Mohamad Faizal Bin Ramli

Market overview

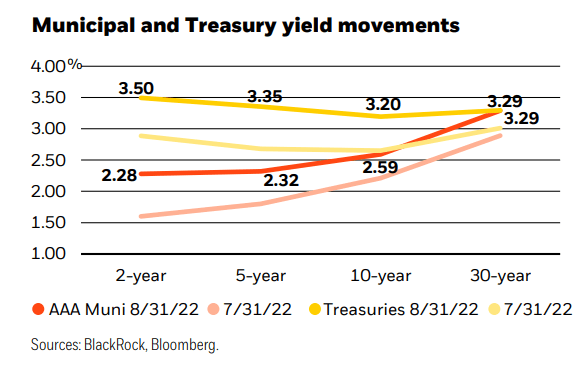

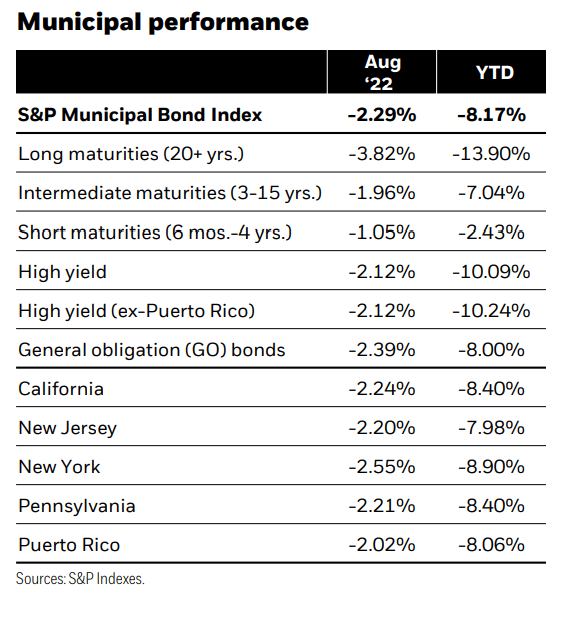

Municipal bonds posted negative total returns in August alongside sharply rising interest rates, as economic data eclipsed tempered expectations and the U.S. Federal Reserve maintained a hawkish tone. Manageable issuance along with more constructive demand spurred modest municipal outperformance versus comparable U.S. Treasuries. The S&P Municipal Bond Index returned -2.29%, bringing the year-to-date total return to -8.17%. Shorter duration (i.e., less sensitive to interest rate changes) and high yield bonds performed best.

Supply-and-demand dynamics remained supportive in August. Issuance was 5% below the five-year average at just $36 billion and was outpaced by reinvestment income from calls, coupons, and maturities by nearly $13 billion. Mutual fund flows turned positive early in the month on the back of strong performance in July but reversed course into month-end as total returns became more materially challenged. Bid-wanted activity remained subdued versus earlier in the year at $1.1 billion per day on average, while new-issue oversubscriptions slightly underwhelmed their year-to-date average at 3.4 times.

We maintain a cautious view on the asset class heading into the autumn months. Valuations, while fair, are not currently overly compelling. At the same time, seasonal trends are set to turn less favorable as the market transitions back to net positive supply, and demand looks poised to struggle amid continued expectations for heightened interest rate volatility. Notably, September has been the third-worst performing month of the year, on average, over the past five years.

Strategy insights

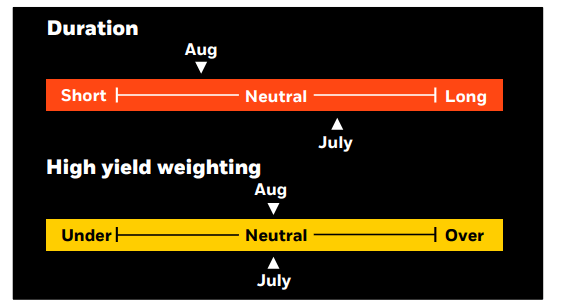

We have shifted to a short-duration stance on municipal positioning and have increased cash balances. We favor the intermediate part of the yield curve to maximize income, while avoiding significant duration risk, and are targeting bonds with defensive structures. We prefer higher-quality bonds overall, with a neutral allocation to non-investment grade bonds.

BlackRock

Overweight

- Essential-service revenue bonds.

- Select highest quality state and local issuers with broadest tax support.

- Flagship universities and diversified health systems.

- Select issuers in the high yield space.

Underweight

- Speculative projects with weak sponsorship, unproven technology, or unsound feasibility studies.

- Senior living and long-term care facilities in saturated markets.

Credit headlines

The first half of 2022 has been a financially challenging operating period for the hospital sector. Despite this, many providers, particularly at the higher end of the rating spectrum, have bolstered balance sheets to help transition through what we expect to be a tighter, structural-margin backdrop. Operationally, several drivers are weighing on financial results: greater-than-budgeted expenses (mainly from labor and supply costs), slow revenue growth constrained by rolling Omicron surges, exposure to skilled nursing, and investment market volatility. Data from the Kaufman Hall National Flash Report confirms this, noting negative median operating margins through July of -0.98%. While year-to-date upgrades at each of the three rating agencies outpaced downgrades (most actions were affirmations), we are seeing weakness show up mostly in the lower-quality space. For example, Doylestown (PA), Grandview (PA), and Marietta (OH) hospitals were all downgraded deeper into junk status, while ProMedica (OH), Catholic Health (NY), and Trinity Health (ND) have dropped from investment grade into high yield. Many providers are struggling to absorb operating losses, especially with most of the CARES Act funds already utilized. In some cases, this is leading to rating downgrades and tight covenant headroom. We expect that a portion of margin compression will be structural and require proactive and disciplined management to sustain credit quality. This may also escalate merger-and-acquisition activity in the sector.

Healthcare is a sector where we continue to allocate capital, but it remains credit specific and positioned up in quality. We generally favor systems with scale and geographic diversity, strategic management, and an adequate margin of safety to operate through the business cycle. However, we are also closely watching for opportunities in fallen angels or distressed names as they become available.

BlackRock, Bloomberg S&P Indexes

This post originally appeared on the BlackRock Blog.

Be the first to comment