AsiaVision

Thesis

Nature’s Sunshine Products, Inc. (NASDAQ:NATR) performed well in 2021, but 2022 profits are suffering due to increased costs of inputs. Despite this, the stock is undervalued compared to peers, with a potential upside of around 30-50%, but very much comes with a lot of risks.

Intro

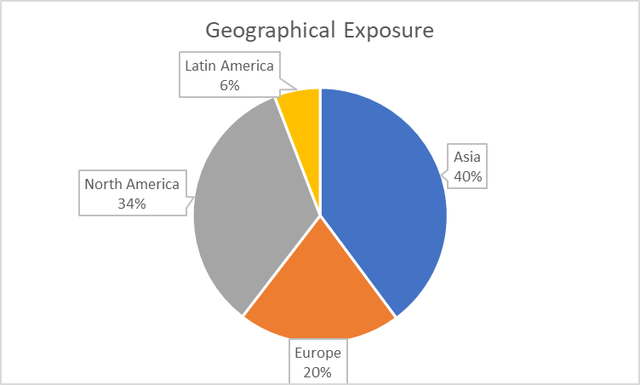

NATR is a natural health and wellness company primarily engaged in the manufacturing and distribution of care products. The company are vertically integrated, where most of their products are manufactured in their own facility in Utah, but the company also have co-mans for certain products as well. The company sells products under 6 categories: general health; immune; cardiovascular; digestive; personal care; and wealth management, across 4 different regions, illustrated below.

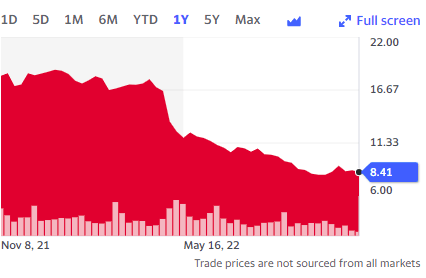

The company’s share price has not performed well over the past year, being down more than 50%, from around $16 to $8 today.

Yahoo Finance

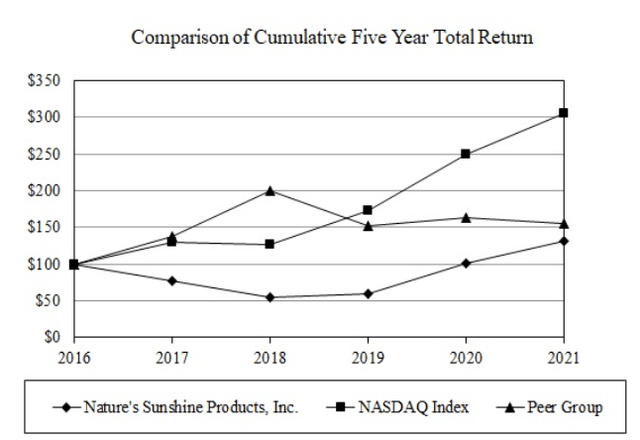

Over the past 6 years, the company have underperformed both the general market (NASDAQ) and peer group.

Financial Analysis

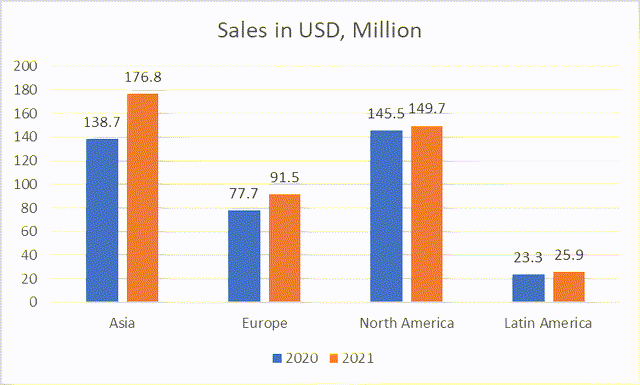

Despite the stock price decline, NATR has improved sales between 2020 and 2021 across all markets, with 28% growth in Asia, 18% in Europe, 3% in North America, and 11% in Latam, leading to an overall sales increase of 15.3% (13.6% on a local currency basis), resulting in 2021 sales of $444 million.

Sales drivers include product promotions and overall market growth in nutritional supplements. The strongest demand has been from Japan and China, where the contribution to growth was from increased consumer engagement.

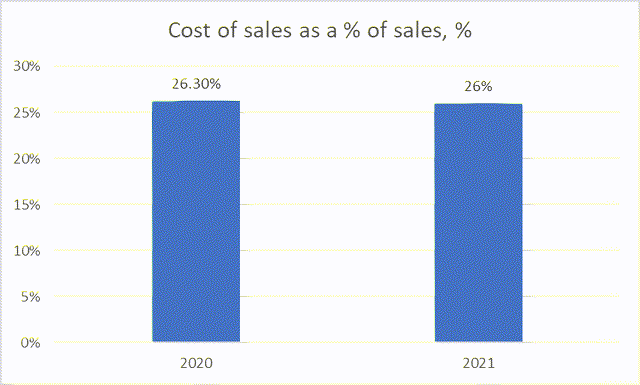

Overall, the cost of sales decreased as a % of sales from 26.3% to 26% in 2021, due to a more favourable market mix.

However, unfortunately, this improvement was offset by an increase in SG&A costs by around $23m for the period, where SG&A as a % of sales increased from 34.1% to 34.7% due to higher service fees in certain markets. On the other hand, volume incentives declined from 34% of sales to 31.5% of sales in 2021, again, due to market mix (as different countries have different fee structures).

These improvements have led to a growth in Operating Profit margin, from 5.6% in 2020 to almost 8% in 2021.

Recent Performance

While financials on a full-year basis look strong, unfortunately, the company has not performed well in recent quarters. Net sales in Q3-22 that came out recently are down -2% compared to the year prior. While this is a reasonable figure given the economic climate, the decline in net income is not. Net income dropped to almost $0 in the quarter, resulting in a $0 EPS. On the other hand, EBITDA was still positive but did drop by almost 50% down to $6.8m in the quarter.

While the company are somewhat maintaining their top line, inflation, and volatile foreign exchange rates (as the portfolio is very geographically diverse) are hitting profits hard. It has resulted in a substantial increase in the cost of goods. Although the company have managed to offset some of these cost rises with improvements in SG&A expenses, these can only go so far.

The unfortunate thing is that these numbers are for the quarter ending September 30, 2022, yet we are at a much higher inflation rate today compared to then, 2 months ago, and we are expecting inflation to remain elevated throughout 2023 as well. If the cost of goods has risen so much already, wiping out almost all profit, then we can expect negative profit in the near future as costs continue to rise further. The USD is expected to continue on its trend which will lead to further losses in currency translation for the company unless they make gains via hedges.

Luckily the company have a very robust balance sheet. As of September, NATR is sitting on $57m of cash and only has $1.5m of debt. Say EBITDA for the full year could be around $20m on a conservative estimate, debt to EBITDA, debt to EBITDA would be almost 0, and net debt to EBITDA would be even greater. Cash as a % of EV is almost 25% alone.

Valuation

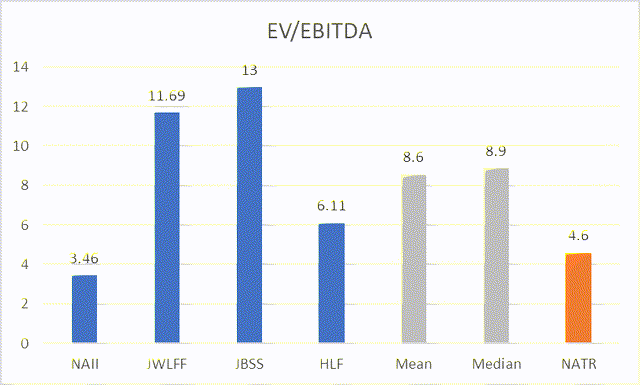

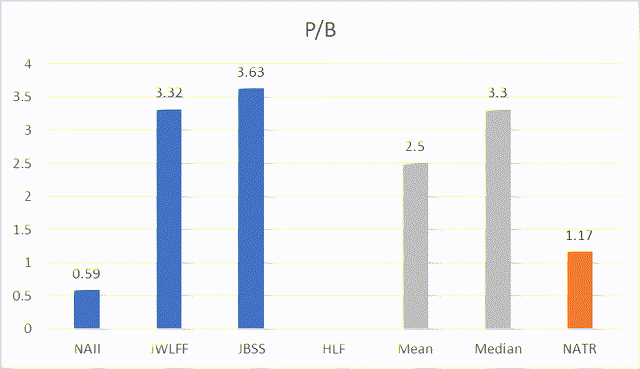

Looking at different valuation methodologies, and based on current information, NATR is undervalued compared to peers.

In terms of EV/EBITDA, NATR are almost 50% below the value of peers.

And for the price to book value, NATR also looks like it is discounted by around 50%.

However, these numbers could easily change given the rapid decline in profits due to substantial increases in input costs, so there is a risk here.

Risks

- If EBITDA is entirely wiped out by much higher input costs, then we could also see the undervaluation disappear. The trend right now is that cost of goods sold is likely to continue rising as inflation continues to increase, coupled with currency effects as the dollar strengthens against peer currencies.

- Secondly, we could see a large decline in revenue that would, again, lead to a decline in profits. Right now, revenue seems to be maintained at its current level and only dropping by a few points. But demand could decrease as prices continue to rise and consumers begin to pull back on purchases.

Conclusion

Overall, NATR had a very strong performance in 2021, with growth across all countries in both revenues as well as profits. However, profits have taken a hit from rising costs and currency effects, leading to increased costs of sales, which has led to a downturn in the share price. Despite this, NATR is undervalued compared to peers on both an EV/EBITDA and P/B basis, as sales remain high, and the balance sheet is robust. Based on the valuation, we could see a potential upside of around 100%, but this is optimistic given the risk of higher input costs, so a potential upside of around 30-50% may seem more reasonable. On the other hand, as stated, this is a risky stock and the economic climate is not in favor, if costs continue to rise, this potential upside could disappear.

Be the first to comment