welcomia

Having fallen over 40% from its 2021 IPO price and nearly 60% year-to-date, I decided to review Mister Car Wash (NYSE:MCW) as this is a business I’d be interested in owning at the right price. The reasons I find Mister Car Wash to be an interesting business include:

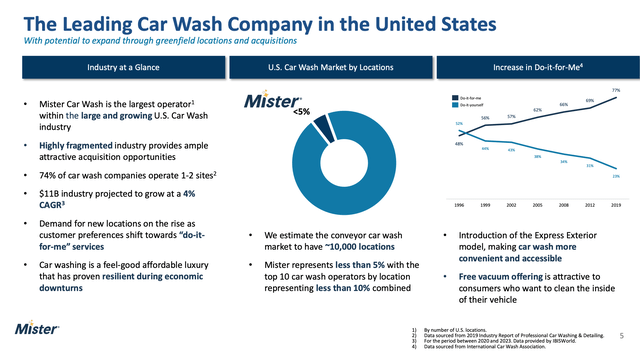

1/ Significant opportunity for growth – MCW believes it can grow its unit count to 1,000 locations versus a current base of ~400. MCW has some competitive advantages versus small mom&pop locations including a more modern fleet of car washes which are more efficient (in terms of water/power usage) and require less expenditure on maintenance.

In addition, having multiple locations within a geographic area gives Mister Car Wash the ability to offer monthly subscriptions (discussed below). A mom&pop operation with 1-2 locations won’t be able to offer the same convenience (a customer would likely have to drive further to make use of the subscription).

Fragmented Industry (Mister Car Wash Investor Presentation)

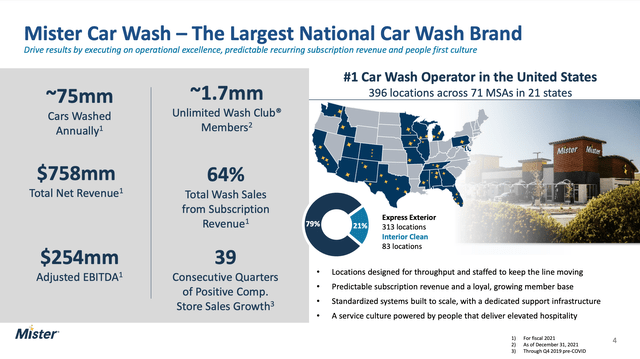

2/ Recurring revenue base- as shown below, 64% of MCW revenues come from monthly ‘all you can wash’ subscriptions. Recurring revenue businesses usually have more stable profitability across economic cycles, and also tend to trade at higher EBITDA/ earnings multiples.

Mister Car Wash Overview (Investor Presentation)

3/ Fast payback on new stores – Management estimates that after executing a sale lease back transaction (note: in a sale lease back transaction, MCW sells its car wash real estate and leases back the location, releasing a good portion of the capital invested), new locations payback in about 3 years. This is a very good return on capital and should allow the company to grow quickly.

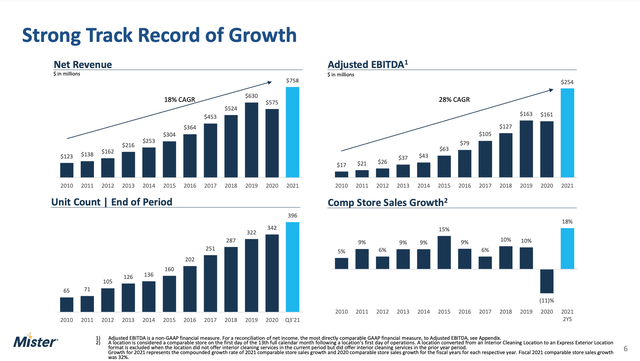

4/ Solid long-term historical track record in unit growth, comparable sales, total revenue and EBITDA while expanding its store base.

Historical Financial Overview (MCW Investor Presentation )

Headwinds

While the company has had a successful long term track record and is well positioned for growth, in 2022 the company has experienced some meaningful headwinds including:

– Slowest comparable sales (excluding COVID/2020) at just 2.4% in 2Q22, which led management to cut full year comparable sales projections from 5-7% to 3-5%.

– Inflation headwinds in labor and utilities. While total revenue increased over 14% (mainly from growth in new locations), EBITDA increased less than 2% and profit margins were negatively impacted by the combination of slow comp sales and rising expenses.

Valuation & Conclusion

At a price of $8.18, plugging in recent management guidance, I arrive at the following valuation multiples for Mister Car Wash:

|

Share Price |

8.18 |

A |

|

Shares o/s |

330 |

B |

|

Market Cap |

2,699 |

C=A*B |

|

Net debt |

900 |

D |

|

Total Cap |

3,599 |

E=C+D |

|

2022e EBITDA |

270 |

F |

|

2023e EBITDA |

290 |

G |

|

Estimated Maintenance Capex |

30 |

H |

|

2023e EBITDAX |

260 |

I=G-H |

|

EV/ 2023e EBITDAX |

13.8 |

=E/I |

|

2023e EBITDA |

290 |

G |

|

Less Maintenance Capex |

30 |

H |

|

Less Interest Expense |

45 |

J |

|

Less Taxes at 25% |

50 |

K |

|

Free Cash Flow, ex growth |

165 |

L=G-H-J-K |

|

Free Cash Flow per share, ex growth |

0.50 |

M=L/B |

|

P/ FCF (ex growth) |

16.4 |

N=A/M |

It is important to note that I use maintenance capital expenditure (the amount of capital expenditure required to maintain existing stores) rather than total capital expenditures, which includes an additional ~$80 million (net of sale-leasebacks) to fund new store growth. Had I used total capital expenditures (net of sale lease backs) rather than maintenance capital expenditures, free cash flow per share would be about $0.25 per share (implying a 33x FCF multiple).

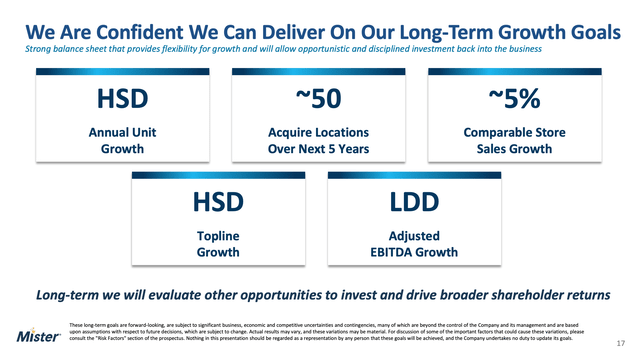

To state the obvious, investors pay higher multiples for higher growth in free cash flow per share. To be consistent with using a multiple of free cash flow excluding growth capital expenditure, investors should compare the 16x multiple to expected same store sales (as shown below MCW management guides to 5% same store over the long-term).

Long Term Financial Targets (MCW Investor Presentation)

16x FCF seems about a fair price for 5% same store sales growth. As a value investor, I look to buy in at about a 1/3 discount to my estimate of fair value – as such I would expect to be a buyer at about $6/share.

Risks

1/ Mister Car Wash may not be able to execute on its long term growth plan, which is dependent on favorable financing terms via sale leasebacks.

2/ Secondary share issuance – following its IPO, the majority of MCW shares are held by PE firm Leonard Green Partners. This creates an overhang on the stock, as the share price could fall significantly if Leonard Green sells additional shares.

Be the first to comment