Editor’s note: Seeking Alpha is proud to welcome CJD Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

7-Eleven (Top Tenant 4.8%) RiverNorthPhotography

I invest in quality companies that provide cash flow in good times and in bad times. In good times, it can be easy to get caught up in high-flying unprofitable growth companies. But, as they say, good times don’t last forever. No one knows how long this tightening cycle will last, but I believe this is a great time to purchase quality companies on sale. Most recently, I purchased National Retail Properties (NYSE:NNN).

Business Model

NNN is a real estate investment trust (REIT). A REIT is a company that owns, operates, or finances income-producing real estate. There are many different business models and property types that REIT’s can own, but that’s a discussion for another article. NNN owns and purchases properties that are single-tenant, freestanding retail properties (no malls or strip centers). These properties are then triple net leased out. A triple net lease typically means the tenant is responsible for taxes, maintenance, and insurance. Companies that utilize triple net leases tend to have stable bond like cash flows because they avoid unexpected expenses.

Why National Retail Properties?

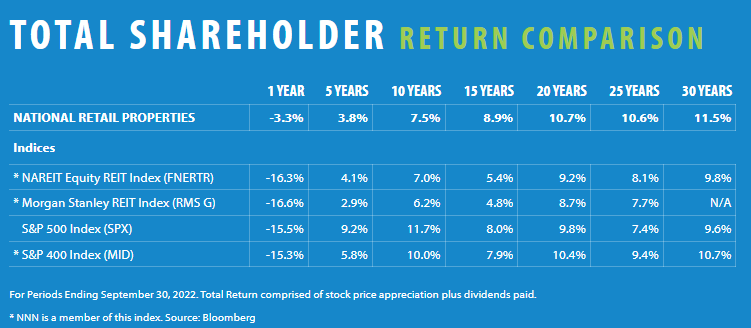

NNN has outperformed the S&P 500 for over 25 years, and I believe it will continue to do so. Everyone looks good in a bull market. For the most part, we have been in a bull market since the 2008 financial crisis. I believe we are in the middle of another bear market and this is when good companies show their strengths and outperform. In the short term, indices have outperformed NNN, but over the long term (including the bad times) NNN has beaten the NATREIT Equity REIT Index (FNERTR), the S&P 500 Index (SP500), and the S&P 400 Index (MID:IND). Have you ever heard the story of the tortoise and the hare? Well, NNN is the tortoise of triple net lease REITs.

National Retail Properties Website

NNN focuses on tenants that are less likely to be negatively affected by e-commerce and technology in general. The only business in the top 10 tenants that I see being disrupted by e-commerce or technology is AMC Theatre (AMC). Management has stated they will not be buying any more theaters, which I welcome as a shareholder. Other than AMC, I believe if any of these main tenants fail (while unlikely, I always like to consider what the worst is that can happen), I do not believe it would be hard to replace the tenant. A convenient store placed in the right location will always be in demand. This same thing goes for car washes, gyms, and restaurants. Many different tenants/operators could lease these properties and be successful, provided that the property is in the right location.

|

Tenant |

Properties |

% of Total Rent |

|

7-Eleven |

138 |

4.8% |

|

Mister Car Wash |

121 |

4.4% |

|

Camping World (CWH) |

47 |

4.0% |

|

LA Fitness |

30 |

3.4% |

|

GPM Investments (Convenience Stores) |

152 |

3.2% |

|

Flynn Restaurant Group (Taco Bell & Arby’s) |

204 |

3.0% |

|

Dave & Buster’s (PLAY) |

28 |

2.9% |

|

AMC Theatre |

20 |

2.7% |

|

BJ’s Wholesale Club |

13 |

2.4% |

|

Mavis Tire Express Services |

134 |

2.2% |

Source: National Retail Properties Website

NNN has a long history to prove its worthiness, as shown by its 33 years of consecutive dividend increases. The company doesn’t have to sell you their story or plan; anyone can do the research and review their performance. The company figured out what works and has stuck to it.

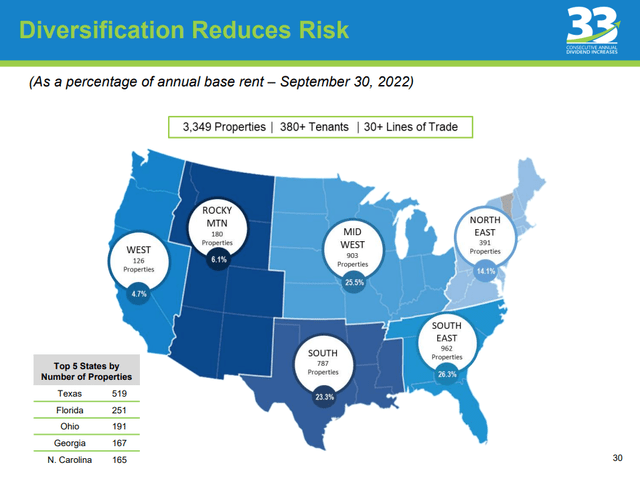

So what sets NNN apart from the rest? NNN has good relationships with their tenants, which historically has led to around 71% of their acquisitions. These sale leaseback transactions benefit both the tenant as well as the landlord. The tenant can free up capital while signing a fair long-term lease with a landlord they trust. NNN uses diversification across industries and geography to reduce risk. I believe their focus on the Southeast, Midwest, and the South will result in higher returns due to post-COVID migrations.

National Retail Properties Investor Presentation

The leases executed by NNN are typically between 15 and 20 years long, with renewal options. These long leases result in stable cash flows for years (while increasing around 2% annually). Their average remaining lease term is 10.4 years, followed by an average debt maturity of 14 years with a weighted average effective interest rate of 3.7%. The long maturities and low interest rates are a wonderful hedge against inflation and the current rate environment.

Another reason I like NNN is for its dividend reinvestment plan that, when reinvested, results in a 1% share price discount. While this is a tiny amount, getting an “owners” discount to reinvest feels good.

Balance Sheet

A common misconception about REITs is that they are heavily leveraged. Taking a look at NNN, it is around 40% leveraged. The typical real estate investor will have a down payment of around 20%. NNN finances new properties with around 60% down, about three times as large as the typical real estate investor.

I think that researching a company’s debt profile and its ability to repay that debt is paramount to investing. My personal preference is to see that the company does not need to rely on the bond market or the equity market. In the world we live in, you never know what might happen. Interest rates might skyrocket to 20% (which actually happened in 1979). If the company has a bond maturity coming due with such high interest rates, they need to pay the bond off with cash on hand, refinance at 20%, or sell equity for cash to pay off the debt. Being forced to refinance at such a high rate or having to sell equity regardless of share price could be detrimental to current shareholders. Selling equity is how many REITs fund their acquisitions, but there’s a difference between selling equity for accretive investments (if the stock price is high enough, a REIT can deploy that newly raised cash from selling shares into properties that will produce more earnings per share for existing shareholders) and selling shares at rock bottom prices during financial stress to raise capital.

Now, let’s view NNN’s debt and do some analysis. NNN has 10 outstanding bonds. There are five bonds that come due each year sequentially from 2024 to 2028. The amounts due range from $350-$400 million. Below is my back-of-the-envelope analysis (some assumptions will not be perfect or exact, but it will paint a good enough picture) of how NNN could pay its upcoming maturities.

Option 1 – Refinance Debt

They can refinance the $350 million at a rate of 6.2% (that’s using today’s interest rates because I don’t know where they’ll be in two years). I don’t believe this would be that bad of a decision, but it would increase interest expenses by around $8.05 million per year. This would be a manageable expense, considering after the dividend the company will retain around $180 million/year (around 4.5c per share expense increase).

Data: The existing 2024 bond interest rate is 3.9%. New five-year bonds would sell for approximately 6.2% based on where their existing 2028 bonds are trading.

Option 2 – Use Cash and Refinance

They can use $180 million of extra cash after dividend to reduce new bond sale to $170 million. This bond at 6.2% would actually have less interest expense than the existing 3.9% bond. This would be a sustainable option that would keep expenses lower than before. Spending all extra cash on debt repayment would reduce new investment growth, but this is a viable option.

Data: The estimated 2022 FFO (funds from operations) is approximately $560 million. The estimated 2022 dividend is $380 million.

Option 3 – Issue Equity

The company can issue equity for around 6.3%. This would result in a similar expense to option 1. I didn’t go through an option of issuing some shares while refinancing some debt, but it would result in a similar expense.

Data: At the time this article was written, the current share price was $43.40. I assumed the company would have to raise approximately 10 million shares at around $35, which results in a 6.3% dividend payment on 10 million new shares.

Option 4 – “Scorched Earth”

This assumes there is a complete breakdown in the bond market and the company share price plummets. In this scenario, the company cannot finance through bonds, share issuances, or selling properties. The company would have to reduce/eliminate the dividend to pay the bond holders. The company’s cash flow would have to drop 38% from 2022 expectations before they could not cover the $350 million bond maturity. For reference, in 2020 earnings dropped to $431 million (a 7% decline). Just for one more point of reference, looking back at the company’s 2010 annual report you can see that the earnings decline from 2008 to 2009 was 32.7%.

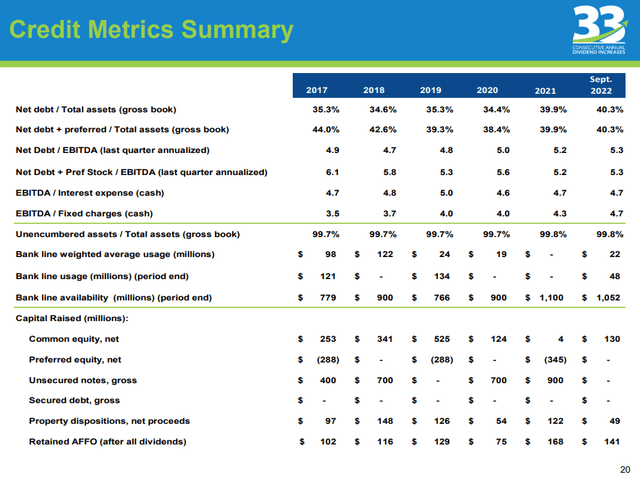

Credit Metrics (Investor Presentation)

I think it’s important to look at the “Capital Raised” section at the bottom of the above slide. You can see the company was issuing equity from 2017 to 2020. In 2020, the share price started to drop. Good management shouldn’t sell equity at low prices, which NNN has proved it’s not doing. Management is agile in financing with the lowest cost available. Instead of using equity, they ramped up their debt issuances. They financed $1.6 billion in 2020 and 2021 with long maturities while interest rates were at some of the lowest levels in history.

Take a look at 2022: While interest rates have soared and the share price has declined, the company has resisted taking out additional debt and for the most part paused raising capital. As cap rates adjust to the volatile interest rates changes, I have no doubt that NNN management will be patient and raise additional capital with the most prudent method available.

Valuation

Although I believe that in the current environment NNN can continue to trade down, I have learned I cannot determine where stocks will move in the next one to two years. I believe the market and multiples assigned to companies heavily rely on decisions made by central banks and governments. I also believe that today the triple net lease sector shows a lot of value; GIC and Oak Street also agree since they purchased STORE Capital (STOR) at a 14.5 multiple.

Comparing the FFO/price multiple with the other triple net lease blue chips, NNN has a slightly better valuation than Realty Income (O) and W. P. Carey (WPC). Spirit Realty Capital (SRC) does appear to be cheaper and could pose as a buyout candidate, as it resembles STOR.

|

Year |

NNN |

O |

WPC |

SRC |

|

2022 |

13.81 |

15.73 |

15.15 |

10.34 |

|

2023 |

13.48 |

15.35 |

15.02 |

10.25 |

|

2024 |

13.11 |

14.76 |

14.25 |

10.04 |

Source: Created by the author using Seeking Alpha data

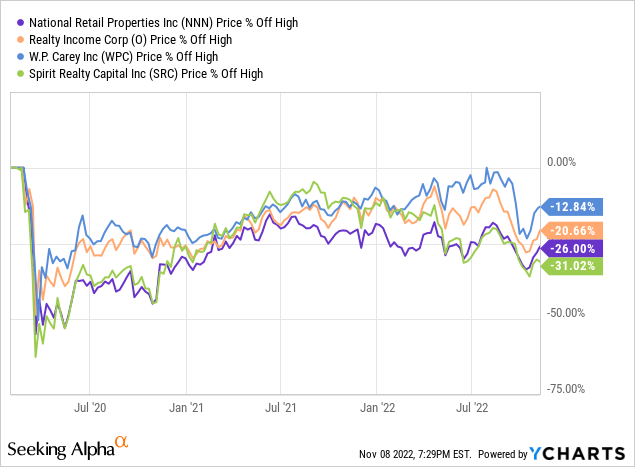

Taking a look at where these stocks are compared with their peaks in 2020, none of them have returned to that peak even while they are expected to have an all-time high in earnings. WPC has held up the best, which I assume is due to their leases having escalations tied to inflation.

Below is a look at dividend yield and the payout ratio. All of these REITs have attractive dividends, offering over 3x that of the S&P 500 index and over 1% higher than the Vanguard Real Estate ETF (VNQ). NNN has the lowest payout ratio compared to the blue-chip net lease companies. This allows them to organically grow while not having to issue as much equity than other net lease companies. I prefer this type of strategy because while the market caps of O and WPC grow at much faster speeds due to share issuance, NNN can match their per share earnings growth without the need to dilute.

NNN also can grow organically in the event the capital markets are not cooperative. I also think that size can work against O and WPC. To move the needle, these companies will have to either make more or larger purchases, which could result in lower quality properties. I prefer the slow and steady approach of internal growth. During the Q3 conference call, Ronald Kamdem from Morgan Stanley mentioned in one of his questions that NNN “should be positioned better than everybody else,” referring to other net lease REITs.

| Ticker | Dividend Yield | Payout Ratio |

| NNN | 5.01% | 67% |

| O | 4.70% | 74% |

| WPC | 5.42% | 83% |

| SRC | 6.76% | 72% |

Source: Created by the author using Seeking Alpha data

Risks

Any investment has risks, and NNN is no exception. While NNN does diversify and have a fortress of a balance sheet, it is not immune to recessions, rising rates, and pandemics. Many of their tenants are not considered to be essential increasing the risk of further shutdowns in the event of another variant. Most of their tenants do not have investment-grade credit, resulting in a higher likelihood a tenant could face financial stress during a recession.

The triple net lease business model does struggle to prosper when interest rates are extremely volatile, as they are now. While interest rates and cap rates adjust it can be difficult to secure a positive spread, which will most likely result in fewer acquisitions. During the Q3 conference call the CEO stated that he “feel[s] better today than [he] did 45 days ago on the cap rate spread,” which makes me feel optimistic regarding future acquisitions.

Conclusion

While I believe the entire triple net lease sector is showing good value, I prefer NNN. I believe it will continue to outperform the market in the long term. This company is great at what they do. They keep it simple and continue to reward long-term shareholders. At today’s prices, NNN has a dividend yield of 5.01%; given that, coupled with its average FFO/share growth over the last seven years of 4.3%, I estimate yearly returns of around 9%-10%. I believe NNN is a buy.

Be the first to comment