Cn0ra

Investment Thesis

I believe monday.com (NASDAQ:MNDY) is an overvalued, unprofitable company that has grown rapidly in low-interest rate periods but could face slower growth in times of rising interest rates. The stock is cyclical because it needs many other small businesses and startups as customers. Given the high valuation and uncertain outlook, I think the stock is a good short ahead of the release of the next quarterly results.

Bad signals from a competitor

Last Friday, Atlassian (TEAM) slumped 30% as the company announced that growth would slow in 2023. Monday also lost 13% on the same day as they operate in similar niches. Both companies sell cloud-based software solutions for small and medium businesses, start-ups, non-profit organizations, or individual teams within companies, depending on what the customer needs. This makes Monday a cyclical company. In times of recessions and rising interest rates, customers grow slower, fewer new companies are founded or they are more likely to go out of business.

Some facts about monday.com

In total, they have more than 150,000 customers, of which 1,160 bring an annual turnover of more than 50k. If I multiply 1,160 by 50k, the result is 58M, about 10% of the total revenue. Therefore, the mass of customers for Monday is more important than these 1160 larger customers. Of course, this calculation is not exact as some probably bring in significantly more than 50k in revenue.

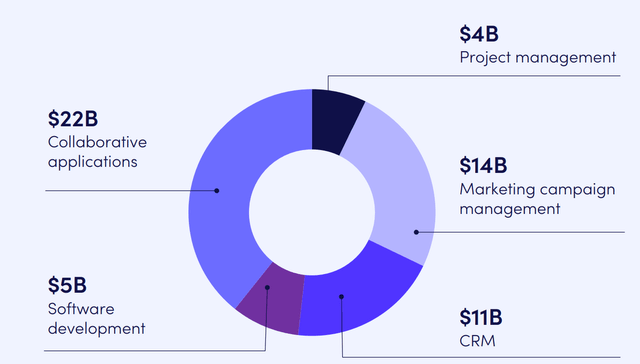

The company went public in June 2021 and rose rapidly until the markets peaked, but it has since fallen more than 80% from its high. The company is active in 200 countries and offers its software in 14 languages. According to the company, the market for collaborative applications is $22B and the TAM $56B.

Monday q2 investor presentation

Financials

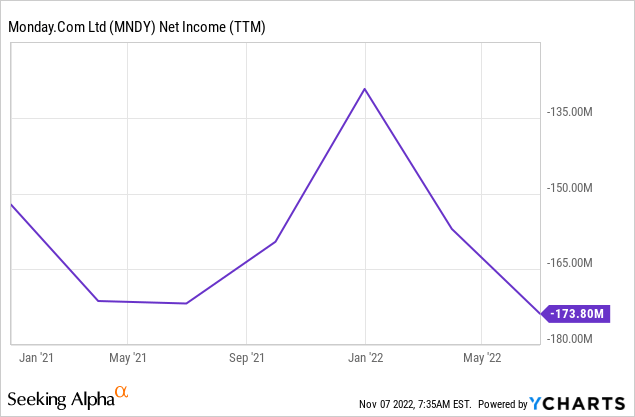

Since the IPO was not long ago, there is still a lot of cash on hand, about $800M, against $58M of debt, resulting in an enterprise value of 2.88B. The cash burn rate for the past 12 months was $173 million, so there should be enough cash for several years.

Revenue

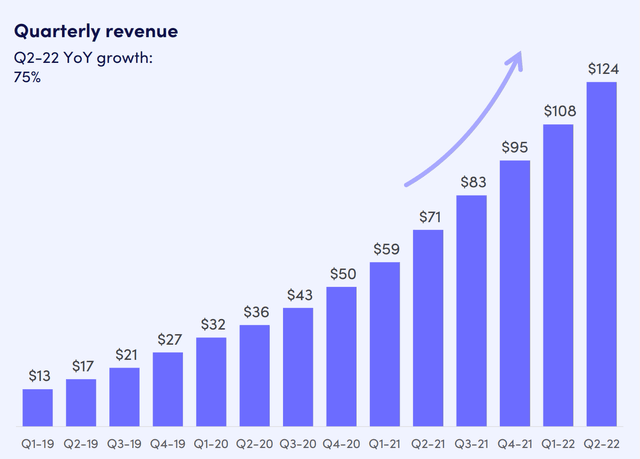

The revenue has been rising sharply for years. They were able to benefit from the pandemic and work-from-home environment. However, this tailwind should now be used up, as it will be exciting to see how the sales trend will continue. However, the jump in absolute figures from Q1 to Q2 2022 was the largest revenue growth to date.

monday q2 investor presentation

Also very strong is the net dollar retention rate of 125%, which means that existing customers pay more and more money to use Monday’s platform. Since Monday is a pure subscription model that generates revenue per user, this means that their customers are growing, or at least within the company, Monday´s service is getting more and more used.

How is the money spent?

The most significant cost factor by far is “sales & marketing,” followed by “research & development” and then “general & administrative.” The company lost more than a dollar per share in the second quarter. According to analysts, the loss will continue until at least 2024, which means that cash reserves will become less and less.

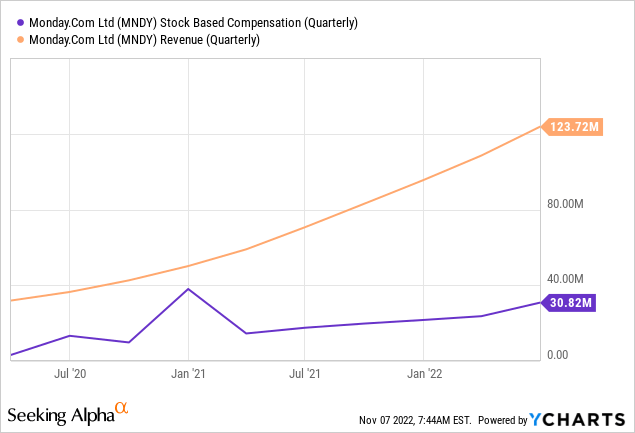

There is a big difference between GAAP and non-GAAP data in financial documents. The company deducts stock-based compensations resulting in much better-sounding numbers. For example, in Q2 2022, the non-GAAP operating loss was 15.3M, but the GAAP operating loss was $46M. A year earlier, in Q2 2021, the GAAP operating loss was $27.5M. I think this is something that investors need to look at closely, especially since the stock compensation is still increasing and is very high relative to revenue.

Slowing growth

One of the most significant risks for the company is a slowdown in growth, which is likely to lead to a lower valuation. The management itself provides as outlook for Q3:

Total revenue of $130 million to $131 million, representing year-over-year growth of 57% to 58%.

Given the revenue-per-quarter chart from above, 130M in Q3 would be a significant slowdown in growth. Year-over-year it is still strong, but if the growth stays at a similar rate, the base effect will kick in soon, and the YoY growth numbers won’t sound as strong. As I know the market, it will strongly penalize this slowdown, especially since Monday is still valued as a fast-growing, scalable company with a P/S ratio of 7.

And this scenario is quite likely in my view as a global recession becomes more and more likely. Monday has indirectly benefited from the zero interest rate policy as this has encouraged the emergence and growth of unprofitable companies that are now coming under pressure.

Further risks

The growth is further challenged by the fact that the competition is becoming more numerous and stronger. When monday.com was created in 2014, this type of team-based collaboration service was still new. But today there are a lot of companies that find it increasingly difficult to differentiate themselves and be unique. It is common in this industry that when a company introduces a new feature, others copy it slightly differently. While there are switching costs for customers when teams are already tuned into the software, significant price increases are still difficult to enforce for Monday.

I use Trello from Atlassian for private purposes, but I recently realized that other software already offers the same and even more. The development in this area is speedy. In the end, they all offer almost the same. Is there a big difference for small businesses depending on which company they choose? It’s hard to judge, but I doubt it. And the list of competitors is getting longer and longer: Asana, nTask, Click-up, Trello, Blue, Wrike, and more.

A side effect of this development is that the corresponding advertising on Google or other search engines becomes more expensive because more companies want to advertise for the same space. Already now, sales and marketing are Monday’s highest costs.

Conclusion

Overall, Monday combines everything I don’t like. No profitability for years to come, growing competition, challenges from global economic development, and a high P/S valuation.

Overall, this makes Monday an excellent short candidate. But one has to be careful. Short interest is already at 18%, which increases the probability of short squeezes. In one week, the next quarterly figures are released, and in the current market phase, we have often seen huge price fluctuations in both directions. The probability of an adverse price development is greater, in my view. However, a short squeeze would drive the price even higher if the numbers are good. This is a short-term trade that each reader can decide for himself. In my view, the share is not a good buy as a long-term investment because the various uncertainties are too great, and it is unclear whether the exponential growth will continue.

Be the first to comment