sankai

Investment thesis

I recommend buying Navitas Semiconductor (NASDAQ:NVTS). Navitas is disrupting the power industry with superior technology that provides greater energy density, faster charging, and sustainability. Its recent acquisition, like adding wings to a tiger, is a huge boost to its ability to thrive in the market. Again, with over 120 patents issued on GaN power circuitry, Navitas is in an untouchable position.

Business overview

Navitas is credited with developing gallium nitride power integrated circuits that guarantee superior efficiency in terms of performance, size, cost, and sustainability. GaN power circuitry offers faster charging and can hold and save more energy, even with the same output power.

The acquisition of GeneSiC, a fabless SiC power device company, has accelerated Navitas’ race to the top of the power industry as the only pure-play, next-generation power semiconductor company. The merger between GeneSiC and Navitas is the start of new innovations, from 20W smartphone chargers to 20kW EV chargers to 20MW grid infrastructure. The combined entity has a strong footing in EVs, solar, energy storage, and a wider industrial market.

NVTS has what it takes to disrupt the industry

Electronic devices that are charged by connecting into a wall socket need a power supply to boil down alternating current [AC] to a lower voltage that is more appropriate. Although advancements have come by using Silicon Metal Oxide Field Effect Transistors or Insulated Gate Bipolar Transistors with related analog semiconductors, silicon-based charging systems have not been able to achieve high energy efficiency and fast charging, requiring large heat sinks to manage temperature.

Navitas designs, develops, and commercializes GaN power circuits used in charging and energy conversion. With these products, power supplies can be used in a wide range of electronic devices, such as cell phones, consumer electronics, solar inverters, data centers, and electric vehicles.

GaN is the result of combining gallium and nitrogen to form a powerful bond with materially stronger electric fields and greater electron mobility. GaN power ICs allow power systems to switch at higher speeds while using less energy, which has far-reaching implications for power electronics in the form of reduced size, weight, and cost. Compared to conventional Si-based power solutions, these are huge leaps forward. A GaN transistor, found at the heart of power supplies, requires a specialized silicon driver and several other parts to properly power and shield the device. GaN hasn’t been used as much in the last ten years because it’s expensive, hard to make, big, and sensitive to system changes.

In order to address this issue, NVTS developed the GaN power IC. The company pioneered the integration of the GaN transistor, drive circuitry, and protection circuitry onto a single GaN chip. The GaN IC solution also saves space, resources, and money in comparison to the GaN discrete solution.

The TAM is pretty huge

GaN power ICs are ready to storm the market, displacing the legacy silicon as the major player. GaN chips offer a smaller, lighter, faster, and more efficient solution for power applications. In the five markets of mobiles, consumer, enterprise, renewable energy, and Electronic Mobility, GaN is set to take its place at the top.

These markets are driven by the dual long-term secular trends of increased demand for connectivity and climate change. Mobiles, Consumer and Enterprise are influenced by increased demand. Climate change drives the remaining two. GaN addresses the problems that come with these secular trends. It has been able to enhance power and energy consumption problems, while electrifying the end applications will provide a more sustainable environment. As you read this, Navitas is shipping devices for consumer and mobile applications, with more to follow soon.

Leading proprietary technology

A robust and defendable portfolio of over 120 patents in GaN power circuitry means that Navitas’ technological lead can be protected and used in all targeted markets. This strong positioning is helped by the fact that the industry’s first comprehensive GaN IC process design kit, which has device and circuit development libraries, characterization, and verification, speeds up end-user development.

High barriers to entry

Navitas’ integrated circuit approach to GaN power semiconductors has made driving, controlling, and protecting GaN systems a whole lot easier. It has been able to overcome crucial obstacles to commercializing its proprietary GaN designs and manufacturing test systems. It has been proven in one billion device hours of reliability testing. There have been zero field failures in the 20 million units shipped. Without a significant amount of time and experience, it’s impossible to achieve this.

GeneSiC acquisition expands TAM

The prolific acquisition of GeneSiC has almost doubled Navitas’ TAM to $20 billion, according to the GeneSiC acquisition deck. The SiC opportunity alone was worth $15.4 billion, with an overlap with GaN in medium-power applications.

Navitas has now offered an entire array of power semiconductors, giving customers the power to pick and choose which GaN products work best for medium-power applications. Navitas claimed that the potential opportunity for GaN and SiC in electric vehicles is expected to reach $12 billion per year by 2030. At present, five GaN customer programs are in development for electric vehicles, touching on $50 million annually. Navitas has been expanding its reach through cross-selling with high-value GeneSiC customers.

Valuation

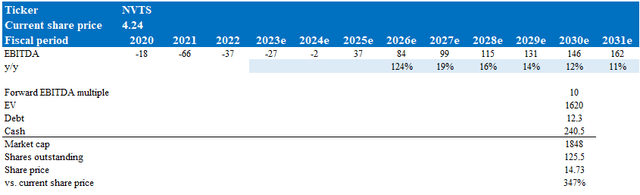

My model takes a conservative approach and assumes NVTS will hit its original guidance by 2031, a 5-year delay due to the current weak economic environment. My assumption also does not take into account the positive value accretion that GeneSiC could bring to the table.

Based on these assumptions, I believe the current stock price could increase by more than 3x over the next decade. In the short term, I assume NVTS will track consensus estimates closely until 2026, and from there, a gradual growth towards its initial 2026 EBITDA target.

By FY30, NVTS is very likely going to be a mature company, and it should trade at a similar level to mature power semiconductors such as Analog Devices (ADI). ADI is currently trading at 12x forward EBITDA, and I think NVTS should trade at a discount to that given ADI is a much larger company with more diversified products.

Risks

Cyclical industry

The semiconductor industry is cyclical. It has its seasons of greatness and downturns. In the downturn seasons, the demand for semiconductors plummets in substantial measure. The market also experiences production overcapacity, high inventory levels, and rapid erosion of selling prices. As its products are used across different markets, Navitas is not finding it easy to predict the demand for them.

Competition

A highly competitive industry, the semiconductor industry is riddled with constant and rapid technological change, short product lifecycles, and mutating standards for quality. Navitas’ success in this industry depends on its ability to meet evolving industry standards and introduce new innovations, timely manner at affordable prices.

Conclusion

To conclude, I believe NVTS is undervalued. Its TAM has been bolstered by the merger with GeneSiC, set to grow even higher in coming years. When one then considers its leading proprietary technology, you become increasingly convinced that Navitas is worth investing in.

Be the first to comment