imaginima/E+ via Getty Images

The April MLP Monthly Report can be found here offering insights on MLP industry news, the asset class’s performance, yields, valuations, and fundamental drivers.

The latest quarterly MLP Insights piece providing analysis into the midstream space can be found here as well.

Summary

News:

1) The US will work with international partners to supply 15 billion cubic meters of liquefied natural gas (LNG) to the European Union this year to reduce European reliance on natural gas. The US and the EU have announced the formation of a joint task force to reduce its dependency on Russian gas by two-thirds this year and end imports of all Russian oil by 2027.

2) The Biden administration announced plans to release up to 180 million barrels of oil from the Strategic Petroleum Reserve (SPR) over the next six months to drive down oil prices and put pressure on oil companies to increase supply. Releasing around 1 million barrels of oil per day into the U.S. market only accounts for just 5% of US consumption of around 20 million barrels.

3) Williams (WMB) announced plans to acquire the Haynesville gathering and processing assets of Trace Midstream, a portfolio company of Quantum Energy Partners, for a transaction value of $950 million. The deal is expected to enhance its scale and expand operations in one of the largest growth basins in the country.

Sources: CNBC, CNN, Williams Companies, Inc (WMB).

Performance: Midstream MLPs, as measured by the Solactive MLP Infrastructure Index, increased 2.11% last month. The index increased by 32.90% since last March. (Source: Bloomberg)

Yield: The current yield on MLPs stands at 7.25%. MLP yields remained higher than the broad market benchmarks for High Yield Bonds (6.19%), Emerging Market Bonds (5.63%), Fixed Rate Preferreds (5.12%) and Investment Grade Bonds (3.61%).1 MLP yield spreads versus 10-year Treasuries currently stand at 4.62%, lower than the long-term average of 5.75%.2 (Sources: Bloomberg and Fed Reserve)

Valuations: The Enterprise Value to EBITDA ratio (EV-to-EBITDA), which seeks to provide more color on the valuations of MLPs, increased by 0.25% last month. Since March 2021, the EV-to-EBITDA ratio is up by approximately 0.85%. (Source: Bloomberg)

Crude Production: The Baker Hughes Rig Count increased to 670 rigs, increasing by 20 rigs from last month’s count of 650 rigs. US production of crude oil increased to 11.700 mb/d in the last week of March compared to February levels of 11.600 mb/d. (Source: Baker Hughes & EIA)

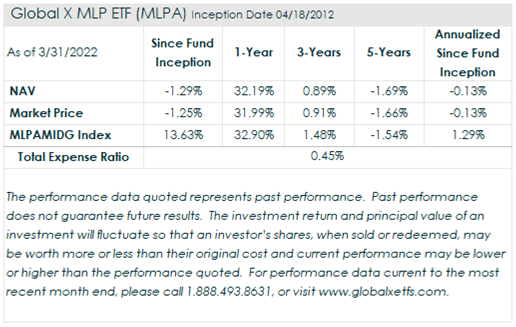

For performance data current to the most recent month- and quarter-end, please click here

As of 03/31/2022, Williams Companies, Inc (WMB) was a holding in the Global X MLP and Energy Infrastructure ETF with a 9.18% weighting.

MLPA ETF and MLPX ETF do not have any holdings in Trace Midstream.

DEFINITIONS

Solactive MLP Infrastructure Index: The Solactive MLP Infrastructure Index is intended to give investors a means of tracking the performance of the energy infrastructure MLP asset class in the United States. The index is composed of Midstream MLPs engaged in the transportation, storage, and processing of natural resources.

S&P MLP Index: S&P MLP Index provides investors with exposure to the leading partnerships that trade on the NYSE and NASDAQ. The index includes both master limited partnerships (MLPs) and publicly traded limited liability companies (LLCs), which have a similar legal structure to MLPs and share the same tax benefits

Bloomberg US Corporate High Yield Total Return Index: The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg EM country definition, are excluded.

ICE BofA Fixed Rate Preferred Securities Index: The ICE BofA Fixed Rate Preferred Securities Index tracks the performance of fixed rate US dollar denominated preferred securities issued in the US domestic market.

Bloomberg EM USD Aggregate Total Return Index: The Bloomberg Emerging Markets Hard Currency Aggregate Index is a flagship hard currency Emerging Markets debt benchmark that includes USD-denominated debt from sovereign, quasi-sovereign, and corporate EM issuers.

Bloomberg US Corporate Total Return Index: The Bloomberg US Corporate Total Return Value Unhedged Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Crude Oil: Measured based on the Generic 1st ‘CL’ Future, which is the nearest crude oil future to expiration.

EBITDA: Earnings before interest, tax, depreciation and amortization (EBITDA) is a measure of a company’s operating performance. Essentially, it’s a way to evaluate a company’s performance without having to factor in financing decisions, accounting decisions or tax environments.

Average Spread: Average spread is the average of the excess of the MLPs yield over the 10 year treasuries yield.

Enterprise Value (EV): EV is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization.

Footnotes

- Asset class representations are as follows, MLPs, Solactive MLP Infrastructure Index; High Yield Bonds, Bloomberg US Corporate High Yield Total Return Index; Preferreds, ICE BofA Fixed Rate Preferred Securities Index; Emerging Market Bonds, Bloomberg EM USD Aggregate Total Return Index; REITs, FTSE NAREIT All Equity REITs Index; Investment Grade Bonds, Bloomberg US Corporate Total Return Value Unhedged Index; Equities, S&P 500 Index; and Crude Oil, Generic 1st ‘CL’ Future.

- MLPs are represented by the S&P MLP Index.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to the Global X Funds.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment