Andrii Dodonov

Introduction

With the passage of the Inflation Reduction Act, renewed interest in climate-related investments has taken hold. While we have seen lots of news and insights on how the new law will drive equity plays in renewables, electric vehicles, and power transmission, I dive into the fixed-income arena as it relates to climate litigation nationwide.

For some time, I have been following legal proceedings across the country to see how they might affect energy equities. However, I have come across a troubling trend related to municipalities and their General Obligation bond offerings. In short, the same cities that are filing lawsuits claiming damages against energy companies because of climate change are also stating in their bond disclosure forms that they cannot attest to the effects of climate change. This does not square.

Also, from an investment perspective, will the questionable climate-related portions of cities’ bond disclosure statements ultimately raise their costs of borrowing? I hope Fitch, S&P, and Moody’s will apply greater scrutiny here, given that the bonds I am assessing below have AA+, AAA, or Aa1 ratings.

In light of this landscape, I analyze four different GO bond offerings. It is important to note, moreover, that the information contained in these bond disclosures directly contradicts the premise of the issuers’ legal claims. Someone is being misleading – either those who are filing these lawsuits or those who are issuing the GO bond disclosure statements.

Judicial Due Diligence

Savvy muni investors know that significant legal proceedings, such as the Supreme Court’s ruling in BP v. the Mayor and City Council of Baltimore, could have material impact on how they assess their fixed income strategies. I argue that a broader judicial due diligence is needed when assessing municipal bond opportunities.

A number of municipalities across the U.S. have filed lawsuits against energy companies. It appears these plaintiffs’ lawyers are seeking large paydays, and tellingly, have no real interest in reducing emissions or addressing our climate challenges. As Ike Brannon, a former senior economist for the U.S. Treasury, wrote for Forbes, “…plaintiffs are attempting to fleece the very companies doing the most to meet consumer demand and reduce emissions.”

I offer this concept of enhanced judicial diligence because municipal bond investors should, at the very least, know the real forces behind these climate lawsuits. Let’s also not forget that, according to the Bloomberg Municipal Bond Index, munis suffered a 6.58% loss from December 31, 2021 through July 31 of this year. Now, let’s look at how and why I believe these GO bonds should be avoided.

San Francisco

I start in the Bay Area, where the City and County of San Francisco have issued its GO Refunding Bonds (Series 2022-R1). Here is a quick look at some of their fundamentals:

- Maturity date: 2032 selected

- Yield: 2.79% (Approximate yield to maturity nationally today for a maturity range of 10 years is 2.5%)

- Interest rate: 5%

- Issuer Default Rating (IDR): Fitch: AA+; S&P: AAA; Moody’s: Aaa (I think these ratings could be in jeopardy given sustained tax base weakness led by suppressed sales, business, and hotel tax revenues.)

When analyzing the city’s financial position, I also remain bearish given employment data. According to Fitch’s U.S. Metro Labor Market Jobs Tracker, the San Francisco-Oakland-Hayward MSA has only recovered 61% of the jobs lost between February 2020 and April 2020 compared with the 81% median among major MSAs.

Now, the disclosure’s cover page suggests: “Investors are advised to read the entire Official Statement to obtain information essential to the making of an informed investment decision.” That’s what I’ve done for this first municipality.

Accordingly, I took serious note of the following passage in the offering’s disclosure statement. Page 22 states:

“Projections of the effects of global climate change on the City are complex and depend on many factors that are outside the City’s control. The various scientific studies that forecast climate change…are based on assumptions contained in such studies. Also, the scientific understanding of climate change and its effects continues to evolve. Accordingly, the City is unable to forecast when…adverse effects of climate change…will occur. In particular, the City cannot predict the timing or precise magnitude of adverse economic effects…during the term of the Bonds.”

In sum, San Francisco’s government is saying in its bond disclosure that climate change studies are based on assumptions, the science is evolving, and it cannot forecast or predict the environmental risks or economic effects of climate change. But that’s not what San Francisco is saying in court.

Back in the fall of 2017, San Francisco City Attorney Dennis Herrera filed a lawsuit in San Francisco Superior Court against five energy companies. On behalf of the city, he alleges that they are to blame for climate change. The case asks the court to make these companies pay for sea walls and other infrastructure because of the “ongoing and future consequences of climate change.” However, if his own employer that is issuing these bonds states that it cannot predict the magnitude of climate change for its investors, then how can this lawsuit claim to do otherwise in court? Because of this discrepancy and my other concerns above, I would avoid this GO bond.

Baltimore

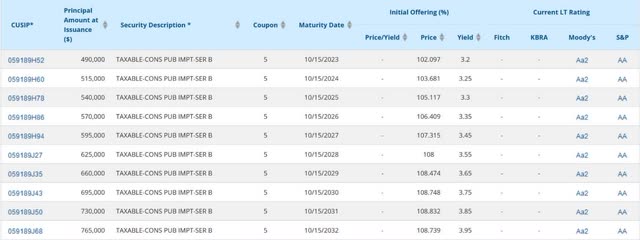

Heading east, I next assess the GO bonds from the Mayor and City Council of Baltimore Series 2022B. This specific offering is $16,000,000 of consolidated public improvement bonds. A review of fundamentals is here, with a chart below.

- Maturity date: 2032 selected

- Yield: 3.95% (while the yield here looks attractive, this bond is also taxable)

- Interest rate: 5% (same coupon as San Francisco’s)

- IDR: S&P: AA (lower than San Francisco); Moody’s: Aa2

Electronic Municipal Market Access (EMMA), Municipal Securities Rulemaking Board (MSRB)

To me, the city’s elevated debt and pension burden is one that I take seriously, and it underlies my bearish view. And as Fitch points out for the larger Baltimore County, “a pattern of increased fixed-cost spending associated with debt service and employee retirement benefits to materially greater than 20% of total governmental expenditures” could lead to a downgrade. I think that’s more than a possibility.

Turning to Baltimore’s disclosure for this muni offering, I am struck by similar climate-related language. On page 60 of the disclosure, the issuer defaults to the fact that the city adopted a Disaster Preparedness and Planning Project (a so-called “DP3 Plan), which was approved by FEMA. In reading through this plan, one can see that it admits on page 102 that, “Due to the uncertainty of climate conditions, and thus of relative sea level rise projections, it can be difficult to assign quantitative probabilities to projections of sea level increases.”

If it is difficult to assign probabilities to such sea-level increases, then I am intrigued by the fact that, in July 2018, the city filed a lawsuit in Baltimore Circuit Court against 26 energy companies, claiming that Baltimore has been impacted by sea-level rise and climate change. As referenced at the beginning of this piece, this case made it all the way to the U.S. Supreme Court. On May 17 of last year, the Supreme Court vacated the Court of Appeals for the 4th Circuit’s ruling and remanded the case for further proceedings. Again, the disconnect between the city’s lawsuit and its bond disclosure statement does not add up.

Honolulu

Hawaii’s capital is where I focus next. Let’s dive into the City and County of Honolulu GO Bond Series 2022A, which is tax exempt.

- Maturity date: 2029 selected

- Yield: 1.33% (despite a quicker maturity, I don’t believe this yield is competitive)

- Interest rate: 5%

- IDR: Fitch: AA+; Moody’s: Aa1

In addition to the low yield, Moody’s warns that significant growth in the city and county’s contribution to its major rail project beyond projections could threaten its rating. Living in Connecticut and witnessing many New York Metropolitan Area transportation projects go way over budget, I would expect this case could be no different. We’ve seen declines in Honolulu’s property tax revenue, too. This also factors into my negative outlook for this GO bond offering.

Concerning my hypothesis, Honolulu’s bond disclosure offers this snippet providing further evidence in favor of it. Upon reading page 58 of its GO bond Official Statement, we see this: “It is possible that climate change increases the frequency and severity of natural disasters, including hurricanes.” Of course, it is “possible”. Importantly, the disclosure continues, “No assurances can be given as to the frequency or severity of any future natural disasters, nor what impact, individually or in the aggregate, such disasters may have on the State, the City and County, their residents or their overall financial condition.”

Possibilities and non-assurances are hardly grounds for a lawsuit. Yet, here, we have the City and County of Honolulu and the Honolulu Board of Water Supply, which filed a “state court case in 2020 with the help of Sher Edling.” According to the lawsuit, Oahu *will* experience rising sea levels, flooding, erosion, beach loss, and extreme weather because of these companies’ activities.

But, again, wait a minute. Honolulu’s government stated verbatim in its official bond disclosure that it cannot provide any assurance as to future natural disasters. These are the same events, however, that the lawsuit, City and County of Honolulu vs. Sunoco LP, cites to make its case. This inconsistency continues to confound.

Before I turn to my last bond offering, I want to provide some context on this law firm Sher Edling, the one behind Honolulu and many others’ suits that are causing these bond disclosure discrepancies.

Sher Edling

Fixed-income investors should be aware of Sher Edling LLP’s activities. They are a San Francisco-based law firm specializing in environmental litigation. The firm represents each of the plaintiffs profiled in this column. Also, a separate lawsuit has been filed by Hoboken, New Jersey. The Washington, DC-based Institute for Governance and Sustainable Development covered Hoboken’s legal bills. The Institute also funded the Center for Climate Integrity to support Sher Edling’s municipal lawsuits.

As former Mercer County, New Jersey Executive Bob Prunetti uncovered about the Center, “The nonprofit tries to convince local officials that climate lawsuits are a good idea and Sher Edling follows close behind to be the firm filing the lawsuit.” He also noted that Sher Edling pitched “the same lawsuit in numerous other states, municipalities, and counties” to pursue “a climate litigation strategy that several federal courts have dismissed.”

In a report entitled “Attorneys General For Hire,” the American Tort Reform Foundation highlights Sher Edling’s contingent fee model and funding sources. Muni investors thinking about these offerings should take note:

“Since 2017, Sher Edling, the law firm acting for plaintiffs in more than two dozen climate lawsuits, has also received close to $5.3 million just from the Rockefeller-backed Resources Legacy Fund. This money appears to be defraying Sher Edling’s costs in litigating these cases, thus raising questions about the propriety of…contingent fee arrangements.”

The investor community should continue to track this collaboration between Sher Edling and the Center for Climate Integrity.

Annapolis

Finally, returning to Maryland, I look into the state capital’s General Obligation Public Improvements Refunding Bonds 2021 Series B. This offering amounts to $48,915,000. A fundamental check is below. The coupon rate here helps push me into bearish territory.

- Maturity date: 2032 selected

- Yield: 1.4%

- Interest rate: 3% (this coupon registers far lower from the previously analyzed GO offerings)

- IDR: S&P: AA+; Moody’s: Aa1; Fitch: AA+

Some additional red flags for me regarding Annapolis’ muni offering as raised by Fitch include: “the city’s parking and transit enterprise funds experienced revenue declines during fiscal 2021 due to the pandemic’s impact on visitor activity in the city compounded by the cancellation of Naval Academy events”; and the “fixed cost spending for debt service and retiree benefits accounting for roughly 20% of total government spending.” That spend on debt and benefits is too high for me.

Interestingly, page 23 of the city’s bond disclosure states, “City management is also developing a plan to make Annapolis resilient against the effects of climate change and other factors by joining Anne Arundel County’s efforts to establish a Resiliency Authority.”

If the city is still formulating a climate plan, why sue 26 energy companies in Anne Arundel County Circuit Court in February of last year for the costs and consequence of climate change? One answer is Sher Edling’s insistence. As Brooks DuBose wrote in the Capital Gazette, “The city has retained Sher Edling LLP as outside counsel on a sliding contingency fee that ranges from 16% to 25% based on how much the city is awarded if they are successful.” That’s a much better return than what we can get from any of these munis.

Conclusion

This bond disclosure lawsuit conundrum dates back to early 2018 when The Wall Street Journal first reported on this discrepancy. Four years later, we are still seeing stark inconsistencies. If these bond disclosure statements are accurate, then the validity of each municipality’s lawsuit should be called into question. Each of the lawsuits I referenced above is in a different state of proceedings. We will have to wait and see. In the meantime, I hope fixed-income investors avoid these GO bonds.

I also hope that, given all the climate-related information crossing our desks, rating agencies take a harder look into these municipal offerings and how their disclosures are presented.

If there was ever an opportunity for a second guess in fixed income, this is certainly one of them.

Be the first to comment