maroke/iStock via Getty Images

Investment Thesis: Mizuho Financial Group could see a rebound in upside once market conditions become less volatile as a result of rising net interest income, an attractive price-to-book ratio, as well as exposure to a strong Japanese real estate market.

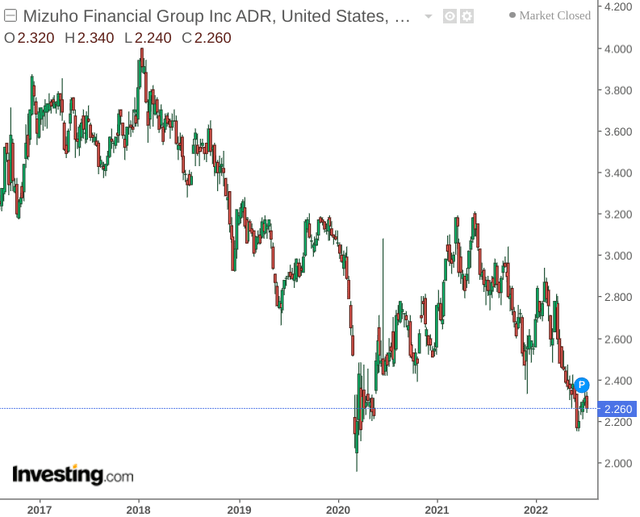

Mizuho Financial Group, Inc. (NYSE:MFG) has come under price pressure over the past few years – and more recently as a result of growing macroeconomic concerns over inflation.

The purpose of this article is to assess whether Mizuho Financial Group could potentially see a rebound in upside from here.

Performance

In determining Mizuho Financial Group’s main sources of risk exposure in the current market, I decided to compare the company’s loans by industry for the periods March 2017 and March 2022.

When analyzing loans by industry in March 2017 and March 2022 – we can see that Finance & Insurance as well as Real Estate have accounted for a larger portion of overall loan exposure in 2022 (figures provided in billions of yen expect percentages).

| Industry | March 2017 | Percentage (%) | March 2022 | Percentage (%) |

| Manufacturing | 8619.4 | 15.31% | 9770.8 | 16.23% |

| Agriculture & Forestry | 37.7 | 0.07% | 47.5 | 0.08% |

| Fishery | 1.3 | 0.00% | 2.9 | 0.00% |

| Mining, Quarrying Industry &Gravel Extraction Industry | 224.8 | 0.40% | 220.7 | 0.37% |

| Construction | 643 | 1.14% | 857.4 | 1.42% |

| Utilities | 2212.1 | 3.93% | 3043.3 | 5.06% |

| Communication | 1429.2 | 2.54% | 1206.4 | 2.00% |

| Transportation & Postal Industry | 2032.5 | 3.61% | 2581.5 | 4.29% |

| Wholesale & Retail | 4737.2 | 8.42% | 5214.7 | 8.66% |

| Finance & Insurance | 7126.9 | 12.66% | 9032.1 | 15.01% |

| Real Estate | 7142.2 | 12.69% | 10160.4 | 16.88% |

| Commodity Lease | 2104.6 | 3.74% | 2891.9 | 4.80% |

| Service Industries | 2648.8 | 4.71% | 3082 | 5.12% |

| Local Governments | 873.4 | 1.55% | 589 | 0.98% |

| Governments | 3191.1 | 5.67% | 836.5 | 1.39% |

| Other | 13263.5 | 23.56% | 10650 | 17.69% |

Source: Figures sourced from Mizuho Group – Historical Data. Percentages calculated by author.

The performance of these sectors stand to be significantly influenced by inflation trends going forward.

At present, a cheaper yen is making Japanese real estate more attractive to overseas investors – particularly from Hong Kong. In addition, the Bank of Japan has not taken the same approach as the Federal Reserve in raising rates – instead opting to maintain a loose monetary policy. As such, we can expect that the Japanese real estate market still has significant room for growth in the current environment.

With that being said, the loose monetary policy by the Bank of Japan could end up proving a double-edged sword for the financial industry. Should interest rates remain low in the face of inflationary pressures – then this could potentially limit the degree to which the bank can raise net interest income.

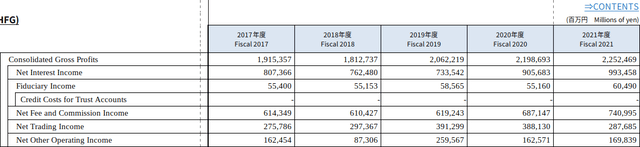

Mizuho Financial Group Historical Data

We can see that domestic net interest income in fiscal 2021 was still higher than in other years for the Mizuho Financial Group. While we have conversely seen that net fee and commission income is also up significantly – inflationary pressures could place pressure on demand due to higher fees – even if interest rates themselves remain low.

This remains a risk both for Mizuho Financial Group in its own right, as well as its loan exposure to other financial firms that could stand to see pressure on domestic net interest income going forward.

In terms of the insurance industry – the degree to which the sector performs going forward – and thus the ability of insurance companies to repay loans – will hinge significantly on performance across the life insurance sector, which reportedly accounts for 80% of the overall market in Japan. While the sector came under pressure as a result of COVID-19, the outlook for the market has recently been revised to stable from negative – due to such companies reportedly maintaining strong capital positions as well as hikes in global interest rates allowing such companies to better manage reinvestment risk.

Looking Forward

Going forward, a significant consideration in how Mizuho Financial Group will perform from here will be driven by the broader macroeconomic environment, and in part monetary policy by the Bank of Japan.

While interest rates currently remain low – investors will expect stronger growth in net interest income going forward. Mizuho Financial Group could potentially benefit from lower rates – as relatively cheaper loan repayments could make Mizuho more attractive compared to its international counterparts.

However, if we do not see evidence of a rise in net interest income, then I take the view that this could be a concern for investors going forward. This could particularly be the case if inflation drives higher fees and commissions, which in turn reduces loan demand.

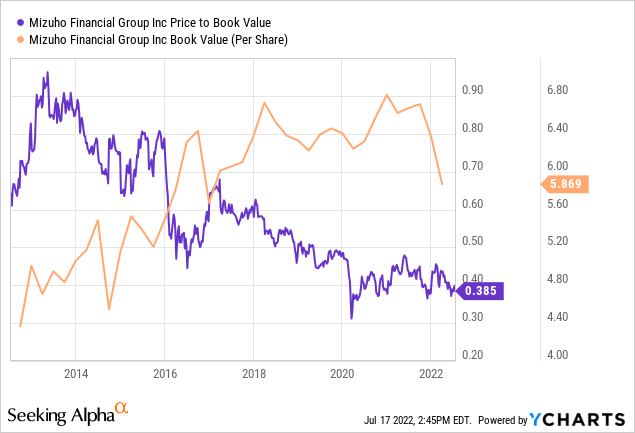

With that being said, we can see that the stock seems to be attractively valued on a price-to-book basis, with book value per share having steadily risen over the past ten years, along with price to book value near a 10-year low.

ycharts.com

In this regard, while the stock might see some downside given the volatile macroeconomic situation, I take the view that Mizuho Financial Group has significant potential for a rebound if the company can continue to effectively manage its loan risk and increase overall gross profits.

Conclusion

To conclude, Mizuho Financial Group appears to be trading at an attractive valuation and given the company’s exposure to an attractive real estate market as well as rising net interest income. I take the view that the stock could have significant room for upside once market conditions become less volatile.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment