Pranita Thorat

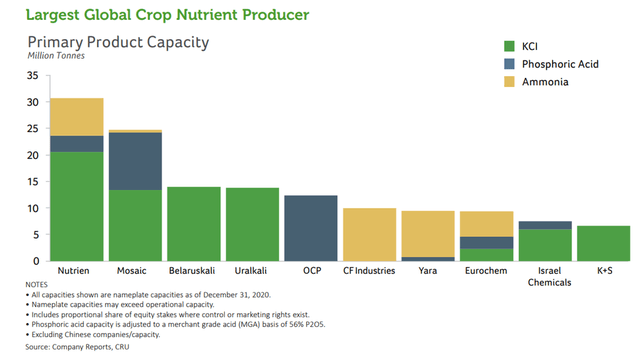

The Mosaic Company (NYSE:MOS) is one of the largest companies headquartered in Tampa, Florida, and is a world leader in the production of phosphate and potash fertilizers. However, Canadian competitor Nutrien (NYSE:NTR) has a large production capacity of phosphate, potash, and nitrogen fertilizers and a portfolio of seeds and crop protection products that bring in billions of dollars a year. Both companies have growing net income and margins, and lower financial ratios than most companies in the materials sector. But, despite the attractiveness of The Mosaic Company and Nutrien, one of them is more promising in the long term.

Financial position of Mosaic vs. Nutrien

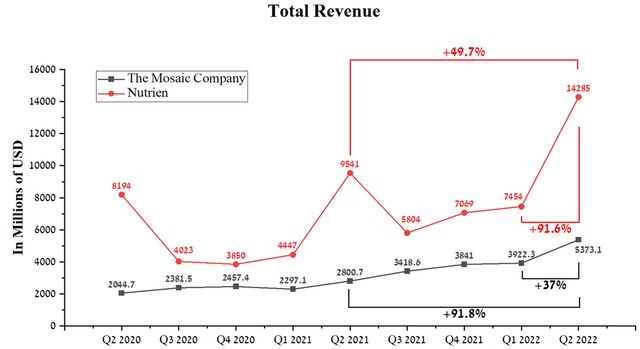

The Mosaic Company’s revenue was $5,373.1 million in Q2 2022, up 37% QoQ. At the same time, Nutrien showed stronger dynamics, which earned $14,285 million in Q2 2021, up 91.6% compared to Q1 2022.

Source: Author’s elaboration, based on Seeking Alpha

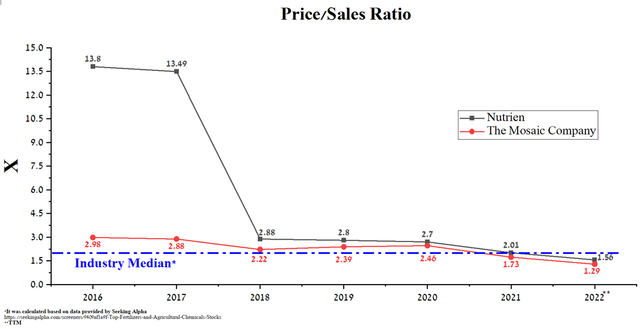

The price/sales ratio of Mosaic and Nutrien is lower than the average for the fertilizer and agrochemicals industry, indicating that both companies are undervalued by Wall Street. However, Nutrien’s ratio was 1.56x, which is 17.3% higher than Mosaic’s, showing that the US company is the more undervalued asset in the industry.

Source: Author’s elaboration, based on Seeking Alpha

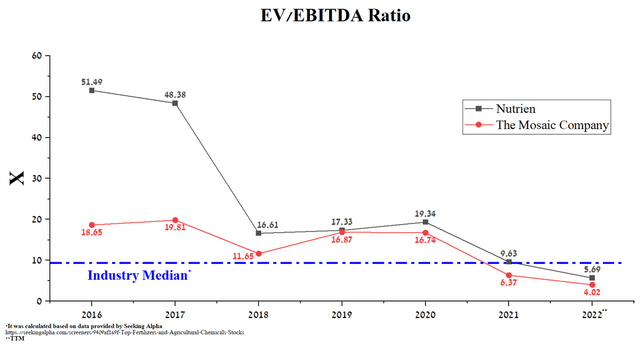

Another key financial metric is the EV/EBITDA ratio, which is an effective tool for comparing companies in the same industry as it is independent of capital structure. Both companies’ ratios are lower than the industry average, but Mosaic’s EV/EBITDA ratio was 4.02x at the end of Q2 2022, 41.5% less than Nutrien’s. This is mainly due to the large debt of the Canadian company and higher price increases for phosphorus fertilizers, which Mosaic specializes in.

Source: Author’s elaboration, based on Seeking Alpha

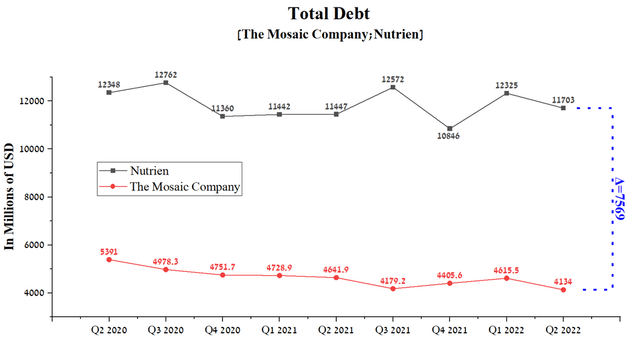

Nutrien’s total debt is $11,703 million at the end of Q2 2022, down 5% QoQ. While Mosaic’s total debt is $4,134 million, down 10.4% from the previous quarter. However, the difference in total debt between the companies is about $7.6 billion, which makes Mosaic more attractive due to lower debt service costs.

Source: Author’s elaboration, based on Seeking Alpha

Dividend and buyback program of Mosaic vs. Nutrien

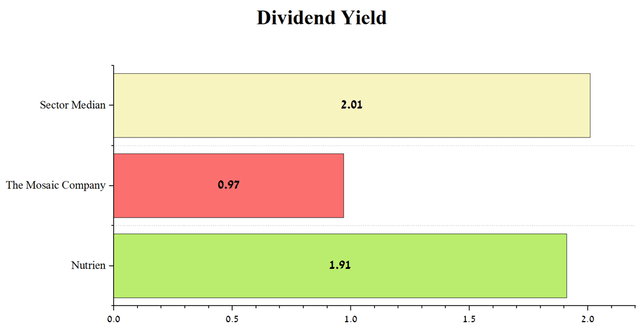

Nutrien’s dividend yield is 1.91%, slightly below the sector average. However, Mosaic has a dividend yield of 0.97%, which is extremely low given the growth in net income, and thus reduces the investment attractiveness of this company in the eyes of long-term investors seeking to find an asset that brings a stable and high cash flow.

Source: Author’s elaboration, based on Seeking Alpha

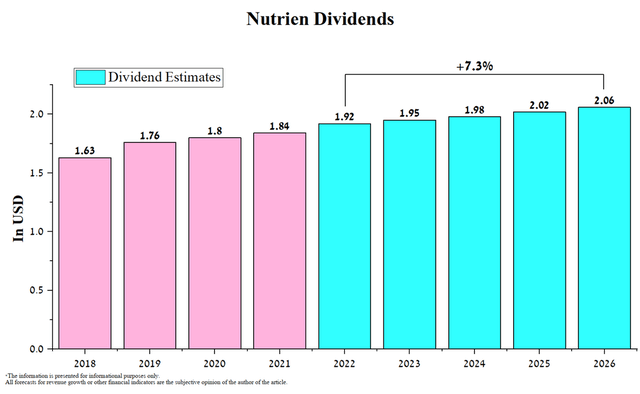

The management of the Canadian company has a policy of increasing dividend payments by about 4 cents a year, and I believe that the company will maintain this pace until at least 2026. As a result, according to my estimate, Nutrien investors will receive $2.06 per share by 2026, which is 7.3% more than the current value.

Created by author

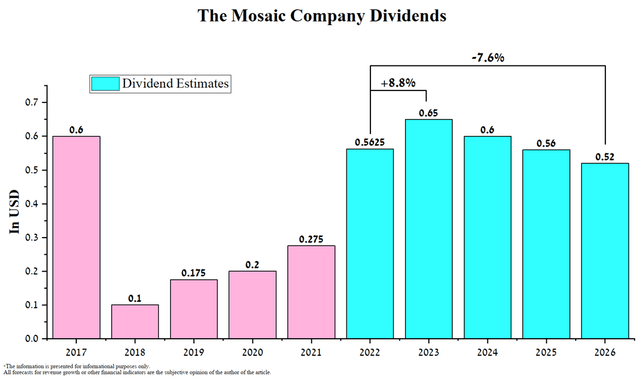

Thanks to the growth in cash flow in 2022, Mosaic made a significant increase in dividend payments compared to previous years, and for 2022 investors should receive $0.5625 per share, which is almost equal to the level of 2017. However, unlike Nutrien, I believe that the company will slightly reduce its dividend payout by 2026 due to the reduction in production volumes and the normalization of fertilizer prices.

Created by author

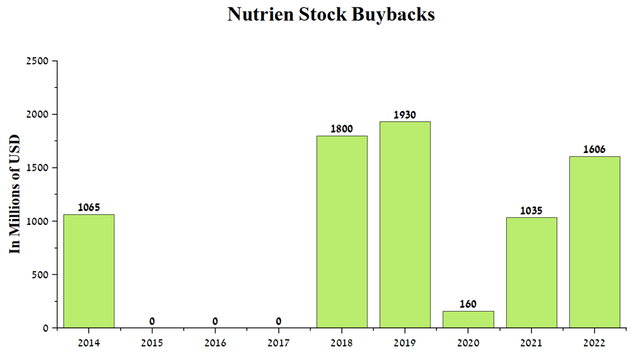

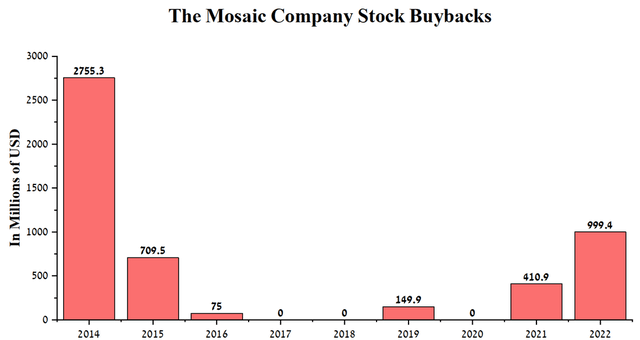

In order to increase investment interest and maintain share prices during a period of high volatility caused by news of the Fed’s interest rate hike and statements by Jerome Powell, who is ready to take more aggressive steps to reduce inflation in the US, both companies increased their buybacks. In H1 2022, Nutrien bought back $1.61 billion in shares, and the remaining amount of the company’s share repurchase authorization is about $3.39 billion through 2022.

Source: Author’s elaboration, based on Seeking Alpha

The Mosaic Company, with fewer financial resources, repurchased shares in the first half of this year for an amount that is 37.8% less than its Canadian competitor, but at the same time, the remaining amount of the company’s share repurchase authorization is slightly more than $1 billion during 2022.

Source: Author’s elaboration, based on Seeking Alpha

Thus, Nutrien’s management has the greater financial capacity to maintain the company’s capitalization during a period of increased market volatility by reducing the number of shares outstanding relative to Mosaic. Let’s move on to three factors that, in my opinion, have a significant impact on the business of fertilizer producers and exporters.

Location of ore mining and fertilizer production

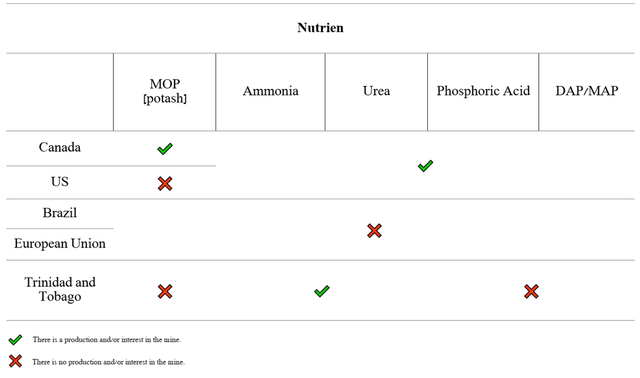

The problems of the European Union open up new opportunities for fertilizer producers outside the region. Nutrien and Mosaic are prime candidates for huge profits from European competitors’ troubles. Both companies operate in South and North America and maintain production rates to meet global fertilizer demand and take advantage of higher fertilizer prices. Nutrien has six potash and phosphate operations and nine nitrogen production facilities in North America and Trinidad, placing the company among the largest producers of nitrogen and potash products in the world. The multibillion-dollar increase in revenue is leading to a more aggressive policy of expanding business through the construction of new plants or the expansion of existing ones. On May 18, 2022, Nutrien announced the construction of a clean ammonia plant that will use innovative technologies to reduce carbon emissions, which is especially important after the passing of the Inflation Reduction Act. The construction of this plant is due to begin in 2024 in Louisiana with a planned capacity of 1.2 million tons, which could theoretically generate additional billions of dollars in revenue per year.

Source: Author’s elaboration, based on quarterly securities reports

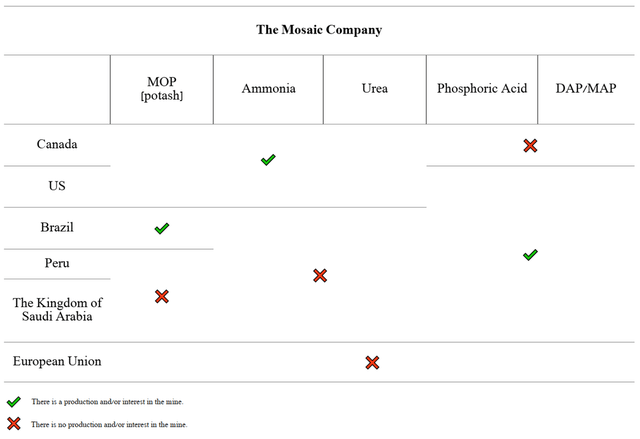

Despite the similarity in the geography of mining and fertilizer production between the two companies, Mosaic has mines and plants in Brazil and Peru, which were acquired under a deal worth a total of $2.5 billion with Vale S.A in 2016. The business in South America includes five phosphate rock mines, four chemical and fertilizer plants, and one potash plant in Brazil, and the company also owns a 75% interest in a Peruvian phosphate mine.

Source: Author’s elaboration, based on quarterly securities reports

Thus, Mosaic and Nutrien have a widely diversified network of ore mining and subsequent production of fertilizers needed to increase crop yields.

Fertilizer Price Trends

Mosaic produces potash and phosphorus fertilizers, while Nutrien has a more diversified business that also includes nitrogen products. Nutrien has a production capacity of 7.1 million tons of ammonia per year, which is then used to produce urea, urea ammonium nitrate (UAN). Nitrogen fertilizers are necessary for crops, but fruit crops and root vegetables, such as tomatoes, carrots, and beets, depend on them to a greater extent. Moreover, nitrogen-containing fertilizers must be applied to the soil every year, as they are hydrolyzed in it, releasing gases such as carbon dioxide, ammonia, and nitrogen oxides. While phosphorus and potash fertilizers do not have this disadvantage and their application to the soil is less frequent and will depend on the concentration of potassium, monophosphate, and diphosphate ions in it.

Nutrien Fact Book

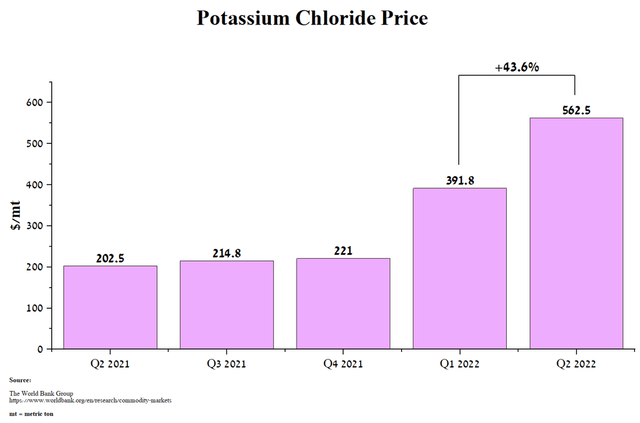

For both companies, the main production volumes are potash (potassium chloride or KCl), which continues to rise in price from quarter to quarter. According to the World Bank, its price was $562.5 per ton for the 2nd quarter, which is 177.8% more than in the previous year.

Source: Author’s elaboration based on data from the World Bank Group.

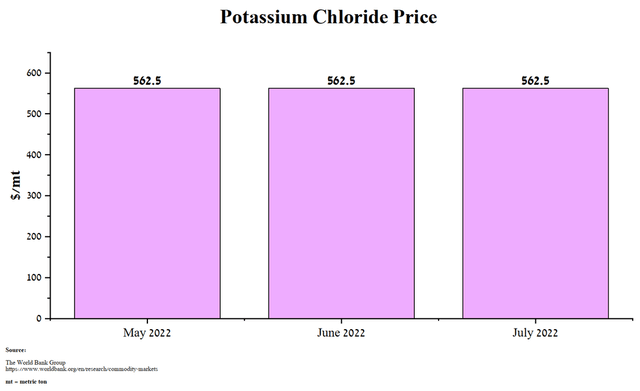

Moreover, potash prices have remained stable over the past three months, despite seasonal declines in fertilizer imports by India and Brazil between April and June of each year.

Source: Author’s elaboration based on data from the World Bank Group.

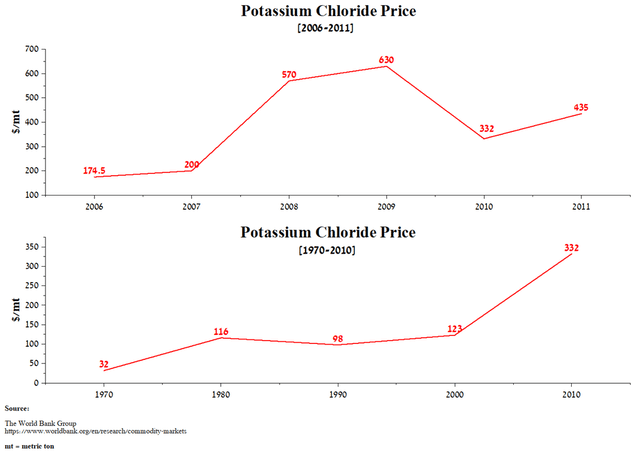

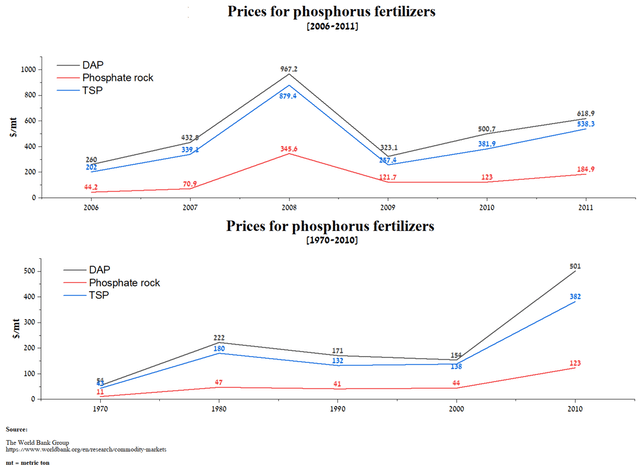

When evaluating commodity price movements in the past, there are two positive trends for investors in fertilizer producers. Firstly, almost every decade since 1970, potash prices have grown at a significant pace, and in the current conditions, when inflation has captured all the major countries of the world, I expect this trend to continue. In turn, the Fed’s continued policy of fighting inflation by raising rates could put the US in a recession, that is, when there is a reduction in GDP, etc. At the moment, I do not expect a new economic crisis, but in order to determine the risks from the occurrence of this event in the mineral fertilizer industry, I analyzed the Great Recession that began at the end of 2007. This crisis led to a sharp contraction in world trade until 2010, but this event had little effect on potash prices. Thus, the average price for potassium chloride in 2010 was $332 per ton, which is 66% more than in 2007.

Source: Author’s elaboration based on data from the World Bank Group.

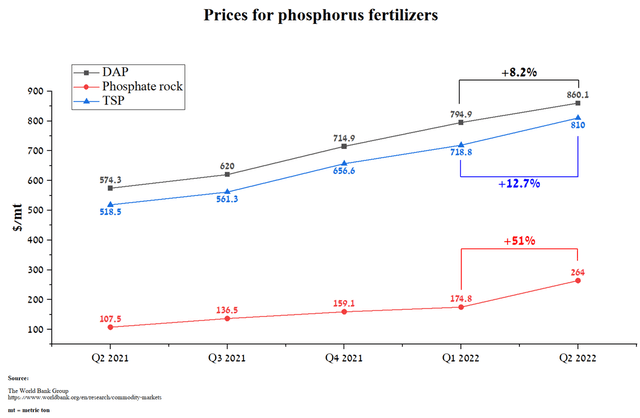

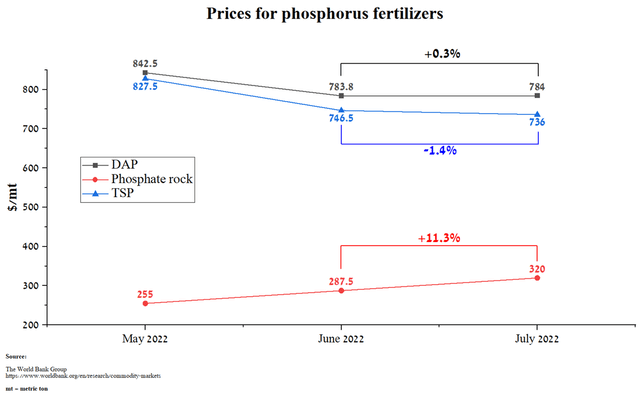

The ongoing military conflict between Ukraine and Russia contributes to the continued shortage of phosphorus fertilizers on the world market due to sanctions imposed against Russian and Belarusian companies. According to the World Bank, the average price of diammonium phosphate (DAP) reached $860.1 per tonne in Q2 2022, up 8.2% QoQ.

Source: Author’s elaboration based on data from the World Bank Group.

Moreover, prices for phosphorus fertilizers are rising in monthly terms. For example, the average price for phosphate rock was $320 per ton in June, up 11.3% from the previous month.

Source: Author’s elaboration based on data from the World Bank Group.

From a historical point of view, as in the case of potash, there is a clear growth trend in the price of these fertilizers in the period from 1970 to 2010 and during the economic crisis that occurred more than 14 years ago.

Source: Author’s elaboration based on data from the World Bank Group.

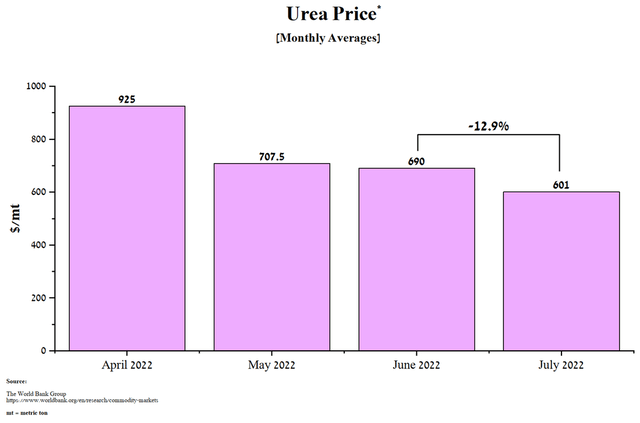

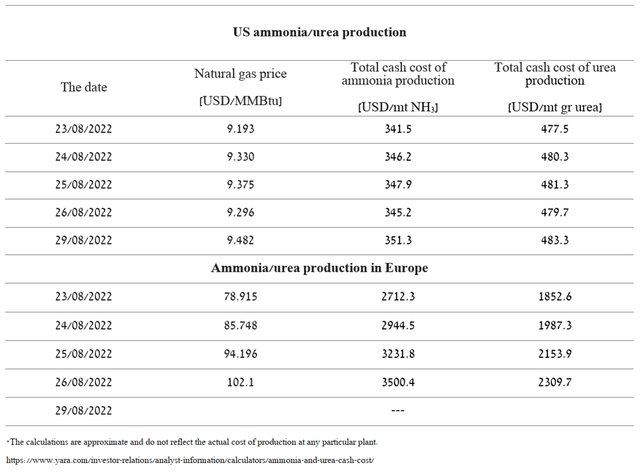

And the last type of fertilizer is nitrogen fertilizer, which is mainly produced by Nutrien. Urea is one such fertilizer that is made from ammonia and carbon dioxide. In turn, ammonia is synthesized from the nitrogen contained in the air and hydrogen, chemically obtained from methane and which is the main component of natural gas. However, due to the aggravation of the military situation in Eastern Europe, which, among other things, led to a confrontation between Russia and Germany over the return of the turbines necessary for pumping natural gas through the Nord Stream 1 gas pipeline to Europe. At the moment, repaired Siemens Energy turbines (OTCPK:SMEGF) are still in Germany and do not allow Gazprom (OTCPK:OGZPY) to pump the maximum amount of gas, which leads to an acute shortage of this raw material in Europe. As a result, natural gas prices are at multi-year highs and make the production of ammonia and nitrogen fertilizers uneconomical. The largest chemical companies in Poland and Norway are significantly reducing the production of ammonia, while Grupa Azoty and Anwil SA have completely stopped the production of nitrogen fertilizers. Prior to the publication of news about problems with the supply of turbines, the price of granulated urea decreased and amounted to $601 per ton in July, which is 12.9% less than a month earlier.

Source: Author’s elaboration based on data from the World Bank Group.

However, due to reduced supply in the nitrogen-containing fertilizer market, I estimate that a recovery in UAN and urea prices should be expected, which will ultimately lead to higher growth rates for Nutrien’s net income and revenue relative to Mosaic. Moreover, due to the lack of prerequisites for resolving the war, the prices for natural gas in the European Union continue to rise, which puts American producers in much more favorable conditions.

Created by author

Comparison of production volumes

The third and most important factor that reflects the correctness of the strategic decisions of the company’s management on the construction of factories and mine developments are the volumes of raw material extraction and the subsequent volumes of fertilizer production. This is especially important at the current time when fertilizer prices continue to be at their highs, as the increase in production capacity will allow more money to be reinvested for various purposes. These goals may include the development of new fields, equipment upgrades that reduce the likelihood of future operational problems and increased dividend payouts.

Nutrien production volumes

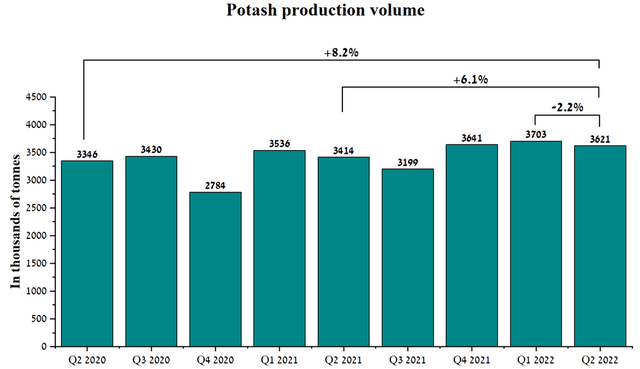

Potash production volumes amounted to 3,621 thousand tons in the second quarter of 2022, an increase of 6.1% compared to the previous year.

Source: Author’s elaboration, based on quarterly securities reports

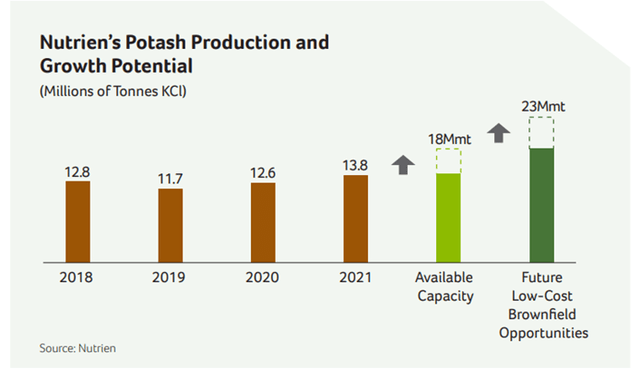

The company does not plan to rest on the progress made and plans to accelerate the increase in production capacity to 18 million tons of potash by 2025, which, in my estimation, will bring at least $2 billion to current revenue.

2021 Nutrien Annual Report

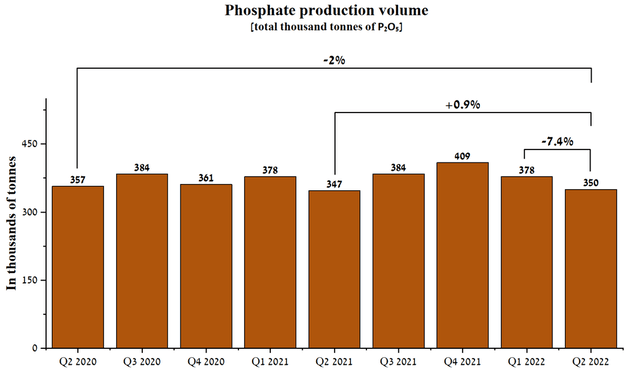

Weaker dynamics were shown by the company’s phosphate segment, whose production volumes amounted to 350 thousand tons of P2O5 equivalent in the second quarter, up 0.9% YoY.

Source: Author’s elaboration, based on quarterly securities reports

However, Nutrien continues to benefit from innovative investments made several years ago. So in the first half of 2022, together with Arkema, a plant for the production of anhydrous hydrogen fluoride (AHF) with a capacity of about 40 thousand tons per year in North Carolina was put into operation. The raw material for the new hydrogen fluoride synthesis plant will be by-products obtained during the extraction of phosphorus ore. The company’s innovative approach will have a negative impact on companies that extract fluorspar, the main source of fluorine required for the production of AHF, and as a result, the revenue of companies such as Orbia Advance Corporation (OTCPK:MXCHF), Ares Strategic Mining (OTCQX:ARSMF) may decrease. On the contrary, Nutrien will increase the margins of the phosphate business not only by raising the price of raw materials, but also by making a profit from waste, which was previously practically not commercialized.

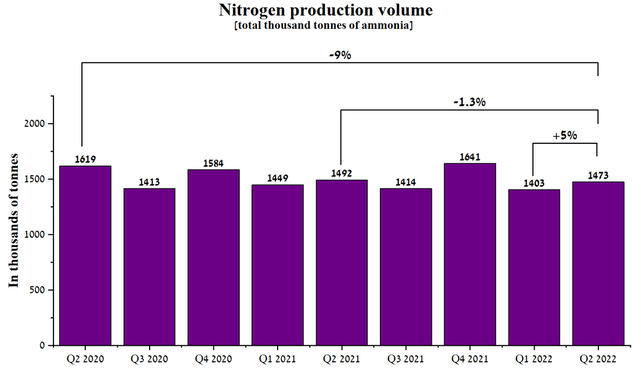

Production volumes of nitrogen-containing products amounted to 1,473 million tons of ammonia equivalent in the second quarter of 2022, showing a slight decrease compared to the previous year. But I believe that the company will be able to partially increase the production of ammonia and urea due to the situation in Europe to meet the needs of European agricultural holdings for nitrogen fertilizers. In the earnings call, the company’s CEO said the following and it’s what ultimately inspires optimism for Nutrien’s nitrogen segment.

“European gas prices averaged close to $50 per MMBtu in July which equates to an ammonia cash production cost of over $1,700 per ton more than 20% of the Europe’s ammonia production is estimated to be curtailed, and there are concerns over gas pricing and availability through the winter in Europe. Many buyers have delayed purchases given recent market volatility, and we paid by seasonal resurgence of then in the second half that could further tighten supply.”

Source: Author’s elaboration, based on quarterly securities reports

Mosaic production volumes

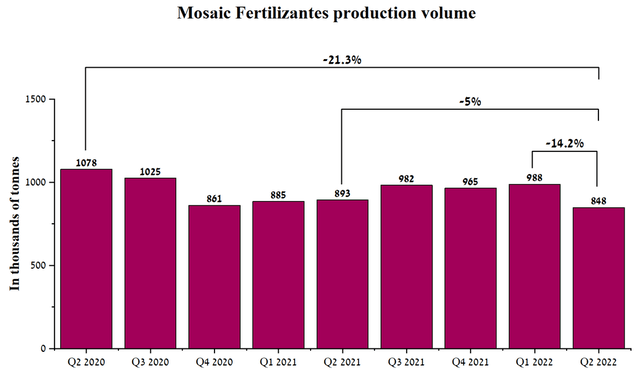

Mosaic Fertilizantes segment production volumes were 848 thousand tons in the second quarter of 2022, down 14.2% QoQ due to adverse weather conditions in parts of Brazil.

Source: Author’s elaboration, based on quarterly securities reports

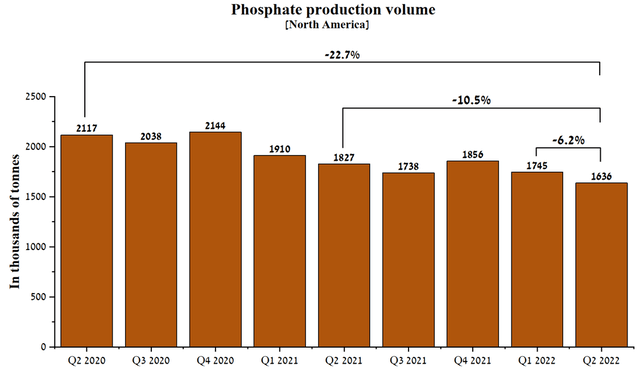

Also, negative trends were noted in the phosphate segment of Mosaic, whose volumes continue to decline and amounted to 1636 thousand tons in the 2nd quarter of 2022, having decreased by 22.7% compared to the second quarter of 2020. The decline is quarter on quarter and is mainly due to ongoing incidents that included sinkholes and the subsequent discharge of process water under a stack at a New Wales facility, which eventually led to a partial shutdown of production. However, despite the decline in phosphate production by Mosaic, the volumes are still much larger than those of Nutrien. This is especially important in anticipation of the acceleration of the production of electric vehicles by Ford (NYSE:F), Tesla (NASDAQ:TSLA), and Volkswagen (OTCPK:VWAGY), a significant proportion of which will use lithium iron phosphate (LFP) batteries, which are produced using phosphate rock.

Source: Author’s elaboration, based on quarterly securities reports

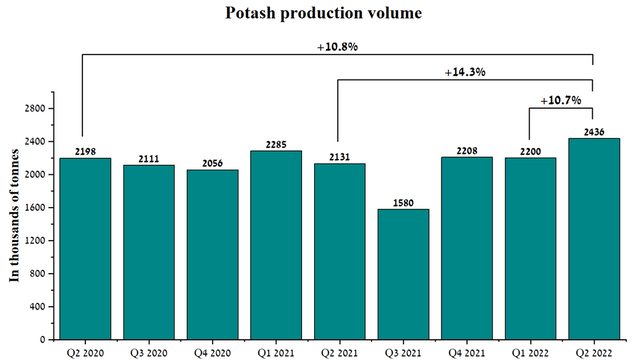

The only segment whose production volumes increased in Q2 2022 YoY is Mosaic’s potash segment due to the resumption of production at the Colonsay potash mine in 2H 2021 and an increase in production capacity at the K3 mine. The company’s management has successfully dealt with the challenges due to the closure of K1 and K2 mines in June 2021 due to increased brine inflows that threatened to completely flood them.

Source: Author’s elaboration, based on quarterly securities reports

Conclusion

The Mosaic Company is the world’s leading fertilizer manufacturer, producing about half of US phosphorus fertilizers. At the same time, the Canadian company Nutrien has a large capacity in the production of potash and nitrogen fertilizers, which, together with Nutrien Ag Solutions, brings in billions of dollars every year. Increased fears due to natural gas shortages in the winter are driving up the spot price of LNG imports to Europe, which continues to move towards $100/MMBtu. This will bring the cost of ammonia production to more than $3,000 per tonne, and the nitrogenous fertilizer industry in Europe will be hit hard, making Nutrien one of the main beneficiaries in the current situation. At the same time, Mosaic has practically no production of nitrogen-containing products and, as a result, the company will not be able to benefit from the reduction in the supply of urea, urea ammonium nitrate in the world market. However, Mosaic remains the world leader in the mining of phosphate rock and the subsequent production of high-margin phosphate products. Demand for the company’s products is likely to grow ahead of an increase in electric vehicle production, a significant proportion of which will use LFP batteries. I estimate that the markets will experience increased volatility in the coming weeks, but the buyback programs of both companies should partially mitigate their impact on the price movements of Mosaic and Nutrien shares. Both companies have growing revenue and cash flow that should rise in the coming quarters during the energy crisis in Europe and the problems of European competitors. However, thanks to a higher dividend policy, fewer production problems, and a faster pace of business expansion, I believe that Nutrien is more promising in the long term relative to Mosaic.

Be the first to comment