Pietro S. D’Aprano/Getty Images Entertainment

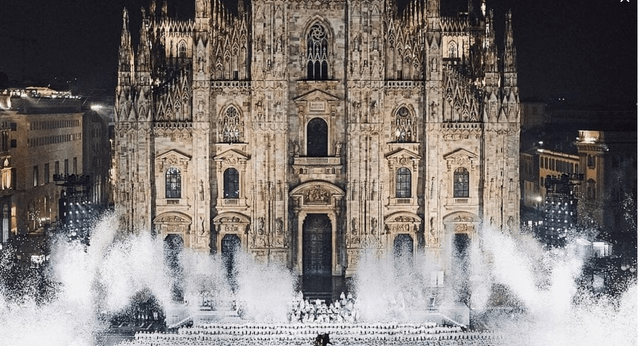

Moncler (OTCPK:MONRF) was incorporated in 1952 and last week, in concomitance with the Milano Fashion Week, thanks to 1952 artists (700 dancers, 200 musicians, 100 choristers and 952 models) decided to celebrate its 70th anniversary with an extraordinary event in one of the most iconic and central squares in Milan (Piazza Duomo) and to present the latest and special Moncler Maya 70 model specifically made for the anniversary.

Source: MilanoToday (Moncler Event)

Extraordinary Forever was the title chosen for the event and it certainly represents an ambitious vision but perfectly in line with Moncler CEO ideas.

Indeed, according to Remo Ruffini, in the world of fashion and luxury – to which Moncler belongs “only in part” – there has been a digital revolution, but also a Copernican one with a new power balance between high-end brands and customers. Moncler is managed as a start up with 70 years old history and today this spirit is more necessary than ever. Digitally runs faster than humans, hence, to keep up, Moncler must use what computers do not have, the imagination. Or to quote the CEO words: “the dream“. Visionary yes, but also extremely lucid in recognizing when you lose harmony with the market.

Vision combined with concreteness and clarity since 2013, when Moncler went public on the Milan Stock Exchange, an IPO that still holds the most successful record ever on the European market. On that occasion, there was no lack of originality: on the steps of the Borsa Italiana building, dozens of skiers dressed in Moncler and wearing skis in hand and boots on their feet appeared. Since it was listed, the company has accelerated growth and the results of the first half of 2022, published on July 27, have beaten analysts’ forecasts for the umpteenth time. Revenues have touched €1 billion, growing at constant exchange rates of 46% compared to €622 million in the first half of 2021 and, more importantly, 62% compared to the same period of 2019. The latter comparison is also positively influenced by Stone Island acquisition which was finalized in April 2021. The financial data for the period January-June 2022 remain extremely positive. Numbers in hand, Moncler’s revenues alone rose to €724.3 million (+27% on 2021, + 28% on 2019), while those of Stone Island reached €194 million (+33% on 2021). Returning to the Milan event, the CEO explains that it will only be the beginning of the celebrations: “they will actually last 70 days and will touch many cities and countries, because already today Moncler is a global brand and wants to continue to be one. The world is made up of many communities”.

Conclusion and Valuation

Why are we positive? Last time, our buy case recap was based on the following:

Moncler: Buy Case Supported By Macro To Micro Reasons

Source: Mare Evidence Lab’s previous publication

Today, we are even more positive. The luxury category can continue to be supported by the Chinese market. Moreover, at the global level, demand for luxury goods continued to be very strong during the summer season, this was supported by tourism flow in Europe, but also by the Chinese rebound in the third quarter. A recovery that was also emphasized by the CEO words explaining that “the restart was not bad“. The Stone Island acquisition is delivering, winter is coming and the Moncler seasonality will revert. This will support turnover (estimated at €2.5 billion) and margins. We remain overweight on Moncler shares, with an investment case reflecting the brand’s desirability and the Chinese recovery story (almost 45% of Moncler’s stores are located in APAC region).

Be the first to comment