Lauren Nicole/DigitalVision via Getty Images

August has come to an end and so has the stock market rally. Last month I stated that due to the fact that many people take time off work during the summer months, volume tends to be lower and it is easier to push stock prices up (or down). However, we can not only contribute the end of the stock market rally to the lower volume during the summer, as the Fed has reiterated its hawkish stance and the economic news that has come out during August was mainly negative. As I think that time in the market beats timing the market, I added additional capital to my positions and in the end, had 3 transactions this month.

For the people that have not read my previous articles: I am a 25-year-old investor from the Netherlands who is trying to start early so that I will have the option to retire early or at least earlier (the current retirement age is 67 in NL and is trending upwards). If you are interested in previous updates on my portfolio, you can find them here:

August Update

During August we saw the end of a bear market rally. Up until halfway through the month the S&P 500 was up compared to July, but it still ended the month in the red. It is always hard to pinpoint the exact reason why the stock market goes down but investors returning from some time off, bad economic news, and the hawkish comments by Fed chair Jerome Powell, who said that the Fed needs to keep at it (inflation), haven’t helped the market. I expect the current environment to persist in the near future, which will most likely have a negative effect on my current stock positions. However, it will also give me the opportunity to buy more stocks, which could greatly increase my future returns. Nevertheless, it doesn’t matter much as I continue to stay invested.

Given the rally and subsequent decline, I am not too sad that I was not able to fully keep up with the stock market and only had 3 transactions this month. The reason for this is that I visited Houston at the beginning of August and when I returned I had to catch up with a lot of things, which made it harder for me to keep up to date with the stock market and thus I felt like I wasn’t able to make the right decision when it came to asset allocation. This also means that I was unable to assess the stock positions that I had planned for this month. I will try to continue the assessment this month, but I am uncertain how much time I will have next to my master’s program.

Transactions

Rules

|

Core |

Value |

Small-cap growth |

|

|

Buy |

|

||

|

Reconsider |

|

|

|

|

Sell |

|

This month I only bought European stocks. I was inclined to buy US stocks but did not have enough time to fully assess the USD/EUR exchange rate situation. As there is the possibility that this will eventually go back to €0.90 or less per $1 (currently the USD is worth more than €1), I wasn’t confident enough to put capital in US stocks.

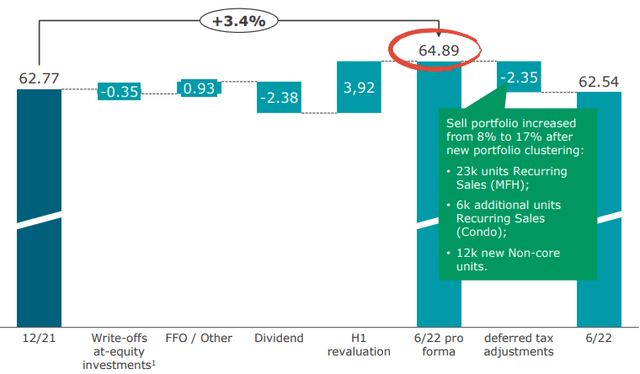

Beginning of August

Vonovia (OTCPK:VONOY)(OTCPK:VNNVF)- Bought 9 shares for €31.63 each: I continue to allocate more capital to European real estate stocks as I think that they are significantly undervalued. This month I decided to add to Vonovia, which is the largest residential real estate landlord in Europe. According to the calculations of the experts that Vonovia hired (which is mandatory in Europe), the company is trading at less than 50% of its net tangible assets (NTA), while not that long ago it used to trade at a slight premium to NTA. However, investors are worried that the company has too much debt on the balance sheet, and I agree that its current net debt/EBITDA is worrisome. At the same time, the company’s loan-to-value is only 43.6% (down 2 percentage points since the end of FY 21), which is significantly lower than what most people would use for their mortgage. Furthermore, the company is actively working to bring down its debt by recycling properties and selling new developments (which it initially intended to hold). For these reasons, I remain confident in the company and will continue to add as long as the weakness persists

Vonovia NTA per share (H1 report )

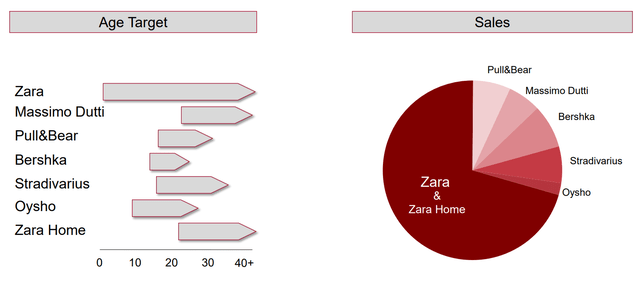

Industria de Diseño Textil (Inditex) (OTCPK:IDEXY)(OTCPK:IDEXF) – Bought 12 shares for €23.87 each: Inditex is active in the fast-fashion industry, which is characterized by its relatively cheap prices (although the company’s prices may be perceived as expensive in some countries). In the current environment of decreasing disposable income, the company’s value-oriented product offering will become more attractive to consumers. At the same time, the current inflationary environment allows the company to increase prices while not losing its competitive advantage of cheaper prices compared to its competitors. What makes Inditex more attractive than some of its competitors in the fast-fashion industry is that the company owns multiple brands that focus on different target groups and price segments. This increases the company’s TAM compared to competitors such as H&M (OTCPK:HNNMY)(OTCPK:HMRZF), which are more limited in terms of their brand portfolio. Simultaneously I estimate the company to be worth approximately $27.70 based on a DCF, PE, and EV/Revenue calculation. This gives the company an undervaluation of approximately 30% to my estimated fair value at the moment of writing.

Inditex brands (Inditex)

End of August:

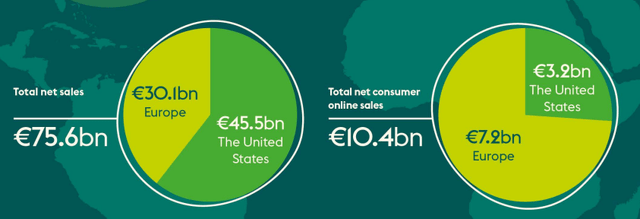

Ahold Delhaize (OTCQX:ADRNY)(OTCQX:AHODF)- Bought 9 shares for €28.10 each: At the end of the month of August, I decided to add more capital to Ahold Delhaize. There are a few reasons why I decided to add more capital to Ahold. First of all the company had lost some ground as it postponed the IPO of Bol.com indefinitely, the company’s e-commerce operations, which in many ways is similar to Amazon but with a focus on the BeNeLux. Secondly, the company earns the majority of its revenues (60%+) in the United States. As the USD has appreciated significantly in value compared to the Euro (by over 10%), this will have a positive effect on the company’s revenue and income. Additionally, the company has been raising its prices to keep up with inflation (in some cases it raised prices by significantly more than inflation), which would further boost revenue and income. Meanwhile, the company’s valuation remains attractive and I estimate a fair value for the company of €34.96, which represents an undervaluation of approximately 20% at the moment of writing.

Ahold revenue breakdown (Ahold FY 21 report)

|

Company |

Shares |

Total price |

Effects on dividend pre-tax |

|

Vonovia |

9 |

€285.92 ($283.74) |

€14.94 ($14.83) |

|

Inditex |

12 |

€290.44 ($288.23) |

€5.58 ($5.81) |

|

Ahold Delhaize |

9 |

€254.11 ($252.18) |

€8.55 ($8.48) |

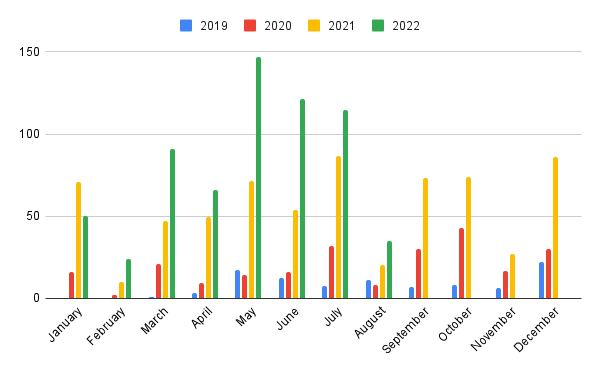

Dividends

In August I received $40.94 in dividends before tax, which is significantly lower than the amounts I received over the past few months. Nevertheless, this is in line with the past few years. Compared to last year it did increase by $16.74, which is almost double. The main reason that it increased is the addition of new capital, which still has a huge influence on my total dividends.

|

Company |

Dividend 2021 |

Dividend 2022 |

Difference |

|

Reinsurance Group of America (RGA) |

$7.30 |

$0 |

-$7.30 |

|

Jerash Holdings (JRSH) |

$3.90 |

$0 |

-$3.90 |

|

AbbVie (ABBV) |

$7.80 |

$22.00 |

$14.20 |

|

CVS Health (CVS) |

$5.50 |

$7.31 |

$1.81 |

|

Morgan Stanley (MS) |

$0 |

$11.63 |

$11.63 |

|

Total |

$24.20 |

$40.94 |

$16.74 |

Dividends per month (Author)

This month CBOE Global (CBOE) announced an increase of $0.02 in its quarterly dividend (4%). The dividend raise of CBOE, addition of new capital and the appreciation of the dollar make my new forward dividend €1063.97 ($1056.13). Compared to last year my dividend is up approximately €40 ($39.71) and if we compare my current forward dividend with August of last year my dividend is up by more than $400. The main reason for this remains the addition of new capital, but this should change once my portfolio becomes larger.

|

Company |

Increase in dividend quarterly |

Dividend per share pre-raise |

Dividend per share post-raise |

|

CBOE Global |

$0.02 |

$0.48 |

$0.50 |

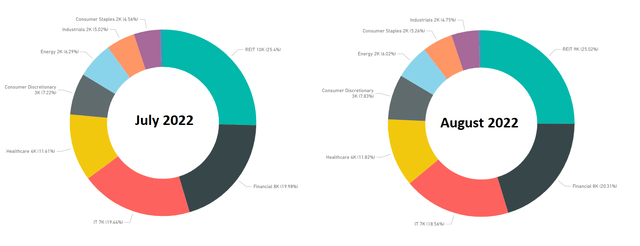

Sector Overview

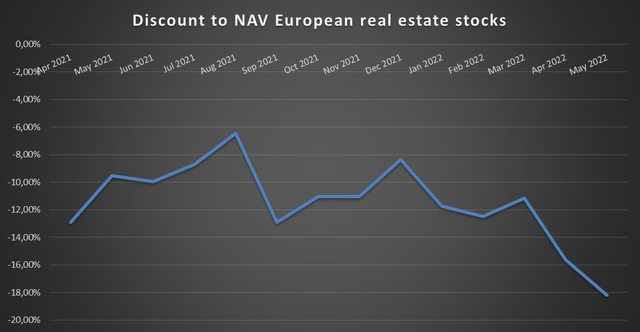

Compared to last month we don’t see a lot of change in my sector allocation. There is a minor decrease in the allocation to my real estate holdings. The main reason for this is that European real estate companies continue to severely underperform the market. As I think that the sector is currently undervalued and stronger than some investors might think I remain confident. My belief is based on the fact that the value of European properties hasn’t fallen as much as might be indicated by the public markets.

What can also be seen in the graph is that my allocation to the IT sector has increased by approximately 1 percentage point. This was due to the fact that my IT companies outperformed the other sectors, which slightly deviates from the performance of the indexes (the general S&P 500 outperformed the tech-heavy Nasdaq 100). I don’t expect this to continue as the valuation of tech companies is mostly based on cash flows in the future and thus the rising interest rates and the subsequent increase in the discount rate, will have a larger effect on these companies.

Current Holdings

| Company | Qty Held | Portfolio % | Days Since Latest Buy |

| VICI Properties (VICI) | 73 | 6.37% | 206 |

| Enbridge (ENB) | 55 | 6.02% | 299 |

| AbbVie | 16 | 5.66% | 286 |

| Prudential Financial (PRU) | 21 | 5.29% | 37 |

| Ahold | 72 | 5.26% | 12 |

| CBOE | 16 | 4.97% | 215 |

| CTPNV | 134 | 4.82% | 48 |

| Brookfield Asset Management (BAM) | 38 | 4.76% | 34 |

| L3harris (LHX) | 8 | 4.75% | 220 |

| Morgan Stanley | 20 | 4.69% | 34 |

| Visa (V) | 8 | 4.37% | 111 |

| TJ Maxx (TJX) | 25 | 4.26% | 143 |

| Vonovia | 55 | 3.92% | 34 |

| NETSTREIT (NTST) | 73 | 3.82% | 39 |

| Prosus (OTCPK:PROSY) | 23 | 3.67% | 111 |

| Inditex | 62 | 3.58% | 34 |

| Aroundtown (OTCPK:AANNF) | 458 | 3.53% | 65 |

| CVS Health | 13 | 3.52% | 221 |

| Broadcom (AVGO) | 3 | 3.39% | 65 |

| Armada Hoffler (AHH) | 86 | 2.92% | 40 |

| Fresenius&CO KGAA (OTCPK:FSNUF) | 40 | 2.65% | 156 |

| CoreCard (CCRD) | 29 | 1.85% | 156 |

| Intel Corporation (INTC) | 20 | 1.69% | 220 |

| CareCloud (MTBC) | 126 | 1.30% | 111 |

| StoneCo (STNE) | 53 | 1.25% | 51 |

| Linkfire | 1121 | 0.73% | 195 |

| Interactive brokers (IBKR) | 4 | 0.60% | 110 |

| The Hut Group (OTCPK:THGHY) | 189 | 0.32% | 243 |

| Tezos (XTZ-USD) | 50 | 0.20% | 556 |

| Hedera Hashgraph (HBAR-USD) | 680 | 0.11% | 528 |

| Bitcoin (BTC-USD) | 0 | 0.08% | 528 |

| Binance (BNB-USD) | 0 | 0.02% | 556 |

Going Forward

During September I will expect to add approximately €900 to my portfolio. This is slightly lower than what I added over the past few months. The reason for this is that I have to pay my tuition at the end of September and rather have some additional cash in case of emergencies. I expect to add approximately 50% of the cash to European stocks and 50% to US stocks. Although the second highly depends on how the FX rate will develop over the coming month. The stocks/sectors I am looking to add to are the following:

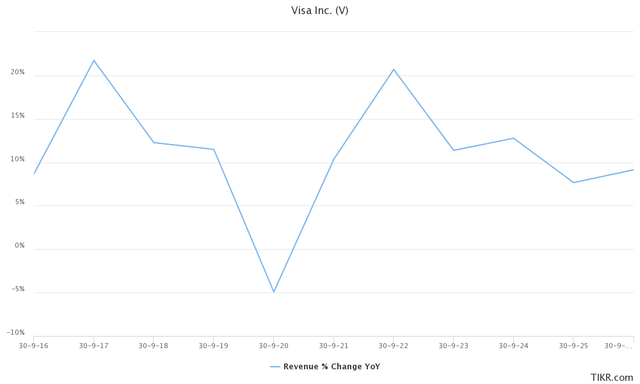

Visa

Visa is a household name for most investors and many people have at least 1 Visa card in their possession. The company receives a small percentage of every transaction and with the increase in prices the size of transactions increases. The flip side of the coin is that people’s disposable income is going down, leaving less room for splurging on other things. The main downside of this is that people are less likely to travel cross-border, which is a large percentage of Visa’s revenue. Nevertheless, during this summer international travel surpassed the numbers of 2019. Therefore, I remain confident that Visa will continue to grow. The company’s valuation also remains attractive to me and I estimate the fair value to be around $227.

Visa revenue estimations (Tikr.com)

European real estate

I mentioned it multiple times over the last few months and a few times throughout this article but I strongly believe that the European real estate sector is severely undervalued. Firstly, the majority of companies in the sector are trading at less than 50% of their estimated NTA, some of these estimates have recently been updated. These are estimates made by industry professionals based on, for example, 10-year discounted cash flows. Furthermore, in the private market, many properties are still going for cap rates near the cap rates that were assumed for the abovementioned valuations. There might be a few companies that have problems with their debt levels, but most of them have debt maturities at least a few years into the future and have a loan-to-value of 45% or less. Therefore, I will add more capital as long as the weakness persists.

Overview discount to NAV (OTC:EPRA)

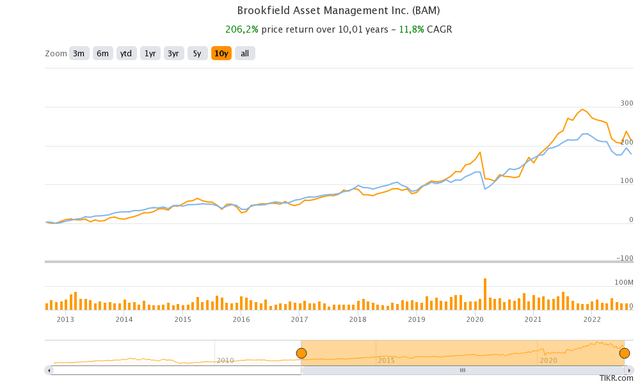

Brookfield Asset Management

Brookfield Asset Management is one of the best (if not the best) alternative investment managers. The current environment with a lot of volatility should be positive for them as they are known to be good asset allocators. The company is also working on spinning off its asset management, making the remaining holding an asset-light business. This could unlock a lot of value and should help investors in understanding the company’s full business model. For these reasons and the attractive valuation (my current estimate based on a DCF and sum of the parts is $60.10, although the last update has been before the latest quarterly result).

Outperformance of BAM vs SPY past 10 years (Tikr.com)

European small caps

In August I scrutinized my European small caps and my initial theses for holding them. After going through the annual reports of the companies that I own in this space, I am uncertain if these are the right companies to own. As a result, I have identified 6 other companies (such as MIPS AB (OTC:MPZAF), and Nordic Semiconductor (OTCPK:NDCVF)) in this space that fit my investment criteria and will compare them to my current holdings. If these fit my investment criteria better and have better fundamentals I will swap them with my current holdings.

Conclusion

August marked the end of the bear market rally and during the month a lot of negative economic news, as well as new hawkish comments came out. This could have a negative impact on stock market returns in the coming month((s)). As I think that it is impossible to time the market I continue to regularly add money to my portfolio.

In August I received approximately $41 in dividends, which was up approximately $17 compared to last year. My forward dividend at the end of August was $1,056.13, which is up over $400 compared to last year’s August. I remain confident that I will reach my new goal of $1,200 at the end of this year.

I hope you enjoyed the update about my progress, and I would love to hear your thoughts on my portfolio and what you would like to see in future updates.

Be the first to comment