Olivier Le Moal

Shares of Myovant Sciences (NYSE:MYOV) rallied nearly 50% since my April article and 30% since my update in July. This was the result of the company executing on the commercial front and, more importantly, the clearance of the regulatory overhang in the form of Myfembree’s approval for the treatment of endometriosis. The company now has a clear road to execute the launch of Myfembree in the more popular indication, at least based on the sales of AbbVie’s (ABBV) Orilissa/Oriahnn.

Myfembree’s approval for endometriosis

This was an overhang on the stock due to the deficiency letter the company received in April, but the subsequent three-month PDUFA extension made the situation a bit clearer, and the stock rallied as a result.

In my previous article, I noted that any issue related to Myfembree’s negative impact on bone mineral density can be addressed with appropriate product labeling, the same way it was addressed in the case of Orilissa, and the same way it was addressed with Myfembree itself for the treatment of uterine fibroids. At least if that was holding up the approval.

Myfembree received FDA approval in early August, and the label looks good and should not hold the promotion back relative to main competitor Orilissa/Oriahnn.

However, if that was the hard part, the next is even harder – the commercialization of Myfembree in the large endometriosis market. I say that’s the harder part due to AbbVie’s complete failure in launching Orilissa/Oriahnn (which also goes by the generic name elagolix). I covered this in my April article, but it’s a subject worth mentioning again and expanding a bit on.

I would say the failure of Orilissa/Oriahnn has a lot to do with the lack of effort on AbbVie’s side. AbbVie went from being seemingly genuinely excited about the prospects of this drug in the large endometriosis and uterine fibroids market (AbbVie’s CEO Gonzales said this in late 2018: “Elagolix is yet another compelling asset that represents a multibillion-dollar growth opportunity”) to not even mentioning it anymore on earnings calls, and lately, to not even reporting quarterly sales. For the last two quarters, I had to calculate the sales based on royalties reported by AbbVie’s partner Neurocrine Biosciences (NBIX).

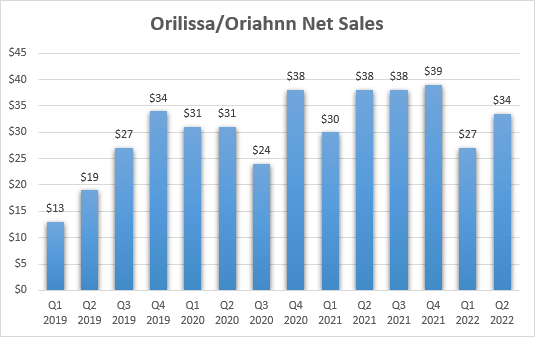

And the situation is not pretty. Sales of Orilissa/Oriahnn flatlined in the high 30s last year and have declined to $27 million and $34 million in the first two quarters of 2022, respectively.

Orilissa/Oriahnn sales growth (AbbVie Earnings reports, Neurocrine Biosciences earnings reports)

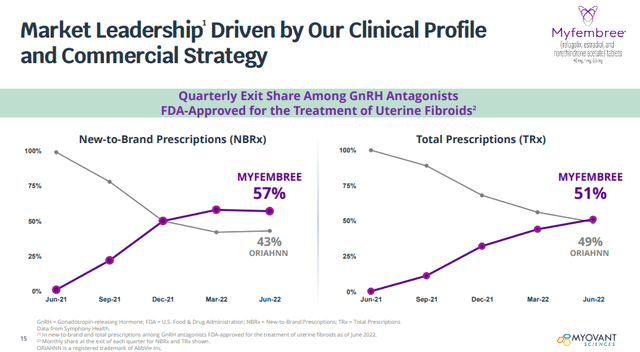

First, Myovant is far more motivated than AbbVie to succeed. Orilissa is a tiny and largely irrelevant product to AbbVie, and it’s a very important one for Myovant. Second, Myovant is not doing this alone, it’s co-promoting the product with Pfizer. And third, we have seen evidence of the early commercial success of Myfembree compared to Oriahnn as Myfembree has already reached 51% total prescription market share and 57% new to brand share in the uterine fibroids market. This is a significant achievement this early in the launch and goes back to the first point – that Myfembree is a high-priority asset for Myovant and a low or no-priority asset for AbbVie.

Myovant investor presentation

But that’s not to say I expect Myfembree to be a blockbuster product for Myovant. I just think it can do better – as already stated in my initial article, I expect annual sales of Myfembree to reach $400-500 million in 4-5 years.

Orgovyx’s progress continues

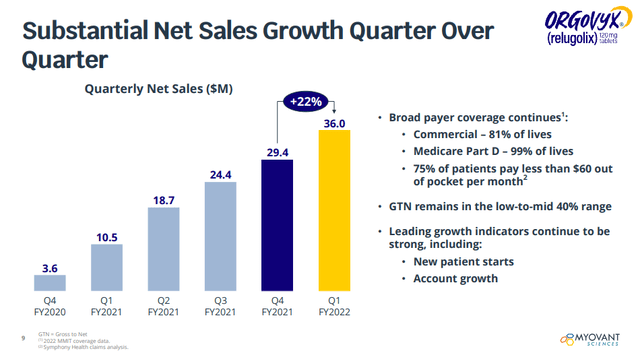

Net sales of Orgovyx grew 22% sequentially to $36 million in the fiscal Q1 2022 (calendar Q2 2022).

Myovant investor presentation

Approximately 3,500 new patients started treatment on Orgovyx in the quarter, reaching 18,000 cumulative patients since launch.

Gross to nets remained within the previously stated range of low to mid-40s, though they were on the higher end of the range due to what management explained were “quarterly fluctuations.” Due to these fluctuations, the net price was a bit lower sequentially. But that meant the underlying volume growth was even better at 26% vs. the 22% sequential increase in net sales. Should gross to nets go back to the mid-point of the expected range, net price should be a slight tailwind in the second half of the year.

Orgovyx received European Commission and U.K. approval for Orgovyx in April and June, respectively. Myovant leveraged the approval to partner Orgovyx with Accord Healthcare and it received a $50 million upfront payment. Accord plans to launch Orgovyx in Europe in the second half of the year and Myovant is eligible to receive up to $90.5 million in additional milestone payments and royalties starting in the high teens and going up to the mid-20s.

Financial overview

Myovant ended the calendar second quarter with $358.7 million in cash and equivalents and $41.3 million of available borrowing capacity under the Sumitomo Pharma loan agreement, and the approval of Myfembree triggered a $100 million milestone payment from Pfizer for a pro-forma cash balance of $458.7 million.

The company is well capitalized to continue to drive the sales of Orgovyx and to launch Myfembree for the treatment of endometriosis, but the cash burn remains on the high side and is higher than I initially anticipated.

With expenses annualizing at around $100 million a quarter and with half of Orgovyx and Myfembree net profits going to partner Pfizer, the uptake of Orgovyx and Myfembree would need to pick up for the company to avoid additional dilution by mid-2024, or to avoid getting another loan from Sumitomo Pharma. And the added benefit of improved uptake of the two products should be the triggering of sales-based milestones from Pfizer. Royalties from partner Accord should also start flowing next year, but I do not expect them to be material.

Conclusion

Myovant is not as attractive as it was a few months ago, but it’s still trading below my estimated fair value range of $22 to $30 per share which is based on Orgovyx and Myfembree generating a combined $1.2 billion to $1.5 billion in annual net sales by 2027.

And the de-risking of Myfembree makes Myovant more attractive to potential suitors, though it all depends on what majority owner Sumitomo (52.3% of shares outstanding are owned by Sumitomo) wants to do – to acquire Myovant or hand it over to a large pharma company. If it’s the latter, the main suitor would be Myovant’s partner Pfizer.

Be the first to comment