peterschreiber.media/iStock via Getty Images

Magically years and psyche, and so news changes as calendars flip. 2022 was of course a down year. We had been bearish because of the Fed pulling the plug on their insane balance sheet buying program. That reversed and took wind out of the market. For 2023 I think the setup is in place for the Fed to reverse again, and I think potentially hard. That should be good for the S&P 500 (SP500, NYSEARCA:SPY). The market has a shot to make new highs next year but I think it won’t. Maybe in 2024, but of course my crystal ball needs to get this one right.

No Recession

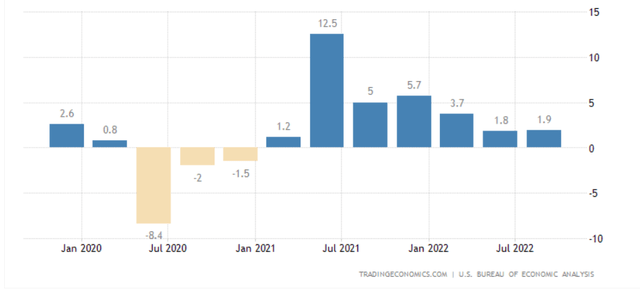

First, let’s look at if there’s going to be a recession in 2023. It’s amazing that it sounds like everybody is expecting a recession. But recession means down GDP quarters and we’re not seeing that. GDP was up in Q3 and so far up in Q4.

Uh, so far no recession.

GDP quarterly (Trading Economics)

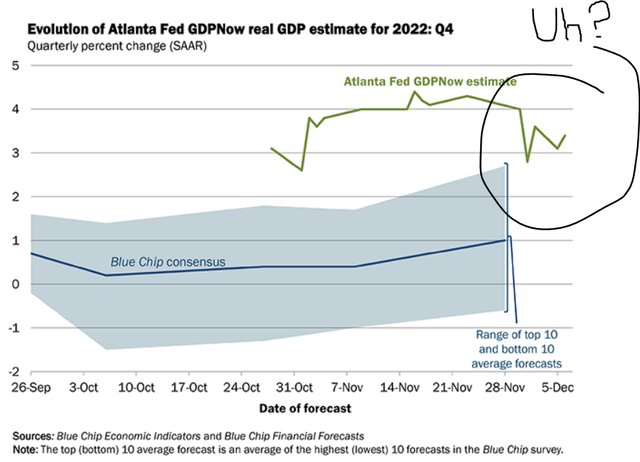

And here’s so far the trending Q4 estimate for GDP.

Atlanta Fed’s GDP Now (Atlanta Fed)

The Atlanta Fed estimates GDP by tracking real-time data. Their estimate currently for Q4 is above 3% while the Street is about 200 basis points below at about 1% and all expecting recession soon.

But so far we’re not seeing it in the numbers.

Yes Q3 was a drop off a cliff for many companies, mostly manufacturing and tech.

But the services sector which is the larger part of the economy is holding up well.

So I don’t see a recession next year despite everybody looking for one.

No Recession, Earnings Hold Up

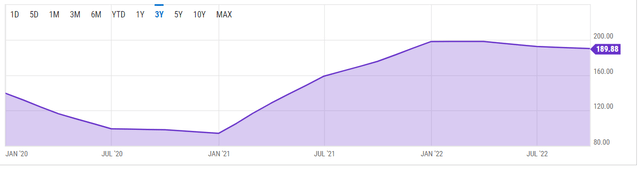

So far this year earnings have not yet dropped hard.

S&P 500 earnings (Y-Charts)

The news reported tech slowing hard in Q3. We predicted a lot of that in our service.

Tech has some of its own issues and captures most of the media’s attention. Media needs shock value to drive views and so reports about tech which has more cyclical swings.

There are two main problems in tech right now.

One is that it had a huge demand pull-forward as companies scrambled to adapt to work-from-home.

Second was a build up of inventory to offset supply constraints.

All of those started to unwind in Q3 simultaneously. It’s likely that continues to unwind over the next couple of quarters.

Unwinds happen for at least four quarters typically until we lap the unwind quarter which resets the base and gives a shot to grow again year-over-year.

But notice above that 2022 EPS estimates didn’t drop hard on all that tech unwind.

So wild guess, that Q4 drops a little and Q1 to Q3 2023 can drop a little further since tech and manufacturing are dragging. But services holding it up keeps room for growth in all segments in Q4 and maybe a flat or up earnings year all-in.

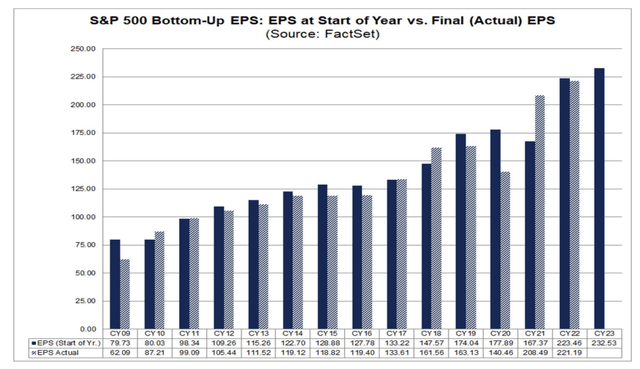

Here is the overall estimate for 2023 by FactSet.

S&P 500 Earnings Annual (FactSet)

The Street currently is talking recession but in the numbers expecting about 5% EPS growth for 2023.

I’m OK with that. I don’t mind assuming flat to up 5% for 2023.

I’m using a single point of $226 for S&P 500 earnings.

The big driver for 2023 I don’t think comes from earnings but rather comes from PE as the Fed drops rates and halts quantitative tightening.

Fed Change in 2023

Inflation is dropping hard, so it appears.

I think that will force the Fed to flip back to need to loosen policy, drop rates, and stop shrinking their balance sheet.

The Fed is carrying way too big a stick now and having way too much fun with their balance sheet to save the economy from recession starting back in 2009.

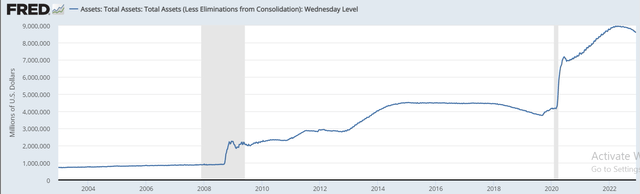

Here’s the Fed gone mad in one chart.

Fed Balance Sheet (St Louis Fed)

The Fed has caused itself a problem. They have backed themselves into a corner and have zero risk control. Yes ultimately printing so much money to drive this balance sheet size is inflationary. But the decisions to expand and reduce it have immediate impact on liquidity on the overall economy.

So the Fed changing its stance on rates, but I think more so on the balance sheet, affect the economy so powerfully and immediately. I think the lags that the Fed expects based on history are overstated because this QT-QE bat is too big and bigger than they themselves understand.

I think the balance sheet moves are much more impactful than rate moves because it’s directly adding or sucking money from the economy as they decide to grow their balance sheet or reduce it.

When they buy securities it funds the economy or government with cash. That grows their balance sheet. When they reduce the balance they undo those purchases and sap money from the economy.

It has a monster impact and we see it in the stock and bond market which depend on margin and liquidity.

The market moves wag corporate thinking which changes their business plans and then cycles buying decisions.

The Fed messes with the market through liquidity which changes business leader psyche which then changes EPS cyclically. Yes tail wags the dog and in this case that tail is humongous.

So as tough as the Fed speaks they know nothing except the latest data like all of us. They are at the mercy to that data.

Their reduction of the balance sheet has sapped money from the economy and already reversed the inflation trajectory. That should force them to reverse tightening in 2023. I believe that more than earnings will be the main market driver in 2023.

Personally I think they have zero clue about how big a bat their balance sheet moves are and so are going to be surprised to see inflation turn to, yes, deflation.

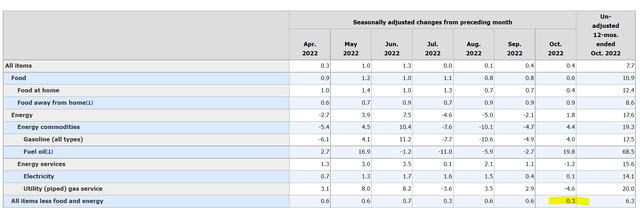

CPI has started to drop….

CPI monthly (‘BLS’)

I believe strongly that the Fed moving to QT has sapped a ton of money from the economy and so is causing prices to drop back down.

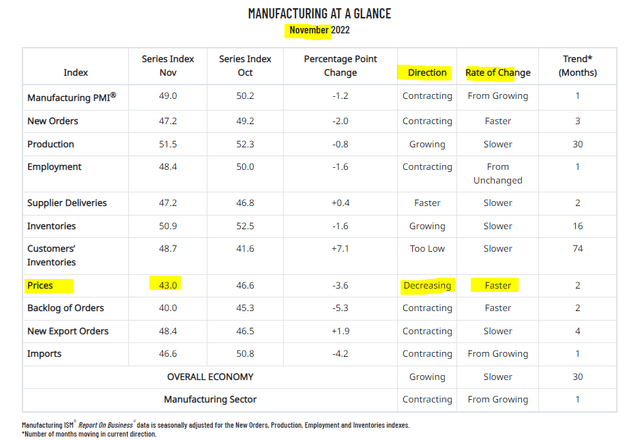

Here’s more recent data from ISM prices falling off a (can you say) cliff.

ISM Survey – Price (ISM)

If CPI prints for November like ISM price hints, prices should be “decreasing” at a “faster” rate. The .3 of October should be something lower.

The supply of money itself, not goods prices per-se are the main driver.

Printing too much money, lowers the value of money. The lower value of money makes the goods it buys more expensive – inflation.

Printing too little money causes a lack of supply. Econ-101, lower supply of money raises the value of money itself.

Too little money, too little supply, raises the value of money, lowering the value of the goods it buys; deflation.

The Fed’s stick is way way WAY too big and imprecise.

The Fed for years admits that their estimates are usually wrong and they usually get it wrong in some major way. (As an aside, as a Fed watcher the idea of Fed watcher is trying to figure out where they get it wrong, not what they do.)

Now the instrument they are messing with, huge amounts of balance sheet changes driven by money printing changes is swinging the level of prices in big ways.

So QT now is likely soon causing deflation.

They’ll need to reverse QT.

That reverse in QT, I think will be a big driver in adding money to the system and so adding money to the market in 2023.

So earnings I expect will be less a driver for 2023. The main driver I believe will be valuation / multiples and buying demand led by the Fed reversing from sucking money from the system.

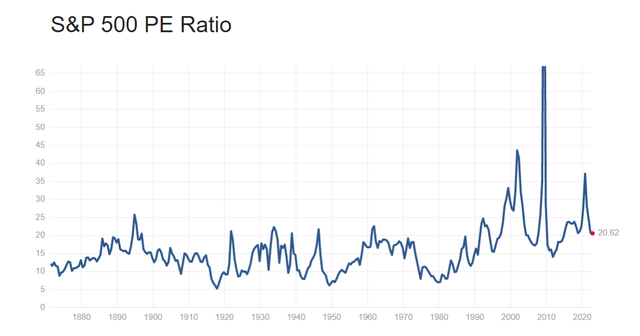

Valuation and Target For 2023

S&P 500 PE Over Time (multpl.com)

So what’s the market worth? Generally for stocks I use the last three years midpoint to tell me what the market pays for things.

In this case I think the last three years is off because of the huge EPS drop from the pandemic.

But in our generation, it’s not hard to think the market gets 20x.

20x $226 = 4520.

My target for 2023 would be 4520.

That’s about a 14% move from where we stand today.

I think that makes sense because I would guess if the Fed reverses (pivots) inflation probably starts to show up again. The simple fact that the Fed is adding money supply, reducing the value of currency, thus causing relatively higher prices in goods, will cause the Fed to reverse again…. And again and again….

So it’s not off to the races but this next major Fed pivot can be a main driver to get markets up but I would guess not making new highs. I would guess no new highs, again because they’ll have to stop “loosening” money supply when they see deflation turn back to inflation as they swing back and forth, back and forth, back and forth.

Conclusion

Global coordinated central bank decisions is shifting the money supply up and down in big ways. Itself I think is the main driver to inflation and deflation in a fiat currency system. The Fed is data-point-watching but it’s a joke. They are the main driver to that data based on the supply of money they decide to have in the system. And since they are so big and back-and-forth, it’s causing massive changes and tradable swings in the market. This next Fed move I think will be the main driver to get stocks up for 2023. My single point AI – crystal ball target: 4520. Good luck.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment