Euro Outlook:

- The Euro remains plagued the by the pandemic, as slowed growth and high inflation leave the ECB in a bind.

- Technical weakness may be on the verge of setting back in for two of the major EUR-crosses, which have recently failed to overtake their daily 21-EMA.

- Per the IG Client Sentiment Index, the majority of EUR-crosses have a bearish bias.

Not Much to Like Right Now

The Euro’s problems are persisting. COVID-19 infection rates continue to rise, and the possibility for more stringent lockdowns has increased as government officials scramble to figure out the best way to deal with the omicron variant. Geopolitical pressures are increasing in Eastern Europe, where Russia has been amassing troops along the Ukrainian board. The Nord Stream 2 pipeline may be scrapped as a retaliatory measure, raising questions about Europe’s energy security.

As these questions grow around the Eurozone’s growth trajectory, elevated inflation measures are sending Eurozone real yields lower, representing an albatross on the Euro’s proverbial neck. And yet, the European Central Bank doesn’t appear poised to act soon. ECB President Christine Lagarde recently stated that the inflation looks like a “hump,” suggesting that it will soon fall back again.

In other words, as other central banks like the Federal Reserve or the Bank of England are readying to tightening policy, the ECB continues to sit on its hands. And for the foreseeable future, that leaves the Euro at a disadvantage relative to the other major currencies.

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to December 2021) (CHART 1)

The rebound seen in EUR/USD rates at the start of December may have run its course. The attempt to climb through triangle resistance failed as the pair ran into its daily 21-EMA and reversed lower. In context of the preceding move – a downtrend – the triangle consolidation calls for a continuation effort lower. EUR/USD rates are moving back below the 50% Fibonacci retracement of the 2020 low/2021 high range, setting up a potential return back to the yearly lows below 1.1900 – which coincided with the 61.8% Fibonacci retracement of the 2017 low/2018 high range at 1.1187.

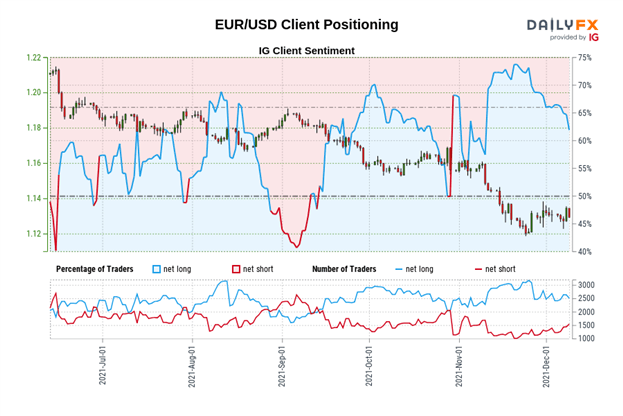

IG Client Sentiment Index: EUR/USD Rate Forecast (December 9, 2021) (Chart 2)

EUR/USD: Retail trader data shows 64.75% of traders are net-long with the ratio of traders long to short at 1.84 to 1. The number of traders net-long is 2.98% higher than yesterday and 6.19% higher from last week, while the number of traders net-short is 2.20% higher than yesterday and 0.13% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

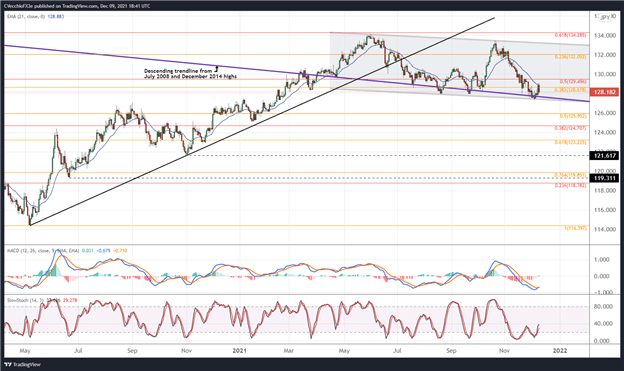

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (April 2020 to December 2021) (CHART 3)

Like for EUR/USD, EUR/JPY rates have turned lower after reaching their daily 21-EMA. The pair is struggling to rebound from channel support in place going back to April, and a more considerable breakdown below the multi-decade descending trendline from the July 2008 and December 2014 highs is possible. It remains the case that “selling rallies is the modus operandi in the near-term.”

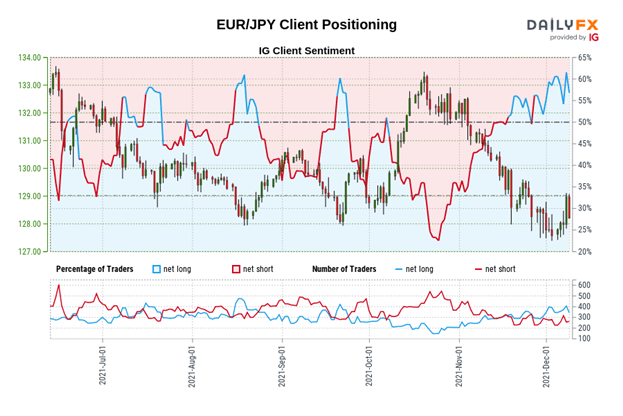

IG Client Sentiment Index: EUR/JPY Rate Forecast (December 9, 2021) (Chart 4)

EUR/JPY: Retail trader data shows 61.08% of traders are net-long with the ratio of traders long to short at 1.57 to 1. The number of traders net-long is 9.37% higher than yesterday and 3.93% higher from last week, while the number of traders net-short is 2.32% lower than yesterday and 17.86% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/JPY prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/JPY-bearish contrarian trading bias.

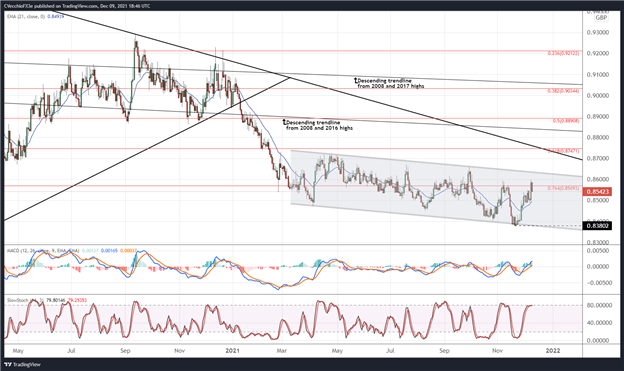

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (November 2020 to November 2021) (CHART 5)

The British Pound’s considerable weakness has been masking the Euro’s own issues in the EUR/GBP pair, which recently rallied through its November high before reversing sharply. While the pair remains above its daily 5-, 8-, 13-, and 21-EMA envelope, momentum looks frail given the negative divergence seen in daily MACD and daily Slow Stochastics. While EUR/GBP rates’ prevalent move may be sideways, reaching recent highs suggests that the next swing lower is due.

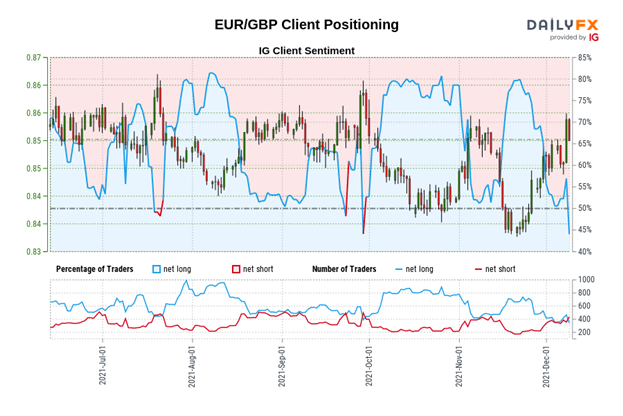

IG Client Sentiment Index: EUR/GBP Rate Forecast (December 9, 2021) (Chart 6)

EUR/GBP: Retail trader data shows 42.29% of traders are net-long with the ratio of traders short to long at 1.36 to 1. The number of traders net-long is 7.39% lower than yesterday and 15.83% lower from last week, while the number of traders net-short is 18.56% higher than yesterday and 25.39% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bullish contrarian trading bias.

— Written by Christopher Vecchio, CFA, Senior Strategist

Be the first to comment