tolgart/E+ via Getty Images

As our Earth’s population grows, our contribution to waste continues to grow exponentially. Hence, for many years, humans have continuously practiced burying waste in the ground or creating landfills for countries to dump their waste on. In fact, much of our waste could outlive our lifespans if we bury it in the ground and even poses greater environmental problems for hazardous materials being mixed in with the garbage as well. As such, we think that Mo-BRUK S.A. (OTCPK:MBRFF) is an attractive investment as it solves problems related to the build-up of both normal and toxic industrial waste, plus addresses the high electrical costs for the foreseeable future. In the long run, we envision that Mo-BRUK environmentally sustainable business model would attract investments from the ESG movement, returning more value to equity holders.

Company Analysis

Mo-BRUK is an industrial waste management company that has three main business segments: Solidification and stabilization of inorganic waste, Incineration of hazardous and medical waste, and Production of alternative fuels. For the first business segment, the company uses its own proprietary technology to treat inorganic waste from chemical and construction firms, producing granulated cement which is made into concrete as a final product. For the second business segment, the company conducts thermal treatment of industrial and medical waste from hospitals, refineries, and paint and medicine manufacturers in an environmentally safe manner, generating technological steam to produce electricity for sale. The last business segment involves collecting combustible industrial waste supplied directly by industrial plants and waste collection companies to be converted into alternative fuel, after being subjected to safe mechanical processing.

The company has been incredibly successful in the recent few years in ramping up its revenue and profitability and was inducted into Poland’s Warsaw Stock Exchange mWIG40 index, placing it among the top 40 medium-sized companies in Poland.

Value Proposition

Alignment with EU’s Waste Management Policies

Mo-BRUK’s business model is perfectly in line with the EU’s waste management policy to reduce landfills and implement a closed-loop economy. This involves the reusing and recycling of municipal waste, which is set to increase steadily and hit 60% by the end of this decade, barring recoverable waste from being disposed of in landfills. This will benefit the second and third business segments of Mo-BRUK as it is able to incinerate toxic waste to produce electricity and alternative fuel for usage. Furthermore, the Polish government cited “ecological bombs”, referring to landfills that are the victim of illegal and hazardous waste disposals, as a key source of concern, and they are committed to systematically clearing it. This is where Mo-BRUK can value add by taking up government contracts to incinerate waste that could even help the country save tens of millions of dollars.

One specific example that was reflected in Mo-BRUK’s Investor’s Relations (No.15/2022) stated that Mo-BRUK signed an agreement with the City of Gorlice to remove hazardous waste illegally stored on a property at ul. Wyszyńskiego 2. The maximum value of its service rendered was PLN 48,870,000.00 for an estimated 5000mg amount of waste (stated in announcement No.41/2020) before it was increased to PLN 75,183,700.00 gross for 2,700 tonnes of waste. As such, it is evident that Mo-BRUK is a cost-effective way for the government to get rid of five times more waste at just a two-fold increase in remuneration.

Shareholding Structure

We find it hard to obtain information and views about Mo-BRUK from the Internet, partially because it was in a different language and has a relatively smaller market capitalization. This allows us to dig into the fundamentals deeper to figure out the reason why this stock is undercovered. Well, it turns out that Mo-BRUK is much perceived as a family company, with the Mokrzycki family holding many executive positions and owning 35% of the company’s total shares. This leaves the percentage of free-floating shares in the market at 63.3%, after the company-owned shares totalled up to 1.7%. In our view, we favor such a shareholding structure of a family-owned company, considering shareholders still have much to benefit from the strategic decisions of a family of executives.

In addition, something that is rather inconsistent with traditional family companies is that Mo-BRUK has been very generous in its dividend payouts. Investors in family companies would know that the company would rather pay their executives huge compensation packages compared to distributing higher dividends.

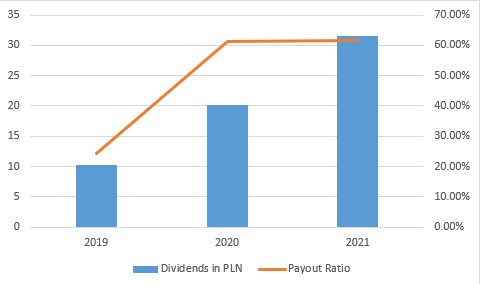

Mo-BRUK’s Dividend and Payout Ratios (Capital IQ )

The current dividend yield for Mo-BRUK is 10.2%. We think that dividend yields will continue to remain high as the company continues to return value to its shareholders with a relatively high dividend payout ratio.

Perfect Fit into Poland’s GDP

Poland derives 29.3% of its GDP from the Industrials sector in 2021. Although its Services sector still comprises 55.6% of GDP, we see potential secular trends that could benefit Mo-BRUK in the mining and manufacturing sector.

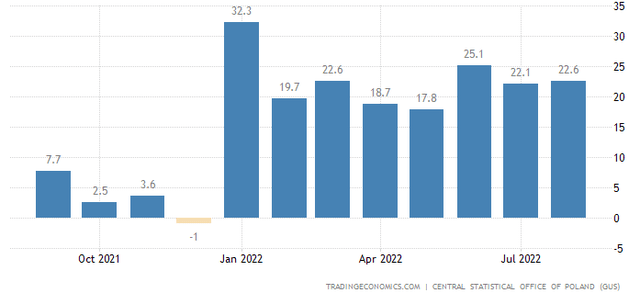

Mining Productions in Poland for 2022 (Trading Economics)

In the mining sector, mining activities have seen double-digit growth rates year-on-year for every month in 2022. This produces more waste that would require almost immediate treatment from firms like Mo-BRUK.

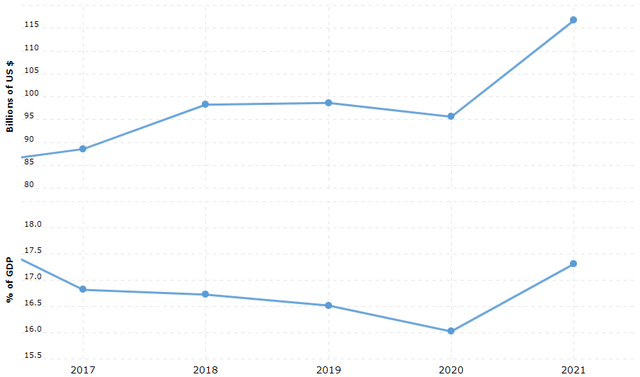

5Y Manufacturing Output in Poland (Macrotrends)

In the manufacturing sector, we saw a huge jump in the value of output and the proportion of GDP in 2021 after a slight increase in production output for the years prior. Since then, manufacturing has contributed to 22.4% of Poland’s GDP to date. With the increase in manufacturing output likely to increase the amount of waste, it is essential for waste management firms like Mo-BRUK to process the waste to ensure that Poland remains a liveable country.

Well-Positioned for the Future

Apart from being a waste management company, Mo-BRUK is definitely well positioned for both the foreseeable future and many years down the road, given the ESG movement and increasing considerations for green investments. Some may argue that these waste management companies incinerate waste and release toxins and greenhouse gases into the air, thus Mo-BRUK should not be classified as a green company. We would like to offer an alternative view because we think that Mo-BRUK has much to offer in terms of sustainability.

Energy prices have soared massively in major geographic regions from electricity and natural gas prices in Europe to oil in the US, even impacting Asia as the Russian-Ukraine war strains prices of commodities needed to produce energy. Mo-BRUK’s second business segment allows for energy to be recovered from the combustion of municipal solid waste, and its third business segment allows the production of alternative fuels from combustible industrial waste. This could be essential in propelling the company towards a net-zero carbon-producing business model, despite the incineration method being one of their waste management methods.

Looking further into the future, a confined and controlled method of treatment of waste will reduce the amount of solid waste ending up in landfills, saving up land for quintessential infrastructure to support the increasing human population. Not only that, we would reduce the volume of greenhouse gases such as methane and carbon dioxide being produced in these landfills, ultimately benefitting mankind with a slower increase in global temperatures and thinning ozone layer.

Valuation

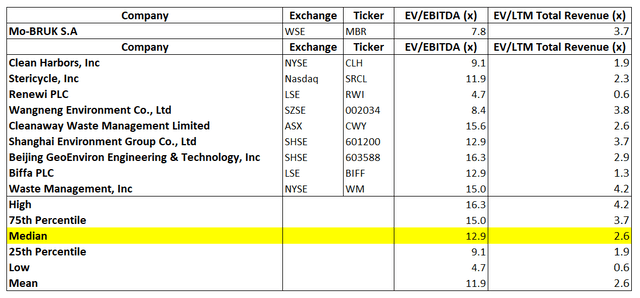

We took into account all of Mo-BRUK’s peers in the waste management sector, especially dealing with hazardous waste, and have other business segments capitalizing on the by-product of hazardous waste or in the waste management sector in general. This would ensure a fair comparison between Mo-BRUK and its peers targeting different markets around the world.

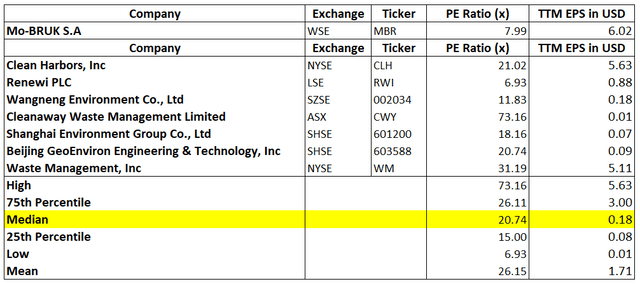

Peer Comps – Trading Multiples (Capital IQ )

Mo-BRUK has a higher EV/Revenue multiple as compared to its peers, which displays its high growth potential as investors think that its revenue is likely to increase. However, it has a lower EV/EBITDA as compared to its peers by a huge margin, which signifies an undervalued opportunity in our screening process.

Peer Comps – PE and PS Ratio (Capital IQ )

Based on relative valuation, Mo-BRUK has been trading way below its peers. We believe that as it grows, it should adjust to the long-term median of its peers or at least a double-digit P/E, considering its strong exponential growth in these few years

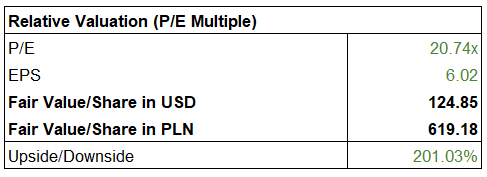

Relative Valuation – PE Ratio (Author’s Spreadsheet )

As such, we think that Mo-BRUK has enormous upside potential even with its LTM EPS, projecting against its long-term P/E target.

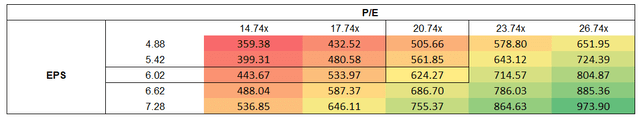

Sensitivity Analysis – PE Ratios (Author’s Spreadsheet)

A quick check using sensitivity analysis, these are the range of prices that Mo-BRUK could be worth based on the exit PE multiple and estimated EPS.

Risks

The biggest risk that we identified would be a change in governmental policies on waste management, specifically the regulations of Poland’s Minister of the Environment on waste management and environmental protection. Currently, the regulations favor Mo-BRUK by closing the loopholes that companies and individuals use to dispose of waste illegally. We think that this will continue to be the stance of the government but if more loopholes were to be created or policies change, this could impact the revenue of Mo-BRUK drastically.

Conclusion

In all, waste management is definitely an undercovered sector in the past and we hope that this sector will continue to generate interest in investors. Not only are companies like Mo-BRUK reducing the amount of waste in our environment, but they are also very profitable despite being highly reliant on governmental contracts. Our pick, Mo-BRUK, will likely continue to ride on the tailwinds of the Polish government’s goal of reducing toxic waste in their country, as well as its relative positioning in the wider EU region’s waste management policies. We think that as this nascent concept of ESG becomes more relevant and pertinent in our society, large inflows of institutional money would fill the gaps and provide the necessary funding that waste management companies to build more processing plants. This will no doubt return much value to loyal shareholders of Mo-BRUK over long periods of time through dividends and capital appreciation.

Be the first to comment