Scott Kleinman/DigitalVision via Getty Images

Introduction

In August 2022, I wrote a bullish SA article about Canadian diamond mining company Mountain Province Diamonds (OTCPK:MPVDF) in which I said that it looked cheap based on fundamentals but that I was concerned that the uncertainty surrounding its debt situation was pushing the market valuation down.

Well, the company bought back $16.9 million senior secured loan notes below par in Q3 and recently announced a term sheet for a $195.9 million private bond instrument to replace $190.0 million aggregate principal amount of existing notes. Also, Mountain Province Diamonds booked revenues of $83.3 million in Q3, which was the best result in its history. However, the strong US dollar in September pushed net income into the red. Let’s review.

Overview of the recent developments

In case you haven’t read any of my previous articles about Mountain Province Diamonds, here’s a short description of the business. The company owns 49% of the Gahcho Kué diamond mine in the Northwest Territories, with international diamond major De Beers holding the remaining 51%. De Beers is the operator of the mine and Mountain Province Diamonds has more than 107,000 hectares of claims and leases that surround the project which are known as the Kennady North project. Gahcho Kué is among the top 5 largest diamond mines in the world with an annual output of about 7 million carats. The life of mine is close to 7 years.

Mountain Province Diamonds

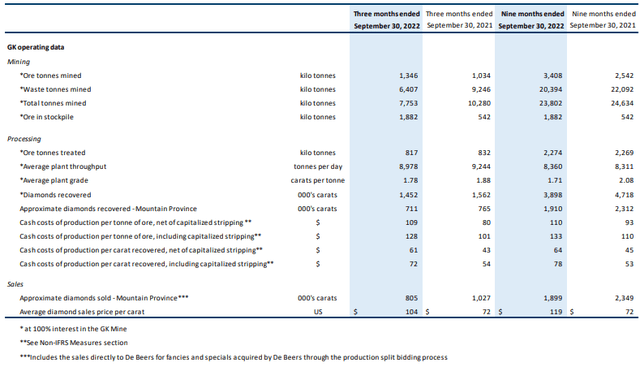

Turning our attention to the Q3 results, output continues to recover to pre-COVID-19 rates. Gahcho Kué’s diamond production rose by 15% quarter on quarter to 1.45 million carats while ore tonnes treated inched up by 7% to 816,201. These rates are still below the levels of Q3 2021 but there was a significant increase in ore tonnes mined which led to a 39% jump in the ore stockpile to almost 1.9 million tonnes.

Mountain Province Diamonds

As you can see from the table above, total tonnes mined remain a challenge and Mountain Province Diamonds revealed during its Q3 2022 earnings call that there were issues with the availability of heavy equipment operators in north Canada. Despite the improvement of production rates compared to Q2 2022, cash costs of production per tonne of ore, net of capitalized stripping, rose to C$109 ($82) from C$103 ($78). The main reason behind this was the consumption of more expensive fuel.

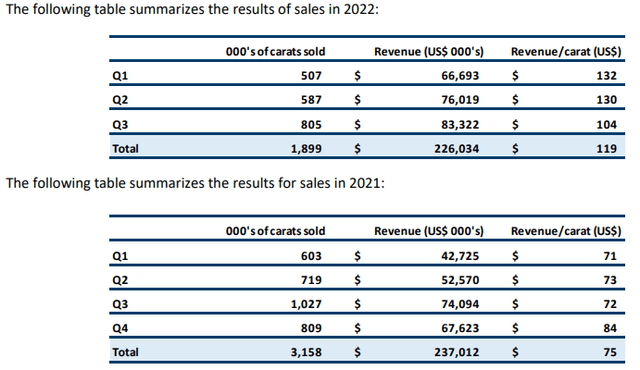

The volume of carats sold is also recovering to pre-pandemic levels but Q3 saw a significant decrease in revenue per carat in US dollars. Nevertheless, supply on the global market remains tight and diamond prices are still much higher than pre-pandemic levels. This enabled Mountain Province Diamonds to book the highest quarterly revenues in its history, with a total of $83.3 million.

Mountain Province Diamonds

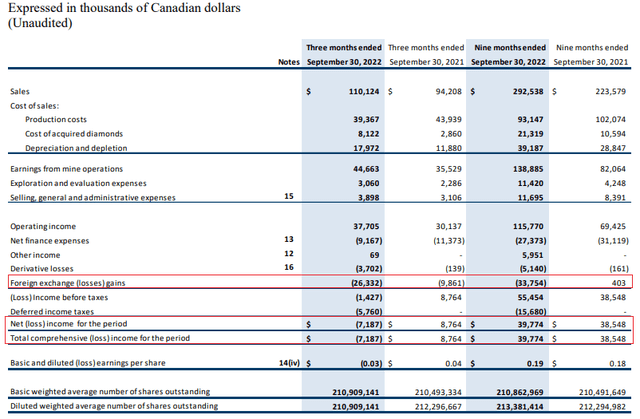

EBITDA, in turn, came in at C$54.1 million ($40.8 million). Unfortunately, the US dollar strengthened significantly against the Canadian dollar during September, and this led to a C$26.3 million ($19.8 million) unrealized foreign exchange loss in Q3 which pushed the net income into negative territory.

Mountain Province Diamonds

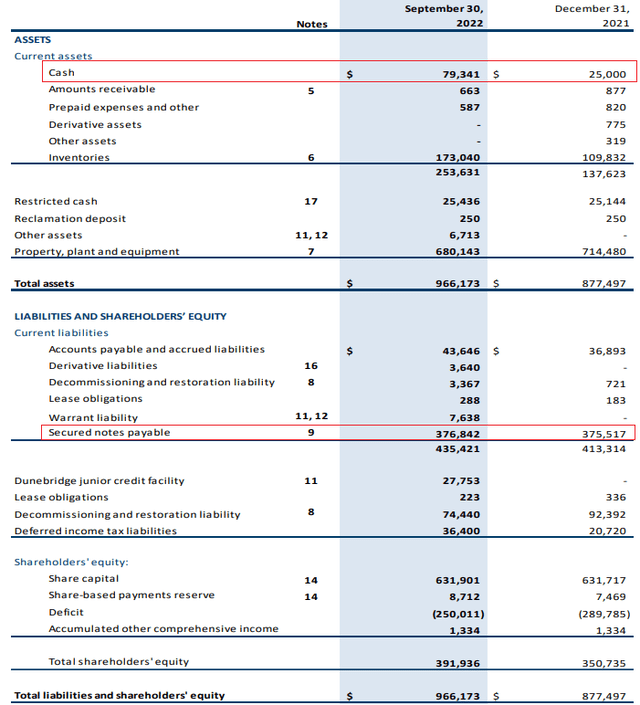

In my view, the large foreign exchange loss casts an undeserved shadow over a strong quarter for the company from a financial perspective. For example, Mountain Province Diamonds bought back $26.9 million senior secured loan notes in the first nine months of 2022, but the book value of the notes in Canadian dollars rose. This could give the impression to potential investors that the company isn’t doing well during a time when it has record margins and is paying off debts. Mountain Province Diamonds closed Q3 2022 with C$79.3 million ($59.8 million) in cash and purchased $15 million of secured notes payable shortly after the end of September. Cash from operating activities was C$103.5 million ($78 million) for the first nine months of 2022 and C$59.4 million ($44.8 million) in Q3 alone.

Mountain Province Diamonds

Speaking of the notes, they were the main reason I was avoiding investing in Mountain Province Diamonds thus far. You see, their U.S. dollar balance was $258 million and they expire on December 15. As you can imagine, they pose a significant going concern risk for the company, but it seems that the issue is likely to be resolved in the coming weeks. October 27, Mountain Province Diamonds announced that it executed a non-binding term sheet with certain the holders to exchange $190 million aggregate principal amount of existing notes for around $195.9 million aggregate principal amount of new notes with a three-year term. The new notes will be secured by the same assets and shareholders will vote on the deal on December 1. The new notes will bear an interest rate of 9% which is 1% higher than the current ones but I think it’s a pretty good level considering the current challenging macroeconomic conditions. The remaining December 2022 notes will be retired using cash on hand and in my view, this deal will solve the short-term liquidity issues of Mountain Province Diamonds.

Looking at the future, the company expects Gahcho Kué to produce 5.6 – 5.8 million carats for the full year with production costs of C$76 ($57) – C$80 ($60) per carat recovered. These targets seem easily achievable, and I think it’s likely that the mine will be back to an annual production rate of 7 million carats by the end of 2023.

Turning our attention to the global diamond market, it seems likely that prices will remain elevated for the foreseeable future. High inflation is hurting demand in the USA and Europe but there is likely to be significant increase in demand in China as COVID-19 lockdowns gradually end. In addition, diamond supply from Russia is still disrupted following the invasion of Ukraine due to sanctions imposed on the country.

Looking at the risks for the bull case, I think that there are two major ones. First, I could be too optimistic about future diamond prices. Another wave of COVID-19 in China or an end of the conflict in Ukraine could sent them tumbling. Second, the debt refinancing transaction is not a done deal yet and it has to be approved by shareholders. It’s not 100% guaranteed that it will go through.

Investor takeaway

Although the financials in Canadian dollars might not show it clearly, Mountain Province Diamonds had a strong quarter and its cash balance increased significantly. Diamond prices remain high and Gahcho Kué is ramping up production to pre-pandemic levels. In addition, the company has a deal on the table for the refinancing of its debt and I think that a green light from shareholders could be a major catalyst for the share price.

Overall, I think that Gahcho Kué is a good mine that is humming in today’s diamond market. According to a technical report from March 2022, the after-tax net present value [NPV] attributable to Mountain Province Diamonds stands at $759 million.

Be the first to comment