Martin Poole/DigitalVision via Getty Images

monday.com (NASDAQ:MNDY) falls under the rapidly growing niche category of workflow software, alternatively pegged by some as Project Management Software as a Service (PM-SaaS). Amidst the mega drawdown in high-growth tech and the valuation re-rating of several software categories without much distinction, I’m here to make the case for this particular company in this particular category.

To begin, I’d like to take a top-down perspective on what exactly this strange software category means and why it’s seemingly underrated as a mass-scale long-term opportunity.

Premise: The Need For Workflow Software

Across the software world, there’s perhaps a spectrum of companies that on one end are hardcore engineering businesses, while on the other are design-oriented. Think Snowflake (SNOW), a highly technical data warehousing platform that arbitrages common infrastructure data storage prices and compute power with elegant software to provide cost savings and optimization of data management. On the other end – Slack is a thoughtfully designed messaging app built for the workspace that has succeeded by virtue of user experience design, driving efficiency in business communication. Both types of businesses have thrived in the past few years. One focuses on easily quantifiable objective aspects of storage and computing, while the other zeroes in on the human nature of workplace interaction and adds efficiency there – building organic product adoption through employees championing the product. Workflow software falls into a similar group. The human element of it, therefore, makes it tricky to analyze and that may be why it’s somewhat overlooked.

To understand this value of workflow software, I pose a simple question: How do we work?

At my last corporate job, work involved emails for primary communication both internally and externally within my organization. Zoom (ZM) helped out on the video front with clients and colleagues based in other offices. The telephone at my desk came with hotline numbers to call anyone within the organization. Documents were controlled by folders within folders within folders with varying access set by managers up the chain of command. IT services were used as part of a custom ERP that became outdated every few years. Most of the technologies I used have been around for decades without much change, save for a few disparate apps.

These practical but rather tedious technologies remained dominant because they achieved mass adoption – making them uniform across organizations, enterprises, and geographies. It should come as little surprise that the way we work itself was due for some change.

Can the inefficiencies in the way we work be solved? Many would agree that we’ve leapfrogged in a few ways out of necessity during the pandemic. Slack, Zoom, and Teams have helped, products from Atlassian and Salesforce (CRM) have helped, and Microsoft (MSFT) too in many ways going beyond Office. There is, however, a next-gen of these apps that are seemingly all-encompassing. They provide a centralized platform for communication, sharing, teamwork, project management, and more. They aren’t just new apps but they plug into and form a control centre for every other app you already use – in a way, they’re like operating systems. That’s exactly what leaders in the workflow space: Monday, Asana (ASAN), Smartsheet (SMAR), Airtable (private), and ClickUp (private) are seemingly moving towards. Theoretically, their addressable market is any sizeable team of any enterprise size, in any industry, anywhere in the world. Some market forecasts peg it at $55B by 2030. At the moment, market leaders are on ~$500m annual run rates. So there’s a lot of room to grow for a long time should the next gen proliferate.

The Monday Vision – Work OS

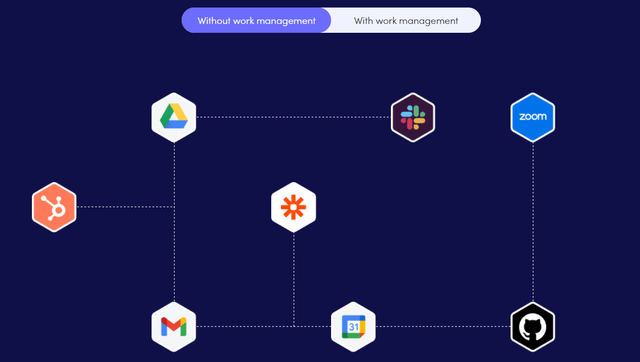

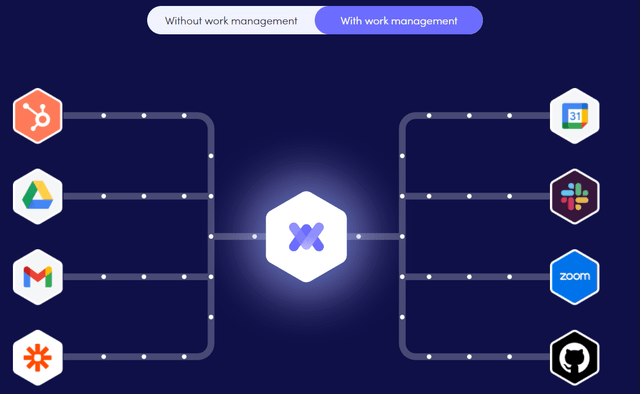

monday.com uses a “land & expand” strategy across different use cases, but the heart of the company remains project management and by extension work management. The following two images illustrate the concept of the “app for other work apps” below:

Work Management Graphic (Monday Website) Work Management Graphic (Monday Website)

The distinction between an app with singular functionality compared to a hub for other apps is an important one. Integrations drive stickiness and the user experience builds repeatable workflows that eventually become habitual. Consider Adobe’s (ADBE) prominence in the Creative Cloud, and why they can charge high prices while delivering just minor updates across Photoshop, Premiere etc. The habits users have formed on Adobe have made it a sticky industry standard. The same goes for Microsoft Office. Ideally, a monday.com investor ought to like the same – standardization and mass adoption across most enterprises as the modern Work OS – not just a project management tool.

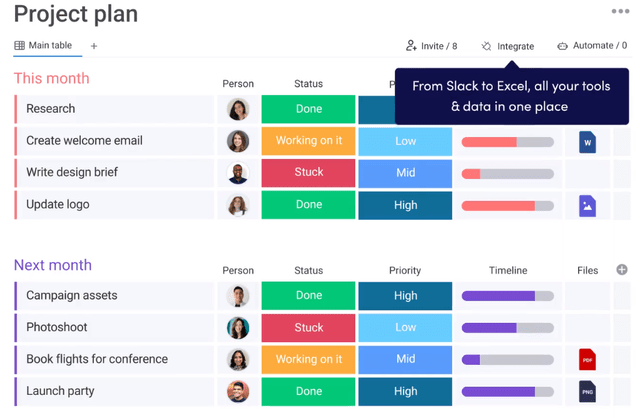

Project Plan Interface (Monday Website)

Going beyond project management, monday.com has been quick to innovate across a variety of features by leveraging its customer satisfaction by building and delivering new apps. Some of these include a CRM platform, a Marketing product, and a host of developer tools to open up the ecosystem beyond the core functionality.

Looking past what monday.com has built, they’ve done well to integrate with every major app out there which allows users to gain visibility and control across the following workflows:

Microsoft, Google (GOOG) (GOOGL), Slack, Zoom, Salesforce, Adobe, Zendesk (ZEN), Shopify (SHOP), Stripe (STRIP), HubSpot (HUBS), GitHub, GitLab (GTLB), and more. Every popular integration tool is now available and can speak to the centralized Work OS.

Why Is monday.com My Pick?

I can filter it down to three reasons: Speed of Growth, Product Quality, and Cash. These are the areas where I see monday.com currently holding some advantage over public competitors Asana and Smartsheet, though no advantage is absolute and entirely clear. On the private front, ClickUp and Airtable also appear to be sizeable potential challengers. It’s a young and competitive space, and there are quality businesses all around. Picking a winner is not easy, especially against a runway that’s likely in the 10s of billions. That said, I expanded my reasoning on picking monday.com.

#1 Speed of Market Capture

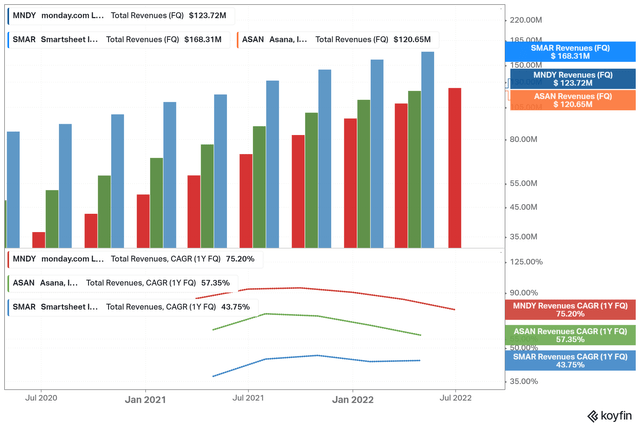

Quarterly Sales & Growth Chart (Koyfin)

On Quarterly Sales, monday.com has come from behind and has closed down the gap to Asana and Smartsheet, while maintaining a meaningfully higher sales growth rate on both a %YoY and %QoQ basis. In recent quarters, and likely the next one, monday.com will continue adding higher incremental absolute sales to the top line compared to its larger competitors. The following metrics further illustrate this momentum.

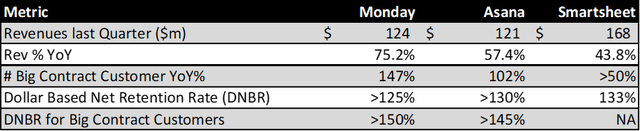

Growth Metrics (Author, Data from IR sites)

#2 Product Quality

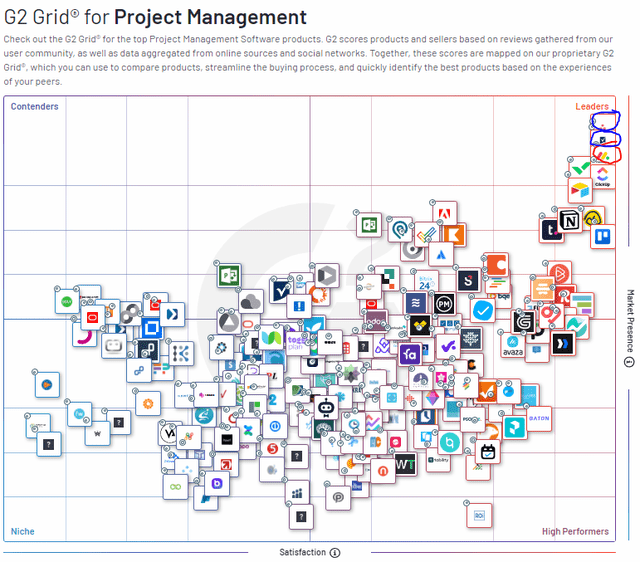

monday.com remains at the top on “customer satisfaction” (x-axis), and close to the top on “market presence” (y-axis) according to the alternative data from F2 Crowd below. The financial trend is likely to push monday.com to #1 in a few quarters if absolute revenues and G2’s version of market presence align.

G2 Crowd Grid For Project Management Software (G2 Crowd Website)

monday.com is highlighted in red, with Asana and Smartsheet in blue. The grid shows a heavily crowded and dynamic landscape, but one can infer that product quality is among the best in class. This certainly helps when there are so many players chasing a piece of a $50B long-term market opportunity. It isn’t just G2, but multiple sources and independent studies confirm monday’s product excellence.

Product Recognition (Monday Website)

#3 Cash

As of last quarter, monday.com had over $800m in cash on its balance sheet. This is over double the cash of Asana ($280m) and a lot more than Smartsheet ($560m). Despite being younger and smaller, monday is pulling its 75%+ growth with moderate burn while Asana has a -$40m/qtr FCF burn rate and Smartsheet is flat. Relatively, the company is stocked with ammunition for growth. It’s also worth noting that ClickUp raised $537m in October 2021, and Airtable raised $735m in July 2021, likely at elevated valuations that are now effectively halved since the tech crash. Burn rates for both companies aren’t public knowledge. I’ve dug deeper into why monday.com might be growing the way it can with mild cash burn.

Explaining The Cash Advantage

Cash is doubly important in a difficult macro with global recession headwinds. All valuations for tech have been chopped, some by about 70-80% since 2021 highs. What this essentially means is that unprofitable businesses are going to burn through their balance sheets without the safety net of raising more cash at attractive prices. In the case where they’re short on cash, they’ll need to cut costs, likely in sales and marketing expenses, which will in turn lead to lower growth and less market share capture. It’s a nasty cycle and growth flywheels in this space work on sales momentum which needs to be maintained to win. The larger these businesses get, the more likely they are to sustain a long-term advantage as network effects and economies of scale drive the flywheel faster with more S&M spend on hand.

So if you’re trying to pick a winner, discrepancies in competent cash management can greatly tilt a thesis in an environment like this. monday.com shines in this regard, and I consider this macro as a gift for prudent analysts as they have one more logical variable to bet on after the age of cheap capital.

How is monday.com managing high growth with little cash burn? I’d argue that it isn’t just about a best-in-class product that sells itself. Folks who’re new to this stock would be surprised to learn that monday is not an American company. It is based in Tel Aviv, Israel – a rather underrated global high-tech hub. While the company has a presence in NY, SF, and London, the bulk of product development appears to be based out of Israel. That means lower engineering salaries. Any software company’s income is heavily influenced by the salaries of its engineers. After all, CapEx and PPE aren’t particularly huge, and everything they sell is in bits and bytes so the Costs of Goods Sold (‘COGS’) are fairly low. As a result, Israel is a geographical advantage that helps with profitability. It stands in contrast to Silicon Valley where salaries are $200k-$500k and are eventually used up for extreme rent and living expenses. To add, going by the end product quality, monday’s engineers don’t seem to be any less competent than their SV counterparts. People seemingly love the platform. The extra cash can be used to boost the growth flywheel. Recent financial trends, seem to confirm this point of view.

Financials

monday.com and its public market counterparts record customer growth and net retention rates as key metrics. The metrics most important to us are those pertaining to customers with >$50,000 in Annual Contract Value. The number of big-contract customers grew 147% YoY, also representing a >150% dollar-based net retention rate. Big customers scale more than smaller ones over time as they roll out software slower. Importantly big customer wins roughly translate to lower acquisition costs per contract value from a sales expense perspective. All this helps the bottom line.

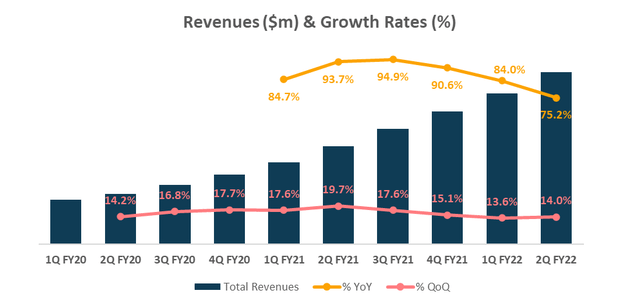

Revenue & Growth (Author, Data from Quarterly Results)

monday.com has been in a hyper-growth mode for several quarters since the pandemic’s onset. As the revenue base has expanded, the company is now on a decelerating trend but is still recording an impressive double-digit QoQ % growth. The Q1-Q2 quarter usually calls for some minor acceleration as the post-holiday season is typically a little weak. That said, with customer and retention rate trends, one ought to expect monday.com to maintain 40%+ YoY growth for several quarters if not years to come.

Financials – Sales and Margins (Author, Data from Quarterly Results)

The company remained Free Cash Flow flat in FY21 but has made a very intentional decision to burn some cash to acquire market share recently by investing in further growth. Last quarter saw some $20m in burn, half of Asana’s, and it remains perfectly acceptable given the top-line growth and richly funded balance sheet of $800m in cash & equivalents. In fact, I wouldn’t mind them burning more to beat out the whole lot of ClickUp and AirTable in landing big contracts. The IPO was extremely well timed in hindsight, and the capital on hand should fund monday’s ambitions for years to come, even with a recession. There’s no haste to achieve GAAP Profitability as the future market positioning is what matters, especially against strong competitors.

Valuation

Sales Valuation Multiples (Koyfin)

monday.com has high current valuation multiples for the software space. There’s no surprise here with a 70%+ YoY sales growth, and moderate cash burn, chasing a large opportunity. While it may tempting to look in the 4-8x Sales range for value-driven software opportunities, monday shines as a prospect for long-term investors on account of its execution, growth, and potential. With a company equipped with both a class-leading product and the financials to achieve flying growth, it has an edge in my view against the competition. And if one does find a rare edge in a thesis, it’s worth betting on in order to extract alpha before it becomes more obvious.

To contextualize the long term, let’s assume 64%, 40%, 40%, 35%, and 30% YoY sales growth in the coming years. At FY26, with a 20% FCF Margin, 45x exit FCF, and a 50m share count up from today’s 45m, I get a 25.6% potential IRR in slightly over 4 years.

This would imply about $1.74B in sales in FY24, still a tiny fraction of the likely future $40-50B pie. There’s a lot that needs to happen for the company to get there, but for investors with a bullish thesis, there’s immense upside potential from the current $120 price. With more bearish forecasts (30x Exit FCF and slower 27% YoY growth in FY26), there’s about 11% IRR.

Risks

- Competition: monday.com is far from an obvious winner despite its mix of commendable qualities on both product and financials. Competition from Asana, ClickUp, and Airtable can influence monday’s growth trajectory as well as the bottom line as profits may be eroded away for market capture.

- Macro: monday.com is showing surprising resilience in this macro environment, as spending trends hold strong and new customer wins keep coming in. This trend may moderate or decline if the economy turns towards a more full-blown recession. Naturally, the future will be pushed further away and there’ll be justification for downward revisions on monday’s financial prospects.

- Systemic: monday.com is a high-growth, risky stock. It was trading at $90-100 not too long ago and it can return to those levels or below considering market gyrations. Expect the coming quarters to remain volatile.

Conclusion

My monday.com bull thesis rests on a mix of advantages the company has accumulated versus its public competitors. There’s a $50B long-term market opportunity at hand for workflow software and the company is seemingly leading the crowded market space in capturing share through faster sales, excellent product quality, prudent cash management, and an underrated geographical advantage by being based out of Israel.

As software eats the world, workflow software is also on a trend to make its way into every enterprise, across every industry, worldwide. At least it seems that way with until we see a meaningful slowdown in these stocks. While it may be too early to call a winner, monday.com has enough going for it to warrant an investment. With a healthy valuation post the recent tech crash, MNDY makes for a compelling play considering risk/reward potential.

Be the first to comment