Michael M. Santiago/Getty Images News

In a somewhat surprise move, Mobileye Global (NASDAQ:MBLY) has traded with positive conviction since the busted spin-out from Intel (INTC). The chip giant once expected a $50 billion valuation for Mobileye, yet the IPO price was only $17 billion while Wall Street is now ironically bullish on the stock. My investment thesis remains Bearish on the stock due to an elevated valuation in a difficult market.

Wall St. Pump

Mobileye priced their IPO of 41 million shares at $21. Though, the IPO was a huge failure for Intel after promoting a valuation of $50 billion for the auto tech business, the stock is ironically booming now.

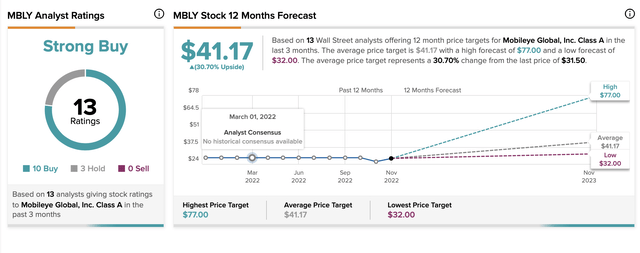

The stock is up 50% from the IPO price and analysts have huge predictions for Mobileye. Analyst Ivan Feinseth of Tigress just started the stock with an amazing $44 price target pushing the average analyst estimates to over $41 for over 30% upside.

The IPO pricing was so weak Intel had cut the price range to below $20 for the 41 million shares. The current analyst price target is nearly 100% above the IPO price.

The analysts are amazingly bullish as the trend has become following an IPO. Of 13 analyst ratings, 10 have Buys and 3 have Hold ratings with no Sell ratings despite the valuation issue discussed in the below section.

The dangerous part is that Intel still owns ~95% of the stock. The company could easily unload more shares increasing the share float that is helping keep Mobileye at elevated prices here.

Auto Tech Hype Ended

The stock now has an amazing market cap of $26 billion. Mobileye has a massive opportunity ahead in EVs as well as advanced driver assistance systems, or ADAS, and autonomous vehicles, which should boost autonomous-mobility-as-a-service and the robotaxi industry.

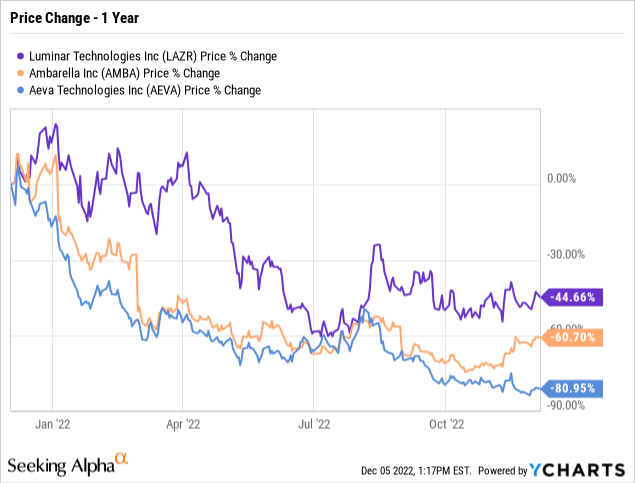

The amazing part of the rally is that other auto tech players have been crushed in the last year with a limited bounce. Luminar Tech. (LAZR) and Aeva Tech. (AEVA) are both beaten down SPACs while Ambarella (AMBA) was a public chip company shifting focus to computer vision chips for autos.

All of these stocks are down 60% on average over the last year. The concern with owning Mobileye here is the valuation with the stock trading at nearly 12x 2023 sales targets while other auto tech sector stocks are falling without the backing of new analyst coverage following a very public IPO.

To reach the analyst target at $41, the stock would need to reach an insanely high 17x 2023 sales targets. Whether one can make the case for Mobileye being expensive here, one should have a hard time justifying a further large rally to reach this price target.

The AV market offers a huge opportunity to advance growth in the years ahead. Analysts have revenues for Mobileye doubling to $4 billion from 2023 to 2025 in a sign of the massive growth opportunity as the market shifts from low-level ADAS to AVs where the technology content surges.

The problem with using this thesis for buying Mobileye here is that Luminar Tech. is utilized by Mobileye for Lidar sensors and the company has even bigger growth prospects. Luminar is forecast to grow 2023 revenues from $119 million to $771 million in 2025 with another big jump to $1.3 billion in 2026.

Though, the risk to investors here is paying up for some of the hype or excitement in the sector while knowing Intel is likely to dump more shares when the price hits analysts targets at $40+. The chip giant needs more cash to fund new fab construction and Mobileye could quickly become the asset to cash out.

Takeaway

The key investor takeaway is that Mobileye has a very compelling business model with major growth drivers in auto tech over the next decade. The stock is now priced based off a hyped IPO while sector competitors are no longer priced based on hype once their related going public transaction excitement waned.

Investors should use any further rally to cash out of Mobileye with the stock already trading at a rich multiple for the current economic environment.

Be the first to comment