niphon

Investment Thesis

MSC Industrial Direct (NYSE:MSM) has seen robust demand in the fiscal year 2022 and its daily sales growth outperformed the Industrial Production index by ~600 bps. The company’s “Mission-Critical” strategy is helping its sales growth and margin improvement, and the initiatives undertaken under this strategy are expected to continue helping the company post above market growth rate in the future. Further, the improvement in supply chain constraints, price increases, and structural cost reduction should drive the company’s margins, looking forward. The valuation is also attractive, making the stock a good buy.

MSM Q4 2022 Earnings

MSC Industrial reported better-than-expected Q4 22 results earlier this month. The Q4 22 revenue of ~$1.02 billion (up ~23% Y/Y) was better than consensus estimates by $20 million while adjusted earnings per share stood at $1.79, a ~42% Y/Y increase and slightly better than the consensus EPS estimate of $1.78. The company’s revenue growth was driven by healthy end-market demand as well as company-specific initiatives to drive growth. While its gross margins were under pressure due to inflationary headwinds, adjusted operating margins improved due to cost reduction initiatives. Strong revenue growth coupled with improved margins helped MSM post strong EPS growth.

Revenue Outlook

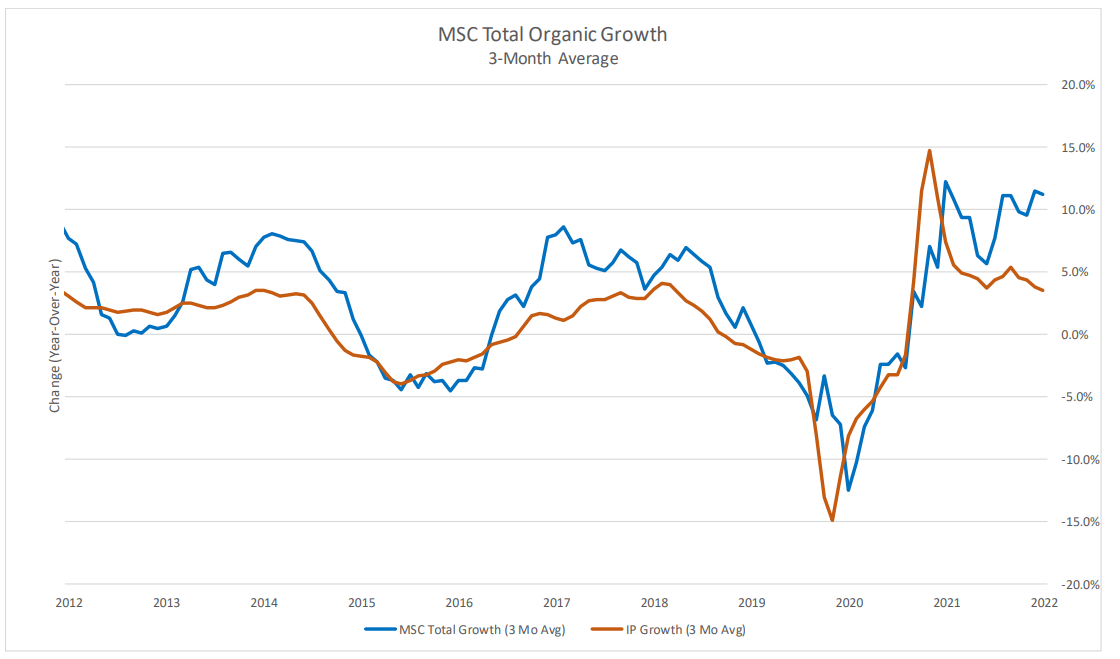

With the economy reopening, MSM is benefitting from a recovery in the demand from its traditional manufacturing end markets. Approximately 70% of the company’s sales come from the manufacturing sector, and the Industrial Production (‘IP’) index is a good benchmark to gauge end-market growth for the company. The IP index has seen good growth in recent years, primarily supported by the lifting of government-imposed lockdown-related restrictions.

While recent interest rate hikes have started negatively impacting some consumer-facing industries, the company continued to enjoy healthy order levels last quarter and its daily sales increased 14% Y/Y in Q4 22. For the full fiscal year 2022, the company’s daily sales were up ~11% Y/Y which outperformed the IP index by roughly 600 bps. This was supported by the pricing increases, bolt-on acquisitions, and successful execution of the company’s growth initiatives under the “Mission-Critical” strategy.

MSM Sales Performance Vs. Industrial Production Index (MSM’s Investor Presentation)

MSC Industrial Direct Co. has implemented its Mission-Critical strategy to accelerate market share gains and improve profitability through the fiscal year 2023. With this strategy, the company continues to invest in its market-leading metalworking business, introduce value-added services, expand vending, Vendor Managed Inventory (‘VMI’), and in-plant solutions programs, and diversify customers and end markets.

Management is seeing good success in its metal working business and witnessing a high customer retention rate and new growth opportunities through a combination of broad and deep product offerings, an extensive network of technical metalworking expertise, and digital innovation to drive profitability and cost-saving for its customers. In its recent earnings calls, management gave an interesting example of how the company is using its metalwork expertise to help its customers reduce waste. Below is the relevant excerpt:

In many cases, we also help our customers to reduce waste, helping them achieve their sustainability goals. A recent example illustrates this. We just won a proposal to supply cutting tools and broad line MRO to a component producer for the energy industry. In doing so, we identified over $200,000 in annual savings at just one of their many locations. The savings come in the form of increased metal removal rates, reduced weights, carbon recycling and reuse opportunities, and we also found safety improvements. As a result, the customer has now asked us to implement the same process at a different location where we’ve since identified another $300,000 in savings.

The company’s deep expertise, and differentiated and technologically advanced products and services should support revenue growth.

Another growth driver for the company is its solutions business, which includes vending and in-plant projects. Both of them continue to gain traction and add to market share gains. Vending signings were up 21% Y/Y in the fourth quarter, and vending sales now represent 15% of total sales. Likewise, signings increased by 42%Y/Y in the in-plant business, and this business now represents 11% of total company sales. The increased number of signings from both of its projects indicates healthy demand in the market, which should support revenue growth over the upcoming years.

The company is also focused on selling its combined portfolio of products and services to increase its wallet share through ancillary products. A good example of it is MSM’s CCSG business in which it provides an outsourced vendor-managed inventory service for the C-Part consumables that keep plants running. These are the critical products for MSM’s customers and carry high margins. Since MSM is taking over this difficult-to-manage category that can shut down a plant if not available, good execution on MSM’s part also results in high retention rates.

In addition, the company is also focusing on E-commerce sales. E-commerce sales grew by 20% in the fourth quarter on an average daily sales basis and reached roughly 63% of the total company sales, up roughly 300 bps from last year. Looking forward, I believe, through its one-day delivery and two-day delivery systems (just-in-time delivery system), the company should be able to generate increased revenue growth from its e-commerce segment.

Further, the company is also focusing on increasing its public sector business and diversifying its client base. Over the past few quarters, the company is building momentum in its government business, including several project wins, such as the 4PL contract serving U.S. marine bases. This has helped the company’s average daily sales for government business increase ~30% Y/Y last quarter.

Apart from these organic growth initiatives under the company’s Mission Critical strategy, the recent price increases to offset inflation as well as inorganic growth initiatives are also helping MSM’s revenues. The company is investing in increasing distributors of metalworking tools and OEM fasteners & components. In the fiscal year 2022, MSC Industrial Co. acquired Tower Fasteners and Engman-Taylor, and both are tracking near their expected performance targets.

Looking forward, the macroeconomic environment remains mixed for the company. On the one hand, rising interest rates are slowing the economy. On the other hand, easing supply chain constraints and reopening are helping industrial companies. Despite a mixed macro environment, management has given between 5% and 9% average daily sales growth guidance for FY23. I believe the company can achieve this target given company-specific initiatives and growth drivers discussed above as well as pricing initiatives.

Margin Outlook

The gross margin for the fourth quarter of 2022 was 41.9%, down 100 bps sequentially and down 10 bps year-over-year. The sequential decline includes approximately 60 bps headwind from the seasonal product mix of summer goods, headwinds from the accelerating growth in the low-margin public sector business, and a 40-bps impact of the recent acquisitions. This impact was partially offset by a favorable price-cost spread.

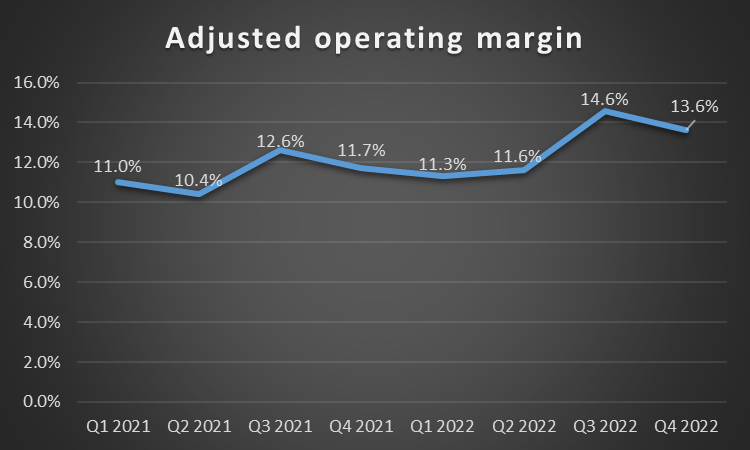

MSM Adjusted Operating Margins (Company Data, GS Analytics Research)

Despite gross margin headwinds, the adjusted operating margin was up 190 bps Y/Y in the fourth quarter and up 140 bps Y/Y in FY 2022. In addition to helping the company’s revenue growth, the Mission Critical strategy is also helping the company improve its operating margin by reducing operating expenses and improving productivity. Management reduced operating expenses as a percentage of sales by 200 basis points in the fourth quarter and, for the full year 2022, the company achieved a structural cost reduction of $85 million. Management has a goal of $100 million in structural cost reduction by the FY23 end, and we can expect another $15 million in structural cost take-outs this year.

In the last few years, supply chain disruptions and labor unavailability have been the major headwinds for the company’s margin. These disruptions have resulted in an inflationary business environment with increasing freight, fuel, and labor costs. The company has been implementing price increases to offset the impact of cost inflation. The recent price increases coupled with improvement in supply chain constraints should help turn the company’s price/cost further positive this year. This coupled with structural cost reduction through Mission Critical strategy makes me optimistic about the company’s margin prospects.

Valuation

MSM is trading at 13.31x FY23 (ending August) consensus EPS estimate of $6.10. This is a discount to its 5-year average P/E forward of 15.54x. The company valuation is also at a discount compared to Fastenal’s (FAST) FY23 P/E of 24.64x and Grainger’s (GWW) FY23 P/E of 18.13x. Given the company’s improved execution and the recent outperformance versus Industrial Production Index, I believe MSM stock’s P/E can see a re-rating. This coupled with good revenue growth and margin improvement prospects makes me bullish on the company.

Be the first to comment