svetolk

The market has sold off a ton of SPACs for valid reasons, but MoneyLion (NYSE:ML) doesn’t fall into this category. The personal finance platform continues to generate phenomenal growth and hike guidance for the year. My investment thesis is ultra Bullish on the stock, trading at only $2 after funding the SPAC deal all the way at $10.

Expansion Galore

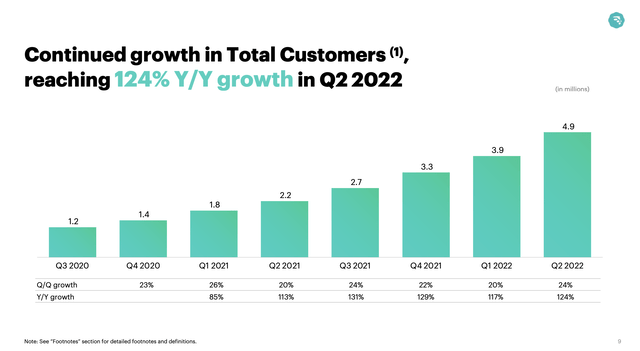

Despite the stock selloff and the fears of economic weakness, MoneyLion actually added a record number of new customers in the quarter. The platform added 1 million new customers in the quarter reaccelerating growth to 124% YoY.

Source: MoneyLion Q2’22 presentation

These customers funnel the revenue growth of the platform, with each customer now using multiple products after starting with an initial financial product. Total Products reached 10.4 million for 75% YoY growth and 1.4 million additional products utilized sequentially from Q1’22.

MoneyLion has seen total loan origination growth slow, with Q2’22 loan origination of $439 million. The amount was up 8% sequentially and 85% YoY. The amount hasn’t grown materially since hitting $386 million in Q4’21.

The fintech doesn’t focus as much now on driving the use of loan products, as much as working with Enterprise partners. MoneyLion now has a network of over 1,000 enterprise partners, powering 41% of the revenue base in Q2 and headed to 50% in the future.

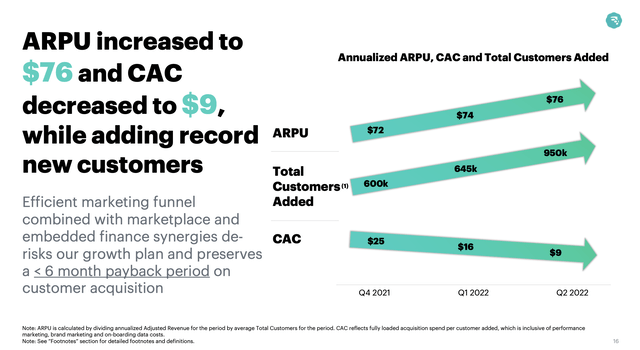

MoneyLion now spends a limited amount of money to acquire new customers, while the ARPU generated by each customer grows. The Q2’22 ARPU dipped to only $9 from $25 just a couple of quarters ago, while customers deliver $76 in revenues annually.

Source: MoneyLion Q2’22 presentation

The quick reduction in CAC is impressive with MoneyLion still relatively small, running below a quarterly revenue run rate of $100 million. The personal finance platform only spent $9.5 million on marketing expenses during the quarter, relatively flat with the prior year period and down from Q1’22.

Over the last year, MoneyLion has acquired both Malka Media and Even Financial to provide financial content and the infrastructure to digitally connect and match consumers with personalized financial product recommendations. These products have apparently greatly enhanced the ability of MoneyLion to attract new customers and connect those with financial partners.

Not Trading On Guidance

The stock initially traded above $2.70 on the strong Q2’22 earnings report and guidance for the rest of the year. MoneyLion forecasts growing revenues at a 103% clip for the year to reach $330 to $340 million.

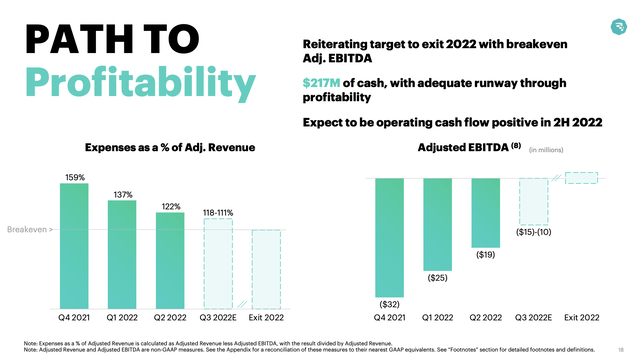

The numbers are improving so dramatically that the company guided to eliminating a Q3 EBITDA loss of up to $15 million in just one quarter. MoneyLion forecasts being adjusted EBITDA profitable at the end of the year and operating cash flow positive in the 2H of the year.

Source: MoneyLion Q2’22 presentation

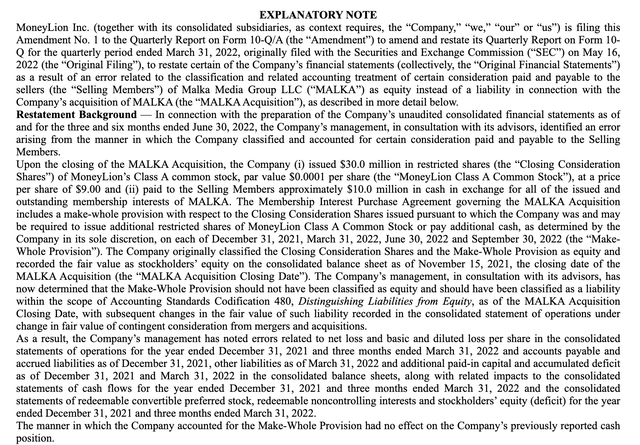

The stock didn’t rally partly because small cap stocks sold off on Thursday, but the prime reason for the dip was the restatement of 2021 and Q1’22 financials via the issuance of new SEC filings. The market doesn’t like accounting issues, but MoneyLion only restated non-cash items related to accounting treatment of certain consideration paid and payable to the sellers of Malka Media Group amounting a $4.6 million non-cash adjustment for 2021 and a similar $4.0 million non-cash adjustment for Q1’22.

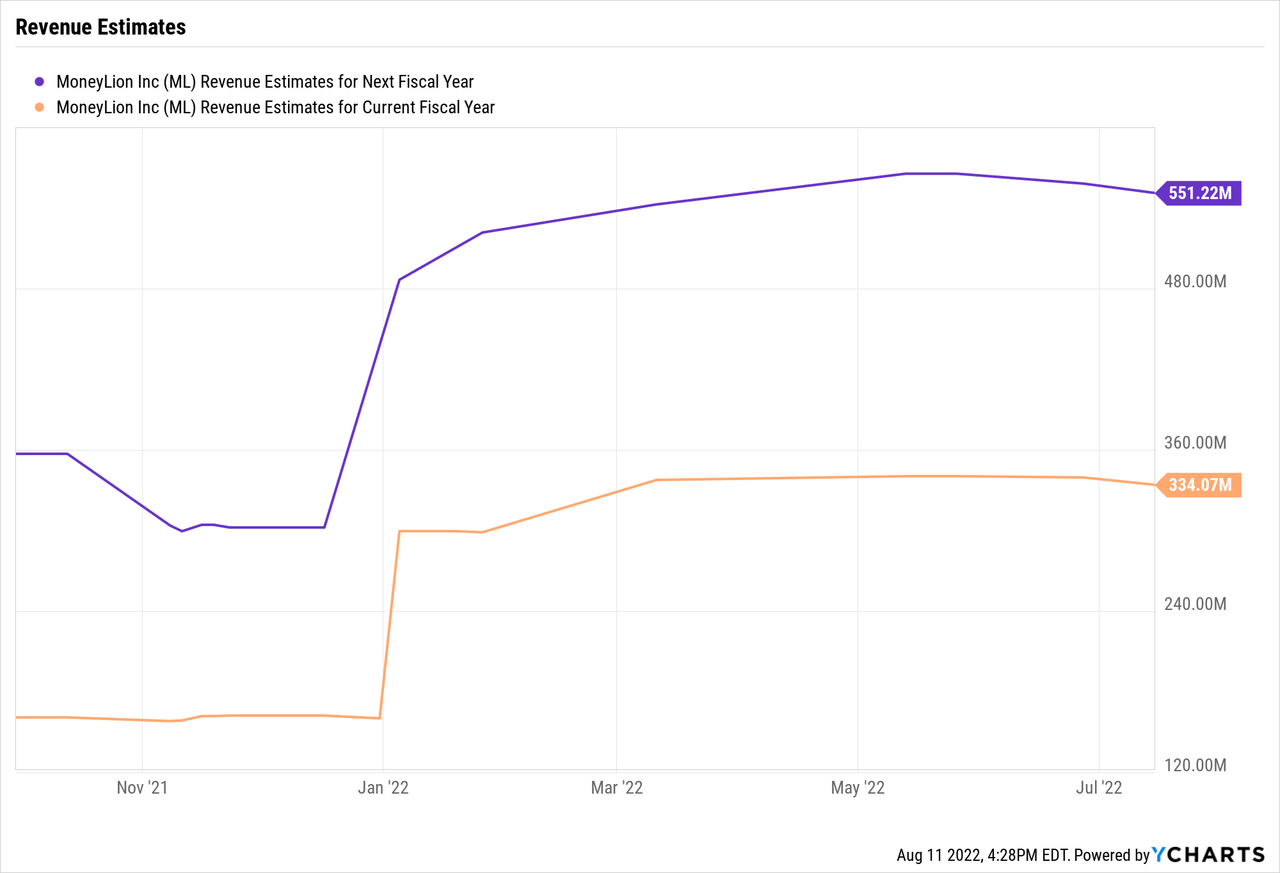

After the dip following a great Q2’22 report where MoneyLion guided up and most companies cut guidance, the stock traded back down to $2. The stock only has a listed cap of $500 million while revenue targets for 2023 hit $551 million.

The market clearly isn’t pricing MoneyLion for the forecasted revenue growth next year. The Q2’22 results were likely about to solve this issue, sending the sock up some 20% in early trading.

Takeaway

The key investor takeaway is that the restatement issue should quickly fade with no cash impact to the business. The combination of higher confidence in the company and a positive operating cash flow business growing revenues in excess of 100% with a cash balance of $217 million will push the stock higher in the months ahead.

Be the first to comment