Vadym Pastukh/iStock via Getty Images

Investment Thesis

In my opinion, both Johnson & Johnson (NYSE:JNJ) and Alphabet (GOOG) (NASDAQ:GOOGL) are excellent choices to be part of your investment portfolio for retirement: both companies have broad competitive advantages, strong financials (Aaa credit rating by Moody’s for Johnson & Johnson and Aa2 for Alphabet) and they are highly profitable (Johnson & Johnson has an EBIT Margin of 26.38% and Alphabet’s is 29.65%). Furthermore, I consider both to have a very attractive current valuation.

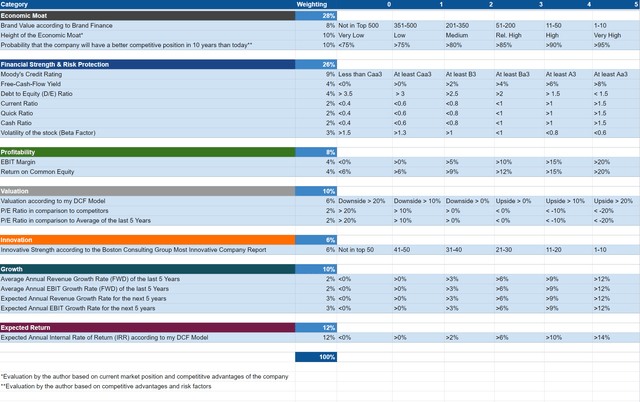

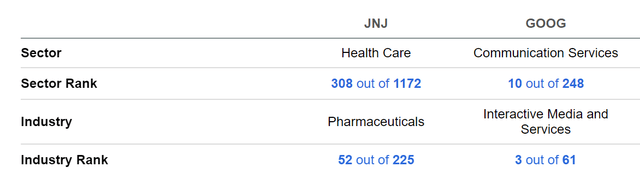

The overall scorings of Johnson & Johnson and Alphabet, as according to the HQC Scorecard, demonstrate that both are currently very attractive when it comes to risk and reward:

Johnson & Johnson achieves an overall score of 83/100 points, showing very attractive results in terms of risk and reward. The company is rated as very attractive in the categories of Economic Moat (81/100), Financial Strength (84/100), Profitability (100/100), Valuation (88/100), Innovation (80/100) and Expected Return (100/100). Only in the category of Growth is the company rated as moderately attractive, where it receives 48/100 points.

Alphabet scores 91/100 points on the HQC Scorecard, also showing a very attractive overall rating in terms of risk and reward. The company achieves very attractive results in all categories of the Scorecard.

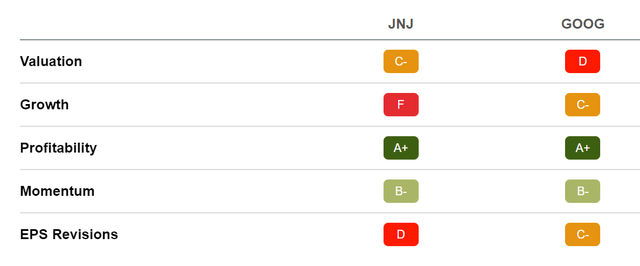

According to the Seeking Alpha Quant Ranking, Johnson & Johnson is ranked 52nd out of 225 in the Pharmaceuticals Industry and 308th out of 1172 in the Health Care Sector. Alphabet is ranked 3rd in the Interactive Media and Services Industry and 10th out of 248 in the Communication Services Sector. These ratings as according to the Seeking Alpha Quant Ranking, reinforces my belief that both companies are excellent choices when aiming to invest for retirement.

Johnson & Johnson and Alphabet’s Competitive Positions

Johnson & Johnson is composed of 260 operating companies and has a product portfolio of 26 brands that each create a revenue of more than $1 billion.

The company’s high EBIT Margin of 26.38% is an indicator of its strong competitive position within the Pharmaceuticals Industry. This excellent competitive position is further underlined by the Seeking Alpha Quant Ranking, in which Johnson & Johnson is ranked 52nd out of 225 within the Pharmaceuticals Industry. The fact that Johnson & Johnson has been able to continuously grow its dividend over the last 59 years is additional evidence of its excellent competitive position.

In my previous analysis on Alphabet, I highlighted the company’s enormous amount of data and its ability to use this data as one of its competitive advantages. Furthermore, I mentioned that Alphabet’s $124,997M in Total Cash & ST Investments is proof of its enormous financial strength. Additionally, I made reference to the fact that Alphabet has successfully proven its ability to integrate new businesses into the company:

“One of its most successful acquisitions, for example, was YouTube, for which the company paid $1.65 billion back in 2006. Another successful acquisition and integration was Android, which Alphabet bought back in 2005 for $50 million. With a total of 22, Alphabet announced more acquisitions in 2021 than any other year in the past decade.”

Moody’s Aa2 credit rating for Alphabet and Aaa for Johnson & Johnson is powerful evidence of the companies excellent financial situations, thus providing them with an additional competitive advantage over their competitors. Johnson & Johnson and Alphabet’s high credit ratings as according to Moody’s, contribute to the fact that I consider them to be excellent buy and hold investments.

The Valuation of Johnson & Johnson and Alphabet

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Johnson & Johnson and Alphabet. The method calculates a fair value of $230.77 for Johnson & Johnson and $157.34 for Alphabet. At the current stock prices, this gives Johnson & Johnson an upside of 39.30% and Alphabet an upside of 40.80%.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Johnson & Johnson |

Alphabet |

|

|

Company Ticker |

JNJ |

GOOG |

|

Revenue Growth Rate for the next 5 years |

3% |

10% |

|

EBIT Growth Rate for the next 5 years |

3% |

10% |

|

Tax Rate |

8.3% |

16.2% |

|

Discount Rate [WACC] |

6.75% |

8.00% |

|

Perpetual Growth Rate |

3% |

4% |

|

EV/EBITDA Multiple |

14.1x |

13.1x |

|

Current Price/Share |

$165.71 |

$111.78 |

|

Shares Outstanding |

2,629 |

13,044 |

|

Debt |

$32,597 |

$28,810 |

|

Cash |

$10,983 |

$17,936 |

|

Capex |

$3,632 |

$29,816 |

Source: The Author

Based on the above, I calculated the following results:

Market Value vs. Intrinsic Value

|

Johnson & Johnson |

Alphabet |

|

|

Market Value |

$165.71 |

$111.78 |

|

Upside |

39.30% |

40.80% |

|

Intrinsic Value |

$230.77 |

$157.34 |

Source: The Author

Relative Valuation Models

The P/E [FWD] Ratio for Johnson & Johnson and Alphabet

Johnson & Johnson’s P/E Ratio is currently 20.29, which is 15.86% below the Sector Median (24.11). Due to Johnson & Johnson having strong financials (credit rating of Aaa by Moody’s) and high profitability (EBIT Margin of 26.38%) as well as a strong brand image, in my opinion the company should be rated with a premium as compared to its competitors. Johnson & Johnson’s P/E Ratio being 15.86% below the Sector Median, provides us with a strong indicator that the company is currently undervalued.

Alphabet’s current P/E Ratio is 21.41, which is 23.33% below its 5 Year Average of 27.92, strongly suggesting that the company is also undervalued.

The DCF Models as well as Relative Valuation Models (such as the P/E Ratio) provide us with evidence that Johnson & Johnson and Alphabet are currently undervalued. The fact that both companies are currently undervalued is another factor that makes them excellent choices when aiming to invest for retirement.

Financial Overview: Johnson & Johnson and Alphabet

|

Johnson & Johnson |

Alphabet |

|

|

Ticker |

JNJ |

GOOG |

|

Sector |

Health Care |

Communication Services |

|

Industry |

Pharmaceuticals |

Interactive Media and Services |

|

Market Cap |

435.68B |

1.41T |

|

Revenue |

95.59B |

278.14B |

|

Revenue Growth 3 Year [CAGR] |

5.53% |

23.32% |

|

Revenue Growth 5 Year [CAGR] |

5.68% |

22.88% |

|

EBITDA |

32.38B |

96.89B |

|

EBIT Margin |

26.38% |

29.65% |

|

ROE |

25.17% |

29.22% |

|

P/E GAAP [FWD] |

20.29 |

20.83 |

|

Dividend Yield [FWD] |

2.73% |

– |

|

Dividend Growth 3 Yr [CAGR] |

5.79% |

– |

|

Dividend Growth 5 Yr [CAGR] |

5.95% |

– |

|

Consecutive Years of Dividend Growth |

59 Years |

– |

|

Dividend Frequency |

Quarterly |

– |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Johnson & Johnson and Alphabet According to the HQC Scorecard

As according to the HQC Scorecard, both companies can currently be classified as very attractive in terms of risk and reward. Johnson & Johnson scores 83/100 points and Alphabet scores 91/100.

Alphabet is classified as very attractive in all categories of the HQC Scorecard. Johnson & Johnson is rated as very attractive in all categories expect for Growth; where it receives a moderately attractive rating (48/100 points).

In the category of Economic Moat, Johnson & Johnson receives 81/100 points and Alphabet receives 93/100. The companies’ strong ratings in this category are indicators that both can be excellent choices when investing with a long-term investment horizon: a wide economic moat helps them to maintain their competitive advantages over the long-term.

In the category of Financial Strength, Alphabet receives 87/100 points while Johnson & Johnson receives 84/100. The high scores for both companies in this category is due in particular to their high credit ratings (Johnson & Johnson has an Aaa credit rating from Moody’s while Alphabet has a rating of Aa2) and low Debt to Equity Ratio: while Johnson & Johnson has a Total Debt to Equity Ratio of 42.69%, Alphabet’s is 11.28%. Furthermore, the high Current Ratio and Quick Ratio of the companies contribute to the high Financial Strength ratings. Alphabet, for example, has a Current Ratio of 2.81 and a Quick Ratio of 2.64.

Both companies receive 100/100 points in the category of Profitability. This is a result of having high EBIT Margins (Johnson & Johnson has an EBIT Margin of 26.38% and Alphabet of 29.65%) and a high Return on Equity (while Johnson & Johnson shows a ROE of 25.17%, Alphabet has a ROE of 29.22%).

In terms of Valuation, Johnson & Johnson currently receives 88/100 points and Alphabet 80/100. These high ratings are mainly a result of the upside for both companies as according to my DCF Model.

In terms of Growth, Alphabet receives 88/100 points while Johnson & Johnson only receives 48/100. This moderately attractive Growth rating for Johnson & Johnson is in particular a result of my low Revenue and EBIT Growth Expectation for the company over the next 5 years.

The HQC Scorecard demonstrates that both Johnson & Johnson and Alphabet are very attractive companies in terms of risk and reward. The high scoring underlines my investment thesis that both are excellent choices when aiming to invest for your retirement this month.

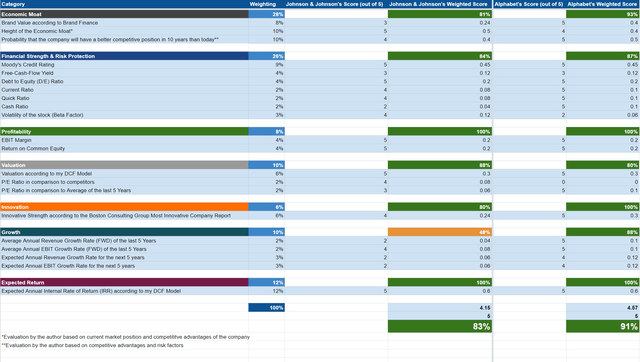

Johnson & Johnson and Alphabet According to the Seeking Alpha Quant Factor Grades

As according to the Seeking Alpha Quant Factor Grades, Johnson & Johnson receives a C- rating and Alphabet a D in terms of Valuation. For Growth, Johnson & Johnson receives an F and Alphabet a C-. For Profitability, both companies get an A+ rating. The companies’ high profitability has already been demonstrated with the results of the HQC Scorecard (in this category they both received 100/100). For Momentum, Johnson & Johnson and Alphabet receive a B- rating.

The strong results in the categories of Profitability and Momentum underline my opinion that both are currently excellent picks when aiming to invest for retirement.

Johnson & Johnson and Alphabet According to the Seeking Alpha Quant Ranking

As according to the Seeking Alpha Quant Ranking, Johnson & Johnson is ranked 52nd out of 225 in the Pharmaceuticals Industry and 308th out of 1172 in the Health Care Sector. Alphabet is ranked 3rd in the Interactive Media and Services Industry and 10th out of 248 in the Communication Services Sector.

The results of the Seeking Alpha Quant Ranking once again strengthen my theory that both companies are excellent choices when aiming to invest for your retirement during the month of September.

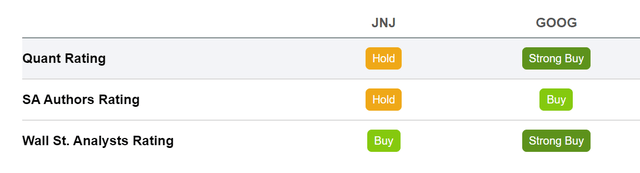

Johnson & Johnson and Alphabet According to the Seeking Alpha Authors Rating and Wall Street Analysts Rating

While Johnson & Johnson receives a hold rating according to the Seeking Alpha Quant Rating, Alphabet gets a strong buy. According to the Seeking Alpha Authors Rating, Johnson & Johnson is currently a hold and Alphabet is a buy. Taking into account the Wall Street Analysts Rating, Johnson & Johnson receives a buy and Alphabet a strong buy.

The Bottom Line

The results of the HQC Scorecard show us that both Johnson & Johnson and Alphabet can currently be considered as very attractive when it comes to risk and reward: Johnson & Johnson receives an overall score of 83/100 points while Alphabet gets 91/100. The very attractive ratings in terms of Valuation and Expected Return as according to the Scorecard, underline my theory to recommend adding these two companies to your investment portfolio for retirement.

While Alphabet is rated as very attractive in all categories of the HQC Scorecard, Johnson & Johnson is rated as very attractive in all categories except for Growth, in which it is rated as moderately attractive.

Both companies hold a strong competitive industry position, which is underlined by the rankings given by the Seeking Alpha Quant Ranking. While Johnson & Johnson is ranked 52nd out of 225 in the Pharmaceuticals Industry, Alphabet is ranked 3rd in the Interactive Media and Services Industry. These rankings once again underline my opinion that both are appealing picks for your retirement portfolio. Johnson & Johnson’s low 60M Beta of 0.61 shows that you can reduce the volatility of your investment portfolio when investing in the company.

I currently rate both companies as a buy: both have broad competitive advantages, dispose of a wide economic moat (which helps them to maintain their competitive advantages over the long-term), are highly profitable (proved by high EBIT Margins) and have strong financials (demonstrated by a credit rating of Aaa from Moody’s for Johnson & Johnson and Aa2 for Alphabet). My DCF Models and Relative Valuation Models (such as the P/E Ratio) suggest that both companies are currently undervalued. All of these characteristics make both Johnson & Johnson and Alphabet excellent picks when aiming to invest for retirement.

If you could only invest in two companies for retirement this September, which would be your favorites?

Be the first to comment