Thomas Barwick/DigitalVision via Getty Images

Introduction

It’s time to talk about agriculture. Since 2020, we have spent a lot of time discussing agricultural investments based on ongoing and expected macro developments. This includes incorporating the ongoing energy crisis, geopolitical risks, weather, and whatnot. I have gotten a lot of questions in the past few months from people who want to include “agriculture” in their long-term portfolios. As we have discussed machinery producers, fertilizer companies, traders, processors, and pretty much every stock in the agriculture supply chain, I believe it is important to make a distinction between “trading vehicles” and buy & hold investments. In this article, I will give you two of the best stocks in the industry that are in a great spot to deliver long-term alpha.

These companies are Deere & Company (NYSE:DE) and its US-peer AGCO Corp. (NYSE:AGCO). These companies allow investors to buy long-term agriculture without being too exposed to the big swings in margins that companies in other stages of the supply chain have to deal with.

We’re also going to look into the general bull case for agricultural stocks, which provides fertile ground for long-term outperformance.

So, bear with me!

What To Look For In Agriculture

Agriculture is a tricky topic. Large traders that trade agriculture often use highly liquid futures covering key crops like corn, soybeans, and wheat.

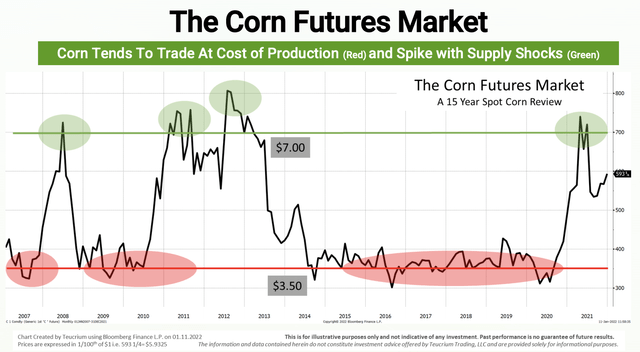

I often use CBOT corn futures as a benchmark as corn is the most planted crop in the United States. It is fertilizer intensive, an energy commodity feedstock (ethanol), used to raise cattle and serves industrial purposes as well.

When looking at the corn chart below (not updated, but that doesn’t matter in this case), we see that corn hasn’t been in a long-term uptrend like the stock market, for example. Like many other crops, corn trades close to the cost of production. Spikes are caused by supply shocks. That can be weather-related, caused by wars, fertilizer shortages, or a combination of headwinds.

Generally speaking, a rapidly rising global population and a stronger middle class in emerging markets were the reasons why investors wanted agricultural exposure. However, it still didn’t cause commodities to remain in a longer-term uptrend as supply also kept up with demand.

Using corn as a proxy again, we see that production has kept up quite well with demand.

CME Group

The problem is that production growth has slowed dramatically in the past 8-ish years.

This has many reasons. One of them is the fact that massive agricultural production growth in the past was boosted by fertilizer usage.

According to Goehring & Rozencwajg:

Between 2000 and 2020, global coarse grain production surged by 42%. Over the same time, fertilizer application also grew by 40%. On a shorter-term basis, the same relationship holds. Global grain production grew 18% between 2010 and 2020, while fertilizer application increased 17%.

Moreover:

[…] we estimate that as much as 40% of coarse grain yield increase since 1961 can be attributed to increased nitrogen application. We believe that a 5% reduction in nitrogen application could result in an immediate 1 to 2% reduction in global grain supply.

Not only are we in a scenario where fertilizer supply is constrained because of protectionism and the (related) war in Ukraine, but also because of environmental regulations to cut down on fertilizer usage and – even worse – the fact that the energy crisis has caused production to implode. In August, roughly 70% of fertilizer production capacity was offline in Europe. 70%!!

These supply issues are obviously a problem. However, it is made worse as supply and demand are expected to be tight, in general. In June, the OECD published its 2022-2031 agriculture outlook.

There were a few things in this 363 pages report that are worth including in this article. For example, the OECD expects long-term food consumption (crop demand) to rise by 1.4% per year, driven mainly by population growth.

With regard to agricultural production, the OECD expects 1.1% growth per year. According to the OECD:

The Outlook assumes wider access to inputs as well as increased productivity-enhancing investments in technology, infrastructure, and training as critical drivers of agricultural development. However, a prolonged increase in energy and agricultural input prices (e.g. fertilizers) will raise production costs and may constrain productivity and output growth in the coming years.

It also doesn’t help that agriculture land per capita is quickly falling due to a rising population.

Our World In Data

This emphasizes efficiency. Meaning, the efficient use of fertilizers and agricultural technologies to use every inch of available land as productively as possible.

So, essentially, there are a few solutions to this problem. For starters, the energy crisis needs to be solved. The availability of affordable and reliable energy is key, and we’re currently finding that out the hard way. Moreover, once fertilizer production is up again, trade protectionism will likely fade, allowing farmers to have more access to fertilizers – especially in emerging markets.

On top of that, it is important to enhance agricultural technologies.

Moreover, there’s a climate aspect, which has been highlighted by the highly controversial World Economic Forum. While I publicly disagree with a lot of statements from the WEF, there is no denying that they are onto something.

While the WEF wants more agriculture technology for the sake of the environment (I mainly care about supply, in general), they do highlight what needs to be done.

In precision agriculture, real-time weather forecasting helps farmers with day-to-day decisions on when and how much to irrigate, fertilize and apply pesticides to their crops.

Precision agriculture is even more important when incorporating the fact that inputs like fertilizers, herbicides, and related have become rather expensive.

That’s where my two stock picks come in.

Why I Like Deere & AGCO

The title and the intro already gave it away, but my picks in the industry are Deere and its smaller peer AGCO.

To avoid confusion, it’s important to once again mention that the purpose of this article is to find suitable long-term investments. I remain bullish on all agriculture stocks I have covered in the past few months. Nothing changes, even as they are not part of this article.

Deere and AGCO are the world’s largest and third-largest providers of agriculture equipment. Located in Moline, Illinois, and Duluth, Georgia (in the case of AGCO), we are dealing with two companies that dominate equipment sales in the Americas and Europe.

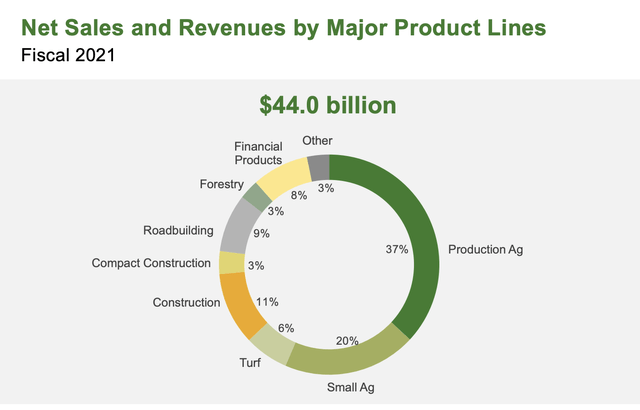

Deere, with a market cap of $107.5 billion generates 37% of its sales in its Production Ag segment, which is based on its largest tractors (like the 8 and 9-series), as well as its combines, major planting and spraying equipment, and related technologies. Small agriculture accounts for 20% of total sales. The remaining 43% comes from construction, turf, roadbuilding, forestry, financial products, and others.

Roughly half of its sales are generated in the United States. Western Europe accounts for 15% of total sales.

AGCO is different. While it is the third-largest equipment producer, its market cap ($7.9 billion) is almost $100 billion below the Deere market cap. The company sells only 19% of its products in the United States. European countries account for roughly 55% of total sales.

In other words, both Deere and AGCO are competing for a higher market share in each other’s main markets.

In the case of AGCO, the company generates 57% of its sales from tractor sales (small and large). Combines and machinery account for 18% of total sales. Replacement parts add another 15%. The remaining exposure (close to 10%) comes from grain storage and protein production systems. Meaning infrastructure to store grains and raise i.e. chickens.

Not only that, but AGCO’s strength is its brands. While Challenger is mainly US-focused, the company owns highly popular brands in Europe. Fendt, for example, has the second-largest market share in Germany. A market that is expected to see 5.1% annual compounding growth in tractor unit sales. Add to this Massey Ferguson, and Valtra, and we’re dealing with a company that owns the most popular brands, besides John Deere, which remains the world’s most popular brand. And I doubt that will change.

So far, I “only” own Deere in my dividend growth portfolio. While I am not worried about cyclical downtrends, I am a bit worried about AGCO’s growing influence in North America, which is another reason why I am writing this article.

AGCO, which was limiting orders in 2Q22 to deal with a rapid inflow of orders and limited production capacity (because of supply chains), is expecting to sell between 5% and 10% more tractors in North America this year. Its Fendt-branded sales are up 20% year-on-year. When adding Challenger (similar to Fendt), sales are set to double in 2022 versus 2020.

AGCO is witnessing an opportunity to penetrate the North American market with its products.

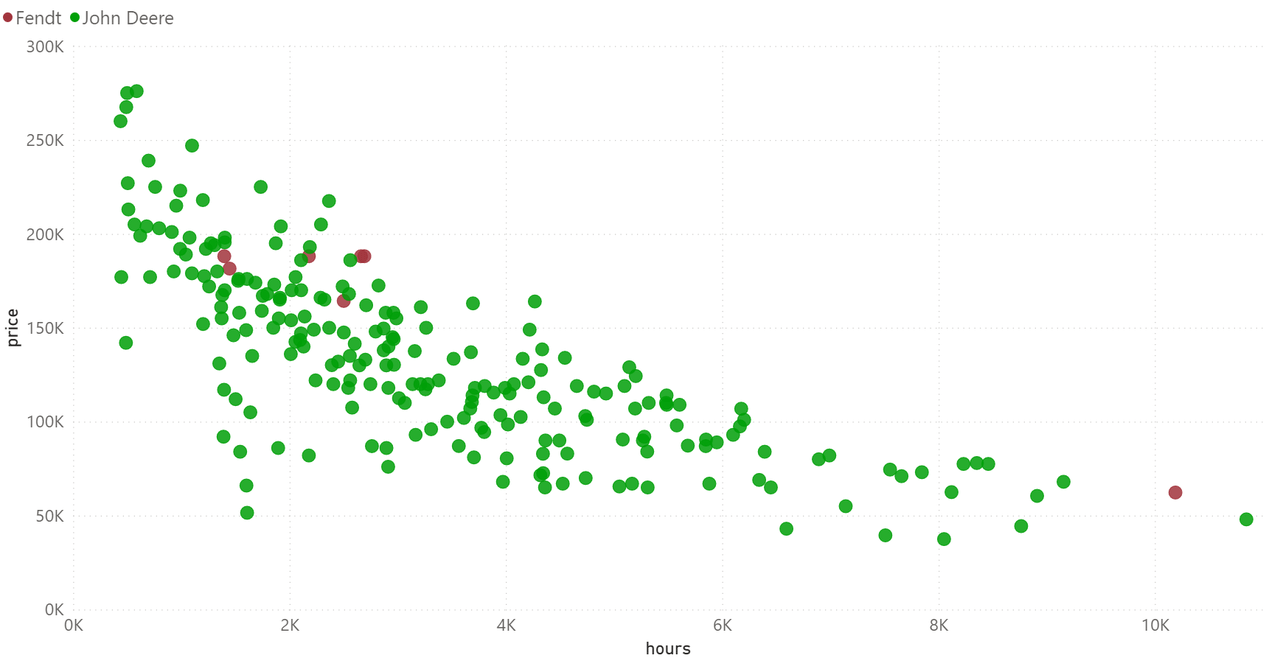

Last year, Ben Thorpe wrote a great article on Farm-Equipment, where he highlighted that Fendt is slowly getting under Deere’s skin. Fendt will eventually replace Challenger and compete with Deere on a higher level. So far, it helps that Fendt tractors offer fantastic re-sell value.

Farm-Equipment

According to the article:

According to a May 28, 2021, report from Ag Equipment Intelligence, over roughly the last 6 months, John Deere has been giving some Deere dealers “unpublished financial incentives” to acquire Fendt tractors specifically on trade-in. The source, an industry expert who agreed to speak under condition of anonymity, stated they had been told by several Deere dealers in the Corn Belt that the funds were being delivered in order to make up the difference on trade-ins for Fendt tractors, sometimes up to $25,000.

While it may look like it, I’m not making the case that AGCO is better than Deere. Also, I’m not in any way worried that my long-term Deere investment is in danger.

The point is to show how capable both of these companies are. If anything, I believe that both will continue to gain market share in an environment where precision agriculture is increasingly important.

In 2019, Harvard published a study on Deere’s role in this new agriculture trend. Essentially, it highlighted Deere’s focus on connecting every single aspect of agriculture, from planting to harvest, and everything related including seed and fertilizer management, weather prediction, yield monitoring, transportation, storage, and more.

Moreover, Harvard highlighted Deere’s independence in developing and offering cutting-edge technologies. According to the university:

A team called the Intelligent Solutions Group (“ISG”) consisting of data scientists and software engineers was created to develop and roll out advanced technology solutions and processes to the four equipment groups under the Ag division. This group has a higher R&D spend than the Deere average and is expected to have its own P&L.1 In August of this year, Deere opened a dedicated, 134,000 square-foot ISG facility in Iowa. By building the technology such as sensors and platform to manage the data in-house, Deere avoids being reliant on others to deliver services to its customers.

Fast-forward to 2022, and we’re in a situation where Deere is seeing the full benefits of its large footprint and investments in technology. According to the company (FY3Q22 earnings):

Relative to the industry, we’ve had our strongest results in high horsepower row crop tractors, and we plan to end the year approaching our highest market share on record. Our order books for the remainder of the current fiscal year are full, and we see signs of robust demand into 2023 with some order books already full through the first half of next year.

The same goes for AGCO as the company is accelerating Precision Agriculture sales:

At AGCO we address the Precision Ag market in two ways. First is through our precision planting business, which has become one of the fastest growing ag-tech companies in the world. Precision planting has been successful in providing automation and intelligence to planters, and now they’re growing well beyond planters into other parts of the crop cycle like spraying, harvesting, and even others.

Moreover:

The other way we address the Precision Ag opportunity is our business called Fuse, which provides OEM solutions for our AGCO equipment, options like telemetry guidance, field mapping, and other Precision Ag capabilities make our AGCO machines smarter and more productive for the farmer.

When adding the agriculture bull case, precision farming benefits, and slowly fading supply issues, we get a scenario where both companies are expected to grow significantly in the future.

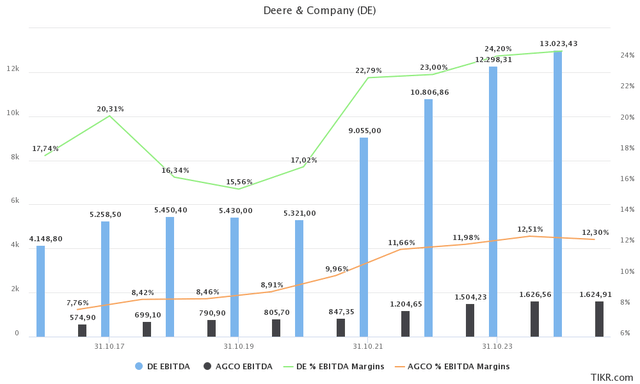

Both companies are expected to grow EBITDA by more than 100% in the years ahead – compared to pre-pandemic levels. Deere is expected to boost EBITDA to more than $13.0 billion in its 2024 fiscal year. AGCO is expected to do $1.6 billion in EBITDA with EBITDA margins 10 points below Deere’s margins. Note that Deere is a vastly more profitable business, which is why I picked Deere over AGCO in the past.

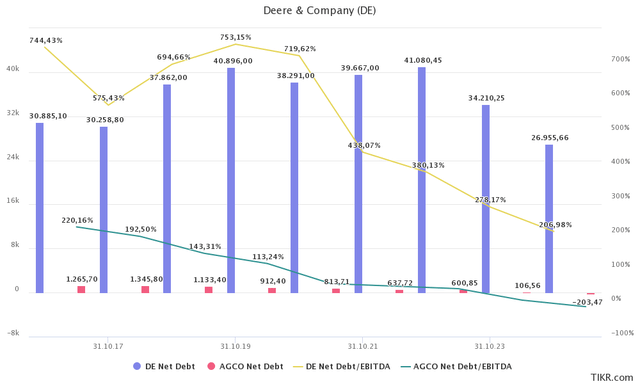

This is expected to come with higher free cash flow, allowing both companies to reduce debt. In FY2023, Deere is expected to lower net debt to $34.2 billion, or 2.8x EBITDA. AGCO could end up with flat net debt, followed by negative net debt after that. Although it depends a bit on how aggressive AGCO handles special dividends and buybacks, which are two ways the company uses to let shareholders benefit from its success.

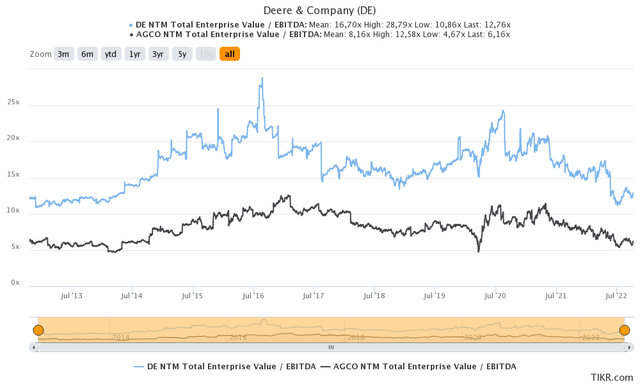

This helps the valuation tremendously. Deere is now trading at 11.9x 2023E EBITDA of $12.3 billion using an implied $146 billion enterprise value, consisting of its $107.5 billion market cap, $34.2 billion in 2023E net debt, and $4.3 billion in pension-related liabilities.

AGCO is trading at 5.2x 2023E EBITDA.

If earnings/EBITDA estimates remain strong, the companies are trading at the lowest forward EV/EBITDA multiples since the start of the economic recovery in 2012. That’s quite something.

This is obviously caused by ongoing market turmoil and the fact that agriculture companies remain in a better spot than a lot of other industrial companies. Prices are high, farmers are finally accelerating spending on new equipment, and the need for food production was “never” higher.

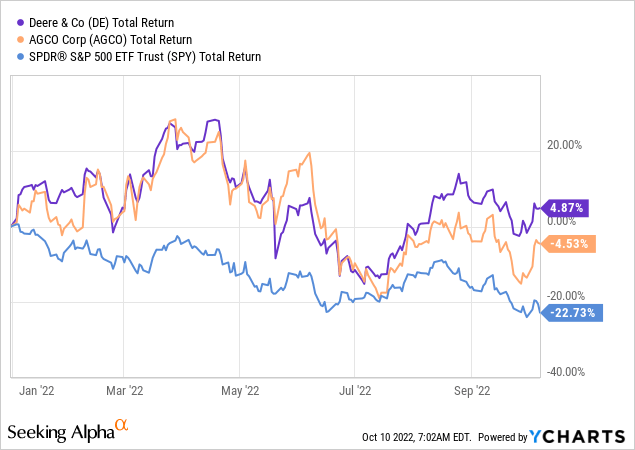

So far, Deere is up almost 5% year-to-date, including dividends. AGCO is down 4.5%, but still far above the performance of the S&P 500.

Moreover, a reason why I am going with machinery producers is their ability to generate long-term value. A lot of companies in the basic material space like fertilizer companies are highly dependent on margins. Just like the price of crops, these companies tend to show large rallies and large drawdowns. While I am currently bullish on most of them, there will come a time when the fertilizer supply comes back, hurting these companies.

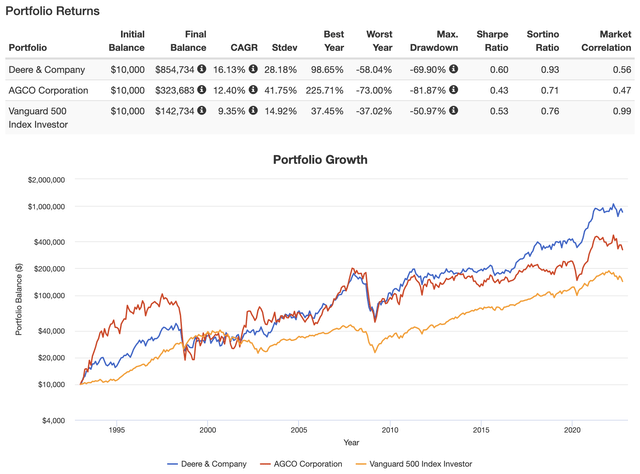

AGCO and DE are also cyclical, however, they have done a great job generating shareholder value. Going back to 1990, Deere has returned 16.1% per year. AGCO has returned 12.4%. One issue is that both are rather volatile, which does not make any of them suitable for a low-volatility strategy.

That said, I expect outperformance to continue. Both on a mid-term and long-term basis.

Takeaway

In this lengthy article, we did two things. First, we looked into ongoing agriculture trends, which indicate extreme supply tightness as a result of fertilizer shortages, the related energy crisis, population growth, and related factors. The emphasis on efficient agriculture couldn’t be more important in this environment.

Second, we discussed two companies that I believe will benefit from tight supply. Deere and AGCO dominate North America and Europe’s “high-quality” agriculture equipment market. Both offer competitive brands with the potential to gain market share from smaller players. This also has to do with the ability to deliver advanced precision agriculture technologies, allowing farmers to cut costs while enhancing yields.

The mix of high crop prices and the need to boost output is triggering what could be a long equipment replacement cycle. Add ongoing market turmoil, and we end up with two attractively priced stocks.

I expect both AGCO and DE to outperform on a long-term basis. I also expect AGCO’s performance to come closer to the performance of DE as the company is evolving. Its high-quality brands will become stronger in North America and compete more with Deere.

For now, I only own Deere. However, down the road, I will add AGCO as well, at some point.

So, long story short, if you are looking to add agriculture to your portfolio, I think one of the stocks (or both) discussed in this article will look good in your portfolio.

(Dis)agree? Let me know in the comments!

Be the first to comment