MaYcaL

Investment Thesis

Mosaic (NYSE:MOS) reported Q3 results that were a welcome surprise after investors sold off the sector last week.

Mosaic is going to stop buying back its debt at the end of this month and going to ramp up its share repurchase program.

Nevertheless, with fertilizer prices rolling lower, investors are simply not interested in paying more than 4x this year’s EPS.

I believe that fertilizer companies are dramatically undervalued and seriously worth considering. Here’s why.

What’s Happening Right Now?

Mosaic reports results after Nutrien (NTR) and Intrepid Potash (IPI). In both of those cases, the market sold off post earnings. Or perhaps, it could be that investors didn’t take too kindly to Nutrien’s results, which caused Intrepid to sell off in sympathy.

Or possibly, since I’m long Intrepid, I’m reading into what I want to read, although I do believe that Intrepid’s results were very much in line with what I expected. But it was Nutrien’s downward revisions into Q4 that took me by surprise.

In any case, both of those companies reported last week and took the sting out of Mosaic’s results. Mosaic had already sold off going into this print by 8%, so anything that wasn’t materially worse was most likely already factored into the price.

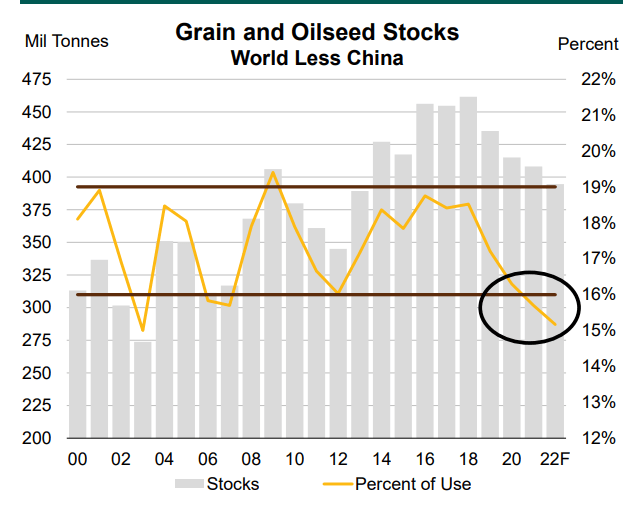

So what was the big news? As it stands right now, the stock-to-use ratio stands at a 20-year low.

MOS Q3 2022

The stock-to-use ratio is an indication of where crop inventories are relative to fertilizer use. Put another way, it’s a supply-demand relationship. When this ratio is down, means that there’s tight inventory. And there’s a low supply of fertilizer.

It was on this basis, with the stocks-to-use ratio so low, plus fertilizer prices being so high earlier in 2022, not to mention the invasion of Ukraine that got investors interested in Mosaic.

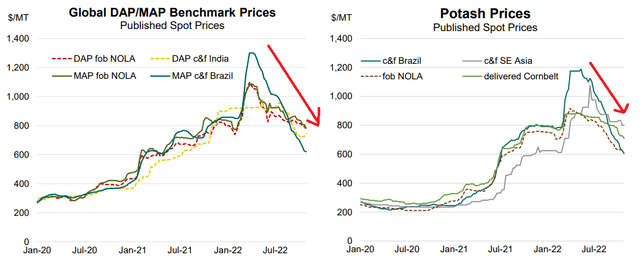

But the problem was that as potash and phosphate prices climbed so high so quickly at the start of 2022, this led farmers to push back and give up paying for fertilizer. And it’s this point where the bulls and bears struggle to agree on.

The bulls believe that with corn and soybean prices so high, farmers have every incentive to buy fertilizer to maximize yields. While bears contend that farmers will continue to refuse to pay up for high fertilizer prices and will wait for fertilizer prices to roll over and become cheaper.

And while bulls can try to rationalize what should happen, this is what is actually happening.

The prices for phosphate and potash are coming in lower and lower every month.

Even if there’s every reason to argue that farmers will return en masse for the spring season of 2023, at this moment in time, the facts are not aligning with that narrative.

And this narrative has led investors to push back from being interested in fertilizer companies.

Revenue Growth Rates Come in Strong

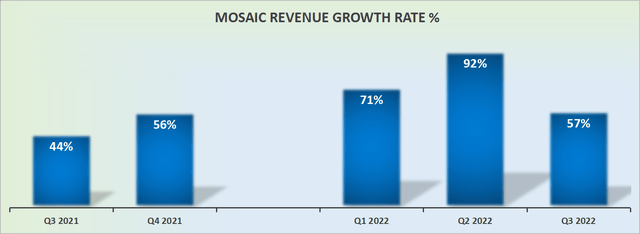

There’s no need to belabor this fact. Mosaic’s Q3 was incredibly strong, with revenues up 57% y/y.

But the problem here is that analysts steadfastly refuse to recognize that 2023 could be just as strong as 2022.

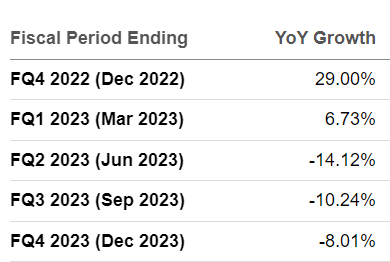

For their part, analysts continue to expect Mosaic’s revenues to decelerate into 2023:

MOS consensus revenue estimates

What you see above is that after Mosaic’s Q3 saw its revenues up 57% y/y, from this point forward well into 2023, there’s expected to be a steady and consistent revenue growth rate deceleration.

And until proven otherwise, The Street continues to believe that there’s mean reversion in 2023.

MOS Stock Valuation – Price Around 4x EPS

Given the facts we have in front of us, I believe that we should downwards revise Mosaic’s Q4 earnings to approximately $3.00. There’s really no significant push to believe that Mosaic’s Q4 EPS figures will come in substantially higher or lower than approximately $3.00.

That means for 2022, Mosaic’s EPS will be approximately $11.50. This puts the stock priced at approximately 4x this year’s EPS.

This is very much in line with what investors are paying for either Intrepid Potash or Nutrien.

The Bottom Line

For my part, I ardently believe that there’s a substantial difference between a company that is a pure play on potash, such as Intrepid, versus one that has exposure to potash and potassium.

Similarly, I believe that since Mosaic’s phosphate production has as its feedstock natural gas, Mosaic carries the added risk of natural gas prices remaining high in 2023, versus Intrepid’s evaporation potash process.

But it appears that from several perspectives, the market simply doesn’t care and is totally unnuanced.

Irrespective of the facts, all these fertilizer companies are getting a blanket 4x to 5x 2022 EPS valuation, and that’s the end of the story.

But what if this is not how the story ends? What if all the dominoes are in place for 2023 to see the revenge of the old economy? Sometimes I wonder whether value investing is actually dead. Or it’s just that it’s so dark the moment before the new dawn?

Be the first to comment