JamesBrey/E+ via Getty Images

Mueller Water Products, Inc. (NYSE:MWA) is coming off a disappointing quarter as it hasn’t been able to solve its ongoing manufacturing issues at its brass foundry.

While the company said it expects to have that solved in the second half of 2023, the length of time it has already taken to do so suggests that is probably the best-case scenario.

However that works out, downward pressure on gross margin and adjusted EBITDA should continue, depending the how quickly MWA is able to get the foundry up and running.

Nonetheless, even with that strong headwind, the company will leave 2022 with a record backlog and pricing power, which is expected to boost net sales for full-year 2023 by 6 percent to 8 percent.

After dropping to a 52-week low of $9.895 on September 23, 2022, the share price of the company has done better than expected in my opinion, rebounding to a little under $12.00 per share before pulling back to trade in the mid-$11s.

In this article we’ll look at the company’s last earnings report for numbers and management commentary, as well as how the current challenges it faces will probably play out in 2023.

Latest earnings report

In its latest earnings report MWA reported mixed results in its fourth fiscal quarter, as demand for its products and services remain in play, but inability to solve its problems at its manufacturing issues at its brass foundry will continue weigh on gross profits, adjusted EBITDA, and free cash flow.

Foundry production in the quarter was down 35 percent from the prior month, and 50 percent down from the same reporting period of 2021.

Even so, revenue managed to climb to $331.4 million in the quarter, up 12.1 percent from the $295.6 million in revenue generated in the fourth fiscal quarter of 2021. Much of that is the result of the pricing power of the company.

Concerning gross profit, it came in at $85.6 million, down 0.8 percent from the $86.3 million in gross profit in the same quarter last year. Higher pricing helped offset lower volumes, inflation and the foundry issues. As it was, gross margin dropped by 340 basis points year-over-year.

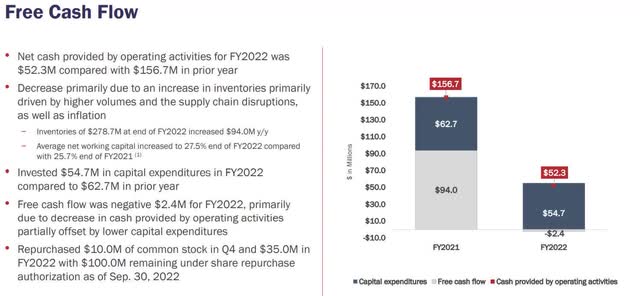

As for operating income, that plummeted from $27.8 million last year in the fourth fiscal quarter to $11.6 million in the fourth fiscal quarter of 2022. In that case, higher pricing wasn’t able to offset lower volumes, inflation, foundry challenges, SG&A expenses and a goodwill impairment. SG&A expenses of $63.6 million in the quarter were up 12.4 percent year-over-year. Adjusted EBITDA fell 15.4 percent to $38.6 million, with adjusted EBITDA margin dropping to 11.6 percent against the 15.4 percent in the same reporting period of 2021. For full-year 2022, adjusted EBITDA was $194.5 million, down $9.1 million or 4.5 percent, bringing about an adjusted EBITDA margin of 15.6 for the year. Net cash was slammed, plunging from $156.7 million in full-year 2021 to $52.3 million for full-year 2022. That was attributed to inflation, supply chain disruptions, higher volumes and boosting inventories.

For all of 2022, free cash flow was a negative $2.4 million. There was a discrepancy in the free cash flow reported in the transcription of the earnings call, which was cited as negative $0.08 million, against the $2.4 million reported in the company presentation. But when considering it was close enough to not make any difference when compared to $97.1 million in free cash flow for full-year 2021.

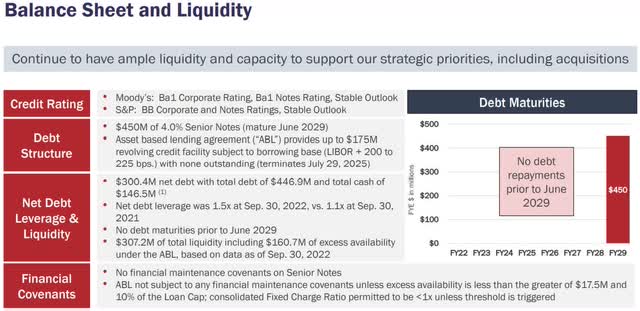

At the end of the fourth fiscal quarter the company held cash and cash equivalents of $146.5 million with total debt of $446.9 million.

Foundry issues

With the impact of continual performance issues at its brass foundry, it’s important to understand what’s going on there.

The overall problem was machine downtime, which the company expected to improve in August and September. Consequently, that resulted in melt production falling over 20 percent below estimates. Sequentially, foundry production fell 35 percent, pointing to things getting worse rather than better.

It’s puzzling as to why something like downtime has taken so long to fix and bring back to levels of 2021, or at least improve more on the uptime.

The major impact on the company is the decrease in brass shipments which brings about “under-absorbed labor and overhead costs.”

That also has resulted in a chain reaction in other parts of the company that had relied on supply from the foundry for brass parts. In response the company had to outsource some of the work which drove costs higher.

The company doesn’t expect to return to 2021 levels until the second half of 2023. If there are any glitches that extend that, it’s going to hit the company hard.

One positive for the company is that its new brass foundry is expected to begin the initial start-up phase later in the latter part of the current quarter. Longer term that should solve the foundry issues it now faces, but for the next three quarters it’s going to remain a headwind. Part of that could be mitigated once the new foundry begins production, as the company will focus on producing its “highest volume brass parts first.” Yet, as with anything in this type of business, this assumes production is brought on line in a timely manner. Again, longer term this should be the solution, but it’s going to continue to have a detrimental impact on the performance of MWA for at least two to three quarters, including the current one.

Conclusion

Even with the unfavorable headwinds the company has faced, it has managed to perform fairly well. A big part of that has to do with it operating in the municipal water sector, which provides it with support to the downside.

With the headwinds the company faces in the next three quarters in relationship to foundry issues, it’ll be instructive to see how anticipated weakening in housing starts will impact the top and bottom lines of the MWA.

Since end-uses must use the products offered by MWA, it has been able to pass on some of inflation on to its customers, but not to the level it was able to fully offset declines in gross profit, adjusted EBITDA and free cash flow.

Including the above-mentioned headwinds, inflation in freight, labor, purchased materials, raw materials, tariffs and utilities remain another challenge the company will have to solve if prices continue to rise over the next several months or longer.

Supply chain disruptions have also played a part in increasing overall material costs. But the company said continual supply chain and labor availability challenges may start to improve, it isn’t expected to have a significant impact on the company until 2024.Even with all the headwinds, MWA has managed to modestly increase revenues, but I think the company is going to continue to struggle on margins, profits and free cash flow until, at earliest, the third calendar quarter of 2023. If the company isn’t able to solve its foundry issues, and the new facility takes more time than expected to ramp up, it’s going to be a tough haul for shareholders over the next year or so.

That said, since most of the bad news appears to be priced in and expectations lowered, those getting in at a good entry point and low cost basis, could do very well if holding for the long term.

While nothing is for sure, after recording its 52-week low in September 2022 and getting a bounce afterwards, and taking into account the headwinds and management commentary, I don’t see any near-term tailwinds that will jumpstart the share price of the company over the next couple of quarters, as far as the visibility we have today.

Further out, I think patient investors are going to be rewarded once things start to improve.

Be the first to comment