art2002

Above: Madison Square Garden, a legendary venue relocated many times in Manhattan, has its own subway stop. Big sports events have been in its DNA for 100 years.

Madison Square Garden Entertainment Corp. (NYSE:MSGE) (“MSG”) and its affiliated companies, to quote Churchill, are “an enigma wrapped in a mystery.” That is because many observers can make the case that live entertainment, pro sports, TV network sports, high-end dining, and live theaters are related businesses in that they all share a common objective: the generation of live bodies or eyeballs in greater and greater numbers paid with discretionary income dollars from consumers.

They also share the need to present ever-compelling content the core of which is passionate fandom linked to high-density tourist visitation cities. The test of management is this: are their locations in tune with their product? The answer is yes. MSGE nodes are in New York, Chicago, Las Vegas, Los Angeles, London and Singapore. Management gets an A.

Above: The Garden sits cheek by jowl with offices loaded with high-end information workers who fill the building no matter how the teams are doing.

The next question: is their product consistently appealing to the markets most inclined to the “You gotta be there” segment of the consumer sector? Here too, the answer is yes—to an extent– depending on a post-pandemic worldview of consumers.

But the final question, the one investors most care about, is this: what can you make of it all to determine value?

Mr. Market has assigned at writing a $2.22b market cap to the company. At the same time, MSG’s most valuable assets, which essentially are off the table, are the two pro sports teams owned by James L. Dolan: The New York NBA Knicks and the New York NHL Rangers.

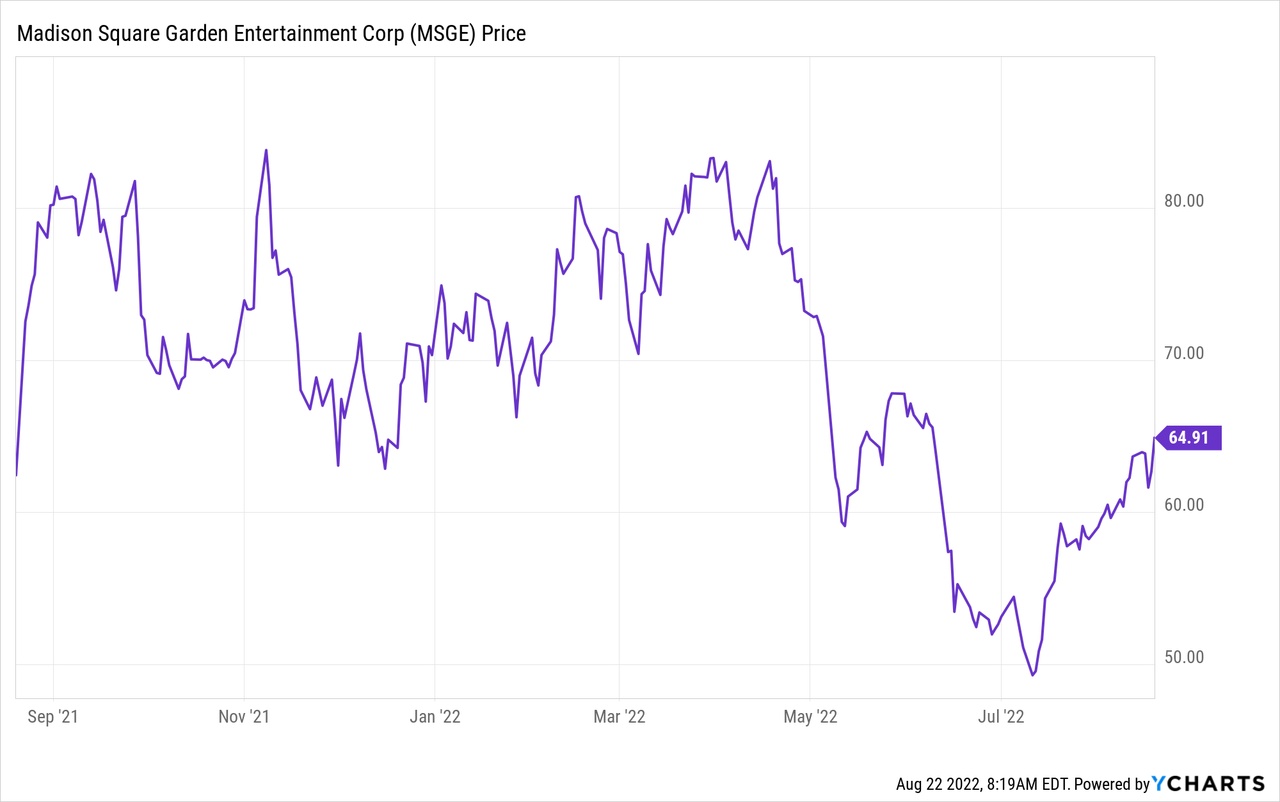

Price at writing:

Madison Square Garden Entertainment Corp. (MSGE): $64.9

Madison Square Garden Sports Corp. (MSGS): $173.86

My buy signal is on MSGE, since the price for the asset base seems to us to be more attractive for a post-IPO head of steam with the Sphere getting rave reviews early in its life. That will ignite interest in the shares.

The heavyweight new MSGS with all the present asset value hidden within the teams and revenues they reliably generate, would it seem to me, move slower, in a market that has become so dependent on what-if news flow. That is a clear “it depends” post-pandemic issue.

According to Forbes’ latest estimates, the Knicks are worth $5.5b, and the Rangers $2.2b, wrapping up a hefty little theoretical package of $7.7b, or more than 3X the valuation of MSGE. The Knicks generate $300m in revenue, the Rangers $95m. Both franchises are profitable, benefitting from the singular mint value of where they play their home games: Madison Square Garden. What is most intriguing about both teams is this: good seasons or disastrous ones, their live gates are always sold out, every game as a reflection of the passionate fandom of the area.

Add to that the short footfall from the mass of Manhattan’s upscale workforce for whom their games present a business/social event above all, and you have a real sitting pretty status. Every game sold out.

But none of this is reflected as a value in the stock of MSGE, essentially the corporate landlords of the two teams. The teams themselves are owned by MSG Sports Corporation’s James L. Dolan, who it is clearly understood now, has no intention of selling them.

And who could blame him? So the value of these two pro sports assets lies principally within the business of the MSGE TV Networks which broadcast their games. And that’s all about ratings and advertising, merchandise sold at the Garden, etc.

(The team values are held by Dolan (71%) as part of Madison Square Garden Sports Corp. (MSGS) whose stock trades at $173 a share).

So for MSGE let’s separate its businesses this way:

Madison Square Garden: It’s no exaggeration to refer to the Garden as a global mecca of sports. Its legacy runs decades deep as the home of famed boxing championships, pro and college sports and in later years, concerts. It is no accident that Billy Joel makes the Garden his twilight-career multiple-appearance home. He knows his fan base mega-power is New York.

The question here is: will the Garden’s split up goal produce accelerated revenue streams that materially enhance its value? The answer probably is no. There are possibilities without question.

The poorly performing NY Knicks NBA team can get a vitamin shot from either the draft or finding top shelf free agents and make the playoffs. That can translate into bonus playoff live attendance and TV dollars quickly. But that’s just a possibility, far from a reality at this moment. The NHL Rangers made a valiant stab at championship shot that blew extra cash to profit.

Will live attendance at MSGE’s venues like Radio City Musical Hall, the NY Beacon Theater, The Chicago Theater, the Christmas Spectacular at Radio City (expected to expand to full capacity this year) produce strong gains in live attendees as covid-19 begins its slow, but stop-start fade in the minds of theater goers?

Thus far, MSGE’s FY22 numbers indicate the bodies are beginning to return in healthy numbers. You have clear pent-up demand among that part of the populace to whom the rising costs of tickets are not an immense barrier. So that can clearly justify some optimism about the earning power of these venues going forward.

Tao Group: In brief, these are 70 destination-type dining outlets in New York, Las Vegas, Chicago, Los Angeles, London, and Singapore. These are not the type of eateries that can simply spread out tables and chairs on sidewalks outdoors and hope to do enough business to compensate for those people still too antsy to go inside. And for those who do feel safe inside, will they continue to spend at the rate of inflation menus price madness in restaurant dining?

Or will the forming recessionary trends bite places like Tao first? The answer is unclear this early. The value of the Tao business will clearly be challenged—by the extent to which tourism comes back. Positive signs abound in Vegas. This is clearly a time will tell dice roll.

The Sphere is the ballgame

Below: The gigantic orb will seat 20,000 when it opens late next year and redefine the entertainment experience in Las Vegas–or will it?

MSG

The big test of MSGE management and asset allocation decisions is the move to place adjacent to the Las Vegas Venetian a massive 20,000 360-degree viewing venue. It’s a massive orb with state-of-the-art entertainment technology that makes its peers look like nickelodeons to some degree. The $2b investment is in the right place for certain. Less certain will be the state of public attendance businesses when it opens late next year.

That is the big bet. Firstly, there is no shortage of seats in entertainment venues in Las Vegas. And filling those that are already in place still requires massive marketing by top-tier casino operators through rewards memberships in the tens of millions to drive attendance. We presume MSG has deals in place to work with casinos and tap those millions of members.

Until now, two kinds of entertainment have worked in Vegas. Been there, done that, in my own casino management days—it’s not easy. Little has changed since. As always, it is the attraction of the star or stars that generate the bodies. Unless there is pre-existing, demo-correct– huge international fandom for an act, you are headed for disaster.

Alternatively, you need the jaw-dropper as we once called them, i.e., spectaculars that evoke the “wow” factor. Among them were the great Siegfried and Roy at the Mirage, as an example (in my day, we did the magic act of David Copperfield).

For all its techno-spectacle, its stunning sense of immersion into new worlds that play to its strength in generating bodies, The Sphere will need to open to a real jaw-dropper to get a firm foot down on the Vegas tourist firmament. Its location is excellent. Its design is a one-only for certain. What investors most need to know above all is what its first year’s programming will offer that Vegas has not yet seen the likes of. It’s that simple.

MSG Networks

Regional sports networks whose dominant content are the games of pro teams and a sprinkling of high visibility college games obviously depend on ratings and the surrounding content of sports blah blah shows. Fandoms both in NBA and NHL teams do not readily grow. If anything, one of the challenges ahead for both leagues is teasing out fresh fandom from younger generations addicted to home made social media fodder. Yet it is safe to say that current levels of fandom for both the Knicks and Rangers can remain steady, perhaps aging a bit, but viable in terms of supporting viewership on MSG Networks.

So you have sports fans, concert goers, tourist diners, TV viewers thrown together as the core customer base for two newly formed public company presented to investors. Their commonality of purpose makes some sense. The ongoing hope is that post-pandemic, they will materially benefit from a return to live entertainment and dining experiences, thus producing earnings to gladden the hearts of investors.

Their challenge lies in their lack of defense as it were, against a forming recession, ongoing inflationary pressures upping prices and the degree of lingering fear in many demographic segments of visiting indoor spaces with great crowds.

MSG Networks can’t alone carry the revenue and EBITDA baggage of a new company. The Tao Group will be fighting on many fronts in terms of menu price inflation, tourist footfall, and increasing sentiment to be happy with take-out delivery.

But overall there is a coherence here not obvious for investors in the current structures. All the components’ futures will lie in the prospects of a recovery in the consumer discretionary sector spend whether for attending entertainment or dining in tourist cities.

So, in a potential split-up, you will own one company comprised of The Sphere and Tao Group—and another with the Garden, the theaters, the networks in another. No matter how you attempt to size this up as two unique propositions to investors, you come up in our view with the prospect that is positive. In other words, both companies will have to prove their worth without any crutches from the businesses of the other.

And will be far easier to understand and value.

I believe once these assets are separated, you will see a clearer way to value them that will ride entirely on what the consumer discretionary world will look like over the next three to five years.

The company now:

Fiscal 2022 (June) TTM

Revenue: $1.7b all units merged and absorbed.

Operating ( loss ) $102.7M

ADJ Op. income: $133M VS. 2021 ($188.2M)

By segment:

Live venues: $655m.

MSG Networks: $608m.

Tao Group: $484.9m

Other: ($23.9m).

The clarity in the split we see is this: the spun-off Tao Group linked with the coming Sphere revenue, probably not to be a fully operative revenue producer until fiscal 2023 in June of that year. So investors are betting on a strong recovery of tourism, as both the Sphere and the Tao Group are heavily skewed by location and attractions as tourist properties.

The MSG sports group will continue to benefit from the stable sports and theater businesses, the MSG networks and landmark Madison Square Garden’s iconic brand value in those arenas.

So you will have two bets: one, clearly built off sports and live attendance, the others linked to a tourist-facing business in dining and spectacular theater.

So instead of one bag of diamonds few can see, you’ll have one diamond necklace and one bracelet in settings that complement them. The post-pandemic world will set the price per karat.

Be the first to comment