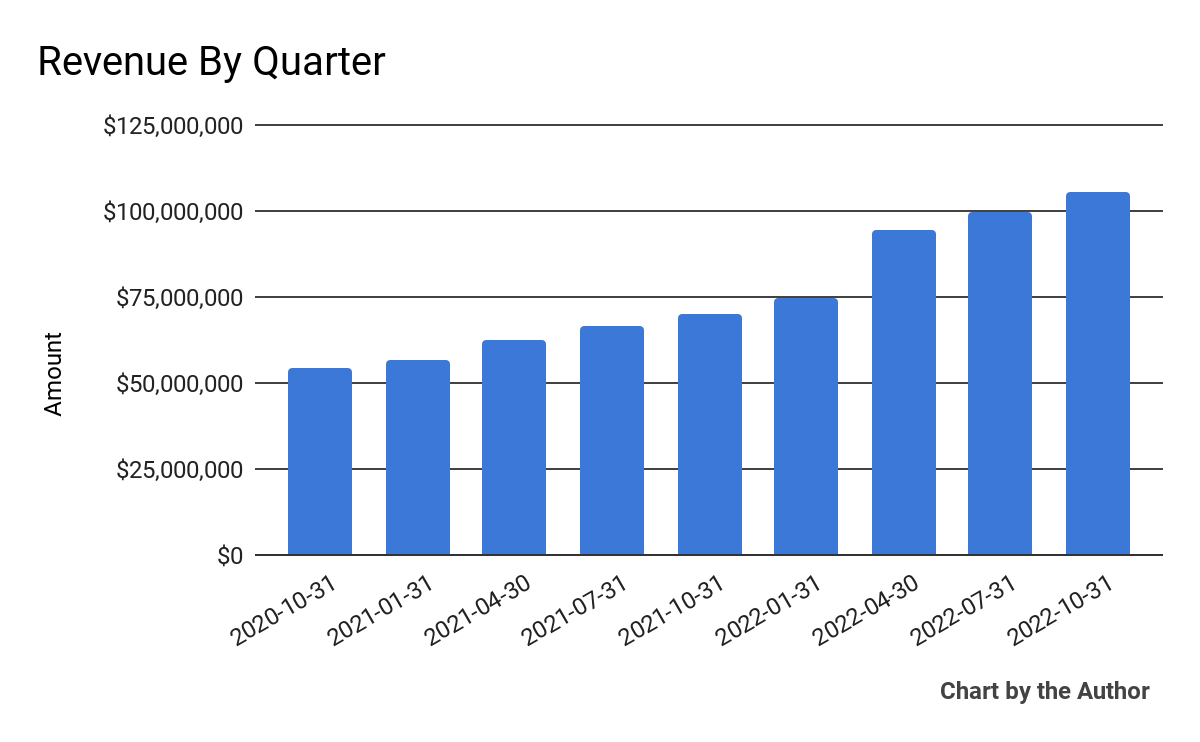

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Financial Modeling Prep)

-

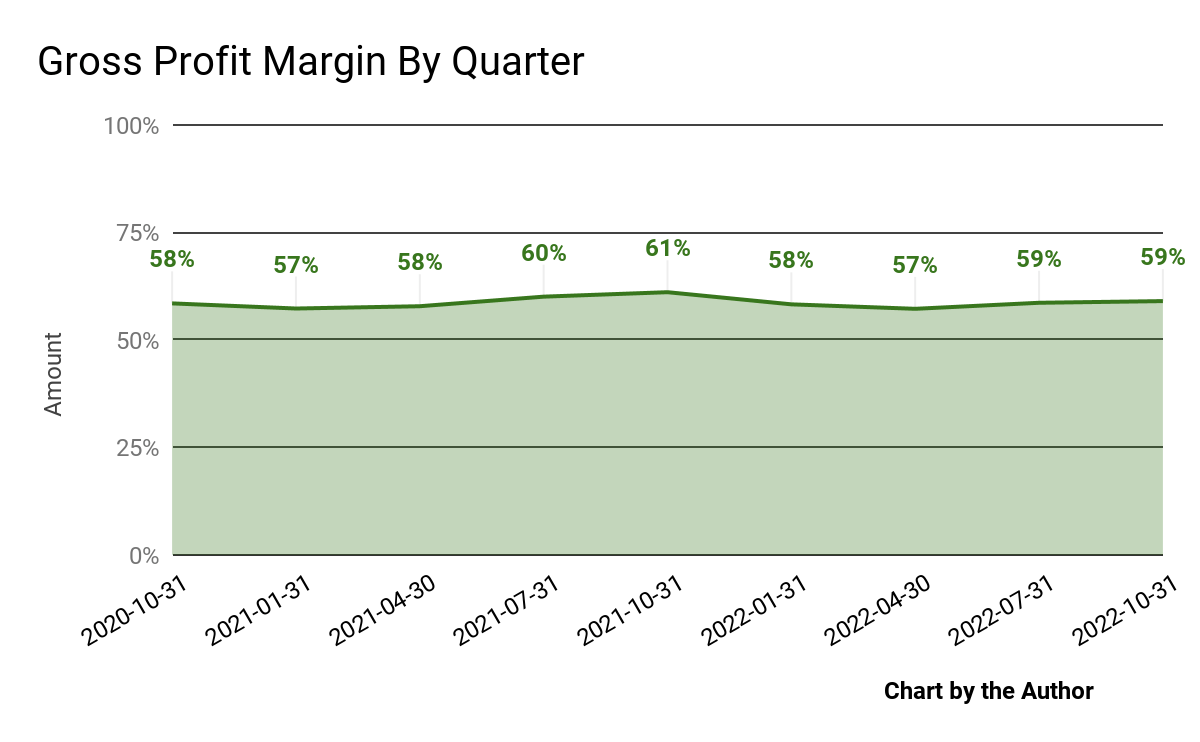

Gross profit margin by quarter has dropped slightly in recent quarters:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

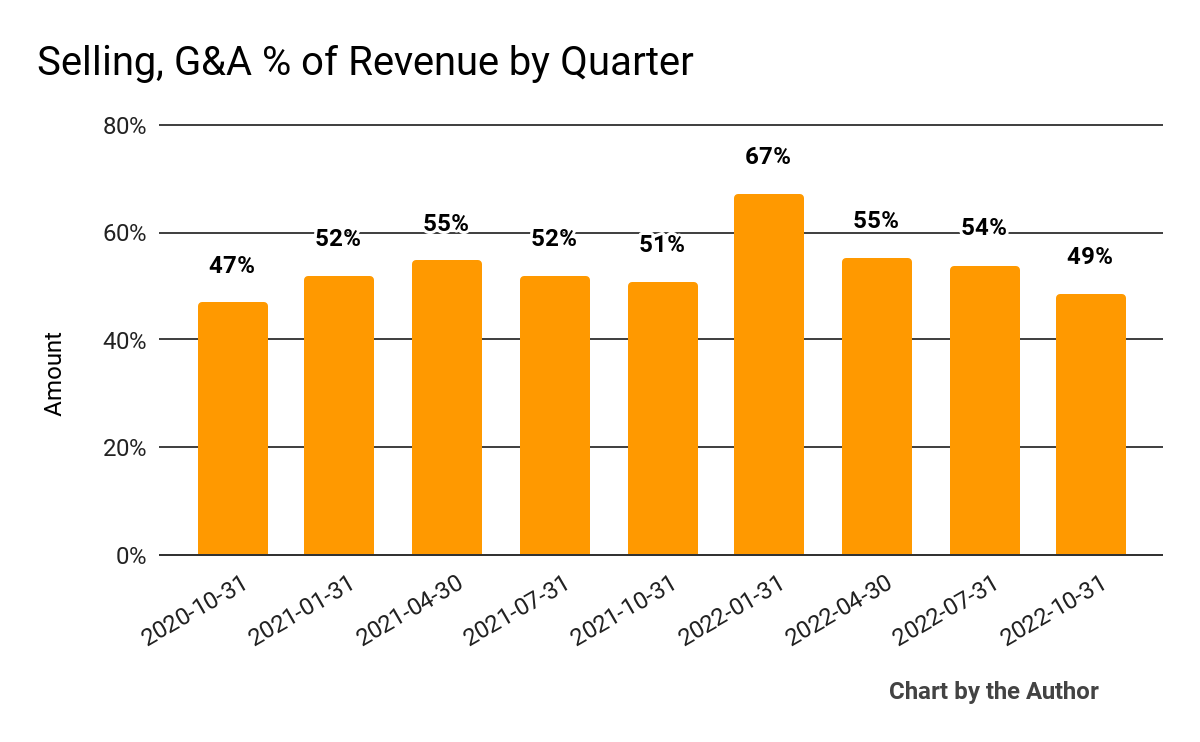

Selling, G&A expenses as a percentage of total revenue by quarter have fallen recently, as the chart shows below:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling prep)

-

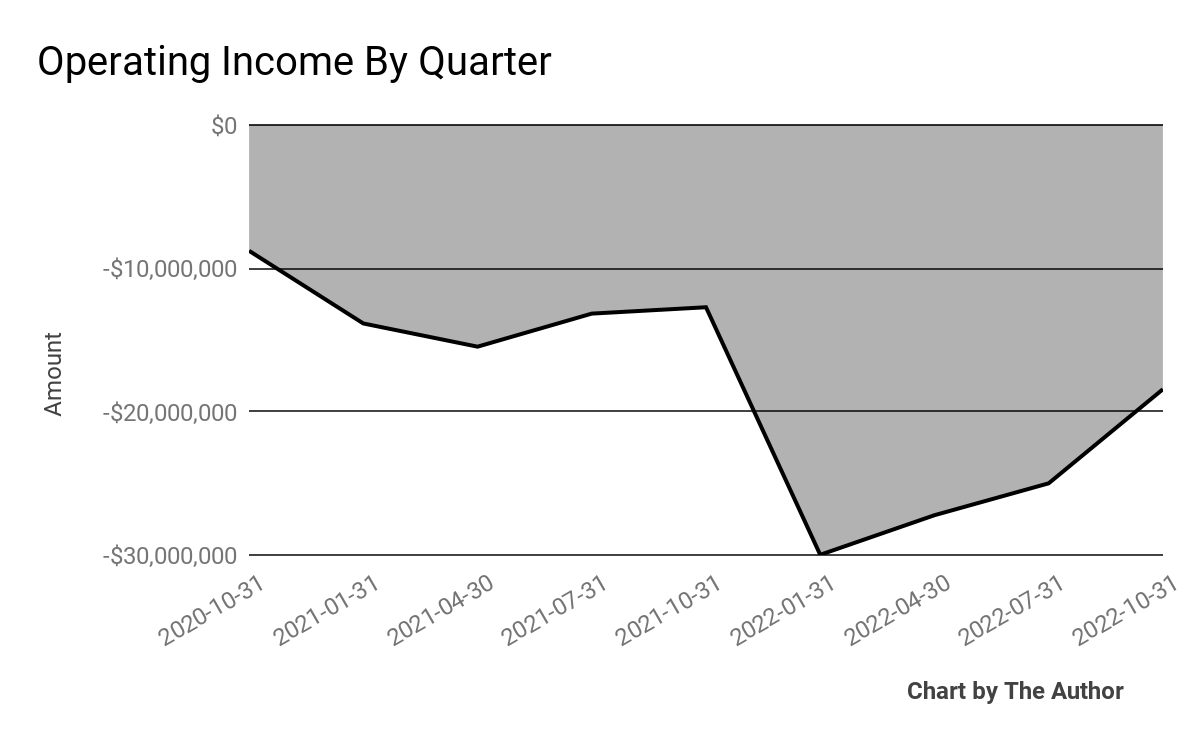

Operating income by quarter has trended lower in the past four quarters:

9 Quarter Operating Income (Financial Modeling Prep)

-

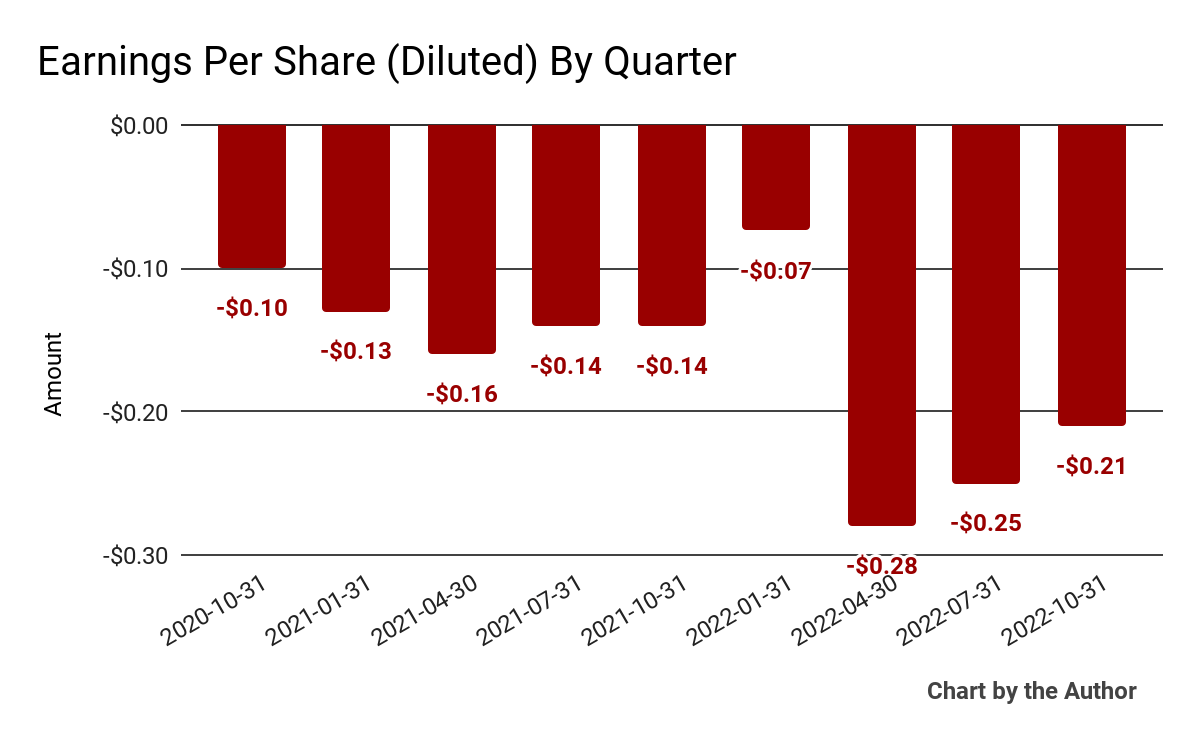

Earnings per share (Diluted) have remained heavily negative in recent quarters, as shown below:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

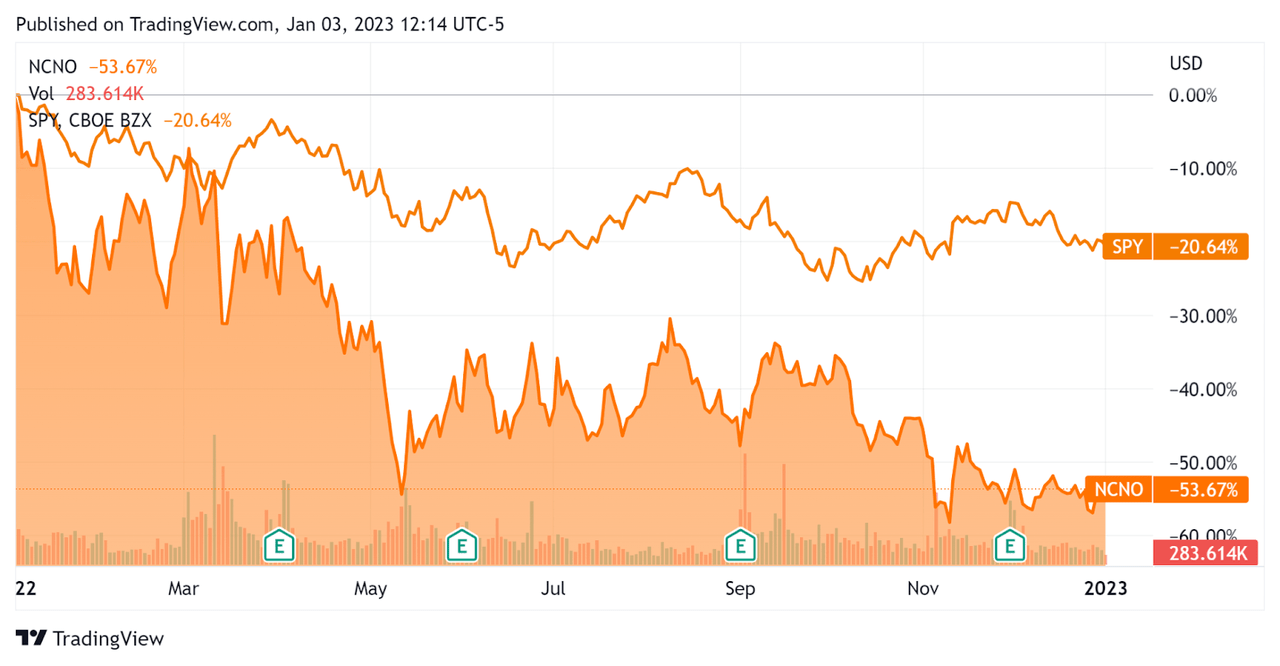

In the past 12 months, NCNO’s stock price has fallen 53.7% vs. the U.S. S&P 500 Index’s drop of around 20.6%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For nCino

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

7.8 |

|

Enterprise Value/EBITDA |

-36.5 |

|

Revenue Growth Rate |

46.4% |

|

Net Income Margin |

-23.7% |

|

GAAP EBITDA % |

-21.3% |

|

Market Capitalization |

$2,935,765,504 |

|

Enterprise Value |

$2,902,825,123 |

|

Operating Cash Flow |

-$14,413,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.81 |

(Source – Financial Modeling Prep)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

nCino’s most recent GAAP Rule of 40 calculation was 25.1% as of FQ3 2023, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP (TTM) |

Calculation |

|

Recent Rev. Growth % |

46.4% |

|

GAAP EBITDA % |

-21.3% |

|

Total |

25.1% |

(Source – Financial Modeling Prep)

Commentary On nCino

In its last earnings call (Source – Seeking Alpha), covering FQ3 2023’s results, management highlighted a continued focus on ‘profitability in fiscal ’24”.

Leadership says the company’s banking customers are financially sound and generally report solid business conditions.

However, the firm is seeing a slower sales cycle environment, especially in Europe, which has been sharply affected by the war in Ukraine and other political and economic conditions.

The U.S. mortgage market has also been negatively impacted, but management believes the company is in a position to take market share during the current challenging environment.

As to its financial results, total revenue rose 50% year-over-year, with organic subscription revenue growing by 28%.

Management did not disclose any company retention rate metrics. The firm’s Rule of 40 results have needed improvement, with strong revenue growth offset by high operating losses contributing to a mediocre figure for this metric.

Operating losses and negative earnings per share have remained substantial, although they are coming off their worst results from a few quarters ago.

For the balance sheet, the firm finished the quarter with $106.5 million in cash and equivalents and $30 million in debt.

Over the trailing twelve months, free cash used was $30.1 million, of which capital expenditures accounted for $15.7 million. The company paid a hefty $46.4 million in stock-based compensation.

Looking ahead, like so many companies in recent quarters, management is now more committed to reducing operating losses and reaching ‘profitability’ sometime soon.

However, without a major headcount reduction combined with non-headcount cost-cutting, those intentions will remain a distant goal.

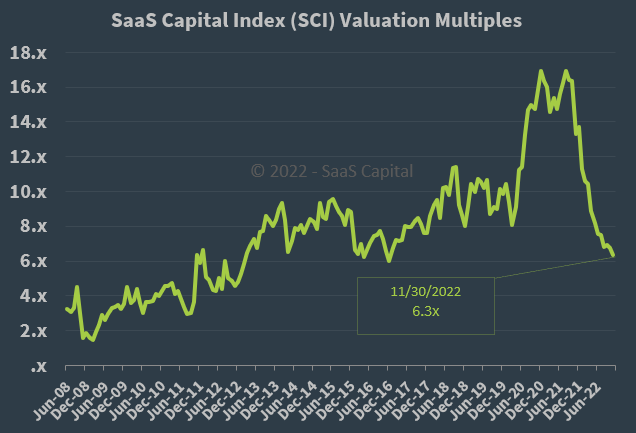

Regarding valuation, the market is valuing NCNO at an EV/Sales multiple of around 7.8x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, NCNO is currently valued by the market at a premium to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which is likely to produce slower sales cycles and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a ‘short and shallow’ slowdown in 2023 or a pause in the rise of the cost of capital, reducing downward pressure on valuation multiples.

However, with NCNO already seeing slowing sales cycles in Europe combined with a tepid response to reducing expenses going into a slowdown, operating losses will likely continue to be unacceptably high.

Until management can make meaningful and sustained progress toward operating breakeven, I’m on Hold for NCNO.

Be the first to comment