On a daily basis, I often see at least one, and sometimes even two free site articles written about REITs or high yield stocks that are trending. I read flashy and bold article headlines such as ‘Buying Hand Over Fist’, ‘This Billionaire’ is purportedly buying REITs or ‘This Is The Buying Opportunity Of A Lifetime’. Within the articles, I see pictures of attractive retirees strolling the beach or traveling to appealing world destinations. The articles read like the authors have discovered some magic elixir and solved the most pressing and perplexing question that all money managers that cater to retirees face – how to build high quality and safe portfolios that have some yield. This is a need that tens of millions of retirees have. There is an unquenchable thirst for safety, low volatility, and high quality income streams. And one more thing, I almost never see actual snapshots of position sizes or evidence of what ‘Buying Hand Over Fist’ actually means. When I hear that phrase, I expect it to mean buying hundreds of thousands of dollars of the stocks mentioned. Yet, once again, where’s the beef?

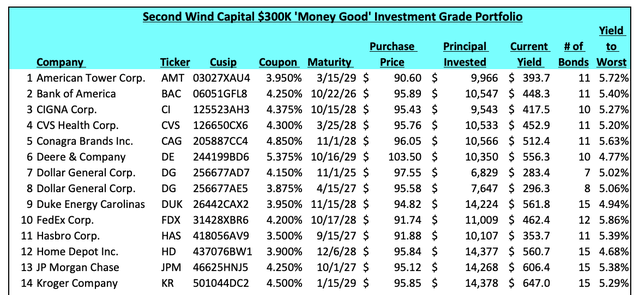

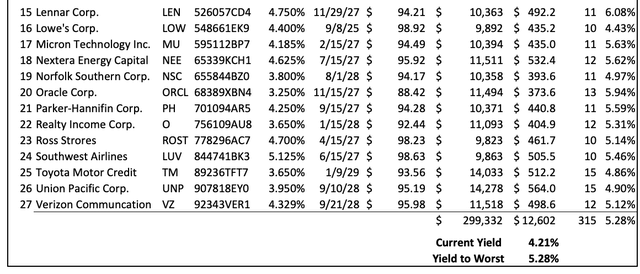

Setting that aside, in today’s piece, I am going to do something extraordinary, I am going to give retirees the list of the 27 investment grade bonds consisting of twenty six different companies. This a real $300K investment grade bond portfolio that I constructed with purchases made on October 5, 2022, when the 5yr U.S. Treasury was yielding 3.90%, and then topped off on October 21, 2022, when the 5yr U.S. Treasury was yielding 4.45%.

As way of background, I spent five years working on the buy side, in a group that managed north of $45 billion of investment bond assets. I worked directly with Senior Analysts and Portfolio Managers. I sat on the trading desk and also worked in research, during my time there. Moreover, I had a front row seat to the financial crisis and saw Bear Stearns stock go from $200 to nearly zero, before JP Morgan (JPM) swooped in, as JPM wanted Bear’s coveted Prime Brokerage business. I saw Lehman Brothers collapse, the Fed take over Fannie Mae and Freddie Mac and countless other events. I distinctly remember David Tepper on CNBC, telling the world that he was loading the boat (as in billions in face value) with Bank of America (BAC) and Citibank (C) preferred stock, then trading at 20% and 10% on the dollar. He said in February 2009, most days, he was on the only buyer of those securities.

My long winded story is my way of saying, I probably know bonds better than most people. I know how bonds work and I know the vital role the bond market (as I’m talking about Corporate Bond today) plays in financing of the world’s best and most important businesses and how retirees directly and indirectly (think pension funds, endowments, mutual funds, and insurance companies) exchange their savings, for a period of time, for the safe and reliable income streams, duration risk notwithstanding!

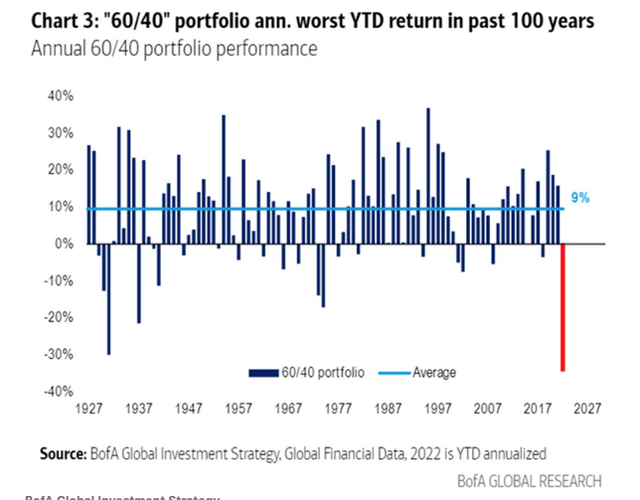

2022 has been an exceptionally tough year for anyone long a traditional 60% stocks /40% bonds portfolio.

I’m guessing many of you might have even seen this chart frequently floating around Twitter.

Bank of America

Anyway, as I simply don’t have the bandwidth, as the vast majority of my working time is spent synthesizing small cap value and special situation companies, it would be unfair for me, and to my group, to devote too much time writing research on each of the companies contained within the portfolio. If I did it, I’m sure these would be widely read articles, as these are great companies and widely owned on both the bond and stock side. However, I just don’t have the bandwidth! Therefore, I am giving this fantastic portfolio list away to retirees for free. I am enabling you to take advantage of years of experience I acquired while working in investment grade bonds, on the buy side, and sharing my ability to construct what I believe is a very high quality investment grade portfolio.

Moreover, before the big reveal, this portfolio was constructed for my retiree parents. This is the bulk of my parent’s taxable savings, and an important asset, outside of their home that they own, their retirement accounts, cars, and pensions. It is very much real money and I put $300K to work, in October 2022. My parents are in their early 70s and my mother is very risk averse, so it took a number of conversations to convince them this was a smart move for them in the context of interest rates, especially as these are some of the best yields for such high quality corporate paper, really since 2008.

I explained to my parents how I selected each bond, how I diversified the portfolio, and how the bonds are ‘money good’, at least in my opinion. Lastly, this is truly a buy and hold portfolio. There is no need to really ever look at it. Just sit back and slowly accrue and then collect the income via semi-annual coupon payments. There is no need to closely monitor it and sprint to the computer, first thing in the morning, to read about it. This is just safe, boring, and reliable income. And in terms of duration, five to eight years was my sweet spot as I think it is highly unlikely treasury yields (TLT) stay this elevated, but I didn’t want to make a massive duration bet either.

Speaking of duration, there is no doubt in my mind we are in a recession and the Fed is looking backward at stale and outdated data. Higher energy prices notwithstanding, the other major drivers of the recent and persistently high inflation data, as in 40 year high inflation data, have clearly peaked and this will eventually show up in the data. Secondly, look no further than Amazon.com’s (AMZN) big earnings miss, last night. Amazon told the street, they only expect Q4 FY 2022 revenue to be $144 billion (mid-point) vs. $155 billion consensus estimates. That is a huge miss and a big deceleration. As Amazon trades super rich and as a growth company, when you stop growing at a rapid pace, your multiple contracts markedly. And Amazon isn’t alone, there is plenty of high frequency data suggesting the Fed is way behind the curve and a 4.25% 10yr Treasury, as of last Friday, is fleeting.

The $300K ‘Money Good’ Investment Grade Portfolio:

- Telecom: American Tower Corp (AMT) 3.5% sized and Verizon Communications (VZ) 3.8% sized.

- Finance: Bank of America (BAC) 3.5% sized and JP Morgan 4.8% sized.

- Railroads: Union Pacific (UNP) 4.8% sized and Norfolk Southern (NSC) 3.5% sized.

- Retail: Dollar General (DG) 4.7% sized and Ross Stores (ROST) 3.2% sized

- Home Improvement: Home Depot (HD) 4.8% sized and Lowe’s Corp. (LOW) 3.2% sized.

- Technology: Micron Technology (MU) 3.5% and Oracle Corp (ORCL) 4.1%.

- Homebuilding: Lennar Corp. (LEN) 3.5% sized.

- REITs: Realty Income Corp. (O) 3.8% sized.

- Consumer Discretionary: Hasbro Corp. (HAS) 3.5% sized.

- Utilities: Duke Energy (DUK) 4.8% sized and NextEra Energy (NEE) 3.8% sized.

- Grocery / Food: Kroger Company (KR) 4.8% sized and Conagra Brands Inc. (CAG) 3.5% sized.

- Healthcare: CIGNA Corp. (CI) 3.2% sized and CVS Health Corp. (CVS) 3.5% sized.

- Package Delivery: FedEx Corporation (FDX) 3.8% sized

- Aerospace and Industrial: Parker-Hannifin Corp. (PH) 3.5% sized. Toyota Motor (TM) 4.8% sized, and Deere & Company (DE) 3.2% sized.

- Airlines: Southwest Airlines (LUV) 3.2% sized

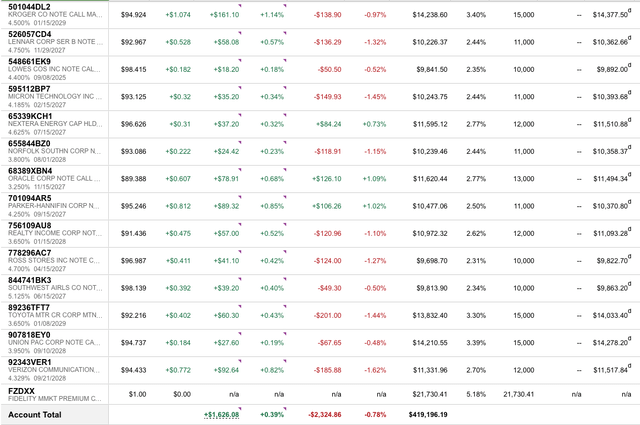

Enclosed below is this handy chart, including the CUSIPs of the bonds.

Author’s Chart

Author’s Chart

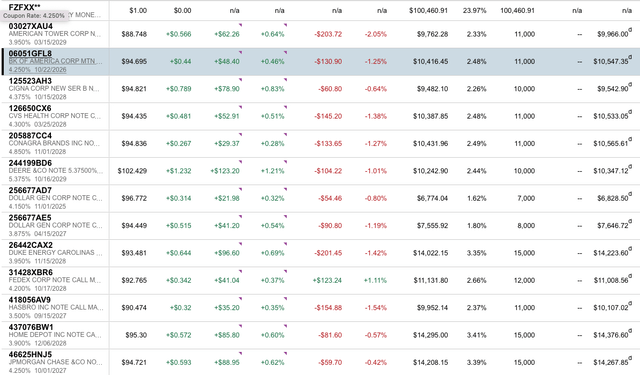

Secondly, here is an actual account snapshot of the portfolio. As you can see, this isn’t dress rehearsal, I consulted my parents and put $300K to work, the majority of their taxable and rainy day savings.

Fidelity Portfolio Snapshot

Fidelity Portfolio Snapshot

Putting It All Together

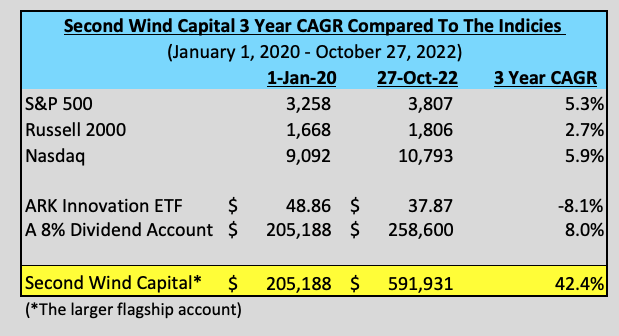

As I simply don’t have the bandwidth to get sidetracked writing on bonds, as small cap and special situation value equities are my focus. Enclosed below is my track record on the equity side of the house. If I can figure out equities then I would argue I can figure out bonds.

Author’s Chart

Quite simply, I’ve elected to share what I would argue is a high quality and ‘money good’ investment grade bond portfolio. Given, the dramatic rise in interest rates, and corporates always trade at a ‘credit spread’ to treasuries, October 2022 was a great period of time to put $300K to work on behalf of my retired parents, aged 72 and 73. I would also argue this is much higher quality portfolio and truly a SWAN portfolio whereas going out on the risk frontier and messing around with high yield REITs and other dividend stocks is far less appealing if you actually want low volatility and a safe income stream.

Lastly, my motivation for sharing this portfolio with retirees, and for free I might add, was because I think any authors that write on behalf of retirees have an extra burden of due diligence and care. Retirees can’t afford permanent destruction of their principal via capital losses in the form of bad stock selection. They simply don’t have another shot at going back into the work force and earning an income, if it turns out their reaching for yield portfolio wasn’t money good, after all.

Cheers,

CCI

Imgorthand

Be the first to comment