Alan Morris/iStock via Getty Images

The British utility National Grid plc (NYSE:NGG) is popular among income investors for its yield and perceived defensive qualities. I like the defensive nature of its business, but the dividend does not look secure to me, and I see limited price upside because of that, and the firm’s structural economics.

Reasons to Like National Grid

Looking back at Seeking Alpha over the past few years, a variety of writers have been either bullish or neutral on the name. Although I do not want to simplify their respective theses, the main themes to emerge in favor of the name have been the yield (e.g., National Grid Is The Clear Winner In The Dividend Bout Against Utility ConEd) and the potentially defensive qualities of the sector (e.g., National Grid: A ‘Consistently Not Stupid’ Buy).

I think the large moat of National Grid’s infrastructure business continues to be highly attractive. It is the owner and operator of the high-voltage electricity transmission network in England and Wales and the electricity system across Great Britain. It also owns a number of localized electricity distribution networks in the U.K. In addition, it operates the U.K. gas transmission network (though announced in March that it plans to sell 60% of that business), increasing its focus on electricity. I see that as positive for the investment case, as it reduces exposure to an area that, due to mounting environmental pressure, is likely to see less custom in the U.K. (GAS) and focusses instead on electricity, which in practical terms, at least, I think is here to stay at scale for longer in the U.K. than gas as a source of energy.

That strong business moat is the foundation of an attractive business model that endears National Grid to many investors. However, when it comes to the dividend, I see the shares as less attractive than many investors seem to think.

The Dividend Is Not Funded by Current Free Cash Flows

Currently the dividend yield is 4.8%. For many investors, the long-term investment case has been about its defensive qualities supporting a dividend, and 4.8% seems like an attractive yield.

Looking forward, though, is the dividend sustainable even at the current level, let alone with the annual increase to which investors have become accustomed?

The past couple of years have seen substantial net cash outflows. Last year, net cash outflows from continuing operations was £1.6bn after paying out £0.9bn in dividends. The prior year was even worse. In fact, recent years show that the company has consistently had negative cash flows even before paying ordinary dividends, which just exacerbate the situation.

|

2019 |

2020 |

2021 |

2022 |

|

|

Ordinary dividends (£m) |

1160 |

892 |

1413 |

922 |

|

Net cash flow (£m) |

-1682 |

-2074 |

-2921 |

-1617 |

Table compiled by author using data from company annual reports

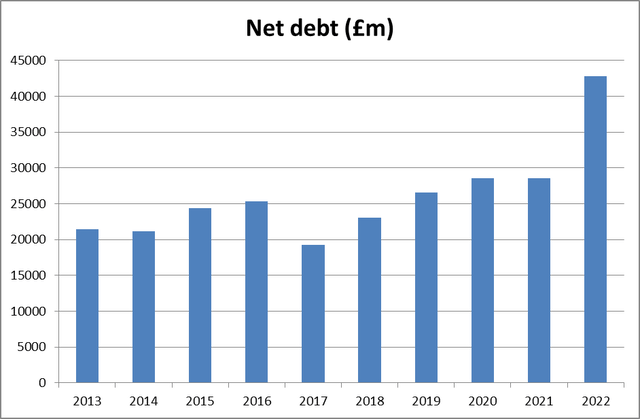

How does the company grow the dividend despite negative cash flow? A look at its net debt helps explain.

National Grid net debt (£m) (company annual reports)

Chart compiled by author using data from company annual reports.

I don’t think that is a pretty picture – net debt has doubled over the past decade. In itself, that is not a problem, in the sense that with its critical infrastructure assets the company ought to be able to maintain its banking facilities and cashflows should service the debt. But when it comes to the dividend, I feel less comfortable.

For now I see no particular trigger for National Grid to cut its dividend. It would hurt a key plank of the investment case, which in turn would likely lead the share price lower. Even during the pandemic, when other companies used the opportunity to pass off a dividend suspension on the pretext of business uncertainty, National Grid stayed the course.

But in the long term, I think economics will reveal themselves. National Grid is consistently seeing negative cash flow on a large scale, and its net debt has been moving upwards. In a responsibly run business, at some point the answer to that combination of factors – if they persist – is cost-cutting, and that could well include the dividend. So, although I see no particular reason for the company to cut its dividend anytime soon, I also don’t think the current economics can go on indefinitely.

NGG’s Valuation is Full

Currently National Grid has a market cap of $47B and trades on a price to earnings ratio of 17.

There is reason to expect it can continue to grow revenues in the future, thanks to its monopolistic position in U.K. energy distribution. Capital expenditure requirements may continue to be demanding, though. But, for a business with that sort of moat, I do not think a P/E of 17 is unreasonable. But I do not think it is cheap, either: National Grid has sizeable debt, and I see its current dividend as structurally unsustainable over the medium- to long-term unless something fundamental changes in the economics of the business.

Although a shift by investors to defensive ideas like utilities may help support the share price in the current environment, from a long-term fundamentals perspective I see limited to no upside.

Why am I therefore of a “Sell” mentality rather than simply being neutral? In short, I see limited-to-no capital gain opportunity, and an attractive income opportunity that I think may ultimately be unsustainable, potentially hurting the share price.

Be the first to comment