GBP/USD Update and Analysis

- GBP/USD looks to the US for main event risk to end the week

- GBP/USD bullish momentum slowing – key technical levels considered

- IG Client Sentiment hints of bullish continuation despite 64% net long positioning

GBP/USD Looks to the US for Main Event Risk This Week

There is very little high impact scheduled event risk for the UK and probably for good reason as stagflation concerns begin to stack up. March GDP data confirmed a monthly contraction while the latest CPI print reached a mammoth 9% – expected to rise above double digits before cooling off according to the Bank of England (BoE).

Therefore, the US takes center stage with May ISM manufacturing data and a number of Fed speakers, most notably, the hawkish James Bullard around 5pm GMT. Friday ends off the week with May’s non-farm payroll (NFP) print is expected to add 325,000 jobs, lowering the unemployment even further to 3.5% potentially. The exceptionally strong US labor market is often cited as a buffer for the Fed’s aggressive rate hiking path. Hiking interest rates tightens monetary conditions leading to fewer new hires and even job losses as companies are forced to tighten their belts and monitor spending.

Customize and filter live economic data via our DaliyFX economic calendar

The Pound Sterling has taken advantage of a temporary decline in the value of the US dollar as recession concerns made their way to the newswires. Household names like Walmart and Target communicated rather discouraging information about consumer demand and the preference for cheaper alternatives when analyzing spending behavior. Additionally, US GDP for Q1 2022 confirmed a contraction in the world’s largest economy (measured using real GDP).

GBP/USD Major Technical Levels Analyzed

GBP/USD has bounced off the underside of the zone of resistance which has a midpoint of 1.2700 and looks to be headed towards a recent level of support, around 1.2473. Should we see a deeper retracement of the bullish GBP/USD momentum, 1.2400 becomes a level of interest with 1.2250 much further down the line. Interestingly to note, volatility (measured using the rolling 14 day average true range indicator) reveals a significant drop-off in volatility which tends to be conducive to ranging markets. Should the bullish move resume and break above the zone of resistance, the next level of resistance, the June 2020 high, comes into focus at 1.2813.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

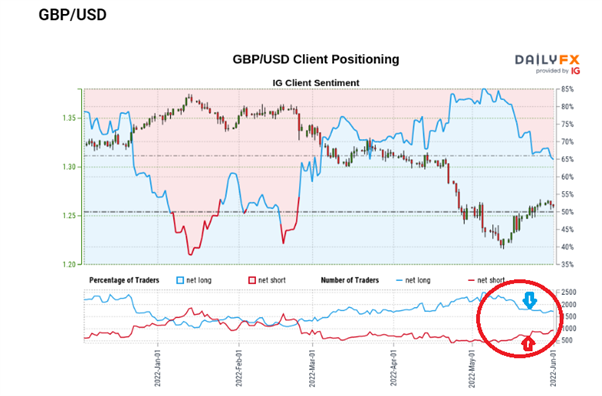

IG Client Sentiment Warns of Continued Upside Potential

Taking a look at the convergence of short and long traders over recent periods (circles in red), there is a clear move away from longs and an uptick in shorts despite the fact there are still over 64% of traders on the long side. As a contrarian indicator, sentiment and market trends tend to move in opposite directions and the fact that we see divergence between longs and shorts may be suggestive of a potential, longer-term uptrend. However, it is far too early to draw any conclusions and be aware that net sentiment can oscillate back and forth like it did in Jan and Feb this year.

GBP/USD: Retail trader data shows 64.25% of traders are net-long with the ratio of traders long to short at 1.80 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

The number of traders net-long is 0.17% higher than yesterday and 6.74% lower from last week, while the number of traders net-short is 7.73% higher than yesterday and 17.17% higher from last week.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

Trading on Sentiment: Using IG client sentiment Data

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Be the first to comment