Justin Sullivan/Getty Images News

Over the last twelve months, Monster Beverage (NASDAQ:MNST) has underperformed both its peer group and the broader market. It shaved off 14% of shareholder value, while the S&P 500 gained 11%. Coca-Cola (KO) and PepsiCo (PEP) did even better, returning ~23% while Keurig Dr. Pepper (KDP) performed in-line with the S&P 500. Despite consistent and predictable performance, a high quality business model, and numerous actionable growth opportunities, the energy drink vertical is maturing and susceptible to new entrants and better capitalized players. Pepsi and Starbucks are releasing a new line of energy products, BAYA, although Coca-Cola has taken a step back with the discontinuation of its Coca-Cola Energy business in North America. Mixed fourth quarter performance and weakened outlook in margins have put a bit of a wet blanket on an otherwise strong business. Global supply chain challenges and input cost inflation, particularly in both freight, labor, and materials, have made the blanket wetter still. This has obscured what I believe to be an otherwise promising stock.

According to Seeking Alpha data, the Street is split on the stock. Although 9 of 23 analysts rate the stock a “strong buy” and 4 a “buy”; almost half rate the stock “hold”. In general, however, this has been the general sentiment over the last three years, so nothing new has changed here. From my perspective, however, the stock is relatively safe in today’s market with a beta of 1.12, strong operating margins of 32.4% and a quick ratio of 4.2. This compares to operating margins of 28.2% and a quick ratio of 1.0 for Coca-Cola; and 14.0% and 0.7 for Pepsi. At the same time, Monster is at a negligible premium of 25.2x forward earnings vs. ~24x for Coca-Cola and Pepsi despite lack of market leadership.

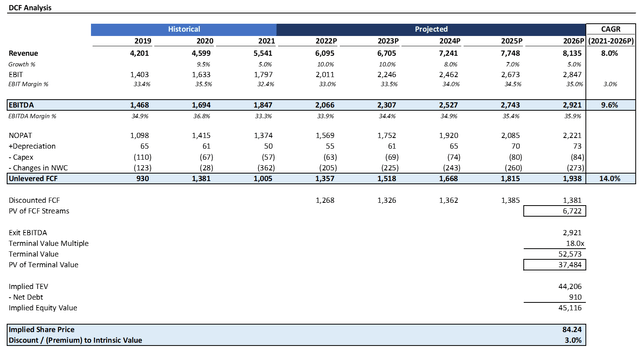

DCF Analysis Indicates Significant Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecasted 10% growth in 2022 tapering to 5% by 2026. I assumed margins expanding minimally by 200 bps into 2026 to 35% but remaining below 2020 high of 35.5%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at just shy of $3.0 billion.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 18x and a discount rate of 7%, the stock is more or less fairly valued. Over the last 15 years, the stock has generally traded in the 15-22x range, so I believe my estimate is on more of the conservative-side, although I wouldn’t call it a “value play” by any means – few stocks in the current environment merit that designation any way.

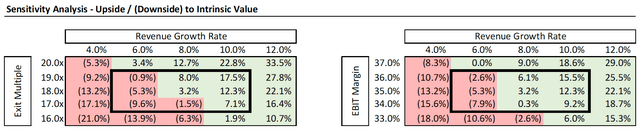

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, the downside scenario doesn’t look so concerning. Even if the multiple falls to the low end of the range at 16x and growth fades out to just slightly more than GDP growth levels at 4%, the stock “only” has a ~20% downside. And that is more than offset by the 7% annual returns implicit in the discount rate. In today’s overvalued market, I recommend focusing more on capturing growth with safe, high-quality reasonably-priced business models as opposed to relying on tremendous value discounts. On the flip side, should the multiple stay put at 20x and growth continue at a 10% clip, there is an additional 23% upside to be had here.

Upside Catalysts

While the energy category is maturing, Monster still has numerous actionable catalysts. The strategic acquisition of CANarchy Craft for $330 million, provided the company an entryway into the alcoholic beverage and hard seltzer category. CANarchy is the sixth largest domestic craft brewer and adds a diversified mix of brands, including Cigar City, Oskar Blues, and Perrin Brewing, among others. Monster, with its large marketing budget and store access, has numerous revenue and cost synergies to unlock. In general, though, I like how the acquisition has shaken up the company’s images as something beyond just energy drinks. This will be critical to the upside story for shareholders.

The company has $3.0 billion of cash in the balance sheet and minimal debt, it is in a position to pursue additional acquisition opportunities and expand product lines to gain a foothold in new markets. The company has sold a variety of brands to bottlers and distributors, so it is attuned to reorienting its product portfolio to meet different market conditions. With a strong know-how in the beverage space, Monster just needs to demonstrate that it can continue to innovate like Coca-Cola and Pepsi have beyond their original flagship products.

I am also optimistic about the company’s growth potential internationally. It is targeting expansion launches in dozens of countries through Predator, Monster, Rein, and Fury, and is focused on improving visibility in China through increased marketing, promotions, and flavor differentiation. While Monster has dominated in North America, there’s plenty of low hanging fruit to be had abroad-the company just needs to demonstrate the relevance of its brand.

Risks

The biggest immediate concern that company faces is continued challenges in the supply chain. In 2021, Monster faced shortages in aluminum cans, lack of ingredients, and insufficient canning capacity. At the same time, import costs rose and labor became harder to attract. Demand is high for the company’s products, yet Monster continues to face bottlenecks.

I am also concerned about a possible weakening in the company’s relationships with bottlers. Unlike other leading beverage companies, Monster suffers from a lack of vertical integration and relies on outsourcing production, which makes it particularly vulnerable to the supply chain concerns. Add in cost of co-packing, and there’s also a risk of lack of production flexibility.

Lastly, a lot of the company’s success depends on its partnership with Coca-Cola. Though Coca-Cola’s energy business was discontinued in the US, the mere launch of Coke Energy was concerning, and it’s still around internationally. If Coca-Cola continues to expand in this category, it could strain Monster’s credibility and complicate the relationship. Lastly, the company operates within a dynamic and competitive industry, so new entrants is always a problem.

Conclusion

While the company has struggled from recent supply chain bottlenecks, this is a short-term story that obscures otherwise strong fundamentals. Management has succeeded in launching new product lines time and time again, has a strong growth potential abroad, and has demonstrated a willingness to enter new markets. It innovated the energy drink market and now enjoys some of the strongest operating margins in the industry despite reduced scale – a testament to the staying power of Monster’s brands. Flush with cash, I believe the company is well positioned to execute upon the upside story. As it is fairly valued in what I see as an otherwise overvalued market, Monster remains a compelling growth play for the long term.

Be the first to comment