ErikMandre/iStock via Getty Images

Investment thesis

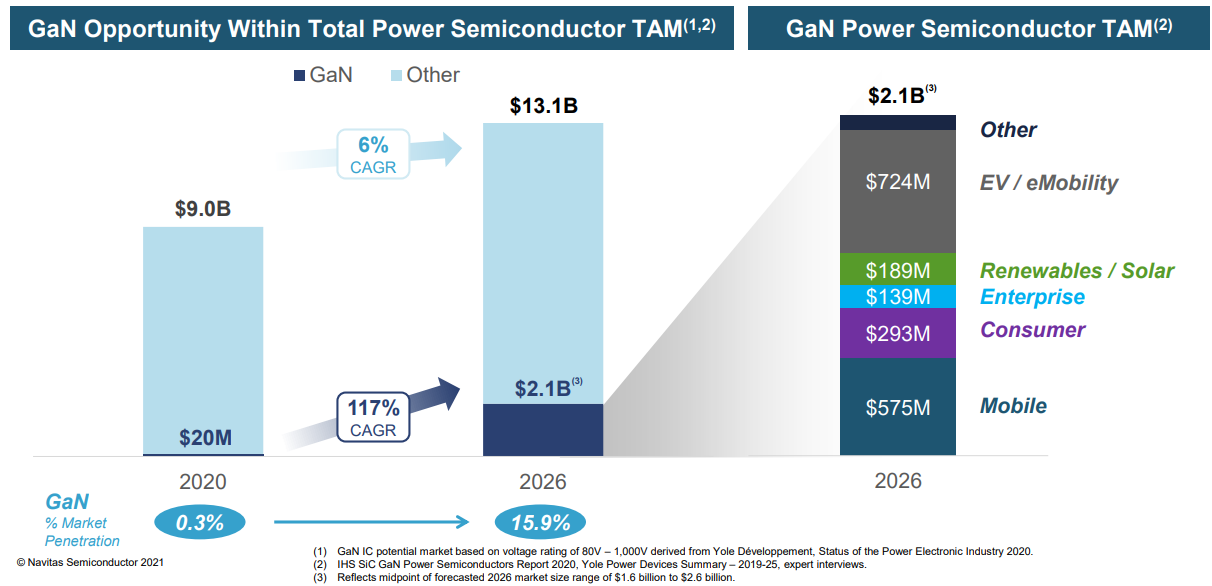

I plan to return to investing in the stock market in the near future and one of the sectors that has attracted my interest is gallium nitride (GaN) power semiconductors as they seem set to replace silicon in power applications in a few years. The total addressable market (TAM) opportunity could be worth as much as $2.6 billion by 2026.

Navitas Semiconductor (NYSE:NVTS) is the leader in the GaN sector power semiconductors at the moment and it was recently listed through a SPAC deal with Live Oak Acquisition Corp II. I was surprised that few people are talking about this company, considering it’s an exciting sector and its valuation stands at $1.58 billion as of the time of writing.

However, after going over its financials and projections, I think Navitas looks overvalued. You see, the TAM could be as low as $1.6 billion in 2026, and competitors like GaN Systems won’t let the company just take a dominant position. Even if Navitas manages to reach its projected EBITDA of $162 million in 2026, a valuation of 8.1x EV/EBITDA almost five years into the future seems too high to me. Let’s review.

Overview of the business and financials

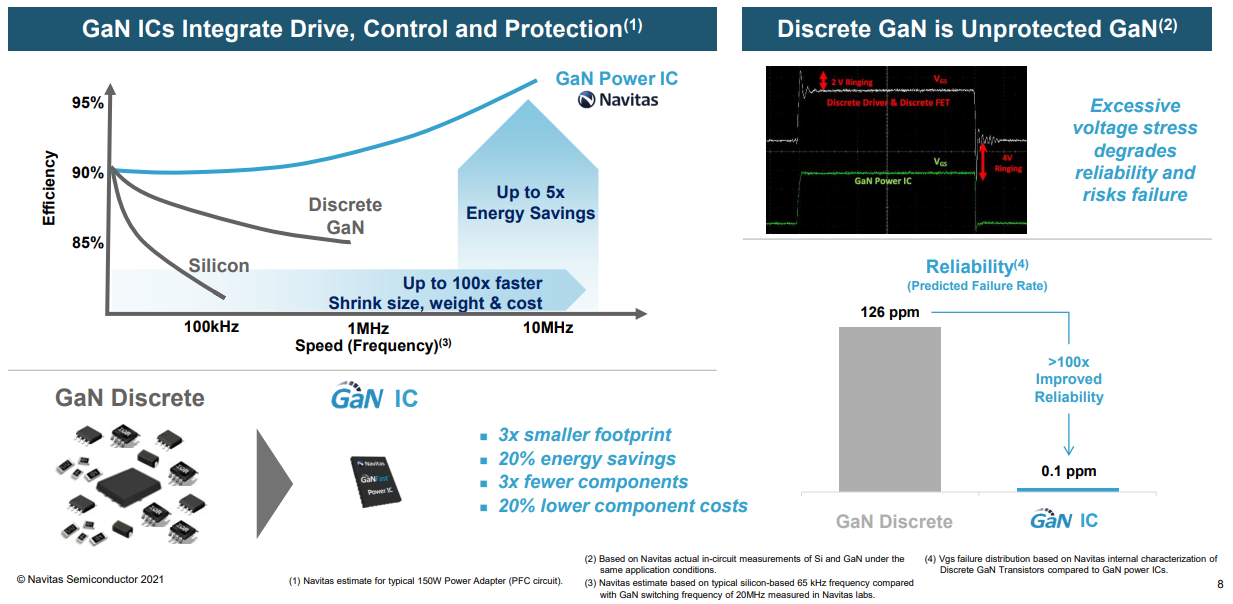

GaN transistors offer companies from the automotive, consumer, industrial, and enterprise markets the opportunity to increase the utility and energy efficiency of their power systems as well as reduce levels of CO2 emissions. According to Navitas, GaN integrated circuits run up to 20 times faster than legacy silicon ones, have up to 3 times more power as well as 3 times faster charging while having half the size and weight. The energy savings could be up to 40%. The mobile sector was the first one to adopt the GaN technology and others set to join as prices drop.

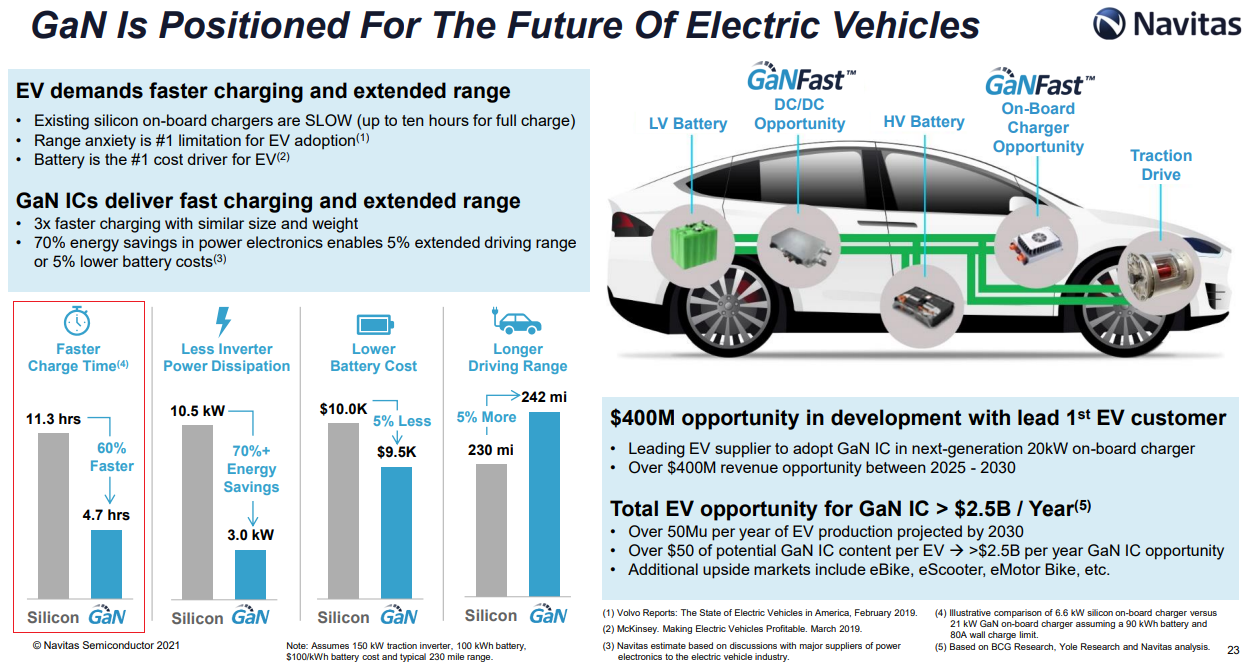

(Source: Navitas Semiconductor)

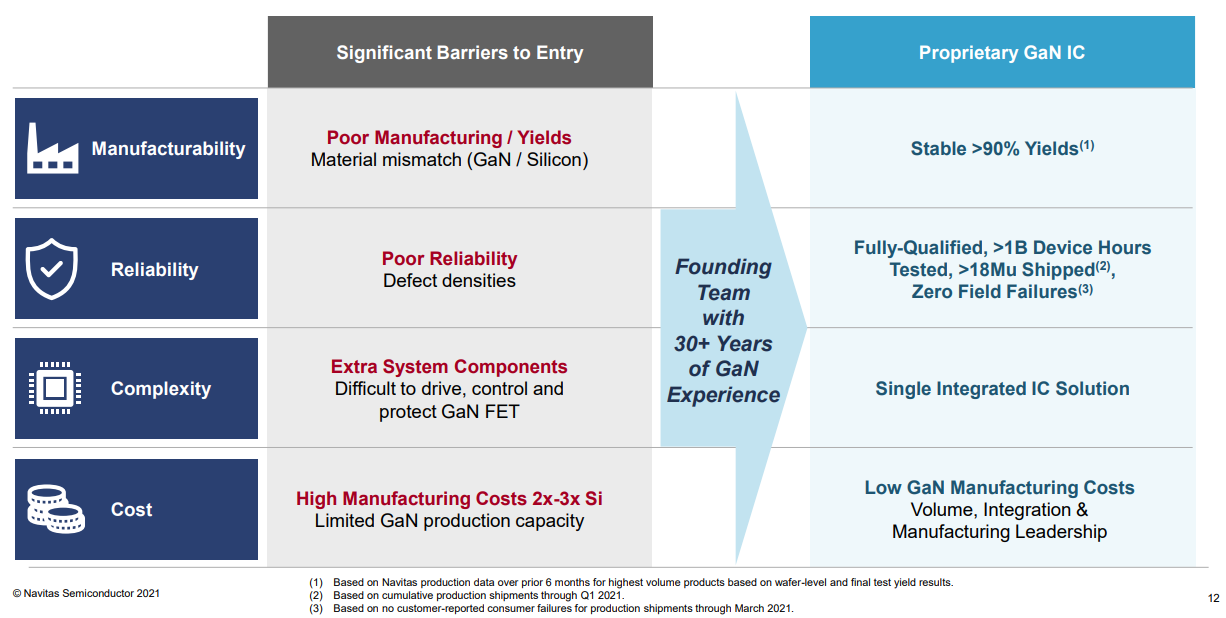

Navitas was founded in 2014 and is the main company in the sector with a portfolio of over 120 issued and pending patents and a founding team of more than 30 years of GaN experience. Its products are integrated into over 130 mobile chargers, which is more than all other GaN companies combined.

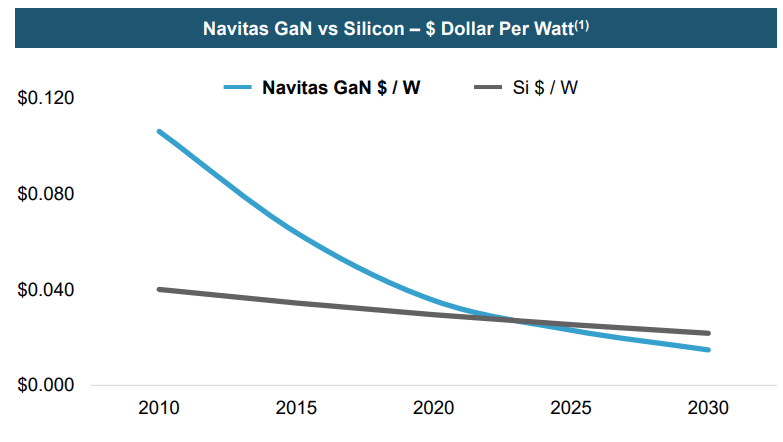

The main issues for the adoption of this technology include low yields, poor reliability, high complexity, as well as high costs. However, Navitas Semiconductor claims to have fixed all of these issues. As of October, the company had shipped over 30 million GaNFast power ICs with zero field failures. It seems that mainstream adoption could be just around the corner as the price per watt is set to become lower than silicon alternatives in around two years.

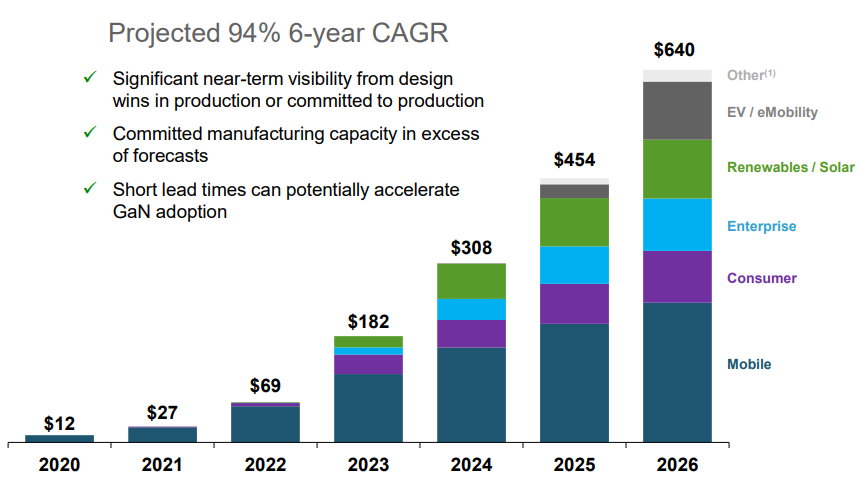

(Source: Navitas Semiconductor)

In 2020, the TAM was only around $20 million but the projections are that it will grow very fast and reach between $1.6 billion and $2.6 billion by 2026. One of the major opportunities is in the electric vehicle space, where Navitas estimates the technology could slash on-board charging times by 60%.

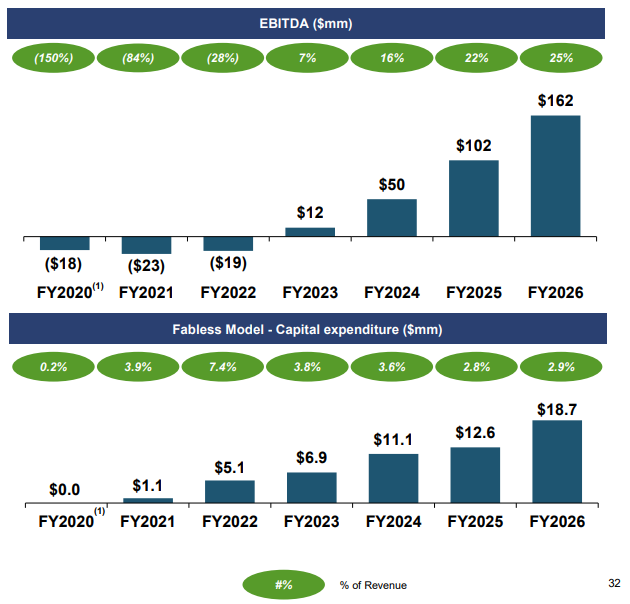

(Source: Navitas Semiconductor)

Looking at the financials of Navitas, Q3 net revenues came in at $5.6 million and Q4 revenues are expected to come in at $7.4 million. The company projects 2026 revenues and EBITDA could reach $640 million and $162 million, respectively. Navitas is betting on a fabless business model, so capital expenses should be small.

(Source: Navitas Semiconductor)

This is where the red flags start to become more visible. If we take the $2.1 billion midpoint of the forecasted 2026 TAM, Navitas Semiconductor seems confident it can keep a 30% share in a rapidly changing market which I view as too optimistic. I think the company is set to face significant competition from the likes of Canada’s GaN Systems, which recently raised $150 million in a growth capital funding round. The latter has some interesting products and is displaying the world’s smallest 65-W charger powering a laptop at CES 2022.

Even if Navitas Semiconductor manages to reach its financial projections, its market valuation still looks high to me. The company had around $260 million in cash and cash equivalents when it closed its SPAC deal, which means its enterprise value stands at $1.32 billion as of the time of writing. Navitas Semiconductor is thus trading at 8.1x 2026 projected EV/EBITDA, which I find too much for a company in an emerging sector. The figures would look even worse if we’re conservative and assume the TAM will be only $1.6 billion in 2026. It seems to me that Navitas Semiconductor is currently priced for perfection and this is usually a bad sign.

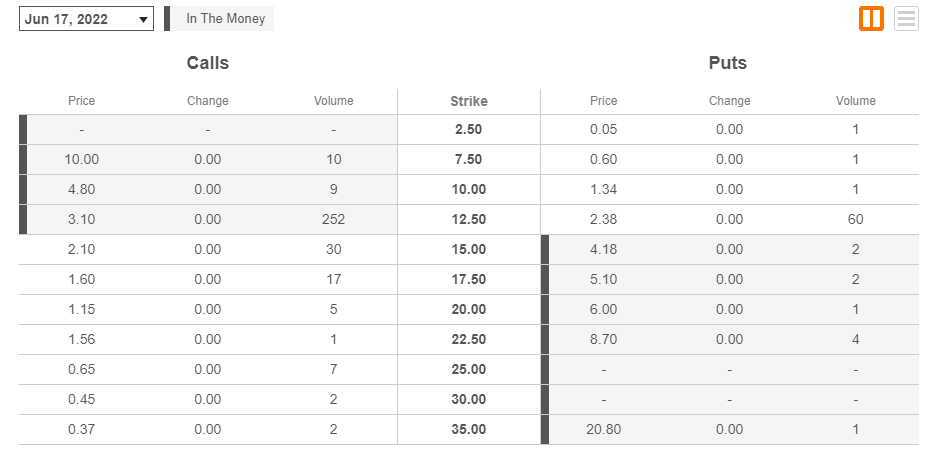

So, how to invest in this one? Well, the GaN power semiconductor market will continue to be small over the next few years and so will be the revenues of Navitas. The company has pretty good visibility into its financial performance in the future as a result of design wins in production. I expect this to lead to cooling investor interest which could drive share prices below $10. I’m bearish and two ways to benefit from a decline in stock prices include put options and short selling. Unfortunately, there are no long-term equity anticipation securities (LEAP) options available here and the put options expiring in June seem expensive.

(Source: Seeking Alpha)

Looking at short selling, the short borrow fee rate stands at 11.74% as of the time of writing, according to data from Fintel. Opening a small short position seems viable to me.

Investor takeaway

I like the GaN power semiconductor sector but Navitas seems priced for perfection even if it manages to reach its financial projections. It’s a rapidly-growing market and I’m concerned that the likes of GaN Systems could capture a large share of it in the future. And if we’re being conservative, the TAM could be just $1.6 billion in 2026, which is equal to the market valuation of Navitas as of the time of writing.

Overall, I rate this one as a speculative sell and I think that the share price is likely to go down below $10 over the next two years.

Be the first to comment