William_Potter

The first month of the year is already done and what a month it has been in terms of stock returns. The S&P500 (SPY) was up 6.2% in January and some of my stocks were up as much as 20%. Although last year was a tough year, I personally did not expect such a good start to the year. In my opinion, the market is currently fairly optimistic about future prospects, even though inflation is still at 5%+ and the Fed has indicated that rate hikes will continue in the foreseeable future. However, as I have mentioned several times in the past, I am not a market timer and for that reason, I continue to invest in my portfolio. In January I invested approximately €800 and used that to increase my stake in 3 companies.

For the people that have not read my previous articles: I am a 25-year-old investor from the Netherlands who is trying to start early so that I will have the option to retire early or at least earlier (the current retirement age is 67 in NL and is trending upwards). If you are interested in previous updates on my portfolio, you can find them here:

January Update

January was a great month in terms of stock returns and my personal portfolio was up slightly more than the market. Although I am more than happy that my portfolio increased by a sizeable amount, this rally seems overdone. December’s final inflation rate was 6.5% and the forecast for January is 6.3%. This means that we have a long way to go to finally reach the target inflation rate of 2%. Additionally, the unemployment rate is still near its all-time lows, which makes the job market tight, and potentially leads to higher inflation. For these reasons I expect the remainder of the year to be closer to last year in terms of returns. This does not mean that there aren’t any good deals around, but it does mean that you have to look harder than a month or so ago. Personally, I added capital to 3 quality stocks at reasonable prices and will add more in the coming months.

In January I also started moving some stocks to my other portfolio as they better fit the strategy of that portfolio. My other portfolio, which I started at the beginning of the year, is significantly smaller and I use it to try out some other strategies. Currently, I am using a growth at a reasonable price strategy for that portfolio. The main target of the portfolio is capital gains and some of my stocks better fit that strategy. In the next few months, I might move my other small-cap stocks to that portfolio, but I haven’t made a decision about that yet.

As regular readers know I am also part of an investment association in which we run an investment competition. Last year we won the competition but this year we are in the middle of the pack. This is partly due to our strategy in which we limit our exposure and keep our beta low. In that way small increases in stock prices will have a larger impact on our risk-adjusted return. At the moment we own 4 different companies that fit this strategy. We own two stocks that are trading at deep value, one stock that is a macro play and one merger-arbitrage. We expect to add more in the coming months and I will try to keep you updated.

Transactions

Rules

|

Core |

Value |

Small-cap growth |

|

|

Buy |

|

||

|

Reconsider |

|

|

|

|

Sell |

|

Beginning of January

Brookfield Asset Management (BAM) – Bought 11 shares for $29.75 each:

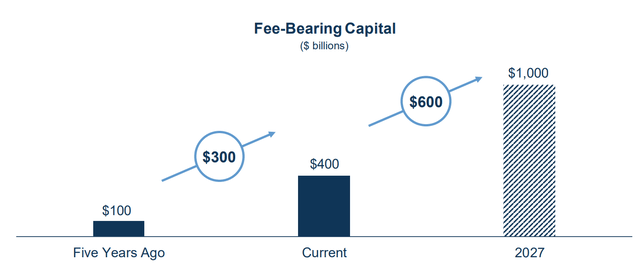

Last month I mentioned that I was interested in adding more capital to Brookfield Asset Management. The spin-off of the asset management company from Brookfield Corporation (BN) is, in my opinion, the right move to unlock value. Asset management is a very stable business and as a result of the separation between the two, the revenue and dividend will be more stable compared to the old situation. The company is planning to pay out 90% of its cash flow and due to its expected cash flow growth, dividends will most likely grow in the double-digit range in the coming years. The combination of a stable business, potential rapidly growing dividend, and decent valuation made me decide to add to this position.

Fee bearing capital (Brookfield Spin-Off presentation)

CVS Health (CVS) – Bought 3 shares for $87.03 each:

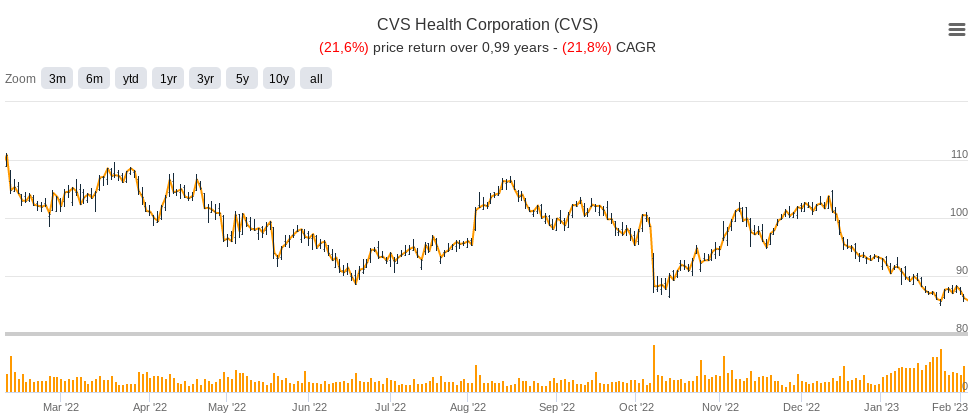

CVS is a company that I have a somewhat love/hate relationship with. The company is turning itself into a one-stop-shop for healthcare solutions, which should make it able to compete with online competitors such as Amazon’s (AMZN) Pharmacy and improve its future outlook. On the other hand, the company does this by acquiring competitors and taking on a lot of debt. The acquisition of Aetna looks to be a good move, even though it increased debt significantly and made the company freeze its dividend until it paid back some of the debt. After they finally raised the dividend again in 2022, the company recently decided to acquire Signify (SGFY). Although the transaction could further strengthen CVS’s business, the market did not appreciate another acquisition. As a result, the company’s stock price has been steadily falling and now trades with a nicer margin of safety.

CVS price graph (Tikr.com)

L3Harris (LHX) – Bought 1.55 shares for $211.81 each:

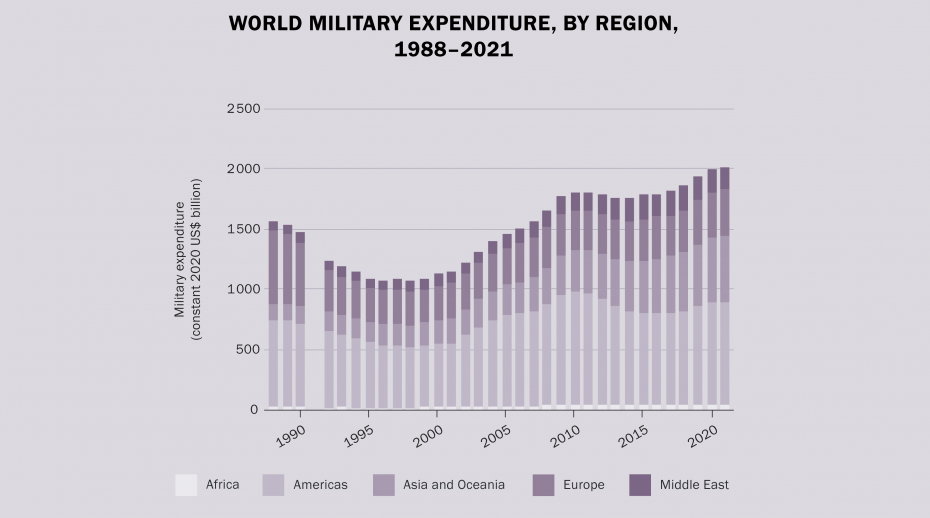

L3Harris is a position that I would love to build out further but that has been trading at the top range of my estimate of fair value. The company, as well as the entire defense sector, was one of the few that appreciated significantly during last year’s massive drop in stock prices. This made the company relatively unattractive, even when the future looked bright as a result of multiple countries declaring their intention of increasing defense spending as a percentage of GDP. As the company has fallen amid an overall decline in the defense sector, the company is trading with a nice significant margin of safety compared to my estimated fair value of $240.76. I could have bought the company at even more attractive valuations this month but was preoccupied with other responsibilities. Nevertheless, I am happy with my purchase and will try to add more in the coming months.

World Military spending (Stockholm International Peace Research Institute)

CoreCard (CCRD) – Transferred to another portfolio at a price of $26.81 & The Italian Sea Group – Transferred to another portfolio at a price of €5.68 each:

At the beginning of the year, I started a new portfolio that uses a slightly different strategy than this portfolio. It mainly consists of companies that can be classified as growth at reasonable price. As a result, I have decided to move some companies that do not entirely fit the main purpose of this portfolio (dividend growth, income). For that reason, I have decided to move CoreCard and The Italian Sea Group out of this portfolio. I will most likely move other stocks in the coming months such as NeoGames (NGMS) and Bragg Gaming (BRAG)(BRAG:CA) to my other portfolio as they better fit that strategy.

|

Company |

Shares |

Total price |

Effects on dividend pre-tax |

|

Brookfield Asset Management (BAM) |

11 |

$327.25 |

|

|

CVS Health (CVS) |

3 |

$261.08 |

|

|

L3Harris (LHX) |

1.55 |

$328.31 |

|

|

CoreCard (CCRD) |

-28.5 |

-$764.09 |

$0 |

|

The Italian Sea Group (TISG) |

-83 |

-€471.44 |

€0 |

Dividends

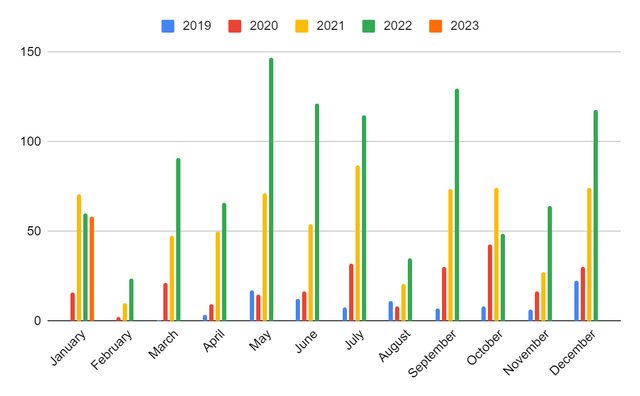

This Month I received slightly less in dividends compared to 2022. This was mainly the result of the timing of the dividend payments. Last year I received all my dividends for BAM and Broadcom (AVGO) in January, while this year one broker paid me in December. As a result, my dividend is down $1.56 year-on-year.

|

Company |

Dividend 2022 |

Dividend 2023 |

Difference |

|

VICI Properties (VICI) |

$16.35 |

$27.76 |

$11.41 |

|

Brookfield Asset Management* |

$1.89 |

$1.82 |

-$0.07 |

|

Broadcom* |

$6.97 |

$7.82 |

$0.85 |

|

Armada Hoffler (AHH) |

$0 |

$21.06 |

$21.06 |

|

Altria Group (MO) |

$16.07 |

$0 |

-$18.90 |

|

AvalonBay Communities (AVB) |

$5.41 |

$0 |

-$6.36 |

|

Associated British Foods (OTCPK:ASBFY) |

GBP 9.91 ($13.33) |

GBP 0 |

-GBP 9.91 ($13.33) |

|

Total |

$60.02 |

$58.46 |

-$1.56 |

At the end of the month, my new forward dividend was €1,143.91 ($1,224.32). This is up approximately €10 compared to last month. The reason for this is the addition of new capital as no company hiked its dividend this month. My aim is to have $2,000 in dividends at the end of the year, but hopefully, we will be able to beat that again.

Sector Overview

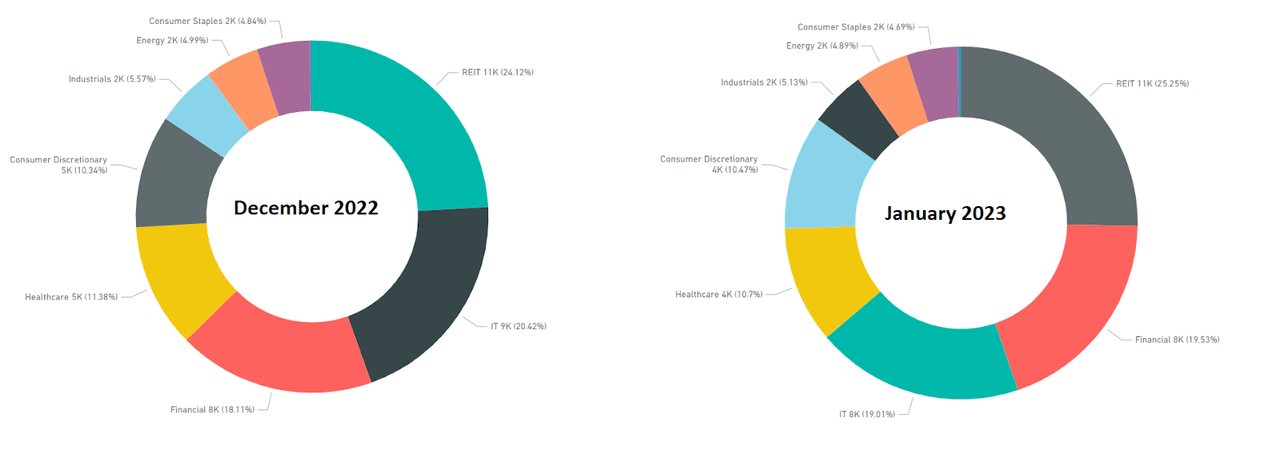

Sector allocation (Author)

Compared to last month we see an increase in the allocation to finance and REITs. This is the result of their outperformance in January. For example two of my real estate companies, Vonovia (OTCPK:VONOY), and Aroundtown (OTCPK:AANNF) were up over 15% during the month of January. These are positions that I have added significant amounts of capital to during 2022 as they were trading at deep discounts to NAV. Both companies’ share prices remain depressed and I expect them to have a good year once the rate hikes stabilize. Thus, expect the allocation to REITs to grow as a result of capital appreciation.

Current Holdings

|

Stock |

Qty Held |

Portfolio % |

Days Since Latest Buy |

|

VICI Properties |

73 |

5.55% |

357 |

|

CTPNV |

164 |

5.19% |

120 |

|

L3harris |

11 |

5.13% |

3 |

|

Abbvie (ABBV) |

16 |

5.02% |

437 |

|

Visa (V) |

10 |

4.89% |

148 |

|

Enbridge (ENB) |

55 |

4.89% |

450 |

|

Prudential Financial (PRU) |

21 |

4.80% |

188 |

|

Broadcom |

4 |

4.77% |

122 |

|

Ahold (OTCQX:ADRNY) |

72 |

4.69% |

163 |

|

TJ Maxx (TJX) |

25 |

4.56% |

294 |

|

Vonovia |

72 |

4.47% |

104 |

|

CBOE (CBOE) |

16 |

4.45% |

41 |

|

Morgan Stanley (MS) |

20 |

4.40% |

185 |

|

Inditex (OTCPK:IDEXY)(OTCPK:IDEXF) |

62 |

4.28% |

185 |

|

Prosus (OTCPK:PROSY) |

23 |

4.03% |

262 |

|

Aroundtown |

608 |

3.71% |

93 |

|

Brookfield Corporation (BN) |

45 |

3.65% |

57 |

|

Netstreit (NTST) |

73 |

3.27% |

190 |

|

CVS Health (CVS) |

16 |

3.13% |

3 |

|

Armada Hoffler |

111 |

3.07% |

41 |

|

Fresenius&CO KGAA (OTCPK:FSNUF) |

40 |

2.55% |

307 |

|

Mips AB |

19 |

1.63% |

41 |

|

Brookfield Asset Management |

22 |

1.57% |

29 |

|

StoneCo (STNE) |

53 |

1.32% |

202 |

|

Intel Corporation (INTC) |

20 |

1.30% |

371 |

|

Microsoft (MSFT) |

2 |

1.17% |

93 |

|

Neogames |

30 |

0.89% |

65 |

|

Bragg Gaming |

103 |

0.87% |

65 |

|

Interactive brokers (IBKR) |

4 |

0.66% |

261 |

|

Tezos (XTZ-USD) |

50 |

0.12% |

707 |

|

Hedera Hashgraph (HBAR-USD) |

680 |

0.10% |

679 |

|

Bitcoin (BTC-USD) |

0 |

0.08% |

679 |

|

Binance (BNB-USD) |

0 |

0.02% |

707 |

Going Forward

In the coming month, I am aiming to add an additional €800 to my portfolio. I will try to add to companies that I think are good value for money. Currently, I am aiming to add to the following stocks:

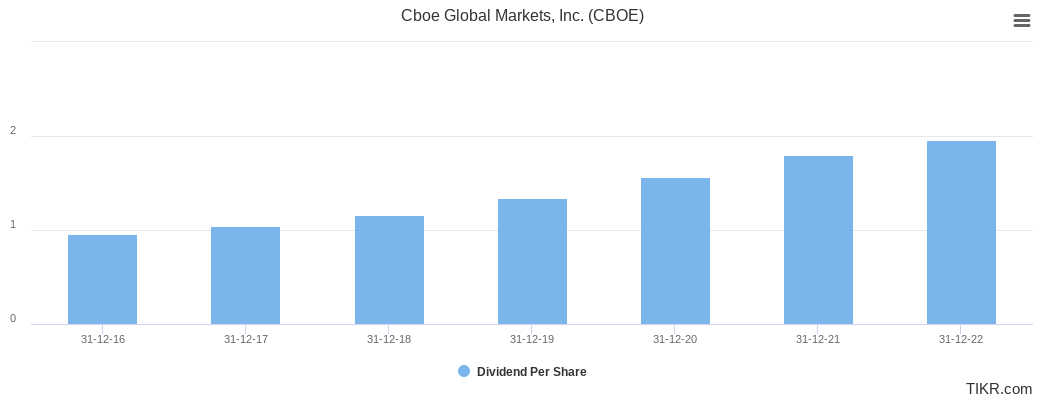

CBOE Global

CBOE Global is the owner and operator of one of the leading options exchanges. Initially founded as the Chicago Board Options Exchange, the company has grown into a large operator of exchanges. The company owns and operates the BATS exchange, CBOE Digital (crypto assets), and the CBOE, among others. The company has done this successfully and as a result, has grown its revenue between 2016-2022 at a CAGR of 18%. Analysts expect the company to do worse in the coming years, but given the acquisitions at the end of 2021, in combination with the increased interest in derivatives products, I remain confident that the company will be able to grow its revenue at a CAGR of 10% in the coming years. The company also likes to reward shareholders and has increased its dividend at a CAGR of 12.6% since 2016. Additionally, the company still trades below my estimated fair value of $135.95, thus making it, in my eyes, a good deal.

CBOE Dividend per share (Tikr.com)

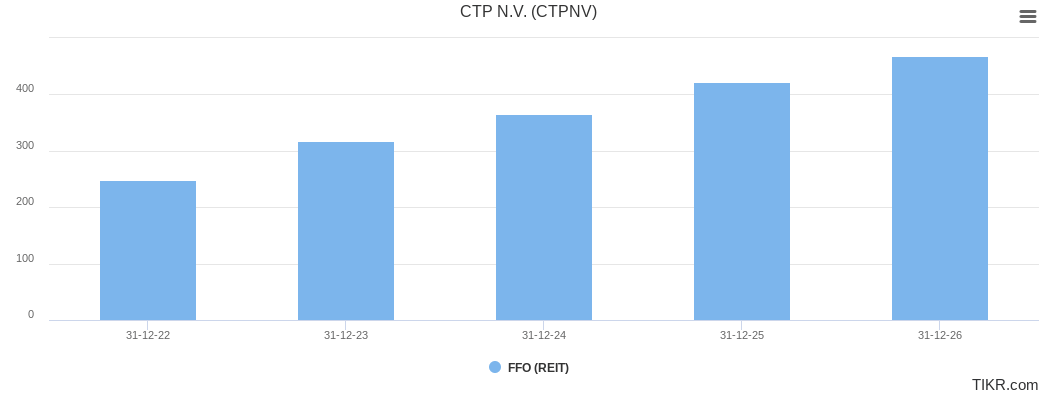

CTPNV

CTPNV is one of, if not my favorite European real estate stocks. The company is specialized in developing and renting out logistics properties in Eastern Europe. What makes the company interesting is that it is one of the largest players in Eastern Europe, a region that is expected to grow faster than Western Europe and the United States. Last year was a tough year for the company and the region as interest rates were as high as 20%. This increased the input costs for development but also increased rent significantly where a CPI escalator is included in the contract. As a result, the company’s results were quite decent overall. Besides its recent results, and its exposure to Eastern Europe, the company has positioned itself as a one-stop shop for logistics properties. The company currently has properties from the North Sea all the way to the Black Sea, giving it a competitive advantage over smaller owners. At the current price, I estimate the company to be undervalued by 15%, making it an interesting pick.

CTP’s FFO expectation (Tikr.com)

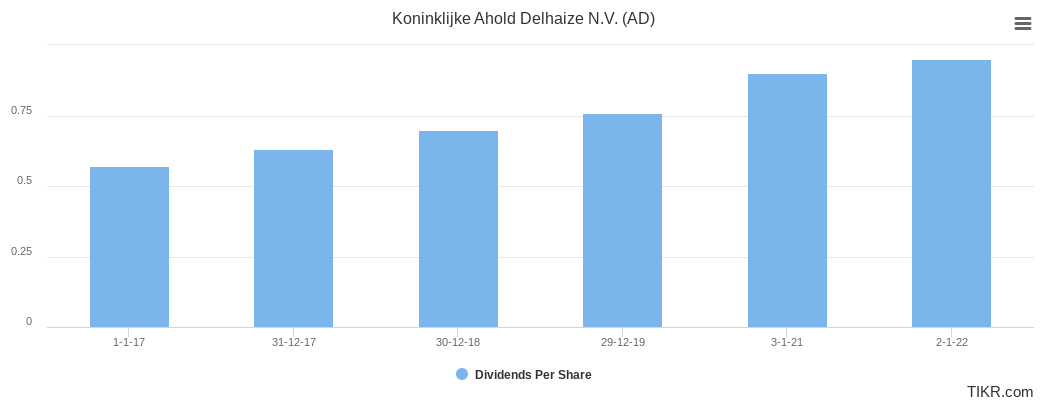

Ahold Delhaize

In November I wrote an article on Ahold Delhaize in which I mentioned that the company is profiting from the strong USD and inflation. Although the USD has depreciated since then and inflation has weakened, they are still at elevated levels. This is favorable for Ahold Delhaize, given that groceries are still getting more expensive due to relatively high inflation and that it gets the majority of its revenue from the USA. Furthermore, the company is trading at a 10% discount to my estimated fair value and pays a growing dividend. For these reasons, I would be happy to add more capital to the position.

Ahold Dividend per share (Tikr.com)

Prosus

Prosus is an investment group that invests in internet companies worldwide. The company made a fortune on its purchase of Tencent (OTCPK:TCEHY) and still owns a significant stake in the company (25%+). The company currently trades at a 35%+ discount compared to the NAV of all its holdings, and approximately 10% below its stake in Tencent. This basically means that if you buy Prosus you get Tencent at a discounted valuation, while you also own a part of its other holdings. These other holdings include companies like Delivery Hero (DHERO), and Udemy (UDMY). Although the discount is significant, I don’t expect Prosus to actually trade at its NAV, as most holding companies trade below NAV. However, I think that a discount between 15% and 20% would be more reasonable, given the potential of its investments.

Overview of a selection of Prosus’ holdings (Prosus Website)

Conclusion

In January the stock market rallied and the S&P was up 6.2%. In my opinion, investors are too optimistic and I expect 2023 to be a bumpy ride. Nevertheless, as I am not a market timer I will continue to add to my portfolio.

During this month I received approximately $60 in dividends, which was down approximately $2 compared to last year. My forward dividends at the end of January were $1,225.

I hope you enjoyed the update about my progress, and I would love to hear your thoughts on my portfolio and what you would like to see in future updates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment