golfcphoto

By Peter Hayes and Sean Carney

Market overview

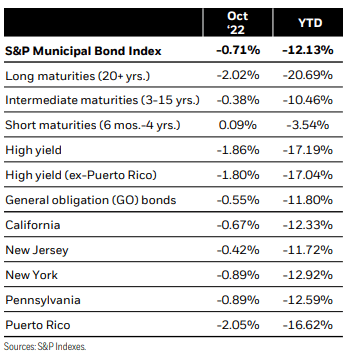

Municipals, hampered by rising interest rates and elevated volatility, posted their third-consecutive month of negative performance in October. Interest rates surged to decade highs early in the month, amid rising global sovereign yields and higher-than-expected inflation, but moderated into month-end as the market began pricing for a slightly slower pace of future policy tightening from the Federal Reserve (Fed). The less volatile nature of the asset class combined with favorable supply-and-demand dynamics to prompt outperformance versus comparable Treasuries. The S&P Municipal Bond Index returned -0.71%, bringing the year to-date total return to -12.13%. Shorter-duration (i.e., less sensitive to interest rate changes) and higher credit-quality bonds performed best.

Issuance underwhelmed lofty seasonal expectations at just $26 billion, or 42% below the five-year average, and was outpaced by reinvestment income from calls, coupons, and maturities by more than $8 billion. However, “shadow supply” via elevated secondary trading weighed on the market and negated some of the tailwind provided by light issuance. Unabating mutual fund outflows were further compounded by tax-loss harvesting strategies, while higher rates and a flatter yield curve forced unwinding of leverage. As a result, the market contended with bid-wanted activity of nearly $1.9 billion per day on average.

While we continue to exercise caution, we anticipate positioning for a stronger year for fixed income assets in 2023. We believe that the Fed is in the late stages of its hiking cycle, and rates are likely near their cycle peak. At the same time, municipal seasonals are poised to turn much more favorable around year-end, and valuations remain compelling, particularly on a tax-adjusted basis.

Strategy insights

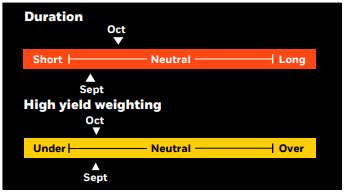

We exhibit a long-duration stance across portfolios with a preference for shortening toward neutral. We favor the intermediate part of the yield curve to maximize income, while limiting duration risk, and are targeting bonds with defensive structures. We maintain an up-in-quality bias and have an overweight allocation to the revenue sectors and an underweight allocation to the tax-backed sectors.

Overweight

- Essential-service revenue bonds.

- Select highest quality state and local issuers with broadest tax support.

- Flagship universities and diversified health systems.

- Select issuers in the high yield space.

Underweight

- Speculative projects with weak sponsorship, unproven technology, or unsound feasibility studies.

- Senior living and long-term care facilities in saturated markets.

Credit headlines

In 2022, 36 states held gubernatorial elections, and 46 states held elections in at least one state legislative chamber. Entering the elections, 12 states had split government, with both parties sharing power with the executive and legislative branches. Single-party authority at the state level provides enhanced flexibility to address budgetary shortfalls if the economy enters a recession. At least two states will move to single-party control by Democrats (MI, MN), while tight gubernatorial races in Arizona and Nevada could flip those states to split-party control.

Voters in 37 states weighed in on 132 ballot measures, several of which have significant implications for the municipal bond market. Massachusetts’ Question 1 passed, which creates a new 4% tax on all income earned above $1 million. However, voters failed to approve California’s Proposition 30, which would have applied an additional 1.75% tax on income above $2 million. Increases to the minimum wage were passed in Nebraska, Nevada, and D.C. In addition, voters determined the fate of an estimated $66 billion in bond measures to finance capital projects. The proposed borrowing is among the highest volume of bonds up for a vote since at least 2009, according to IHS Markit. New Yorkers voted to approve the largest state bond measure—$4.2 billion general obligation bonds dedicated to climate-related projects. California had the greatest amount of local bond measures on the ballot, predominately for school improvement purposes.

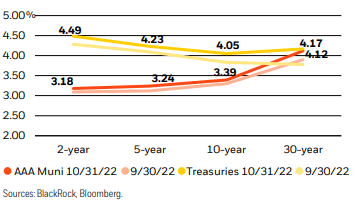

Municipal and Treasury yield movements

Municipal performance

Be the first to comment